Managing Medical Insurance Spend – the Role of Procurement

Providing employee benefits, specifically health and medical care, to an increasingly diverse workforce is complex as well as costly for any enterprise. As health risks and health care costs continue to rise, it is becoming increasingly important for the procurement organization to address the enterprise's medical insurance spend, which typically ranges between 4-8% of the indirect spend for a Fortune 500 company in the United States. Procurement can help companies save 8-15% on medical insurance by pulling the right levers. However, this opportunity is often untapped by enterprise procurement organizations because of the complex cost structure of medical insurance and the unwillingness of the human resources (HR) department to allow procurement to influence spend in this sensitive category. Besides, the impact of changing federal regulations such as the Affordable Care Act is difficult to comprehend and keep a pulse on.

By joining forces with the company's benefit and finance team, as well as the employee benefit broker/consultant, procurement can develop and implement a customized solution, striking a balance between offering a market competitive program, meeting the employees' needs and achieving the company's financial goals.

Cost-Savings Strategies

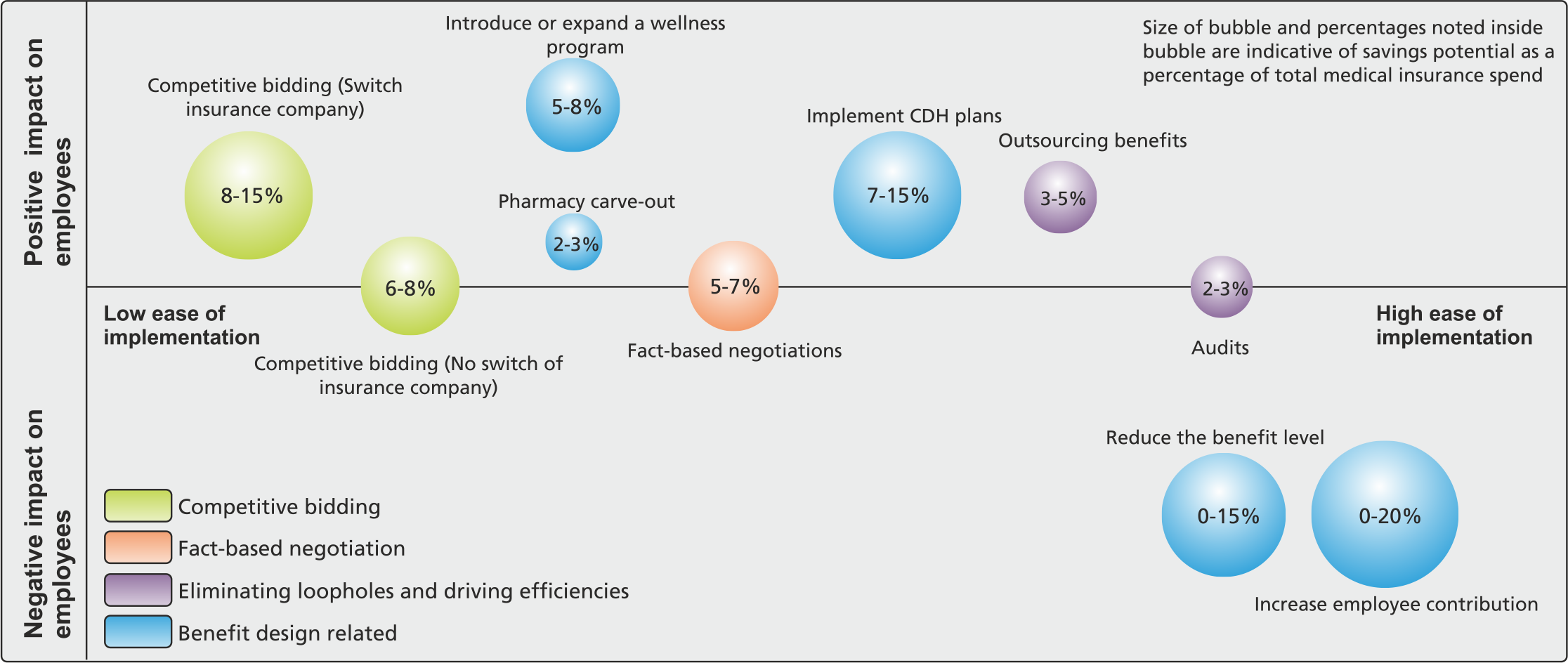

When it comes to choosing the right costsavings strategies to manage the medical insurance spend of an organization, there is no 'one size fits all' solution. As shown in Figure 1, different strategies vary in their ease of implementation, impact on employees and savings potential. Developing a solution in light of the organization's guiding principles with respect to benefits, the employees' and HR executives' appetite for change and the current state of category spend management is extremely important.

For instance, introducing or expanding a wellness program combined with a consumer-driven health plan (CDHP) is an effective method of achieving 10-15% savings, but requires employee participation and an initial investment from HR on communication and marketing. Lack of employee commitment or HR's inability to promote this change would lead to failure of this strategy.

Along the same lines, organizations that offer a richer medical benefits package to attract and retain talent might hurt themselves overall if they reduce the benefit levels or increase the employee premium contribution to achieve cost savings. These plans are earmarked as “Cadillac” plans for executives, and the trend will be to raise the premium costs, but with the Affordable Care Act in place 2014, insurance companies will have to reduce these premiums significantly.

Cost-Savings Strategies

Medical insurance cost-savings strategies can be classified into broad four categories:

- Competitive Bidding

- Fact-Based Negotiations

- Driving Efficiencies / Closing Loopholes

Recommended tactical measures, implementation techniques and potential employee impact of each of these types of costsavings strategies have been outlined below.

1. Competitive Bidding

Competitive bidding or “marketing” of medical insurance on a regular basis is highly recommended. A common myth is that premiums are more or less standard across insurance companies because premiums are formula-driven or because the health insurance industry is regulated. This is not true.

Despite regulatory constraints, bids offered by different insurance companies could vary significantly in terms of total premium costs. Market forces and the economics of demand and supply are very much prevalent in this industry and pressure insurance companies to offer lowest possible bids. Moreover, these competitive pressures tend to drive innovation and cost containment strategies which benefit both parties. It is important to note, however, that if an underwriter sees a request to bid each year, they will decline to quote after a certain period of time.

The underwriter must be convinced that the population risk is desirable and there is an opportunity to win the business. Competitive bidding can help organizations reduce medical insurance spend by 8-15% by switching to a new provider and up to 6-8% by driving costs down with the incumbent provider.

The Tactics

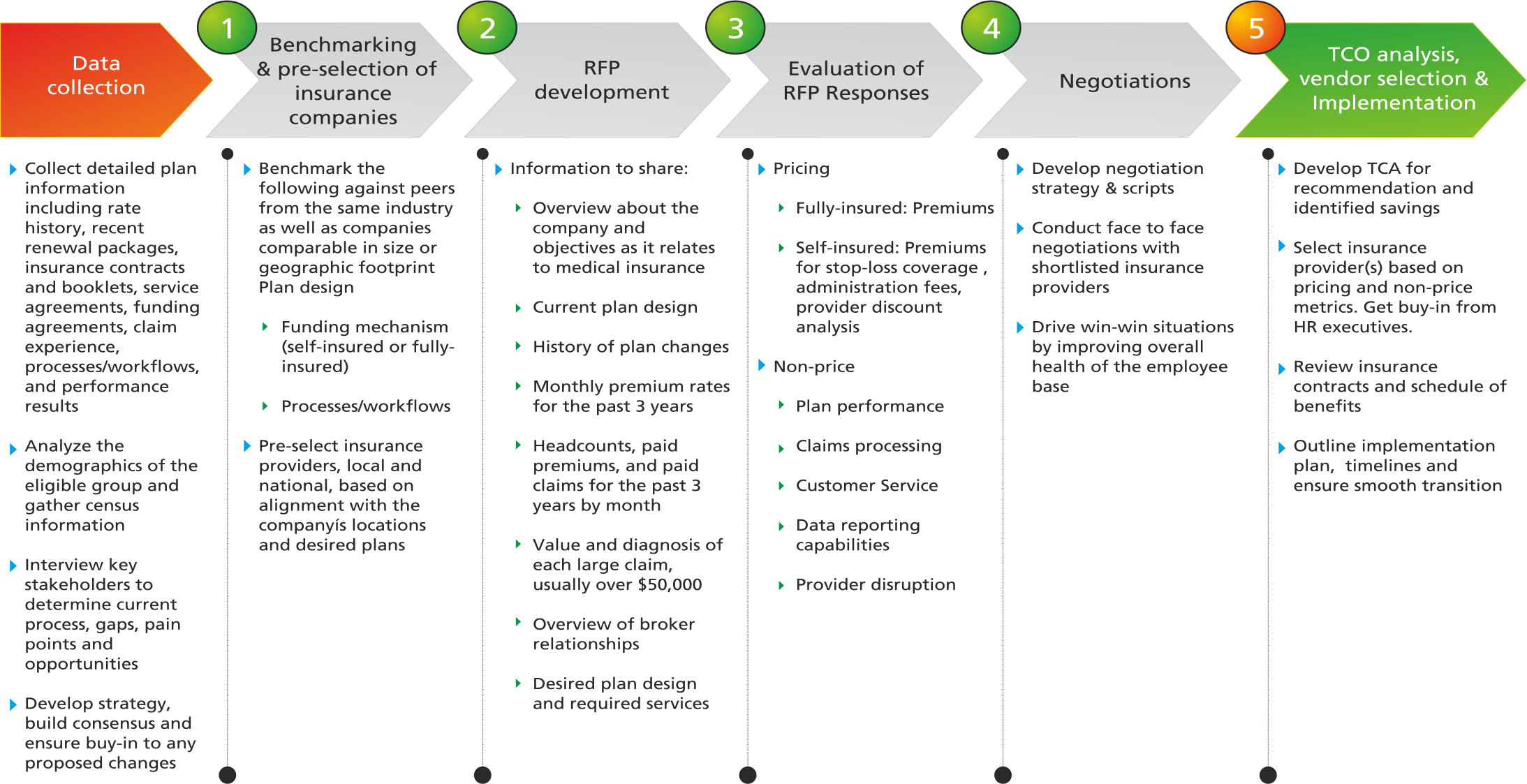

Figure 2 shows the six-step competitive bidding process for medical insurance. The ideal timing to initiate the bid process is 6-9 months in advance of the open enrollment date (to allow for enough time to review the bids, select an insurance provider, and complete the implementation and enrollment process) depending on the size of the company; smaller organizations require less lead time. Figure 2 shows the 6-step competitive bidding process for medical insurance.

-

Data Collection

In most organizations, HR's perception of procurement's category expertise (or lack thereof) is the main reason for procurement's inability to influence medical insurance spend. This challenge can be overcome by gathering and analyzing detailed information with respect to the plan history, employee demographics, processes and workflows and areas of opportunity. Conduct interviews with key stakeholders to understand objectives and build consensus prior to developing the RFP strategy.

-

Benchmarking and Pre-Selection of Insurance Providers

Benchmark the plan design, funding mechanism (self-insured or fully-insured) and processes/workflow with respect to peers from the same industry as well as companies comparable in size or geographic footprint. Insurance companies should be pre-qualified based on alignment of their offerings with the company's objectives. Supplier consolidation across regions is certainly an advantage from HR's perspective as it reduces the effort of vendor management. However, local players with strong provider networks often turn out to be the most competitive in the bid process, which presents a win-win opportunity for employers and employees. Therefore, mid- and large-sized companies should include local as well as national insurance companies in the bidding process.

-

Request for Proposal (RFP) Development

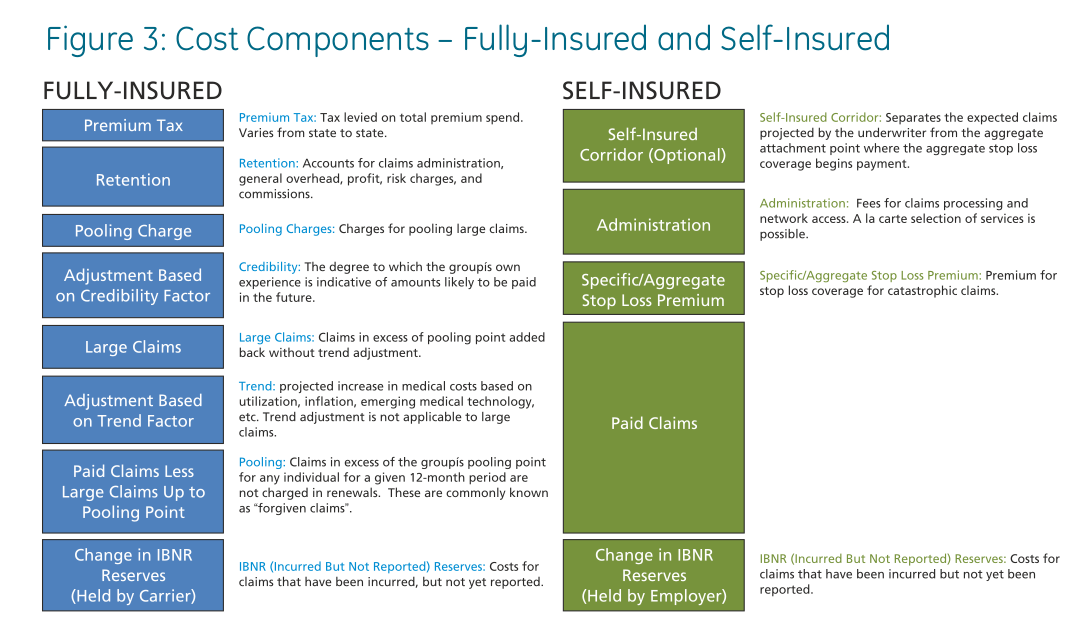

The RFP should then be used as an opportunity to collect pricing for the existing plan design and/or any new plans under consideration as well as to evaluate the financial impact of both types of funding mechanisms: self-insured and fully-insured plans. Figure 2 shows the cost components of self-insured and fully-insured plans however the RFP should be designed to compare per employee per month premium costs. The following information should be included as part of the RFP package:

- A brief overview about the company and its objectives as it relates to medical insurance

- The current plan design

- A history of plan changes

- Monthly premium rates for the past three years

- Headcounts, paid premiums, and paid claims for the past three years by month

- The value and diagnosis of each large claim, usually over $50,000

-

Evaluation of RFP Responses

From a qualitative standpoint insurance companies should be compared on the basis of plan performance, claims processing, customer service, data reporting capabilities, network stability and provider disruption. From a pricing perspective, the key elements that need to be compared across insurance providers for the different funding mechanisms are as follows:

- Fully-insured: All-inclusive premium rates for each plan under consideration

- Self-insured: Premiums for stop-loss coverage (specific or aggregate) and administration fees are the key components that need to be evaluated. The administrative services proposal will identify the services to be offered (claim processing, plan documentation preparation, medical management, network access, etc.) requiring a line-byline pricing review. In evaluating the administration fee, the administrator's bargaining power to develop a robust provider network with deep provider discounts needs to be factored into the final decision. Most administrators charge a 'per employee per month' fee. These fees can be lowered by executing multiyear contracts and applying competitive market pressure.

-

Negotiations

Negotiation tactics as it relates to premium rates have been covered in detail in section 2. In case the shortlisted insurance company is a non-incumbent, it is common for the insurance company to offer one or more of the following concessions:

- Implementation credit to offset transition efforts and the employee communications (typically in the range of 1-2% of the premium costs)

- Administrative support for employee communications and enrollment

- Grandfather plans of employees for whom viable alternatives are not available

- Discounts on wellness-related services such as flu shots and biometric screenings

-

Implementation

Procurement should get HR executive buy-in for any proposed changes in insurance provider and/or plan design. Contracts, schedule of benefits and detailed documentation with respect to implementation plan and timelines should be obtained. To ensure a smooth transition, procurement should remain closely involved in the implementation process, acting as a liaison between HR and the selected insurance provider and ensuring that account management dynamics are in line with Client's expectations and the timelines are being adhered to.

Implementation & Impact

If, as a result of the bidding process, the company decides to renew its contract with the incumbent, the implementation process is routine. However, switching to a new provider (due to cost or qualitative benefits) could pose some challenges especially if it results in significant changes in terms of plan design, network, etc. For some employees, it could mean that their physician or provider is no longer part of the network or a drug they were prescribed previously is no longer covered under the new plan (if pharmacy is part of the main medical plan). This potential impact on employees combined with the transition efforts required on behalf of the HR staff may make it difficult to get HR executive buy-in for switching providers. Here's how procurement can overcome these challenges:

- Build a strong case to justify the switch in terms of pricing or quality or both

- Minimize the transition effort for HR by negotiating administrative support from the insurance provider or an implementation credit to offset transition costs or other value-added services

- Communicate the purpose of the switch to the employees and how it could impact their medical or drug plan, provider network, enrollment process, etc. If switch-related cost savings are significant, the company should consider sharing a percentage of this cost advantage with its employees.

Fact-Based Negotiations

Fact-based negotiations should be conducted as part of the competitive bidding process. In some scenarios, however, due to insufficient lead time, conducting the entire competitive bidding process may not be feasible. In such cases, a fact-based negotiation with the incumbent provider regarding the renewal proposal is an effective mechanism of achieving significant savings with minimal time investment. The obvious tradeoff is that it reduces the savings potential to 5-10% of the total medical insurance spend.

The Tactics

-

Fully-insured formula-based pricing - This is the method an underwriter would use to determine the premium costs for a given benefit plan and population. Figure 2 shows the cost components involved in calculating premium rates based on this formula. It is important to note that (a) market forces pressure carriers to offer premium rates that are lower than those prescribed by the formula and hence formula-based pricing serves a good reference for the Most Supportable Solution (MSS) of the negotiation (b) the formula will yield different results depending on the methodology used by the insurance company to arrive at the subjective parameters used in the formula.

Below are some guidelines which will help validate the insurance company's methodology with respect to these subjective parameters:

-

Adjustment Based on Trend Factor

'Trend' refers to the projected increase in medical costs based on internal factors, such as utilization, as well as external factors such as inflation, cost-shifting from the government to the public sector, emerging medical technology, etc. Trend varies by product and managed arrangement, as well as geography. A higher trend number implies higher premium costs. Hence it's important to benchmark the trend projection used by the carrier against other carriers' projections and consultant surveys for similar plans and locations. Currently, the annual trend adjustment is 7.5%-9.0%.

-

Adjustment Based on Credibility Factor

If the credibility of a group is less than 100% due to small group size (less than 250 lives as a rule of thumb), the claims projection is a weighted average of the experience-based claims projection and the projected manual claims. The projected manual claims is based on the carrier's average claims, adjusted for the group's demographics, industry, benefit plan and/or location. The projected manual claims amount is based on the carrier's book of business and can be ambiguous. This amount should be compared against the past year's renewal, holding the insurance company accountable for justifying changes, if any.

-

Pooling Charge

Pooling charge assessed by the carrier in exchange for 'forgiving' claims above the pooling point. Generally, pooling charges are based on a percentage of claims and will vary based on the pooling level. Pooling charges are typically 4-10% of claims. To determine if the pooling charge is appropriate it should be compared to the previous year's renewal percentage of claims and dollar amount.

-

Retention

Retention is the portion of the premium that accounts for claims administration, general overhead, profit, risk charges, state taxes and assessments, and commissions. Retention costs are typically 8-10% of paid claims. One of the mandates of the Affordable Care Act is that insurance companies must maintain a medical loss ratio of not less than 80% (85% for the large groups). As a result, insurance companies will be forced to publically report and limit administration costs, marketing expenses and profits. This will translate into lower retention costs for employers.

-

Self-Insured Stop-Loss Coverage Pricing

The underwriting principles used to calculate stop-loss coverage premiums are very similar to the above in that the past claims are adjusted for trend and plan design changes. Pooling charges, retention and premium tax are not applicable under a self-insured plan.

Implementation & Impact

Fact-based negotiations with the incumbent insurance company based on the method outlined above does not require any implementation effort and does not have any impact on employees. The company may, however, choose to pass down a percentage of the cost advantage gained from negotiations to the employees resulting in a positive financial impact.

3. Driving Efficiencies / Closing Loopholes

Outsourcing benefits administration and conducting audits are two effective mechanisms of achieving cost savings by driving efficiencies and eliminating loopholes in the end-to-end process of plan utilization through claims payment.

3.1 Outsourcing Benefits Administration

Outsourcing benefits administration may not always result in cost savings. However, for midsized to large self-insured companies, it is typically more advantageous from a cost, compliance as well as customer service perspective to outsource certain components of benefits administration which are either very technical or are impacted by complex and dynamic regulatory requirements. COBRA administration, FSA administration and annual open enrollment administration are the most commonly outsourced components of benefits administration.

The Tactics

Conducting a competitive bidding process is an effective method of selecting a benefits administrator and procurement can play a crucial role in this process. Multi-year agreements (up to 3 years) with benefit administrators are common and can help lower costs. Most third party benefit administrators charge a 'per employee per month' fee which typically includes any portal costs, reporting costs, and employee communications. Setup fees are typically waived.

Implementation & Impact

Outsourcing benefits administration eases the burden on the HR department enabling them to focus on core activities and more strategic issues. The overall impact on employees is also positive in terms of improving quality of customer service and reducing costs. Hence, it is relatively easy to secure executive buy-in for this switch even though the services outsourced may vary from one organization to another.

3.2 Audits

Audits can help drive cost savings by rectifying plan inefficiencies and uncovering plan violations. These audits are best carried out by a neutral third party that is not involved in providing insurance coverage or benefits administration to the company. The following types of audits are known to drive significant cost savings.

- Dependent eligibility audits aim at identifying ineligible covered dependents such as children over the maximum age permitted in the plan, dependents that are not immediate family members and ineligible covered spouses in plans that have a spousal carve-out provision. Removing ineligible dependents off the plan reduces claims and hence premiums.

- Claims audits are performed to uncover any instances of excess or duplicate payments and to make sure that the insurance carrier or the third-party administrator has paid the claims as directed in the contract.

The Tactics

Competitive bidding can be used for the selection of an auditor. Pricing and methodology used to conduct audits are the two main criteria which should be used in the selection of an auditor. Fees for claims audits can be broken into two components: a fixed fee and a percentage fee contingent on the total amount of invalid claims. Multi-year agreements, reducing the fixed fee and increasing contingent fees, and performing internal review of claims prior to external audits are effective in lowering the cost of audits.

Implementation & Impact

Closing loopholes and achieving efficiencies through audits are low-hanging fruits when it comes to saving healthcare costs. Conducting audits requires minimal efforts from HR staff. However, it is critical that there is effective communication with employees explaining the reasons for the audit, the importance of conducting the audit, the audit vendor, the process and the role of the call center to address questions and problems. Finally, the ramifications of ineligible dependents, such as amnesty programs, employment termination, etc. should be reviewed carefully.

4. Benefit-Design Related

In any organization, there are a variety of benefit design components that can be modified to achieve cost savings. However, these changes have a direct impact on employees and hence should be made only upon careful evaluation of the costs and benefits. Some of the most commonly used plan-design related changes that lead to cost savings have been described below:

- Introduce or expand health improvement programs – Every insurance company has different types of health improvement programs to offer. Protecting and promoting workers' health leads to reduced health care costs, improved employee productivity and improved business performance.

- Implement Consumer Directed Health (CDH) plans – Consumer driven health plans are health benefit plans that engage covered individuals in choosing their own healthcare providers, managing their own health expenses, improving their own health with respect to factors they can control. A consumer-driven plan provides:

- Flexibility in how an employee spends your healthcare dollars

- Financial protection if seriously ill or injured through a high-deductible plan

- Option to finance unreimbursed healthcare expenses through a healthcare reimbursement account or a health savings account

- Tools and resources to improve your health

- National network of lower cost, high quality providers

These plans not only help in containing costs in the short term because they often come with a lower premium costs due to the higher deductible but they also provide the framework needed for educating and motivating employees to actively engage in managing their health and wellbeing.

- Reduce the benefit level – The cost savings generated by this mechanism are short term. The most optimal plan design causing minimum change for the employees can be determined in collaboration with the insurance companies from the menu of available options.

- Increase employee contributions – This is a mechanism of shifting the cost burden from the employer to the employees. The most appropriate cost-sharing model can be determined based on the financial goals and the benefits philosophy of the organization.

- Pharmacy carve-out – Carving out pharmacy benefits means unbundling the prescription drug coverage from the main medical insurance plan. Pharmacy carve-out typically leads to lowering of administrative costs due to direct contracting with a specialty pharmacy benefits company. Other advantages include the ability to offer a plan customized to the employee population, greater visibility into pharmacy claims and easy monitoring of member compliance.

The tactics involved in implementing each of the above plan changes is different and warrants collaboration with HR and the benefits broker/consultant to ensure all objectives of all stakeholders are met.

Implementation & Impact

Health improvement programs and CDH plans are effective mechanisms of achieving a consistent year-after-year reduction in health care costs irrespective of the regulatory environment and the competitiveness of the marketplace. Driving adoption of these plans is however the biggest challenge most companies face. The trend is moving towards using communication and marketing techniques to engage participants based on readiness rather than using financial incentives or tiered coverage to employees based on health goals. In the case of CDH plans, subsidizing the premiums for the first year has also shown to drive adoption. Reducing the benefit level and increasing employee contributions are the most quick-fix mechanisms of reaching a middle ground between the high year-on-year increase proposed by the insurance company and the employer's financial goals. However, before making any such changes, one must benchmark the existing plan design with the plans offered by peers in the industry because a non-competitive benefit offering could lead to employee dissatisfaction and attrition. Pharmacy carve-outs can have a significant positive impact on employees due to clinical, financial and operational efficiencies.

Conclusion & Recommendations

Irrespective of the economy, healthcare insurance costs are unlikely to decline significantly, presenting a important opportunity for procurement to demonstrate value. Procurement's involvement brings sourcing expertise to the category and often reduces HR's dependence on the benefits broker/consultant. The ability to build and showcase the necessary category expertise and the nimbleness to react to dynamic external cost drivers such as federal regulations is the key to developing strong credibility with HR and getting ahead of the game. We believe that ability to devise and implement a holistic spend management plan using the guidelines outlined in this paper can help enterprise procurement professionals achieve great success in this complex space.

Theme: Procurement