Introduction

For many, indeed most organizations, there is a gap between what procurement thinks and says it has saved, and what finance can see genuinely impacting the P&L.

This creates a problem for procurement, as the credibility of the function suffers, and for finance and the organization more widely, because opportunities to cut costs are being missed.

In this white paper, we will see out how GEP has helped a variety of organizations close the gap, gain transparency, cash the check, and restore belief in procurement.

Why Finance and Procurement Numbers Don't Always Match

Let us start by understanding the origin of the discrepancy in viewpoint. Procurement as a function is focused on categories of spend – logistics, marketing, IT, MRO and others – and its money-saving machine, strategic sourcing, is focused on the tendering and contracting processes at a commodity level. In its simplest and clearest form, procurement savings are based on a reduction in historically paid prices.

Saving = (Historical Price – New price)* Forecast Volume

Finance, however, has a much more holistic view. It is focused on cost centers – COGS, SG&A, overheads, etc. – and its recognition of savings is primarily against budget: what did we spend compared to what we planned to spend:

Saving = Budgeted Cost – Actual Cost

To make an analogy, procurement is focused on cutting down individual trees, while finance is trying to measure the full extent of the forest. Sometimes it is hard to see the forest for the trees.

The Plot Thickens

Things are more complicated than this, however. Not all procurement savings, unfortunately, can be measured against historical prices. There might be a number of reasons why this is the case:

- A new service or commodity is being sourced. There is no baseline spend because the organization has never bought this before

- There is a significant change in specifications. We used to buy silver plate and now we buy gold plate: no surprise that the cost is going to go up

- Strategic sourcing has been carried out as a defensive mechanism against price inflation. Global oil prices are driving up the cost of plastic components; procurement has been involved to help limit the impact of the cost increases, so any “savings” is in fact an avoided cost

In all of these cases, an element of subjectivity enters the savings calculation:

There are a number of ways of calculating these hypothetical prices (use of price indices, average of bids received, reduction in price during negotiations), but all of them share the disadvantage of not being as objective or certain as historical prices paid.

It is important to procurement and to the organization as a whole that this type of saving is recognized in some way as it is in the organization's best interest. Imagine, for example, that your organization is going to start to buy a new digital marketing service. The agency proposes a cost that is accepted by your marketing department as it is within their budget. In year two, when the contract is up for renewal, procurement gets involved and brings the cost, on a like-for-like basis, down by 20 percent. The likelihood is that this saving could have been realized in year one if procurement had been involved then, but there would have been no historical price to calculate the saving. Nevertheless, the organization could have avoided paying that 20 percent for the first year.

In fact, in many ways, the hypothetical pricing methodology should be very familiar and comfortable to finance, as it is similar to the budgeting process: let us forecast what we were going to spend and then measure what we actually spent. The real problem here is that price increases, especially in indirect goods and services, are frequently not budgeted. Therefore, when procurement creates a hypothetical price savings methodology, finance is unable to match it to a budgeted cost. Finance is typically suspicious of any savings not based on historical pricing.

Identified and Realized Savings

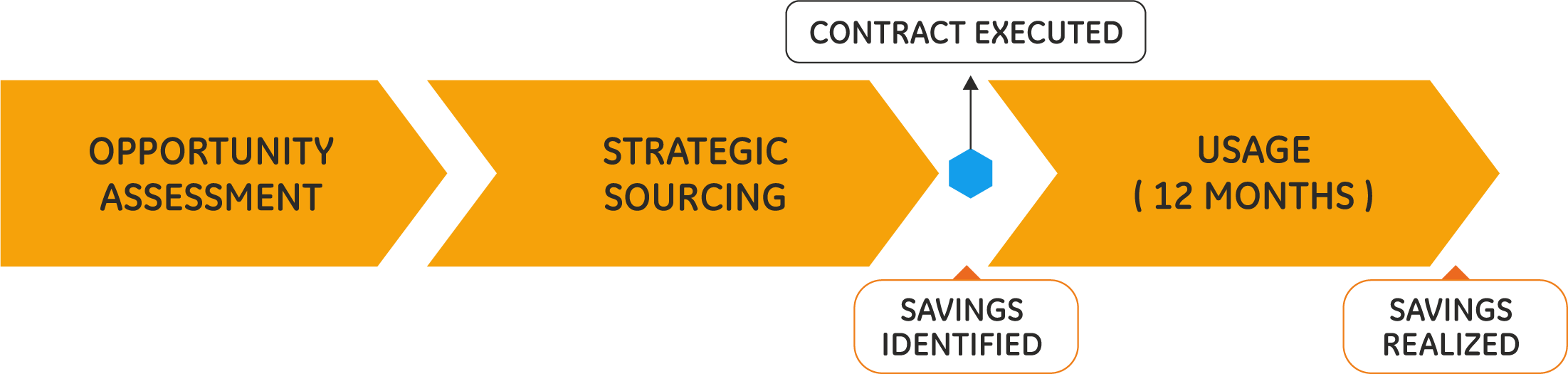

Another cause of disconnect between how procurement frequently calculates savings and finance's view of the world comes from the difference between the” forecast” saving and the “actual” saving. We need to be careful with terminology here – in particular, with the use of “realized”. Many procurement organizations consider a saving to be realized at the point of contracting, but at GEP we prefer to reserve that term for savings that have already hit the P&L in full. The diagram below illustrates our terminology.

In other words, when a contract is executed we know what the price difference is, but we have no more than a forecast of the volume, so the total saving is merely identified. Only after 12 months have gone by, and we have actual volumes, can the realized savings be stated with confidence.

Perhaps the main reason why realized savings are not more commonly used by procurement organizations is that it necessitates tracking at an invoice level. We will return to this point later, but for now let us also consider the fact that a failure to track realized savings means that a further gap between procurement's savings figures and what finance sees will come from a lack of compliance.

Imagine a scenario where procurement has run a successful tender for road haulage and signed a contract with a new service provider, delivering identified savings of 15 percent. If the implementation of the new hauler is not successfully managed then there is a good chance that at some point the dispatch team will go back to using the previous incumbent, at least some of the time. If the procurement “savings” has been declared on the basis of the identified savings alone, while the business is in fact still using the old supplier, then there will necessarily be a gap between procurement's numbers and what finance sees in the P&L.

Conceptual Framework: How Finance and Procurement Numbers Can be Made to Reconcile

Bridging the Gap

So much for the challenge; the good news is that it is possible to align the numbers which procurement and finance use. This can be achieved through three main levers:

- Formalizing savings methodologies

- Tracking Realized Savings

- Integrating Budgeting Processes

We will also consider how best to implement these changes, but first let us consider the future model in some detail.

1. Formalized Savings Methodologies

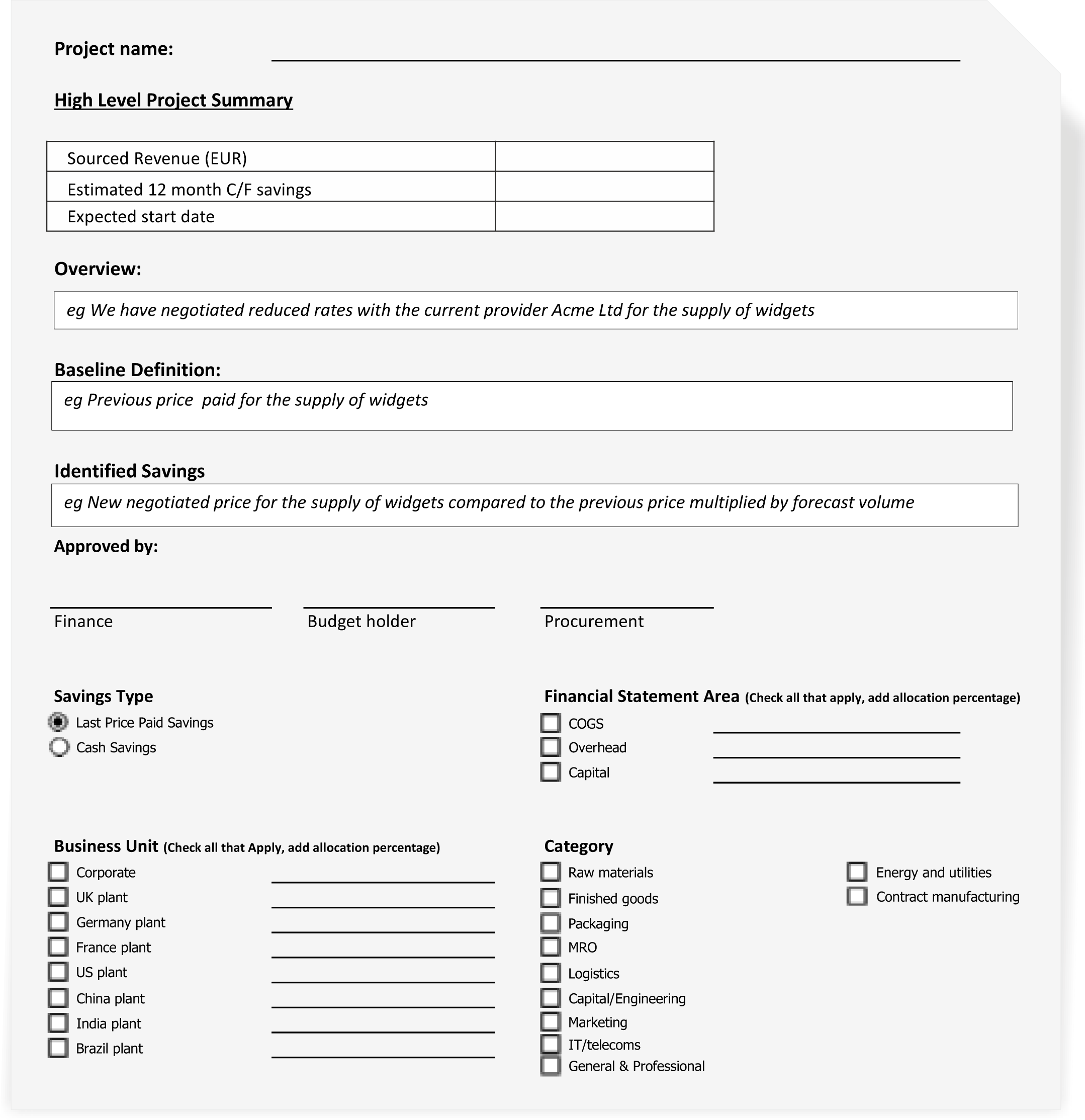

There are two dimensions to formalizing savings methodologies. The first is to create a methodology which relates the savings to categories that finance uses. The second is to get finance to sign off the methodologies themselves!

It is important for procurement to add value to an organization in a variety of ways: supplier relationship management, contract management, market intelligence, and of course strategic sourcing. Within strategic sourcing, as discussed above, there are many projects that procurement may work on which are not based on historical price baselines. In our experience, finance professionals are more than willing to accept this concept but in order for them to recognize procurement savings numbers they need to be able to differentiate between the different types of savings. For each project, therefore, it is important that the methodology stipulates:

- Type of savings (historical price/average of bids received/cost avoidance)

- Source of baseline data

- Cost center affected and general ledger codes where available

- Forecast volumes and therefore total impact

- Any assumptions or dependencies

This gives finance a very good indication of where they might expect to see the savings in the P&L, as well as which projects they will not necessarily be able to see in the P&L at all.

By getting finance to sign off procurement's savings figures themselves, further credibility is achieved. Especially where methodologies are not based on historical prices, there is the potential for the suspicion that Procurement has “marked its own homework”. By involving finance in the formalization of savings methodologies, procurement both removes the likelihood of finance disputing the figures, and improves the credibility of the figures in the wider organization – because they have been signed off by finance!

In practical terms, we recommend two things:

- A sign-off form for each project which sets out all of the information above and which must be signed by both finance and procurement. This should be a pre-requisite for the reporting of savings elsewhere, and it will also serve as a useful trail for any audits on savings numbers carried out in the future.

- A consolidated savings report which categorizes all savings into type of savings and expected cost center impacts. For all communication of numbers outside procurement it is useful to summarize this categorization into two high level categories: P&L impact and value contribution.

This is the first and easiest step to implement alignment between procurement and finance numbers. It builds credibility in procurement's numbers and engages finance directly. Many organizations stop here, and this is already a huge step forward from a situation where no one believed procurement's numbers, but as discussed above, tracking realized savings is also important to take the alignment to the next level.

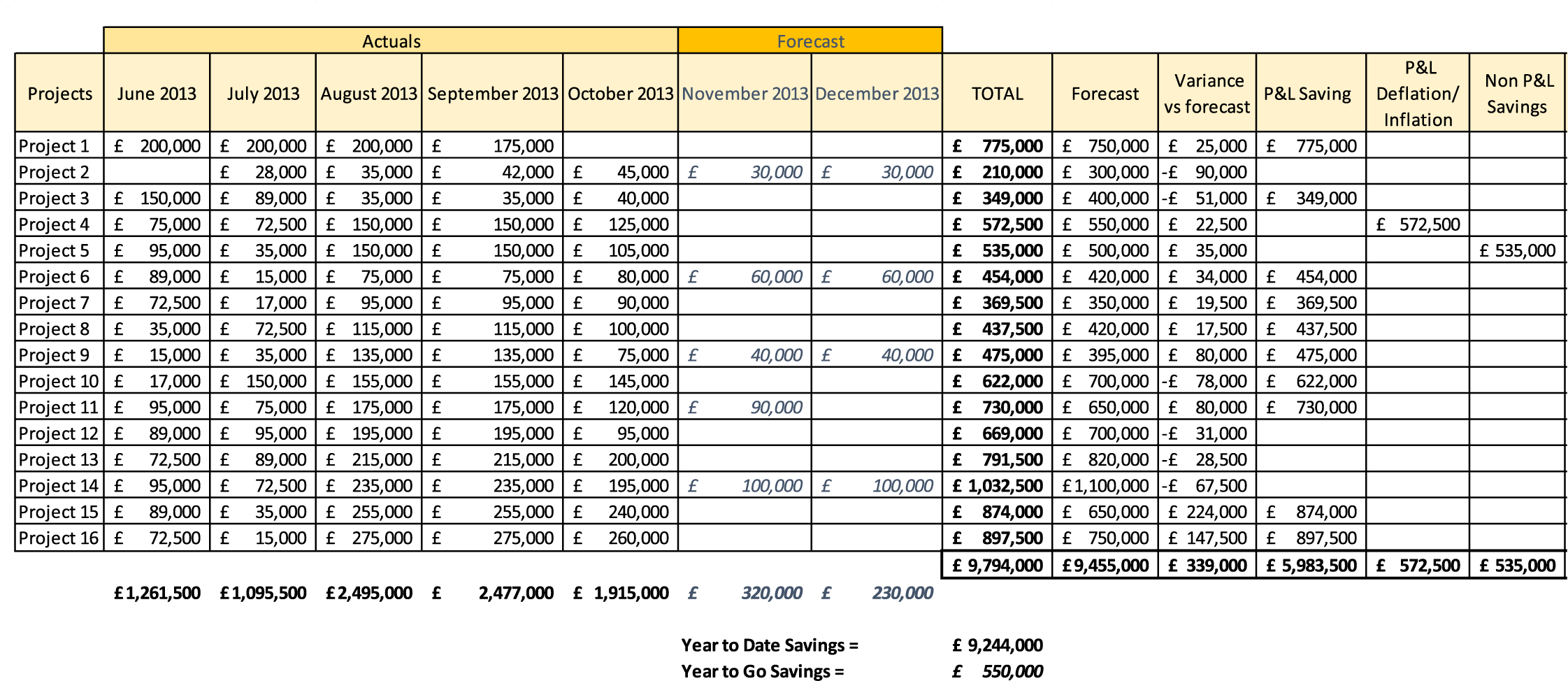

2. Realized Savings Tracking

The concept behind realized savings tracking is very simple – after a contract has been executed, invoices are tracked for 12 months to control and validate exactly how much money has been saved. The challenge here is execution: how to track a high number of projects with this level of granularity. There are two ways to achieve this, one more efficient than the other.

The best way to track realized savings is using an automated system: invoices received are checked against contract terms, and the actual spend can be reported automatically. Electronic invoicing greatly facilitates this type of solution, while OCR is making it more possible to achieve even with paper invoices. The main challenge to implementing this solution – assuming your systems are capable of it – is isolating the relevant spend. Unique supplier/GL code combinations are ideal but some work may be required to ensure that the relevant spend is flagged.

If your systems are not up to automated savings tracking then a manual process is also possible: contracted suppliers are required to provide detailed invoices that allow you to check what is actually being bought. This is simpler to implement than a system-based solution, but requires effort on an ongoing basis. As the effort required is highly repetitive and transactional, it is best handled from your lowest-cost location or outsourced entirely.

In both cases, it is important to make sure that your suppliers understand the requirement for them to provide the necessary level of granularity in their invoices, and in some cases, for them to provide summaries that can be handled outside of the invoice cycle. In our experience, this is not a problem with major, strategic suppliers anyway, but as a rule, it is better to clarify the requirement up front rather than after the contract has been signed.

That more firms do not have this type of process implemented reflects both the limitations of their systems and coding to handle an automated process, and a reluctance to spend money on a process that seems to add little value other than to validate procurement's realized savings. However, there are compelling reasons to implement this type of audit trail. One reason is the ability to facilitate the alignment of budgets, to which we shall turn in the next section; the other major benefit is the impact it has on compliance.

There are two main types of non-compliance in this context:

- Non-Compliance on Price: A supplier does not apply the contractually agreed price

- Non-Compliance on Vendor: An internal stakeholder does not select the preferred supplier

The savings tracking methodology will pick up on both of these. The checking of invoices allows discrepancies to be identified, queried, escalated if necessary, and finally recuperated from the supplier. By checking actual volumes against expected volumes, as well as by leveraging spend reports, it is also possible to identify where the preferred supplier is not being used. By identifying this latter type of non-compliance early, it is possible to challenge the business user, escalate the issue if necessary, and get the savings delivery back on track.

Realized savings tracking certainly makes procurement's figures even more robust, as well as delivering compliance benefits, but for the circle with finance to finally be squared, an alignment with the budgeting process is necessary.

3. Integrated Budgeting Processes

Even with the most detailed savings methodology and the most robust realized savings tracking, there is still every possibility that an organization can struggle to genuinely cash the check on its procurement savings. Imagine you are throwing a party and negotiate a 10 percent discount on the venue, but spend the money saved on an extra four crates of beer. You can certainly argue that you got more for your money, but from a purely financial point of view you did not reduce the total cost of the party. This is a very real concern at a great deal of organizations and there are a number of different ways to address the problem and ensure that savings hit the bottom line. Let us look at the three main levers:

3.a. Cut Budgets Upfront

3.b. Take procurement savings via signing bonuses or volume rebates

3.c. Fully integrate the budgeting process with procurement

3.a. Cut Budgets Upfront

An effective, if somewhat crude, way to ensure that savings are realized is a pre-emptive cut in budgets. This frequently happens with or without a savings contribution commitment from procurement and the best aspect of this approach is that it can create a greater pull for procurement support from the rest of the organization. However, frequently it is treated by the business as a simple request to tighten belts and a lot of the time it can and will be achieved by simply consuming less. In organizations with high procurement maturity, budget holders will turn to procurement to help them achieve their cost challenge without having to cut back on consumption but in organization with lower procurement maturity the budget cut will typically go through without any involvement from procurement. Costs are cut but no additional value is delivered to the organization.

3.b. Signing Bonuses / Volume Rebates

Where procurement savings are difficult to take out of budgets, a favored mechanism is frequently some kind of payment back to the purchaser. Instead of realizing savings through a reduced price, the savings come in the form of a one-off or annual payment. While undoubtedly effective, our view is that this type of mechanism is sub-optimal, both in terms of total savings achievable and organizational impact.

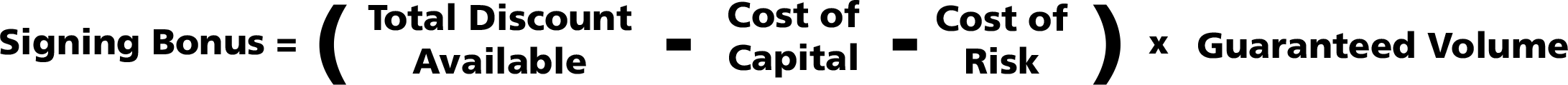

Let us consider the savings impact first. With a signing bonus, a supplier will factor in both risk and cost of capital relative to the total discount it is prepared to give, and will expect volume guarantees as well.

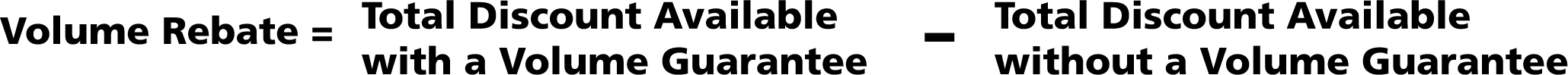

Signing bonuses are by definition cash-flow positive for the purchaser, and for that very reason are popular with organizations needing a very fast return. Our point here is that the total saving for the purchaser is less than could have been achieved without factoring in the cost of risk, especially as a large purchaser may well also have a lower cost of capital than its supplier. Meanwhile the guaranteed volume will tend to prevent or at least counteract any demand management initiatives. The same is true for volume rebates. While a volume rebate obviates the need for a supplier to factor in the cost of risk, it also makes savings reliant on consumption – the more you spend the more you save! It is also cash-flow negative for the purchaser, delaying the realization of savings until the year end. A volume rebate can be a useful mechanism, especially with new supplier relationships where the supplier is reluctant to give its best prices without a volume guarantee.

As such, it is a useful tool for procurement to have in its arsenal, and should be used in conjunction with price reductions.

Let us now consider the organizational impact. As mentioned above, these mechanisms are sometimes favored because they separate savings from the point of consumption. A signing bonus or volume rebate check can be cashed centrally, away from the budget holder responsible for the consumption. In this way, finance can be sure that the savings are truly realized – feeding into the P&L where they choose. However this type of arrangement has a number of negative impacts on the overall organization.

Procurement relies on the engagement and participation of a wide variety of business functions and departments for the successful execution of strategic sourcing work – its internal customers. While procurement's value contribution can be much more than just the savings numbers, it is a fundamental quid pro quo that stakeholders get to enjoy the benefits of the savings in return for the time and effort they put into working with procurement. A decoupling of the two leads to a risk that these stakeholders will be reluctant to work with procurement again. There needs to be some tangible benefit to the stakeholders themselves.

The cashing of savings outside of the cost center responsible for the spend can also easily drive the wrong behaviors in an organization. If this type of bonus mechanism is favored precisely because budget holders are defensive of their budgets, then using it is guaranteed to reinforce that behavior. If budget holders are expected to accept new suppliers and different contractual terms, while the benefits of making these changes do not accrue to them even at the level of recognition, then their perception will be that they need to retain the levers of what they spend more closely themselves.

In conclusion, while we recognize the usefulness of signing bonuses and volume rebates in certain circumstances, we do not consider them adequate alternatives for a true alignment of the budget process.

3.c. Integrated Budgeting

Best-in-class integration between procurement, finance and the organization as a whole sees procurement savings fully integrated into the budget process. This involves both the annual budget round and ongoing monthly re-forecasts, and it is also integrated with the savings sign-off methodology.

The involvement of procurement in financial budgeting has traditionally been restricted to direct procurement. Because a formal budget is required for the purchase of direct materials, it is a well-established process, and finance will typically recognize savings against budget even when nominal prices increase year on year. However, the involvement of procurement in budgeting for indirect spend is much rarer. Here budgets are typically set with budget holders directly by finance, and without consulting procurement. Yet, at least mature procurement organizations will have a reasonable pipeline of projects for the coming year, so it is possible to take account of these expected savings on the indirect side too. Whether budget holders will accept to have their budgets reduced on the basis of procurement forecasts is dependent on how procurement savings are treated, and what role they as budget holders have in the allocation of those savings.

Let us take an example. A marketing director has set aside $10m for a campaign, which was budgeted at the start of the year. Thanks to procurement's involvement, the campaign is run at full specification for only $9m. When the savings methodology is signed off, a three-way meeting takes place between the marketing director, finance and procurement. The business decision to be made is: does the $1m remain in the marketing director's budget, to be invested in other campaigns or for other purposes, or is the $1m removed from the marketing director's budget, to be reinvested elsewhere or allowed to drop to the bottom line? For the marketing director to allow the money to be removed from her or his budget, two conditions need to be met: firstly that she or he gets credit for delivering their campaign under budget; secondly that she or he has full confidence in the saving: any overruns or unforeseen costs will still need to be met. The process described here is a simplification – typically the reallocation of monies across an organization during the course of a year is not a simple 3-way meeting between the level of professionals involved in individual projects – but the key principle here is the involvement of the budget holder in signing off the savings methodology.

In itself the involvement of budget holders in this process is not guaranteed to change behaviors. The instinct to “protect” budget or to spend budgets so that less money is not allocated to them in following years is deeply ingrained in many professionals in many organizations. While people can understand the concept of the “greater good” of the organization they will still want to ensure that they have the requisite funding to deliver the best that their function can. But the transparency we bring to this process at least ensures that the calculations behind the discussions are sound.

It should hopefully also be clear how realized savings tracking supports monthly budget reforecasts. If money is removed from a budget on the basis of identified procurement savings, then each month adjustments can be made based on realized savings. Note here too that higher realized savings than forecast may be a challenge, in as much as they are driven by higher spending.

For example: an organization spends $12M on road haulage each year. Following a successful sourcing process, this is reduced by 10 percent and the budget is accordingly cut. In month 2, total spend on road haulage is $1.8M, or double the monthly average. This means that savings for the month are twice as high ($200K) but in terms of total money spent compared to budget, the organization has spent twice as much as budgeted. Typically, this is because of volume spikes or an underlying increase in demand, so it should not be a problem for the organization, but this example hopefully illustrates how the granularity of our methodology gives finance a much clearer insight into the actual impact of procurement savings. Each month the question can be asked: why the variance from forecast? Are volumes up/down, or do we have a compliance issue?

Once this type of alignment is implemented then procurement will find that it needs to update how it thinks about targets. For many procurement professionals, a savings target is a hurdle – the more savings, the better – and everyone wants to meet or beat their target. However, once finance truly believes and uses procurement's savings, then targets need to become more like a bull's eye: the closer to the target the better. While finance does not want a shortfall in savings, it also does not want to suddenly discover that it has saved considerably more than expected. Spare capital needs to be put to work in the best way possible and discovering, for instance, one month before year end that there are several million extra Euros to be deployed can be an unwelcome surprise. Procurement departments frequently bemoan a lack of their involvement in annual budget setting, but they certainly need to improve their forecasting skills to become valued partners in this process.

Advice on Reconciling Your Numbers

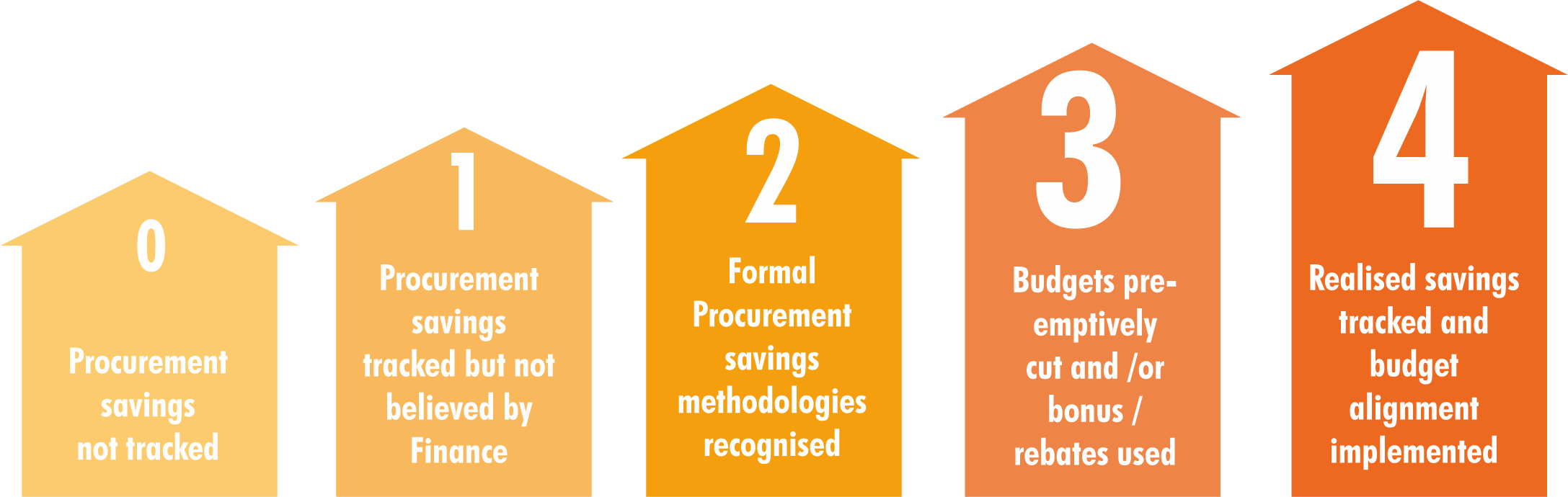

We have examined some of the challenges in aligning procurement and finance savings models, and described what we consider to be best practice. Let us finish by considering how best to achieve the target state described. We can illustrate the overall development with the following maturity model:

This model is a simplification as the development is not necessarily strictly linear. Signing bonuses are used by organizations with no formal savings tracking, and realized savings can be tracked without budget alignment being in place, for example, but it suggests useful stepping stones to plan along the way.

It is also useful to consider that most organizations which employ best practice in this area did not get there overnight. Considerable time and effort is required to successfully implement all aspects of this approach and have it accepted across an organization. Tackling one or two steps at a time and focusing on continuous development is the best approach.

Start simply, by focusing on getting procurement's own house in order – set up some standard methodologies and basic tracking. Excel tables are useful starting points, although database solutions provide a more robust solution. Ensure that the whole procurement organization follows the same way of calculating and tracking savings, and develop the habit of being tough on how savings are calculated. To build credibility and trust in procurement and its numbers, ensure that a third party could not challenge the integrity of how savings are calculated.

Early on, engage a business partner from finance. Where possible get a fully qualified finance professional to be allocated to the procurement team, and leverage them to ensure that procurement starts talking finance's language. This person will be a key asset in getting finance to accept the procurement approach and the value added. Once everything we describe in this white paper has been implemented you will find that finance is one of procurement's biggest advocates in your organization.

While proceeding with a pragmatic approach, maintain an eye for efficiency. Ensure you are leveraging technology to facilitate reporting where possible; consider outsourcing some or all of the tracking work; once you have a well-established process consider removing the sign-off stage for some or all projects (this is a useful tool when building credibility but may become too burdensome on the time of the signatories). The improved standing and effectiveness of procurement will be impressive, but you do not want your sourcing teams to spend too much time working on the numbers.

Conclusion

Aligning procurement and finance is a powerful enabler to maximize the financial value that procurement adds to your organization. The alignment process can take time and considerable effort, but we believe it handsomely rewards the effort invested. Organizations which have achieved this alignment have much greater control of one of their biggest cost levers. And while most CPOs would like to increase the strategic impact of their function, they recognize that savings delivery will continue to be the fundamental service they have to provide to their organization.

By ensuring that procurement's financial contribution is measurable, transparent and robust, procurement organizations can move on to more strategic value contributions, safe in the knowledge that the check they have handed the organization can be cashed at will.

Theme: Procurement