Executive Summary

The nature of the fine chemicals industry, and its associated cost structures, make traditional sourcing strategies limited in their ability to add value. It is a closely knit community, with a small number of players using raw materials (commodity chemicals) that exhibit a high level of price volatility. This calls for a unique blend of strategies to reduce costs and add value.

In this paper, we discuss how to best leverage the current environment and emerging trends in this industry to create a successful, sustainable sourcing strategy for fine chemicals. We also review together the market landscape and factors that influence it.

Chemicals: Definition and Classification

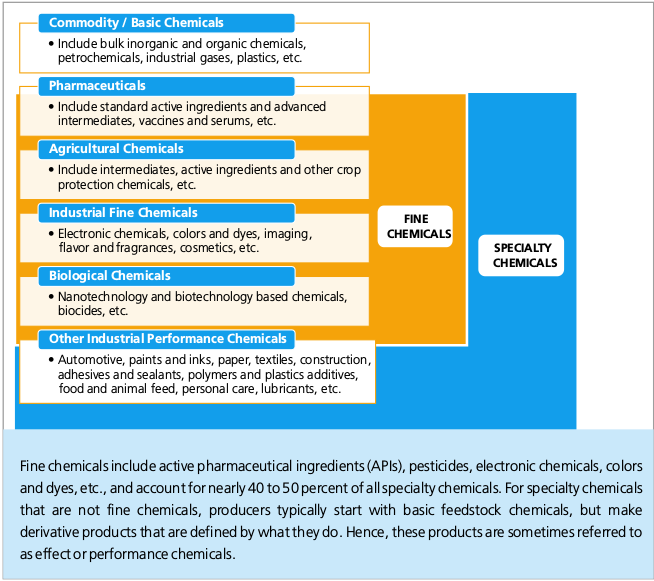

The Chemical industry broadly classifies two types of chemicals: 1) commodity chemicals or basic chemicals and 2) specialty chemicals. Specialty chemicals are further classified as: 2a) fine chemicals and 2b) performance chemicals.

Fine chemicals manufacturers convert raw materials such as basic or commodity chemicals into the more complex building blocks from which common products such as pharmaceuticals, agrochemicals, flavors and fragrances, electronics, pigments and photographic films, etc., are made.

Fine chemicals, usually specified in terms of their chemical composition, are described in terms of what they are. It is for this reason fine chemicals are sometimes referred to as specification chemicals.

Customers in this sector buy molecules. The number of applications for each fine chemical tends to be quite limited when compared to that of commodity chemicals. Also, there are only a limited number of suppliers for each individual fine chemical.

Commodity Chemicals

The commodity chemicals market provides raw materials to different industries such as plastics, paints, adhesives, cosmetics, rubbers, detergents, pharmaceuticals, and pesticides, among others. They also form the key inputs for fine chemicals.

After reaching revenues of $2.24 trillion in 2011 (CAGR 7.3 percent from 2007), the global commodity chemicals market is expected to sustain an annual growth rate of eight percent through 2016, reaching a total revenue of $3.3 trillion.

The downstream demand for end-use industries is projected to increase over the next three years, most notably, the recovery in construction and automobile industries. This is expected to drive the overall demand for commodity chemicals. Additional growth will stem from rising income levels and changing demographics — increased spend on personal care products, for instance, will drive growth in commodity chemicals market.

Following a decade of declining industry competitiveness, the American commodity chemical industry is re-emerging with a significant growth rate, led essentially by an inundation of development and exploration in shale deposits of both natural gas and oil, which is expected to put downward pressure on the petrochemical pricing in the region.

Specialty and Fine Chemicals

In recent years, much of the fine and specialty chemicals industry has shifted to Asia and, by 2030, about half of the chemical companies are expected to be in Asia and the Middle East. The rise of emerging players, especially in Asia, the Middle East, as well as Africa, has led to a deconsolidation of the global fine and specialty chemicals industry. Recent analysis from the Organization for Economic Cooperation and Development (OECD) notes that countries with economies in transition — such as China and the Middle East — are moving increasingly into the markets for specialty and fine chemicals. In the recent past, the Middle Eastern petrochemical capacity has steadily grown as oil and petrochemical firms invested heavily in the region. The Middle East boasts low-cost production due to an abundance of inexpensive, extractable gaseous feedstock such as ethane. Since the fine and specialty chemicals sector is characterized by rapid innovation and cost competitiveness, this suggests that an increasing number of new chemicals may be developed in the Middle East and Asia.

Fine chemicals producers in Asia, especially in China, are actively upgrading their technology, and investing in creating and protecting their intellectual property. Production costs are attractive as the manufacturing base in China still has comparatively lower overall labor costs, lower investment costs per installed cubic meter of reactor capacity, and relatively lower costs to comply with local environmental regulations.

Cost Structures and Trends in the Fine Chemicals Industry

Purchases of base feedstock and intermediates are the largest direct costs for fine chemicals manufacturers. The other major cost head — distribution — is a result of complex package and storage requirements, which leads to higher costs. The fine chemicals industry is also a highly labor-intensive industry, though the good news here is that wages in the US and Europe have declined because of labor cuts that operators made during recessionary times.

Energy and utilities are also major indirect costs. Additionally, longer manufacturing lead times necessitate larger inventory requirements, and thus, higher working capital costs. Marketing costs are minimal, since there is little to no product differentiation, while depreciation is significant as upfront capital costs are high. Real estate costs are low to moderate; other costs include freight and insurance premiums, R&D investments, and licensing and legal fees.

Entry barriers for new firms looking to get into the fine chemicals industry can be high as stringent regulations need to be cleared in order to start production. This includes getting environmental clearances for production processes, as well as for the chemical itself. For supply, firms need to do extensive testing to verify toxicity levels.

To rationalize and advance the former governmental framework on chemicals in the European Union, the chemical industry is regulated by REACH (Registration, Evaluation and Authorization and Restriction of Chemicals) and CLP (Classification, Labelling and Packaging). In the US, the Environmental Protection Agency (EPA) holds sufficient power to regulate chemical manufacturing, and protect human health and environment in the region.

In sync with “REACH” as a model regulatory system, most Asian nations are reviewing and rewriting their regulatory framework for regional chemical industries. Specific regulations also exist for different sub categories of chemical products related to agriculture, pharmaceuticals, personal care, detergents and explosives.

With high entry barriers, the few firms that are in the business have healthy profit margins. Profits across the fine chemicals industry are seven to 10 percent on average — an increase over the last five years as companies are rebounding from poor market conditions and benefitting from cost cutting measures. A rising trend among chemical manufacturers to broaden their products/services portfolio is likely to provide chemical buyers an opportunity to consolidate their spend.

Thus, the nature of the fine chemicals industry and its associated cost structures, make traditional sourcing strategies limited in their ability to add value. It is a closely knit community, with a small number of players using raw materials (commodity chemicals) that exhibit a high level of price volatility. This calls for a unique blend of strategies to reduce costs and add value.

Suggested Sourcing Strategies for Fine Chemicals

Tighter Control on Supply of Direct Materials

This can be done in several ways:

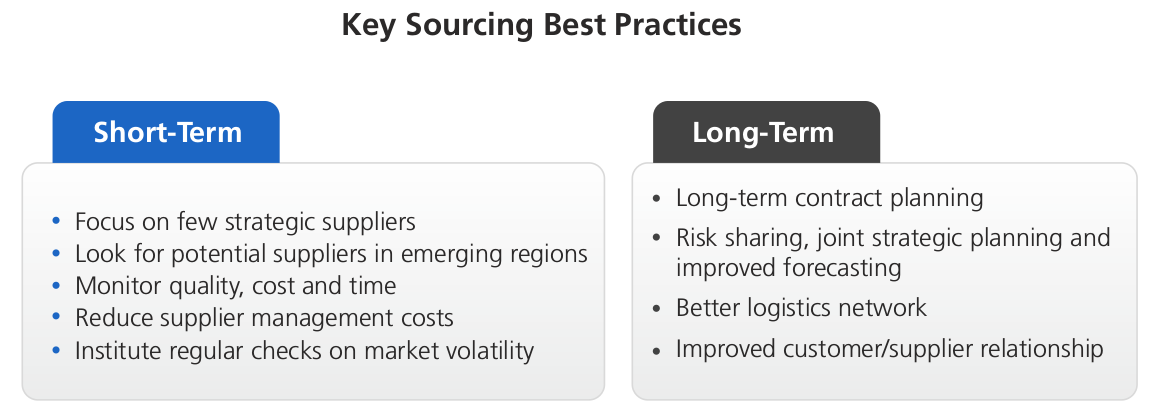

Strategic Long-term Collaboration with Upstream Suppliers: Close collaborations or joint ventures with key suppliers from an early, developmental stage can result in strong relationships that go a long way towards mitigating supply risks as well as keeping costs down. Example: Firms like BASF and Huntsman & Henkel have made large investments in their strategic suppliers.

Backward Integration, Contract Manufacturing or Acquisitions: Since a majority of fine chemicals manufacturers tend to be small- and medium-sized enterprises, this could be a viable option. This works well in cases where the competition is limited and the chemical is of high strategic importance.

Examples: In 2011, China Clean Energy Inc., a specialty chemicals producer acquired Handan Guanxin Technology Ltd, a feedstock provider located in China, to make it the company's internal source of raw materials. Also, in 2011, US-based titanium dioxide (TiO2) producer Tronox cemented its future supply of TiO2 raw materials by acquiring the mineral sands and TiO2 production operations of South African mining firm Exxaro Resources. In 2013, Chinese agrochemical enterprise Huapoint-Nutrichem acquired two fine chemical enterprises: Shandong Fuer and Shandong Kaisheng New Materials. Both firms specialize in fine chemical intermediaries and are seen as strategic investments for the firm. Most recently, in January 2014, Momentive Specialty Chemicals Inc. acquired a facility that manufactures resin-coated proppants located in Shreveport, Louisiana from CRS Proppants LLC. We see this trend continuing in the coming years.

Using Substitutes or Alternative Production Routes

The switching costs in this category are very high and buyers normally prefer to stay with tried and tested products. Any new product, be it a substitute or a variant of the existing product, has to go through a stringent approval process, which is expensive and time consuming. Even a new supplier, if supplying the same product, has to go through the approval process to avoid contamination of products. Hence, the price of the new product has to be significantly lower than the existing product to justify switching. Alternately, firms look to find more cost effective production processes with less complexity.

Examples: The consumption of HMTBa has been rising over the years – it is considered to be a replacement for methionine. The key factors driving the use of HMTBa in livestock and poultry feed include commercial benefits, such as optimized animal growth and higher meat yields, which is likely to have a negative impact on synthetic methionine demand in the near future. Similarly, N-butanol is being replaced by the more cost effective bio-butanol. Also, Methyl Ester Sulfonate (MES) is a potential substitute of DBSA due to better performance and effective cost.

Improving Price Transparency

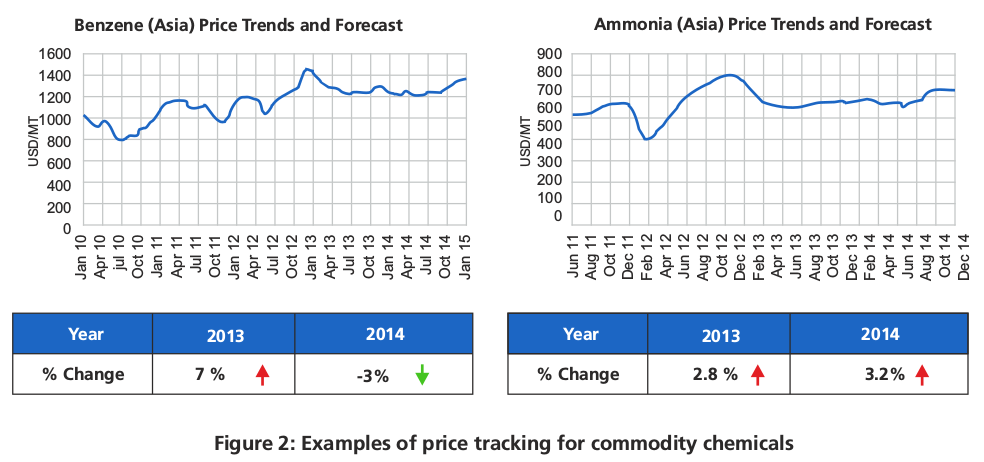

Price transparency is the primary issue at the negotiation table as suppliers are unable to furnish complete information on the chemicals to justify the price revision. While for commodity chemicals, buyers and sellers can be on the same page by tracking the indices for the base feedstock material, for specialty/fine chemicals with complex formulations, the exact cost driver for each chemical cannot be traced completely, thereby diminishing price visibility. At times, due to the lack of transparency and frequent price increases, the buyer-supplier relationships deteriorate and negotiations reach a deadlock.

In such situations, it makes sense to try and tie the price of a fine chemical to a weighted index based on market variables and production economics, considering all the relevant material ratios involved. This, although an extremely complex process, yields great results if executed well. Pricing of fine chemical products does not follow a simple cost-plus pricing model; instead, it is linked with several market dependent forces.

Best-Value Country Sourcing (BVCS)

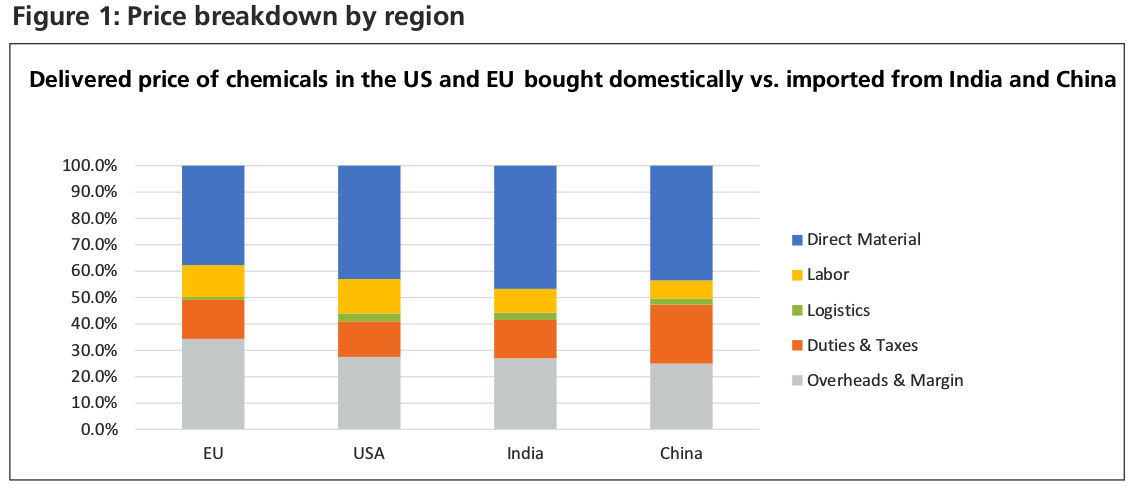

It is clear from Figure 1 that while the proportion of direct material costs to the total price is highest in Asia, labor and overhead costs are lower, and more than make up for the difference. Shifting the source of fine chemicals from Europe or the US to countries with lower cost but not lower quality can result in savings of anywhere between 10 to 20 percent, depending on the specific chemical.

BVCS for fine chemicals is more complex than for other categories due to the high variance in prices. For instance, if an order is placed at a certain price, and prices increase or reduce during the shipping period, the buyer will typically not accept the consignment and renegotiate. This creates pressure on the supplier, who, due to lack of options, is forced to reduce prices considerably to offload the shipment. Hence, many suppliers are wary of negotiations post shipment and include a buffer while submitting quotes.

Structuring Large- and Small-Volume Sourcing

The fine chemicals supply market is dominated by a few players that dictate pricing. Which firm dominates, depends on the type of process or technology. A viable sourcing strategy in this scenario could be to develop such suppliers with investments in technology upgrades who have the required chemistry for the manufacturing process but do not manufacture the specific product yet. This supplier investment strategy becomes particularly important if you are looking to buy larger volumes in the future.

Fine chemical buyers typically engage in annual contracts with price reviews occurring quarterly or every six months owing to the high volatility in prices of both the base feedstock and the intermediates, as well as high supply risk in the base feedstock market. On average, raw material price changes greater than five to 10 percent affect fine chemical prices within a month. For bulk purchases, an annual limited fluctuation contract with a price review every three to six months is generally preferred. On the other side, low volume purchases are favorably made based on spot market pricing.

Large-volume buyers of fine chemicals generally forecast their requirement for six to 12 months. They are well equipped with the background information of fine chemical pricing, formulation, raw material price trends, etc. With this information handy, they can more easily negotiate pricing with fine chemical producers.

For low-volume purchases, spot pricing is recommended because prices of raw materials are volatile and suppliers are unwilling to take the risk of engaging into contracts. Given the considerable capacity in the Asian market, buyers can track the market regularly and buy when the spot prices come down. The problem with this option is the low supply assurance, because most suppliers cut their operating rates when demand levels are low.

Conclusion

Fine chemicals are valued, bought and sold, on the basis of their precise chemical structure – that is, what they are, as opposed to what they do.

The fine chemicals segment is characterized by regulation rapid innovation and cost competitiveness. Indeed, as the business continues to globalize, competitive pressures are intensifying.

Producers in China have some of the industry's lowest costs. They are also actively upgrading their technology, and investing in creating and protecting their intellectual property. The Middle East boasts low-cost production due to an abundance of inexpensive feedstock (i.e. raw material), such as ethane. No wonder then that the industry is increasingly shifting to Asia and the Middle East – industry analysts predict half of the world's chemical companies will be located in these regions by 2030.

The major components of a supplier's cost structure are base feedstock and intermediates, distribution, and labor. Because of the capital intensive nature of the industry, there are high working capital requirements. Overhead costs can also run high. Profit margins on average range from 7 to 10 percent.

On the other hand, it is important to be aware that, relative to other categories, the supplier base is not large and the production processes use raw materials that exhibit a high level of price volatility. This calls for a unique blend of strategies to reduce costs and add value.

In many cases, buyers need to develop suppliers with investments in technology upgrades, and who have the required chemistry for the production process, but do not produce the specific product yet.

Additional sourcing strategies, such as strategic collaboration with upstream suppliers of direct materials (including backward integration), using substitutes, improving price transparency, and best-value country sourcing are suitable for this category.

Finally, factoring in buying volume and structuring contracts accordingly is also critical to successfully weather price volatility (e.g., annual limited fluctuation contract with price review every three to six months for bulk purchases vs. going to the spot market for low-volume purchases).

Theme: Procurement