Introduction

There's an apocryphal Chinese saying – “May you live in interesting times.”

The beginning of 2015 saw unprecedented lows in global oil prices. Combined with this were various geopolitical developments, including the slowdown of the Chinese economy, continued extremism and violence in the Middle East, and Europe's ongoing battle with recession. On the brighter side, there was the news of improved outlook for U.S. economy. In summary, these events and developments toward the end of 2014 provide a potent environment for an extremely volatile 2015. Interesting times, indeed.

Based on these cues and other global economic and business triggers, GEP has identified major trends that will shape and drive procurement strategies in 2015 and beyond. We also outline the key focus areas and priorities for CPOs and procurement teams for the next 12 months.

Trends in 2015

Falling Oil Prices

The biggest story in the latter half of 2014 was the decline of crude oil prices. The end of 2014 saw oil hitting a low of nearly $45/bbl. The oil price reduction has been a product of increased supply (especially from non-OPEC producers, including the US Shale gas producers), geo-political considerations as well as lower demand due to the economic slowdown. GEP experts forecasts a price range of $55 - $65/bbl for 2015.

The decrease in oil prices will have a multifold impact on the global economy. Lower oil prices will have a direct impact on commodity prices, especially on commodities derived from hydrocarbons such as Natural Gas Liquids (NGLs). This will impact industrial manufacturing, plastic products, chemicals industries and the transportation sector. Buyers of these industries will be demanding their suppliers to pass on the benefits of cost reductions to them.

Lower oil prices will also increase the disposable income for consumers, with a net positive impact on the retail and consumer goods sector. This will help in increased economic activity and offset some of the impact of the lower economic performance of Europe and China.

Economic Slowdown and Regional Geo-politics

Gathering signs of a slowdown across many parts of the world are roiling financial markets and confounding policy makers, who, after years of battling anemic economic growth, have limited tools left to jumpstart a recovery.

Slumping exports in Germany are adding fuel to worries about a third recession in the eurozone in six years. China is slowing in the wake of its credit boom, weighing on countries throughout the region. Japan's economy has recently contracted despite a policy offensive to lift it from years of stagnation. Other onetime powerhouses, from Brazil to South Africa, also are struggling.

The U.S. remains a relative bright spot in an otherwise gloomy picture, particularly its job market, which is gaining traction after years of fitful growth. But doubts are building over the U.S. economy's ability to accelerate even as some of its biggest trading partners struggle to sustain their growth.

Climate Change and Sustainability

2014 was the year of polar vortexes and harsh weather conditions that have created a greater sense of urgency toward climate change. This was further enforced by the deal between U.S. and China to cut their carbon emissions by 2030. U.S. intends to achieve an economy-wide target of reducing its emissions by 26-28 percent below its 2005 level in 2025. China intends to achieve the peaking of CO2 emissions around 2030 and increase the share of non-fossil fuels in primary energy consumption to around 20 percent by 2030. This is expected to translate into business imperatives beginning 2015 with a focus on sustainability initiatives across the business value chain of all industries.

In addition to sustainability initiatives, the increased focus on climate change will have a positive impact on renewable energy sources and their use by business. While the falling oil prices might affect the viability of some of these projects in the short term, the use of renewable energy sources will continue to go up, especially as they are considered to be a zero cost energy source unlike the permanently volatile fossil fuel prices.

Speed of Delivery of 'Value’

2014 saw a spate of product recalls from large global enterprises, including General Motors, IKEA, Whole Foods, Nestle and Nokia, to name a few. This would make consumer safety a major focus area for enterprises in 2015. Safety will become a key business requirement in all supplier contracts renewals.

The beginning of 2015 also showed another first – Apple's market capitalization is more than double that of Microsoft, thereby demonstrating that product quality and attention to customers' needs is always the “right thing to do.”

There is also a parallel trend of new startups disrupting traditional ways of doing business. While Uber has changed the way ground transportation is being used by people, companies like Elementum are challenging global giants like SAP and Oracle in logistics and supply chain software. These startups are nimble, provide better service and are also more cost effective. In addition, the increased use of data analytics technology for generating insights is becoming more widespread.

The above scenarios clearly point toward one clear trend in 2015 – focus of the entire value chain toward driving customer quality and satisfaction. This will mean that there will be increased focus on faster delivery of value to customers.

Data Security

E-commerce gained momentum in 2014 and is expected to continue to grow in 2015. While 2014 brought Alibaba to spotlight, 2015 will see consolidation of business by emerging market players, such as FlipKart in India, while Amazon will continue to grow its business. Although the notable growth in this area has been consumer-facing, the B2B marketplace will see a movement toward these online, transparent marketplaces, where enterprises can “shop” for suppliers similar to online consumer shopping.

The rise of e-commerce in the emerging markets and the general omnipresence of technology also brings with it risks related to information security. Increased hacking attacks on enterprises and governments (Sony, US CENTCOM, among others) will trigger focus on data and information security. While we do not anticipate this to impact adoption of cloud technologies, we believe that this will result in increased focus on investments in data security, especially among technology companies.

Organizations will look to leverage their partners in the IT space to develop data security standards, increasingly tying in security to contractual supplier obligations.

Implications for Procurement Leaders

While the above trends are expected to impact the overall businesses, there are some specific imperatives for the procurement function. GEP experts share the key focus areas and priorities for CPOs and procurement teams in 2015.

Generate Value from Lower Crude Oil and Related Commodity Prices

While falling oil prices are bad news for oil producers and downstream commodities, it is a great opportunity for oil-consuming industries to generate drive more savings and value.

GEP experts believe that lower oil prices generate an opportunity to restructure relationships with transportation companies – inbound and outbound – and leverage this cost reduction. For outbound transportation, there will be an opportunity to look at cost reduction in the fuel surcharge component. While carriers are quick to pass on any fuel price increases, fuel reduction has to be proactively managed by the customer. This will be a good opportunity to true-up the surcharges and demand credits as needed. Less intuitively, fuel price reduction also represents an opportunity to negotiate better terms for inbound transportation with suppliers.

Using a clean-sheeting approach, companies can identify key commodities and suppliers — with a significant linkage to freight — that will see a big drop in costs due to the oil price reduction. Similarly, airline companies are at their most profitable currently. This will be a good opportunity to renegotiate airline contracts for employees and generate savings through a more optimized travel program reflecting the current pricing.

For companies that are downstream in the oil value chain, lower oil prices present an opportunity to manage commodity price risks through advanced procurement techniques like hedging, forward contracts and other financial instruments.

Segment Product Supply Chains and Optimize Material Flow

Driven by reduced oil costs, lower overall logistics costs, and the rise of robotic technology that reduces man-hours, nearshoring will be a major business trend in 2015. The shifts it will bring to the supply chain will need to be anticipated and captured by procurement. Companies are relocating their operations, after years of outsourcing to lower-cost economies, to Latin America or back to the U.S. Rising wage rates in emerging economies like China (estimated to increase by 15-20 percent), and higher shipping rates are partly behind this trend.

In 2015, supply chain executives will capitalize on these emerging markets, which will influence many aspects of the supply chain, including product design, pricing and logistics. Moving away from tried and tested regions like China presents a new set of challenges, including movement into areas of greater political unrest. It will be critical for procurement to identify the new economic and environmental risks of these emerging markets and ensure that there are strategies in place to mitigate them.

The impact of shifting production and bringing it back to the U.S. creates the perfect opportunity for companies to optimize splitting of their supply chains into multiple processes. Moving similar product offerings, or segmenting by product share, will allow corporations to arrange and track their supply chains by situational and business importance. Segmenting production will increase efficiency. With reduced transport costs and greater need for transportation of goods throughout the supply chain, optimizing use of shipping and trucking channels will become an increasingly impactful space. The splitting of supply chains will also impact inventory management practices. With the rise of multichannel retailing, supply chain simplification, shrinking product life cycles and new technologies, procurement leaders would look at managing inventory in a holistic manner.

In 2015, supply chain leaders will focus on implementing strategies to optimize the growing inventory network and improve customer service. CPOs will work to establish accuracy in forecasting, serve multiple channels with one inventory pool, and identify the most efficient way to fulfill orders from this pool. Flexible manufacturing will increase. Software solutions and supply chain network optimization tools will become essential for tactical planning.

Drive and Implement Sustainability Initiatives

Sustainability is becoming a key focus area for governments and enterprises across the world. A number of government initiatives to fight climate change and deforestation were announced this year. Enterprises are increasingly integrating sustainability into their value chains and triple bottom line accounting into their corporate governance. Powerful emerging technologies – including solar power, irrigation technology, digital media and cloud-based tools, among others, hold the promise of new, powerful sustainability impacts. So, while energy consumption reduction, recycling, reporting, consumer awareness, employee engagement and other tactical issues will remain a core focus for businesses, the biggest shift we will see in 2015 will be toward sustainability strategies that directly align with business strategies.

As a result of these, sustainability goals will increasingly be part of supplier relationship management structures of organizations, especially for strategic and core suppliers. For example, GEP has been working with a life sciences company to help put in place a recycling and reusability program for lab consumables with its strategic global supplier.

Just as diversity targets are now part of every procurement team's annual goals, sustainability initiatives will also be critical. Use of renewable energy sources, demand management initiatives, employee and supplier recognition programs will be critical components of the sustainability initiatives that enterprises will need to implement in 2015.

Focus on Process Efficiencies Across the Supply Chain Network

Procurement will take the lead in integrating business processes and collaborating across functions in entirely new ways that would drive value enhanced value to the business. CPOs will look to engage in optimizing the financial supply chain, turning accounts payables into a profit center, as they get realtime visibility into invoices, purchase orders and contracts by leveraging e-sourcing and procurement technology. Procurement would able to work with finance to extend days payable outstanding to improve the overall balance sheet while, at the same time, offer early payment discounts to suppliers in an effort to mitigate both financial and supply risk.

GEP expects CPOs to drive this through outsourcing of key category management and process responsibilities to external partners, while retaining strategic decision-making within the organization. GEP recently partnered with a leading biopharma company where a significant portion of the indirect spend was outsourced to GEP for category management and generating savings through strategic sourcing and demand management initiatives.

Use SMAC1 Technologies to Drive Decisions

Buoyed by advancements in e-commerce B2B networks, several capable suppliers will now be able to compete for business simultaneously on a central reportable platform, providing more competitive bids to enterprises, and better understanding of the price trends and movements in the industry. This can potentially reduce the costs of sourcing initiatives by around 20 percent.

Like Amazon and eBay, where consumers can easily shop, share and consume in new and more informed ways, procurement will tap into advanced B2B networks to create a simple experience, replicating a consumerized e-commerce interface where, with just a few clicks, they can purchase goods and services, place, manage and pay for orders, and view and manage spend across all major categories through a single, connected platform.

Predictive analytics will continue to be adopted by more and more enterprises. Use of this technology in procurement organizations will become more widespread. Procurement teams will leverage analytics technology, including big data, to determine trends in commodity prices as well as early indicators of supply-demand glitches. This will be an important input into estimating and planning for supply chain risks.

1 Social, Mobile, Analytics and Cloud

Summary

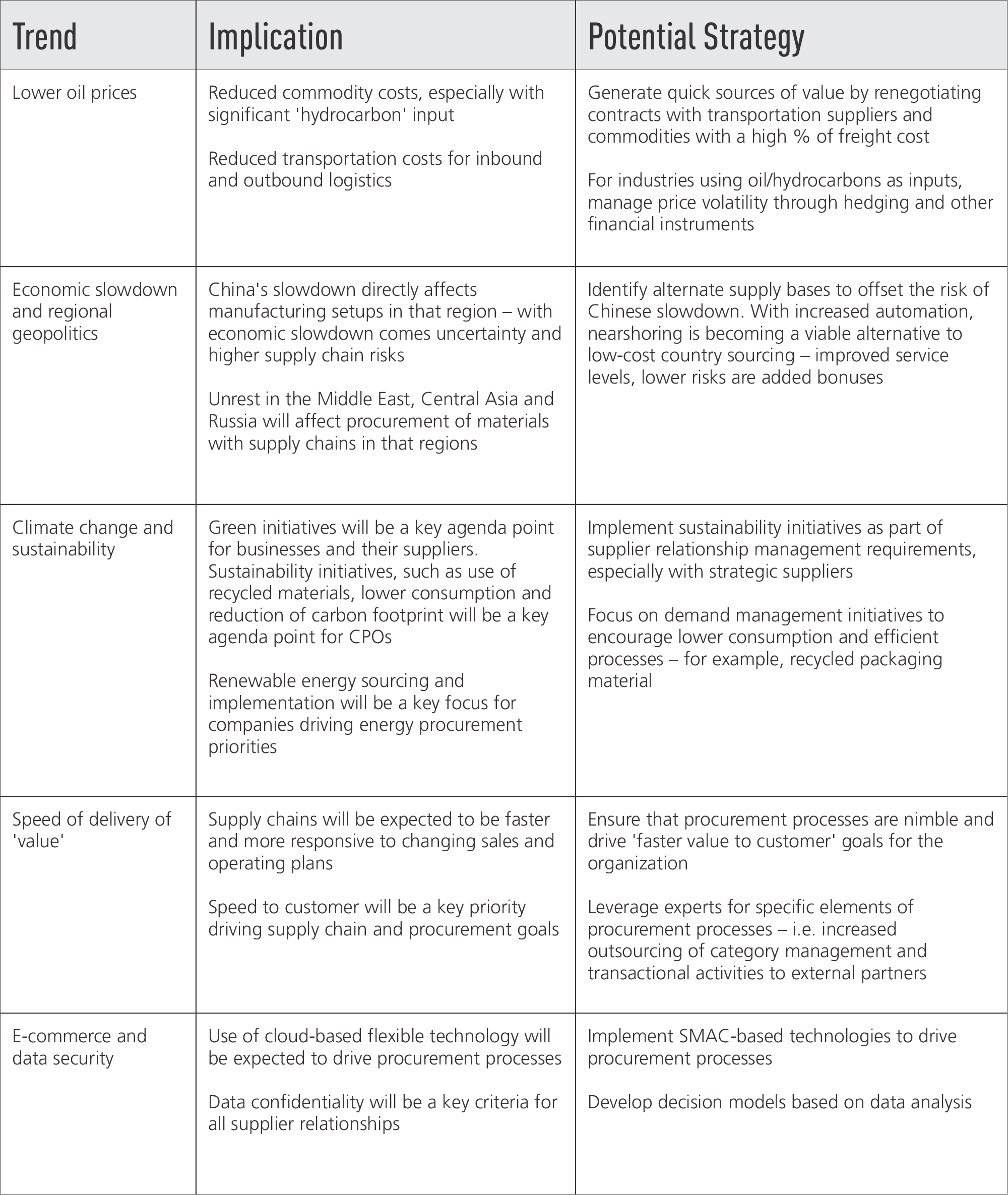

A summary of the key trends, their implications, and recommended strategies for procurement:

Category Trends

Information Technology

Global enterprise spend on cloud-based services (approaching $100MM) continues to increase at a rapid rate of 20-25 percent, five to six times the rate of the total IT spend. By 2018, it is predicted that public, cloud-based software, server and storage spending will account for more than 50 percent of the total IT spend. In the past few years, Software-as-a-Service (SaaS) has been the driver of growth but we are seeing a shift toward higher growth in the Infrastructure-as-a-Service (IaaS) area.

Key industry players like IBM and HP are gearing up for the shift that is already underway. In an off year that was impacted by the slowdown outside the U.S., IBM's 2014 systems and technology revenues were down 23 percent. Software, which carries a gross margin of 89 percent, was down only 2 percent. Cloud-based services are high on the radar screen at IBM and receiving multibillion dollar investments.

IT security investments exploded in 2014 as massive data breaches caused enterprises to reassess their data security capabilities. The security breaches at Target, Home Depot, Apple, Google, Sony, JPMorgan Chase, and many other Fortune 100 companies have threatened to disclose personal information, passwords, account numbers and emails of millions of users.

In the U.S., chip technology is being forced into the marketplace at a much faster pace than was predicted. Spending in security related areas will continue to increase at a 50 percent rate as global hacking becomes more sophisticated and privacy regulations resulting from the rollout of the Affordable Care Act are enacted.

IT consulting services rates were anticipated to increase starting in 2015 due to the improving U.S. economy and high inflation rates in India. However, technology has again come to the rescue. Improvements in automation software will dramatically reduce the need for Level 1 and Level 2 support. The goal is to automate 60-90 percent of administrative functions, thus reducing supplier costs and improved performance due to pre-emptive fault isolation.

We will continue to see the shift in personal devices from the traditional PC/ laptops — which continue to drop in price — to the greater use of tablets and smartphones. Tablet- and smartphonebased software is evolving rapidly, drawing on cloud-based services. Real-time access to inventory, pricing information, sales presentations, order placement, supplier purchase order approvals can now be accomplished on lightweight, easy-to-use tablets in or out of the office.

Telecom

The U.S. wireless market continues to grow as more users acquire smartphones (80 percent) and add/increase data into their plans. Voice and text usage has remained relatively flat in 2014 and is expected to remain flat in 2015. Service providers have responded by offering unlimited voice/text plans combined with shared data for family members or corporate users.

T-Mobile and Sprint continue to dominate as price leaders but AT&T and Verizon still offer broader coverage. We're starting to see AT&T make moves internationally with its two acquisitions in Mexico as regulators open the once closed mobile market. With the formal separation of Vodafone from Verizon Wireless (for $130B), look for Vodafone to acquire/partner with T-Mobile in the U.S. to fill the void they have in their global strategy. Europe will continue to consolidate and we'll begin to see the end of roaming charges.

More companies will look to establish integrated global networks. Leveraged volume will drive lower prices and companies can realize significant operating efficiencies by eliminating redundant connections and operational costs associated with a multivendor network. Companies can achieve savings of up to 40 percent by integrating disparate networks.

Rates for local services continue to increase at double-digit rates. Enterprises need to move to Session Initiation Protocol (SIP) deployment and explore alternative service providers to stem these increases. Service providers such as Granite Telecommunications and MetTel have become viable alternatives nd are now providing other telecom services such as mobile services and Multiprotocol Label Switching (MPLS).

2015 may be the year in which Google's wireless strategy is fully unveiled; cable companies like Cablevision develop a wireless strategy; M2M communications grow rapidly; and the next generation of automotive communications are deployed as the driverless car of the future “hits the road.”

Business Travel

Spending on business travel will remain consistent or slightly increase in 2015 compared with 2014. An uptick in travel volumes may be fueled by the general economic growth, and the perception of travel pricing improvements coming from downward trends in fuel pricing. Meanwhile, pricing outlook remains inflationary for key travel cost components, including airfare and hotels.

While many corporate travel buyers would expect airline fare reductions and opportunities for corporate discount improvements in 2015 — considering the current oil price trends — we do not expect airlines to actively come forward with rate or discount improvements in 2015. In fact, both hotel and airline costs are projected to increase roughly 2-3 percent worldwide in 2015, partly driven by airline consolidation and partnering.

Business travel buyers will potentially see airlines offer corporate pricing improvements if the downward pressure on oil is sustained for a longer term. However, corporate travel managers, especially those who have substantial spend with airlines, should look for preferred pricing deals, and watch for “first mover” airlines that make any price improvements. Should this occur, we expect other airlines to follow suit.

As previously mentioned, airline M&A activity will contribute to an airfare inflation in 2015. Business travel buyers should expect to gain more clarity on the impact of M&A activity to their travel programs from the consolidation of American and US Airways, and partnering of Delta and Virgin Airlines. As this occurs, we expect airline category managers to increase consideration of alternate route and airline options, among other strategies, to mitigate the impact of airfare cost increases and capacity strains.

The ongoing inflationary nature of corporate hotel pricing will continue to lead corporate travel buyers to focus on using third parties to support a robust hotel sourcing process. Companies that actively challenge the specific hotel properties that are included in the preferred hotel pool for all key cities worldwide will be the most successful at mitigating hotel pricing increases and/or gaining cost improvements. Additionally, effective hotel sourcing programs will focus increasingly on hotel amenity costs and inclusions.

From a travel policy and booking standpoint, 2015 will see a continued upward trend in the use of online, and mobile booking and travel management features for business travel. Included in this overall trend is the use of “gamification” and “engagement” applications that allow companies to offer special recognition and awards for positive business travel behavior. We expect to see a upward trend in 2015 in the use of positive reinforcement and employee “engagement” programs in enterprises.

In 2015, GEP's travel practice experts expect to see an ongoing trend of mid- to large-sized companies investigating and implementing global arrangements with Travel Management Company (TMC) partners. The TMC market has evolved and a number of TMC options exist that offer true global footprints and capabilities. Within this trend, we will also see corporate travel buyers seek optimal pricing arrangements for TMC services and a mix of compensation models, including resource-based, activity based, and fixed-fee models.

Overall, in 2015, the travel category presents a challenge for corporate travel buyers to manage costs in an inflationary cost environment. This continued pressure will see corporate travel buyers looking for innovative and new ways to contain costs, including engagement of employees to drive behavioral changes, more robust and transparent hotel sourcing programs, and ongoing negotiations with airlines. With these approaches, corporate travel programs will continue to become more sophisticated and efficient in 2015.

Maintenance, Repair & Operations (MRO)

The MRO market in North America will be relatively volatile in 2015, calling for a proactive and disciplined strategic sourcing and category management approach. Primary trends in the MRO market that will fuel this volatility are:

- Falling oil Prices

- Volatility in the commodities market

- Continued consolidation in the MRO distribution industry

These trends offer a positive opportunity for MRO procurement professionals in 2015. MRO product pricing should remain relatively flat with some sectors — linked to falling oil and commodity prices — showing a decline in pricing. Companies actively sourcing their MRO categories should take advantage of these trends by locking in pricing for an extended period — where possible — and linking commodity-based products to appropriate indices to take advantage of downward movement in commodity prices as well as limit their upside risk as commodity prices rise.

Industry consolidation also offers an opportunity to leverage more spend and negotiate better pricing from the distribution base. Major players in the MRO industry are continuing to “buy out” smaller local distributors. These acquisitions are geared to increase their presence and revenues in “core” products i.e. electrical, power transmission, bearings, etc., but more frequently being done to enhance their product mix and line cards.

There is an ongoing strategy in the industry to capture a larger part of the MRO pie. Savvy MRO buyers can use this knowledge to potentially move some spend to these larger distributors and There is an ongoing strategy in the industry to capture a larger part of the MRO pie. Savvy MRO buyers can use this knowledge to potentially move some spend to these larger distributors and increase their leverage and buying power. However, this needs to be done with caution to ensure that the level of service to the manufacturing facilities is not jeopardized as it could impact the overall Total Cost of Ownership (TCO).

Another trend that we expect to continue and grow during 2015 is the move toward outsourcing much of the MRO activities to third-party providers. In many companies, procurement and management of MRO is not a core skill. Therefore, enterprises are increasingly looking toward experts to take on these responsibilities. These activities encompass the entire source-to-pay value chain, including category strategy development and strategic sourcing, category management, and transaction processing.

By outsourcing this entire value chain, enterprises are realizing double-digit savings in their MRO TCO as well as an overall improvement in service and stakeholder satisfaction.

A final trend in 2015 that we believe will provide long-term value to companies is enhanced management of capital spare parts. In many major industrial enterprises, nearly 50 percent of the total MRO inventory value is in “critical” spare parts and capital equipment spare parts that are excess or obsolete. This has occurred due to practices, such as “just-in-case” inventory management i.e. “I know I need one but let's buy two”, lack of visibility of spares availability across the enterprise, overreliance on capital equipment suppliers to recommend spare parts with little oversight, and lack of visibility in Materials Management System (MMS) of the linkage of spare parts to specific equipment.

Market-leading enterprises have begun to take actions to better manage this inventory with an eye toward reducing existing inventory where possible, while beginning to look at the capital spares acquisition process more critically. Companies are formalizing their “provisioning” processes by critically evaluating spare recommendations to ensure they are consistent with heir maintenance processes and also with experience from other facilities where similar equipment is already operational.

Businesses are also proactively beginning to share spares across the enterprise, either through shared warehouses or virtually through the ERP system. Many companies are changing the business rules for capital spares acquisition. In some cases, where equipment is new to the enterprise, companies are leveraging the equipment manufacturer to maintain the equipment and provide spare parts for a period of time and then using this experience to buy spare parts.

HR Services

HR and procurement organizations — to control or avoid incurring unnecessary costs — understand the idea that both HR and procurement must align themselves instead of operating in a self-reliant state. In the future, both HR and procurement will not only collaborate to analyze the cost effectiveness and quality of certain products or services, but together, they will also assess whether these products or services fit into the enterprise's existing HR structure.

The 2008-2009 U.S. recession caused more organizations to rely on contingent labor to replace the resources lost through attrition. This has also created heavier reliance on the use of contingent, independent contractor and SOW project-based work. As a result, contingent labor has become one of the more complex categories for procurement to manage — traditional temporary labor, which is short term or seasonal admin, clerical, light industrial or accounting; complex contingent labor or SOW project workers for greater corporate or enterprise strategic initiatives; independent contractors or higher tier contract labor talent for critical projects that come with risks, such as federal audits and coemployment considerations.

Healthcare private exchanges are becoming a lucrative option for HR and procurement to consider. Enterprises are beginning to drive their HR and procurement teams to investigate online marketplaces that offer employees the option to choose their own individual healthcare and benefit plan designs. These plans are becoming a new opportunity for HR in the administration of traditional health and welfare benefit programs and beginning to drive the shift toward employee-chosen services related to healthcare.

HR and procurement must prepare for an integrated, blended learning supplier model that is now becoming a trend. Blended learning procedures, combining technology-based education and face-toface interactions will gain traction. Procurement will need to develop strategies with HR to create high-quality online learning programs, combined with personal interactions. This will be a continually evolving blended learning and development process and will need to be flexible, tailored and augmented as resources grow in their career.

Energy & Utilities

Governments and enterprises worldwide are being impacted by the relatively sudden and unexpected decline of oil prices. Importing economies, manufacturing industries and consumers will enjoy the benefits of lower oil prices while exporting economies and producer and oil support service industries will face severe challenges. Executives managing under this environment will require supply chains to be more adaptive and flexible, leveraging technology for enhancing work efficiency and improved supply market intelligence to make the right decisions under compressed schedules.

Equally important will be the actions of procurement teams to execute sourcing strategies aimed at crude oil related commodities and all modes of transportation to seek new contracted pricing, commensurate with market conditions.

The utilities sector is enjoying a period of high financial returns, primarily as a result of a low interest environment in most of the world markets. In addition, the industry continues to transform its generation portfolio to balance between conventional energy and renewable energy. Companies are also continuing to develop their competencies and corporate strategy toward full integration and/or specialization at the business unit levels.

In 2014, U.S. utilities were leading the 10 major sectors in the S&P 500, with a whopping return of 26.6 percent and an average dividend yield of 3.3 percent. While this performance will be difficult to repeat in 2015, we do see an environment for another year of strong returns. This, however, will come with its challenges from regulatory actions, which the industry will continue to address over the next several years.

An internal challenge that will become even more acute this year is the impact of an aging workforce. Many industry experts suggest that the advanced retirement population combined with increased workloads will require enterprises to explore external partnering options to address this gap.

An interesting event took place in Europe where E.ON, the large German utility, in December 2014, announced its split into two entities — one focusing entirely on conventional energy and the other on renewable energy. We believe that other utilities with common portfolios will consider following this trend in 2015-2016. The result will place further strain on supply chain organizations to cover these needs with a smaller, less leveraged resource base.

In summary, the energy & utilities industry executives will have to transform their procurement and supply chain organizations to become more adaptive, focused and skilled.

Packaging

The packaging industry in 2015 will be shaped by several key dynamics - global supply & demand, operational efficiency (capacity utilization and automation) and raw material prices (pulp, paper, paperboard, chemicals). Demand is expected to remain largely flat — driven by tepid global economic activity — and raw material prices are expected to continue their downward trend resulting from the overall commodity slump. With crude oil prices expected to remain in the $55 to $65/barrel range in 2015 and the downstream effect on chemicals & other commodities, we will see a continuation of the lower packaging pricing trends that we saw in H2-2014.

Some producers are already consolidating to manage these headwinds, such as the recent merger between MeadWestvaco and Rock-Tenn, creating a $16 billion industry leader. We also expect to see a shift in usage toward PET and other plastics in the food & beverage industry, away from metal and glass containers, driven by the current lower pricing trends and consumer preferences. Sustainable packaging strategies will continue to be a top priority for enterprises, with trends, such as use of recycled content, weight-reduced packaging and use of renewable/compostable materials. An example is the public pledge made by L'Oreal to reduce its environmental footprint by 60 percent before 2020, largely through packaging levers.

In the midst of all these changes, purchasing professionals will need to continue focusing on strategic supplier partnerships, developing a comprehensive understanding of cost drivers through supply market intelligence, raw material price management, sustainability strategies, and value engineering through specification redesign opportunities.

Theme: Procurement