Introduction

The level of procurement maturity within the insurance industry has traditionally lagged significantly behind other industries such as manufacturing, consumer packaged goods, and energy & utilities. With increasing financial pressures, insurance carriers have started looking for ways to reduce their costs. This has brought the procurement organization to the center stage. There are numerous challenges though in developing an effective sourcing and procurement program for insurance companies. Suppliers are normally deeply embedded within the insurance carriers' core processes, so it can be difficult to switch suppliers while maintaining high levels of customer service and ensuring a hassle free claims experience for the insured.

In this white paper, GEP recommends three key focus areas to help insurance companies deliver increased savings on spend with external suppliers, mitigate risk through more effective supplier contracts, and make more informed business decisions through timely market intelligence.

The claims department is the largest expense center in insurance companies. Up to 80 percent of total premiums collected are spent on claims payments and the costs associated with settling these claims.

Insurance companies can drive significant bottom-line savings, increase revenue and improve ROI by optimizing their claims department spend. It is imperative that the procurement organization looks at the enterprise's spend in a holistic manner, keeping in mind business requirements and functioning while developing an effective sourcing and procurement strategy.

GEP recommends the following three key focus areas to help insurance companies deliver increased savings on spend with external suppliers, mitigate risk through more effective supplier contracts, and make more informed business decisions through timely market intelligence:

Strategic Sourcing

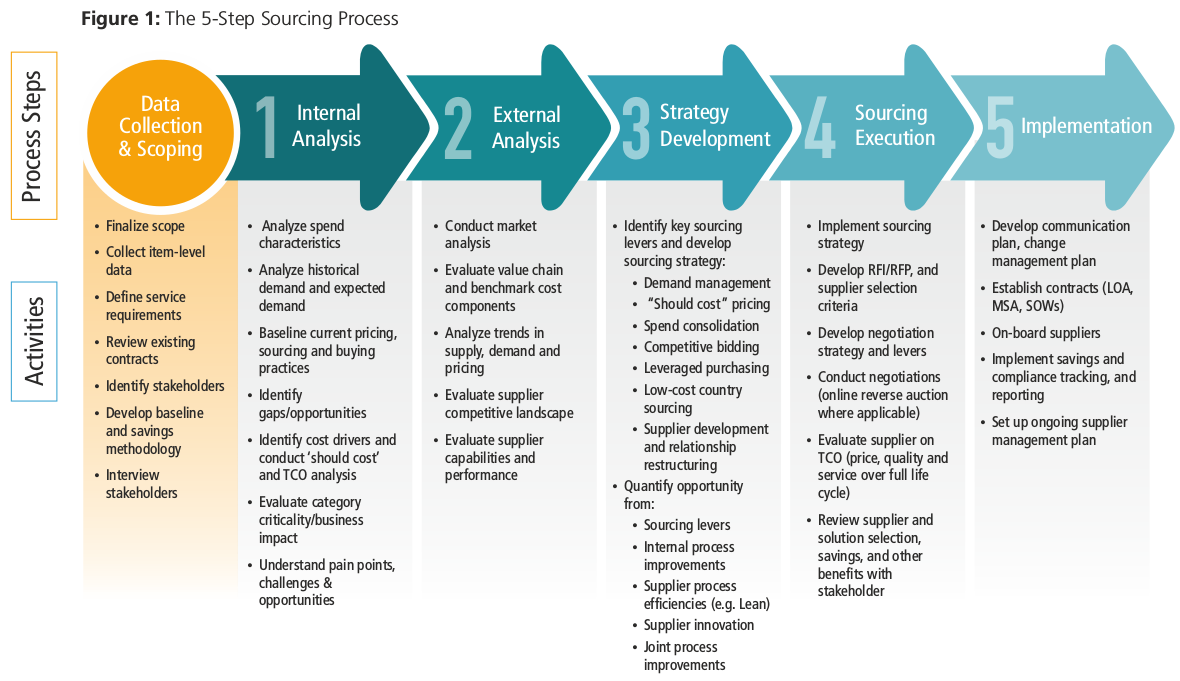

Insurance companies that do not have a structured sourcing process in place are potentially losing out on 10 to 25 percent savings on their spend with external suppliers. Insurance firms should adopt a comprehensive, structured and collaborative strategic sourcing process when addressing their supplier spend. The process should include detailed data collection, benchmarking & supply market analysis, RFP and strategy development, vendor screening and evaluation, online or offline negotiations, operational support, and total cost analysis for supplier selection and contracting. Each of these steps are described in detail in figure 1.

GEP has extensive experience of working with insurance clients using a 5-step strategic sourcing process to optimize costs. In GEP's experience, the claims department is an often untapped area from a Procurement perspective. An insurance company can gain an excellent competitive advantage by reducing its loss adjustment expenses. However, there's a fine line between reducing claims expenses and ensuring that your policyholders have a positive claims experience. In addition to this, claims management can be a highly complex activity with multiple processes potentially going on concurrently.

If a claim is handled unprofessionally by the insurance company, it can have a negative impact on the experience of the policyholder, which could ultimately result in non-renewal of policies. However, if the claim is handled well, it can lead to increased retention rates and higher customer satisfaction levels.

An effective sourcing and procurement program for the claims department can not only help insurance companies reduce costs, it can also enhance customer service as many claims suppliers engage directly with the policyholders and play a critical part in the overall claims experience. In doing so, insurance companies can reap the benefits of an improved bottom line and also expect to see some top-line growth. A robust sourcing and procurement program will help insurance companies achieve sustainable cost reductions while also improving the service experience for customers. GEP has achieved savings of 10 to 25 percent in key claims categories, such as claims litigation, independent adjusters, appraisers, salvage, vehicle auction services, and independent medical exams, by adopting this approach.

In some claims categories, where the supplier is critical to carry out day-to-day business activities, stakeholders can be hesitant in reaching out to the incumbent with an RFP. GEP recommends a benchmarking analysis study which incorporates a study of external market pricing for comparable solutions/services by reaching out to competitors. Based on the results of the study, clients can decide whether to engage the incumbent and negotiate by challenging the current pricing offered or award the competitive supplier a complete/partial piece of the business.

Such studies help identify potential savings opportunities and also help manage sensitive vendor relationships at the same time. GEP conducted a benchmarking study for a US-based insurance client, for categories like insurance replacement car rental and auto glass repair service providers. Savings opportunities in the range of 15 to 20 percent were identified through the study and negotiations were conducted with the incumbent vendors.

Contract Management

Contract management is the process of systematically and efficiently coordinating contract creation, execution, and analysis to maximize financial and operational performance and minimize risk. Implementing a contract management system will help insurance companies reduce their risk exposure by consistently putting in place contracts with “best-in-class” terms and conditions.

The contract management process requires collaboration among many stakeholders and can be complex. Using a common software or tool to create, store, and proactively manage supplier contracts can help facilitate collaboration. The tool will help bring together stakeholders from the business units, procurement, and legal, as well as external suppliers, by using one integrated contract creation, storage, administration, and compliance solution. The ultimate goal for insurance companies should be to have all supplier contracts stored in a central repository.

However, once you have a contract in place with a supplier, you need to monitor that contract on a regular basis to ensure that you are receiving all of the rebates and bonuses which you are entitled to. Enterprises may inadvertently lose focus on contract implementation, fail to monitor the supplier's performance against the contract and also miss to take advantage of a favorable market movement — all of which can lead to a multitude of lost opportunities for an organization.

In a typical insurance company, active monitoring of contract performance can result in about five percent reduction in the overall procurement costs. Contracts must be reviewed holistically to identify the costs & hidden charges associated with them. Removing unnecessary SLAs and KPIs will reduce the supplier's administrative overhead, allowing more room to reduce management and reporting fees. Various overheads like account management fees, third-party management fees, site fees, etc., can contribute up to 10 percent of the total contract cost.

In GEP's experience, it is common for insurance companies to have numerous contracts in place with the same vendor across the organization. By consolidating these contracts into one single enterprise-wide contract, the spend can be leveraged to achieve rebates, even for goods and services that are individually not purchased at scale. Discounts can also be negotiated for any spend above the target spend and rebates can be received at year end.

Establishing a year-on-year annual savings target for a supplier — either by cost avoidance or process improvements — can also help in effectively reducing the procurement costs. A risk/reward mechanism can be set up to incentivize the supplier toward the annual savings target. Also, companies can negotiate for cashbacks from a supplier, if and when a contract is extended beyond the initial contract period.

Annual benchmarking of prices negotiated in the contract helps companies identify possible overpayments. In the absence of annual benchmarking, rates can be indexed (like labor charges) in the contract, providing a degree of price protection. Some companies tie their spend to inflation indexes, but great care should be taken to identify the correct index, as incorrect indexation over many years may lead to significant overpayments to suppliers. Expenses for travel and accommodation need to be monitored periodically to effectively manage hidden costs. It is a good practice to limit or not allow any expenses under a project by introducing such a clause.

Invoicing errors, especially in categories like information services, can result in significant overpayments. Periodic audits are a smart way to avoid disputes. Monthly audits of invoice data to check for price non-compliance can help curb any overpayments beyond the agreed rates. Enterprises must analyze their spend with suppliers with high-spend contracts. This process can help determine if there was any maverick spend with a given supplier and also if there are any major opportunities/scope to be consolidated into the master enterprise-wide contract.

Market Intelligence

Timely, reliable market intelligence allows insurance companies to make credible, data-driven strategic sourcing and supply base decisions by leveraging a wealth of market facts and data. GEP has access to market intelligence tools and resources that help clients make more informed decisions.

Smart consumers recognize that “information is power”. Acquiring market intelligence is a recognized way to support strategic sourcing decisions that drive sustainable value for the organization. However, the ability to gather market, supplier and industry information that is both accurate and timely is a challenge. Market intelligence capabilities can be grouped in three broad areas: category intelligence, supplier intelligence, and sourcing intelligence.

Category Intelligence

Category Intelligence

GEP has hundreds of in-house category specialists on staff and a large network of external subject matter experts who track the markets of various goods and services. Category intelligence includes supply, demand and commodity price trends, market dynamics, new entrants, mergers and acquisitions, technologies and innovation, and regulatory changes, among many others. Using the deep domain knowledge of experts, along with formal research through numerous third-party resources, GEP is able to deliver data-driven insights to support the most complex decision-making requirements in sourcing and procurement.

Supplier Intelligence

Supplier Intelligence

GEP maintains one of the most extensive supplier networks in the industry, with over 35 million suppliers across the globe. GEP's proprietary information is further enriched by third-party sources. By blending these data streams, GEP is able to provide thorough evaluations of supplier capabilities, financial health, performance, and diversity and sustainability ratings. If you are looking for new suppliers or are seeking in-depth, multicriteria assessments of your existing suppliers, GEP can help.

Sourcing Intelligence

Sourcing Intelligence

GEP can help stakeholders identify the right sourcing strategy as well as provide support with research during the entire sourcing process. In addition to category and supplier intelligence, GEP brings spend and savings benchmarks developed over thousands of sourcing projects. These benchmarks and commodity indices help sourcing professionals act swiftly and conduct fact-based, more effective negotiations.

Key Success Factors

A comprehensive sourcing and procurement program can literally transform the way insurance companies do business. Following are key success factors that underpin successful sourcing and procurement programs:

Executive sponsorship: The leadership team must support the program and champion the initiative throughout the organization.

Cross-functional teams: Procurement and all other business stakeholders should take joint ownership of cost reduction and program goals.

Data-driven, factual decision-making approach: Suppliers within insurance companies can be deeply embedded within the organization and, in a lot of instances, have long standing personal and professional relationships with the business stakeholders. A data-driven, factual decision-making approach helps reduce the inherent politics associated with these long standing relationships.

Program governance: A strong program governance infrastructure should be in place to ensure that all the objectives of the program are met and the program strategy is aligned with the overall business strategy.

Enterprise-wide communications: Sustained communication and education regarding the benefits of the program at all stages through multiple platforms and channels is vital to ensure the success of the program.

Conclusion

In GEP's experience, implementing a robust sourcing and procurement program can deliver savings as high as 25 percent for insurance companies while also providing the following benefits:

- Reduced risk through better supplier contracts

- All supplier contracts stored in a central repository

- More informed decision making by business unit stakeholders

- Visibility into enterprise-wide spend

- More predictable operating expenses

An effective sourcing and procurement program will not only help insurance companies reduce costs, it can also increase customer service as many claims suppliers engage directly with the policyholders and play a critical role in the overall claims experience. In doing so, insurance companies can not only reap the benefits of an improved bottom line but also expect to see top-line growth.

Theme: Procurement