The long tail concept

In October 2004, Chris Anderson published his now famous article on “The Long Tail” in Wired magazine. “The Long Tail” took an opposing position to the Pareto principle of focusing on the 20% of high-impact areas that lead to 80% of the results. Chris suggested that many of the traditional assumptions around the 80/20 principle are actually artifacts of poor supply-demand matching and a market response to inefficient distribution. In his world, the long tail was traditionally ignored due to the challenges of finding local audiences and the constraints of the physical world. But successful companies have leveraged technology and innovative business models to unlock exponential value from the long tail (eg. Amazon, Netflix). These models ensured that even products that are in low demand or have low sales volume can collectively make up a market share that rivals or exceeds the relatively few current bestsellers and blockbusters, if the store or distribution channel is large enough.

Procurement implications

From a Procurement standpoint, the long tail manifests itself in the sourcing priorities of organizations. Strategic sourcing programs for high-value categories aim to establish competitive pricing contracts with preferred suppliers, generating millions of dollars in savings and showcasing significant ROI on the efforts. Compare that to the challenges of managing the long tail of low-value fragmented spend and the questionable ROI and you’ll reach the same conclusion as many other CPOs. It is not a worthwhile focus area.

Missed opportunity

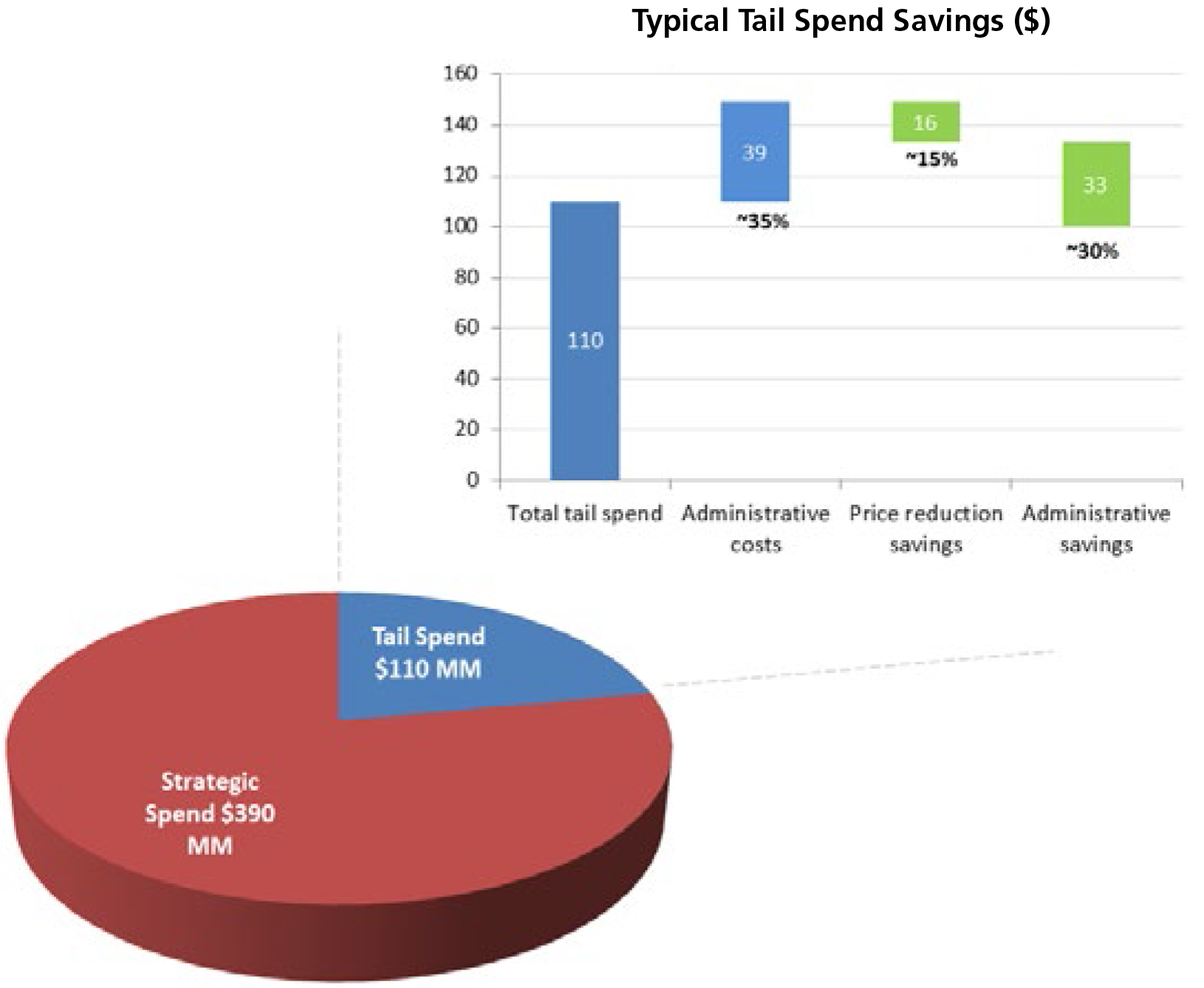

The downside of this approach is that corporations leave significant financial and operational opportunities on the table. In the absence of a streamlined approach to manage this spend, companies lose ~15-20% of potential savings and also add ~35% in administrative costs due to ineficient ad hoc processes. For a mid-sized company that has a total indirect spend of $500 MM, this can translate to potential missed opportunities of $50 MM annually.

The reasons driving conventional wisdom

Tail spend is characterized by poor data visibility, high volumes, low transaction value, lack of effective controls and general lack of interest from stakeholders. Most organizations rarely have a good handle on what constitutes tail spend because of its fragmented nature and do not know where to start. It is also difficult to optimize an operating model while ensuring a good ROI, using conventional approaches to managing these requirements.

The size and scope of the potential cost savings and efficiency gains go well beyond conventional expectations. However, tapping into this opportunity requires companies to invest in resources and processes that will yield long-term benefits. A tested approach that has been used by industry leaders (and several GEP clients) is listed below.

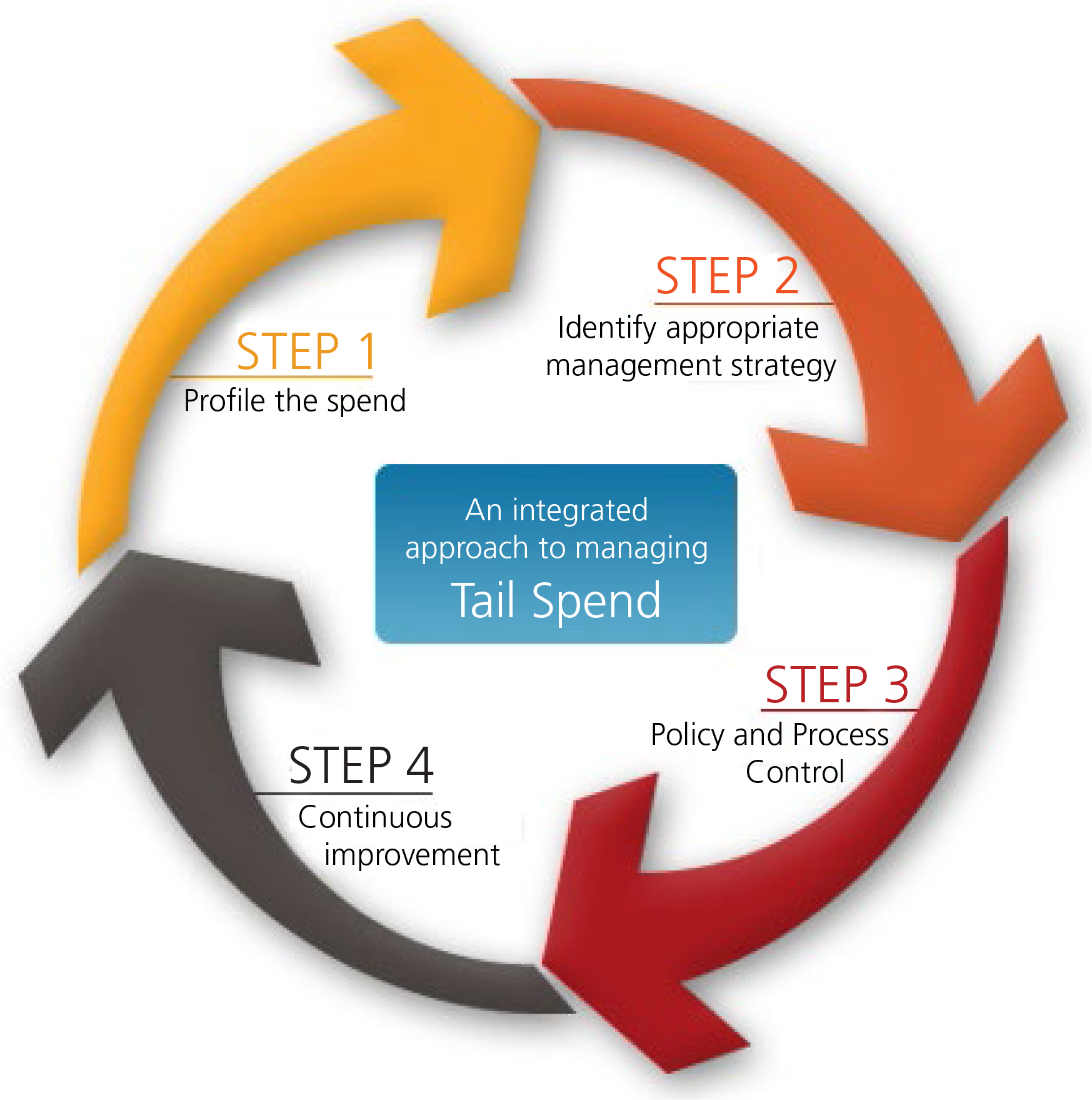

An integrated approach to managing Tail Spend

Step 1

Profile the Spend

The starting point here is data. Best-in-class spend analytics software will take data from a variety of sources (such as Accounts Payable, General Ledger, ERP systems, etc), and classify around 95% of data in the first iteration (already deep into a 20% tail). Over time, this classification can improve even closer to 100%; indeed, proactive TSM will actually improve data classification in the long run. Good spend analytic solutions will also allow you to drill right down to the line item level, critical in the next stage, which is classifying tail- spend data.

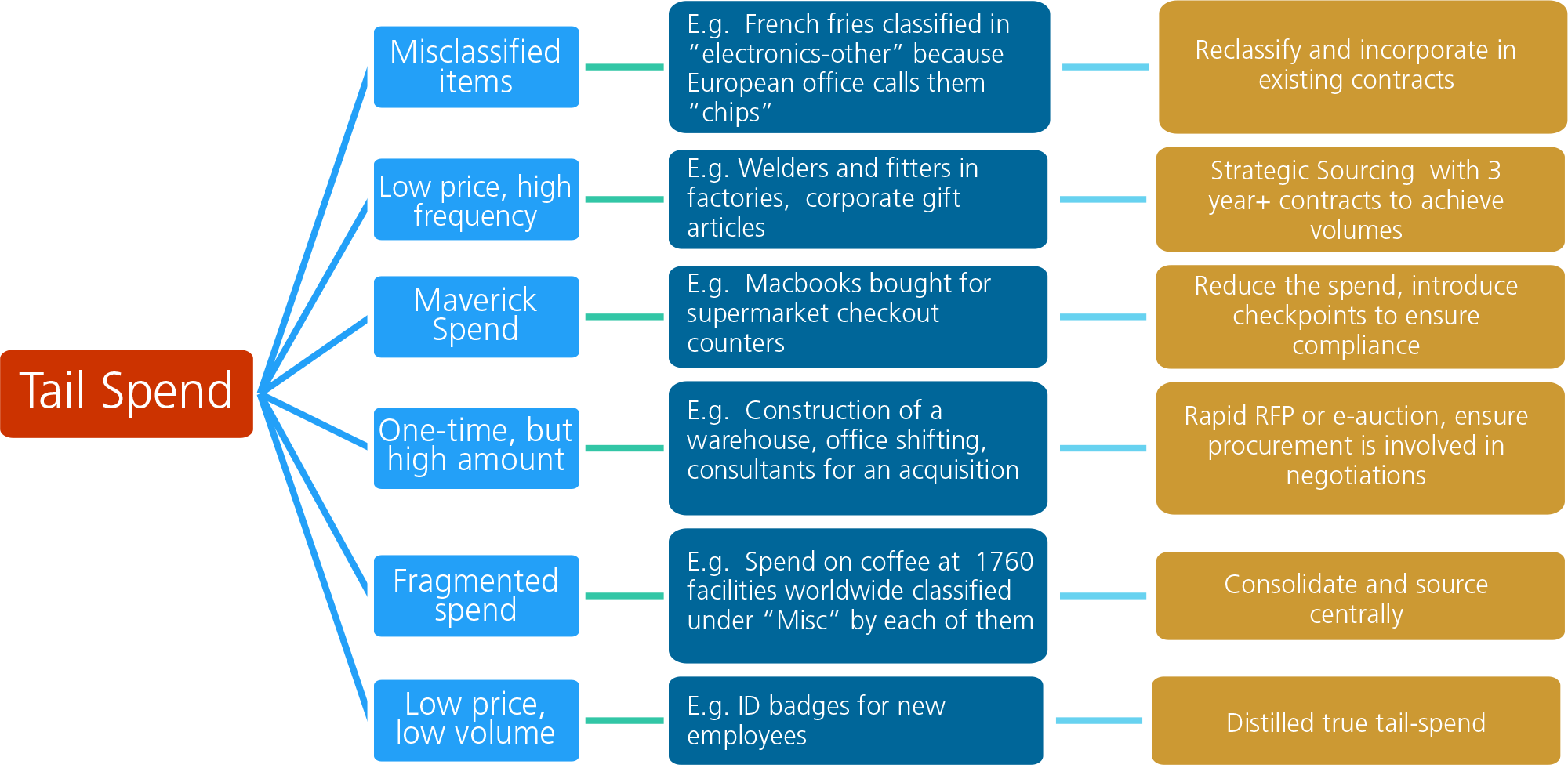

Deep dive data analysis will allow you to filter and reclassify your tail-spend so that appropriate strategies can be employed by category. We typically use filtering models, like the one below, to ensure that different types of tail-spend are addressed in an appropriate manner:

Step 2

Identify appropriate management strategy

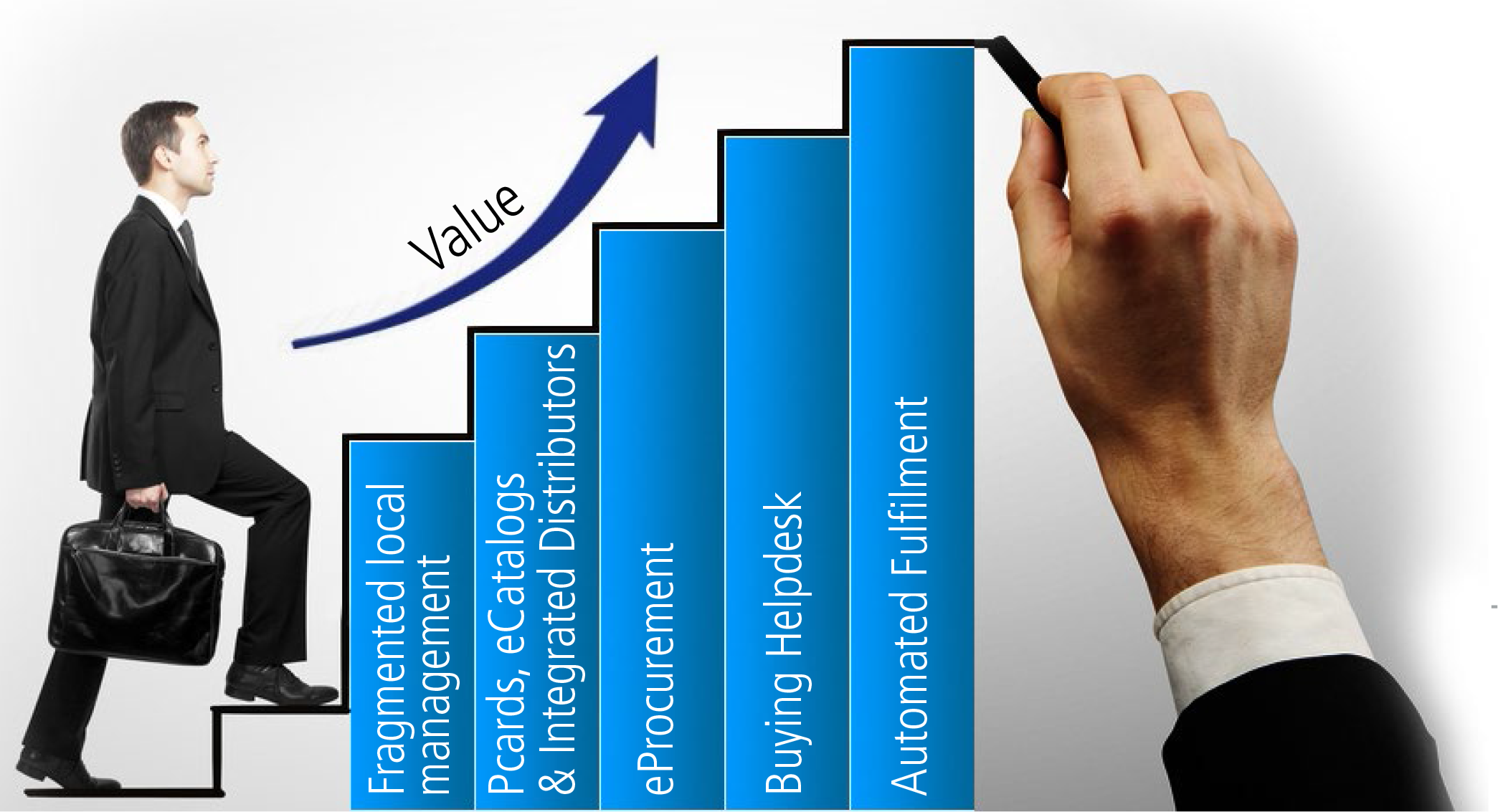

There are several steps to increase organizational competency in managing tail spend. Typically, companies move along this chain to unlock additional value at each phase

Use of P-cards and catalogs

Using this approach, companies analyze the accounts payable data to identify the right suppliers & cost centers to implement purchasing card program and the right threshold for P-card transactions. A key success factor is to encourage use of P-Cards for all such transactions and to capture and track the transaction data to ensure compliance. Another tool to manage such spend is the use of computer/web-based catalogues. For products such as office supplies and MRO, c ompanies should use supplier provided catalogues since maintenance of supplier provided catalogues is not required. A key success factor is to identify the right suppliers / distributors that carry a wide range of merchandise and to outsource procurement of these items to such distributors to simplify the procurement process for non-core purchases.

eProcurement tools

A more advanced approach is to utilize web-based procurement tools (customized versions of eAuction) tailored to suit the unique needs of the non-core categories. We have also seen companies use preferred panels of vendors wherever possible, with a special focus on training these vendors on the e-procurement tools.

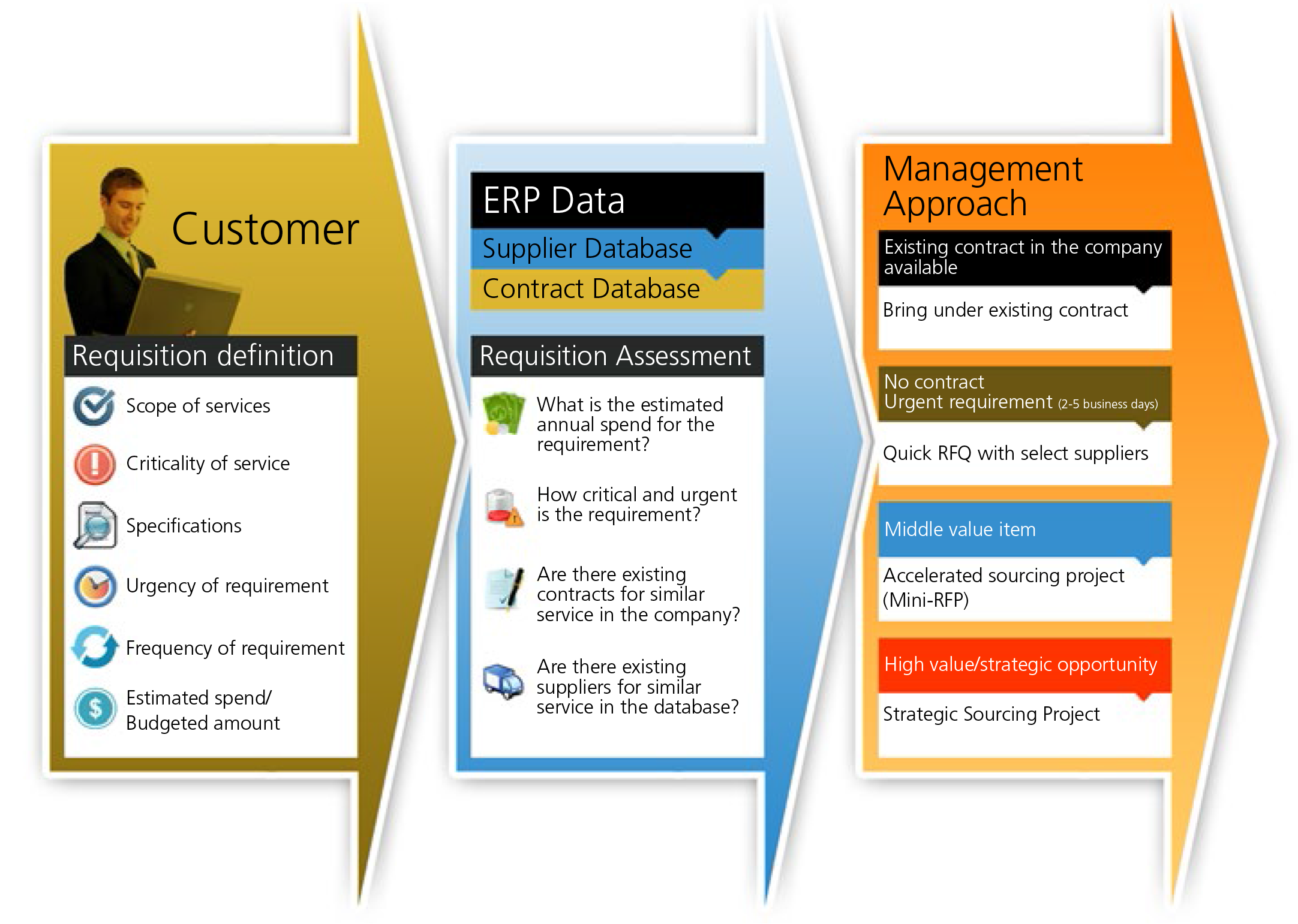

Buying Helpdesk

The approaches of establishing P-card programs and eProcurement tools help improve the level of control on tail spend, but they have limitations in term of managing the large scope of low volume non-recurring items. Best-in-class sourcing organizations have understood the need of supplementing these programs with a dedicated Buying Helpdesk to manage such requirements. Large firms with high value tail-spend can see accelerated returns through dedicated resources in this area. In such a scenario, all requests are directed to a helpdesk which decides an appropriate fulfilment strategy, based on characteristics of the request.

Based on the nature of the request, overall spend, timeframe and other factors, the helpdesk will mine data from contracts, supplier databases and ERP systems to identify a suitable strategy.

Typically, companies can generate significant ROI while ensuring internal customer satisfaction by outsourcing helpdesk activities to a qualified third party provider. Outsourced service providers can leverage category expertise and multi-language capabilities. Managing tail-spend as a single commercial relationship, underpinned by a robust SLA, allows senior procurement professionals to maintain focus on core spend areas.

Automated Fulfilment:

The latest technological solution to manage tail-spend enhances the efficiency of a helpdesk – thereby increasing savings while ensuring internal customers are happy. The latest solutions aim to automate the strategic decision making of the helpdesk and reduce manual labor.

When selecting a solution, one should keep the following features in mind –

- Automated workflow for non-core non-recurring tail spend

- Transaction history based learning

- Supplier suggestion based on historical data

- Requisition library

- Communication mechanism between users and suppliers

- Potential integration with other catalog tools

These best-in-class solutions aim to optimize the blend of technology, processes and people to address a large scope of tail spend, identify savings opportunities, and reduce administrative costs while enhancing end user satisfaction.

Step 3

Policy and Process Control

In addition to the appropriate management strategy, companies need to recognize the limits imposed by low spend and accordingly simplify procurement processes. Exceptions should be obtained from Legal and Finance departments for projects in low spend and low-risk categories. RFPs can be reduced to RFQs, NDAs can be dropped in low sensitivity categories and lengthy negotiations can be replaced by a 3-bid & buy process or an e-auction. In short, each process needs to be examined and simplified, and the effort justified in terms of the potential benefits.

Also, while procurement processes should be simplified, controls need to be tightened elsewhere. Once a TSM team is put in place, effective controls have to be set up to ensure that all tail-spend is sourced from them. For low-spend items, functional teams can get complacent and bypass procurement, which can derail the process. Effective controls need to be coupled with extensive communication to drive awareness within the organization.

Step 4

Continuous Improvement

Finally, for any company starting out on the tail spend journey, it is crucial to iterate and learn from the implementation experience to redesign and refine the model on an ongoing basis.

In conclusion

A good understanding of the nature and challenges of tail-spend is not difficult for procurement professionals to grasp, but given an expectation of low ROI, data challenges and lukewarm interest from the rest of the organization, knowing what to do and how to do it is not so clear cut. GEP has been working with global clients on TSM for the past ten years, and our experience demonstrates that a coordinated, serious tail spend management effort can enable firrms to reduce overall procurement spend and lower the total cost of acquisition by 30%-40%. Such savings can have a dramatic impact on the firm’s bottom line and enhance the standing of any chief procurement officer willing to attack what is a chronic, widespread issue for all companies.

Theme: Procurement