Introduction

The pharmaceutical industry is not short of challenges — patent cliffs, regulatory scrutiny, and R&D productivity, as well as a complex supply chain. Pharmaceutical products see several changes of hands — from the manufacturers to distributors to dispensers and, finally, the patients — allowing easy entry of counterfeit drugs and drug diversions. According to estimates by the WHO, nearly $40 billion is lost each year to counterfeit products.

Drug shortages, cost-cutting pressures, demand for generics, and increased online buying further fuel the sale of counterfeit drugs. This not only leads to the loss of billions of dollars, but also increases health risks and recalls, tarnishing the brand image of the already struggling pharmaceutical industry. Track and Trace (T&T) is a new solution that can help pharmaceutical companies effectively manage their supply chain and mitigate the risks associated with counterfeit drugs.

In this paper, GEP discusses what the pharmaceutical industry needs to know about track and trace, and how procurement can support its adoption.

Supply Chain Complexity

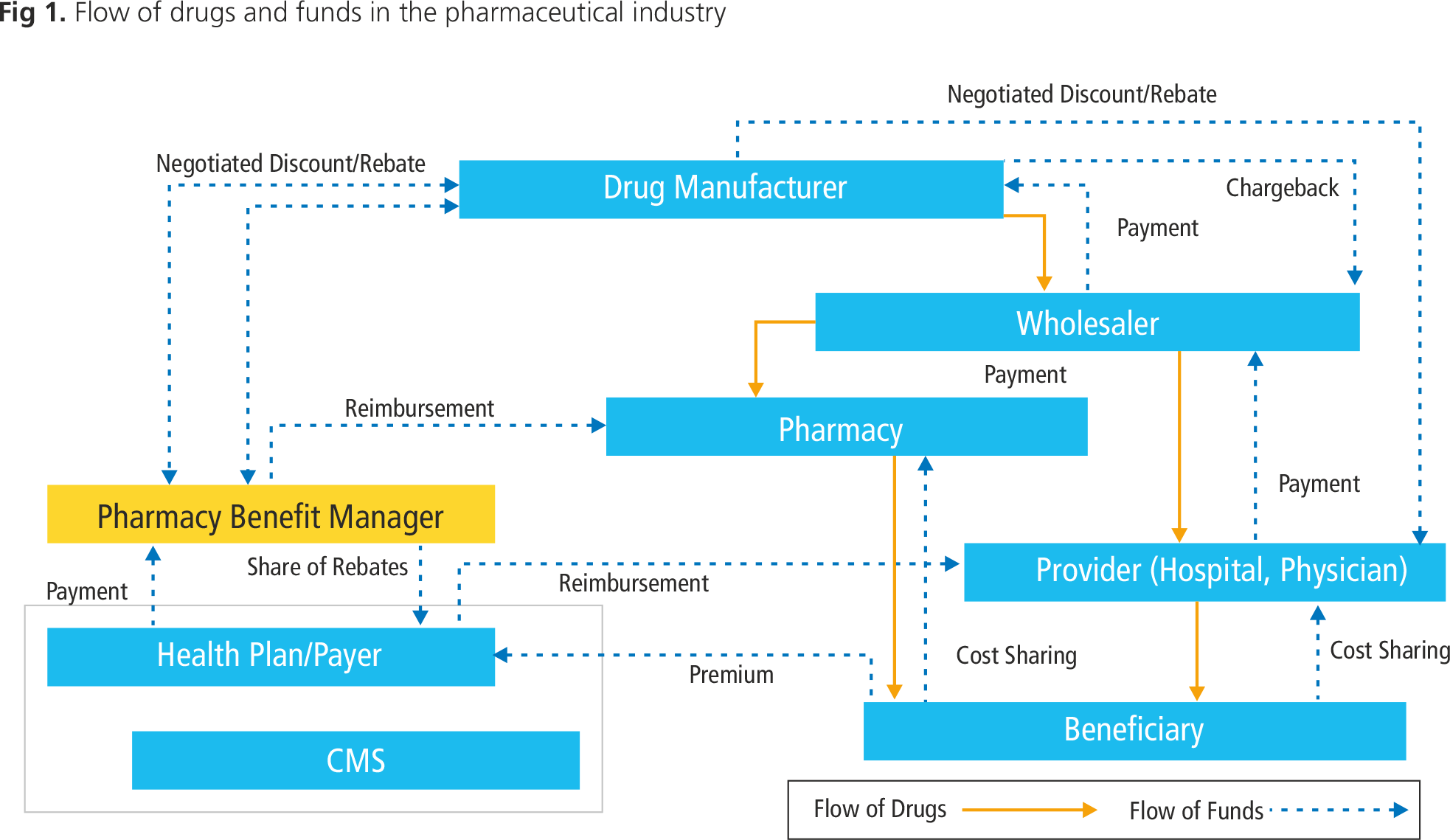

The pharmaceutical supply chain is fragmented and complex, on account of the multiple entities involved as the drugs move from the manufacturing plant to the point of sale. Often, in case of expiry or recalls, the drugs return back to the manufacturer.

Each time the goods change hands, payments are made to the manufacturer or wholesaler. Prices vary depending on the negotiating power of the buyer, with the seller providing discounts in the form of chargebacks and rebates. When goods are returned, the pricing mechanisms are further complicated. The frequent price changes which arise from this complexity create opportunities for wholesalers looking to exploit loopholes in the system. For example, wholesalers may buy in bulk when prices are low and return the drug to the manufacturer at the current market price, following a price increase. This type of scenario means that the very structure of the supply chain has a significant commercial impact, while the frequent and multiple changes in ownership increase the ease with which counterfeit drugs can enter the supply chain.

Besides counterfeit drugs entering the supply chain, there are also opportunities for drugs to be diverted or stolen. Diversion means selling a drug that is meant for a specific purpose or market in the open market. In 2011, an individual diverted $2.7 million in prescription drugs by purchasing them from physicians who get discounted rates, and then reselling them to wholesalers at a profit. Similarly, in 2008, a shipment of Carbatrol (carbamazepine) — a drug to treat seizures — was stolen while traveling from Shire Pharma's manufacturing facility to its distribution center. Shire later reported that Carbatrol from the stolen shipment, and past its expiry date, had made it back into the legitimate supply chain and was being returned for credit.

Pharmaceutical companies have tried unique codes, holograms, and even manual chain-of-custody records in the past to prove the authenticity of products, but without success. To mitigate these risks, regulatory bodies around the world have called for “Track & Trace” — a process to serialize item-level products across the supply chain.

What is Track & Trace?

Track & Trace (T&T) is a mass serialization solution that uses a unique identifying code printed on each product to prevent the prevalent counterfeit problem.

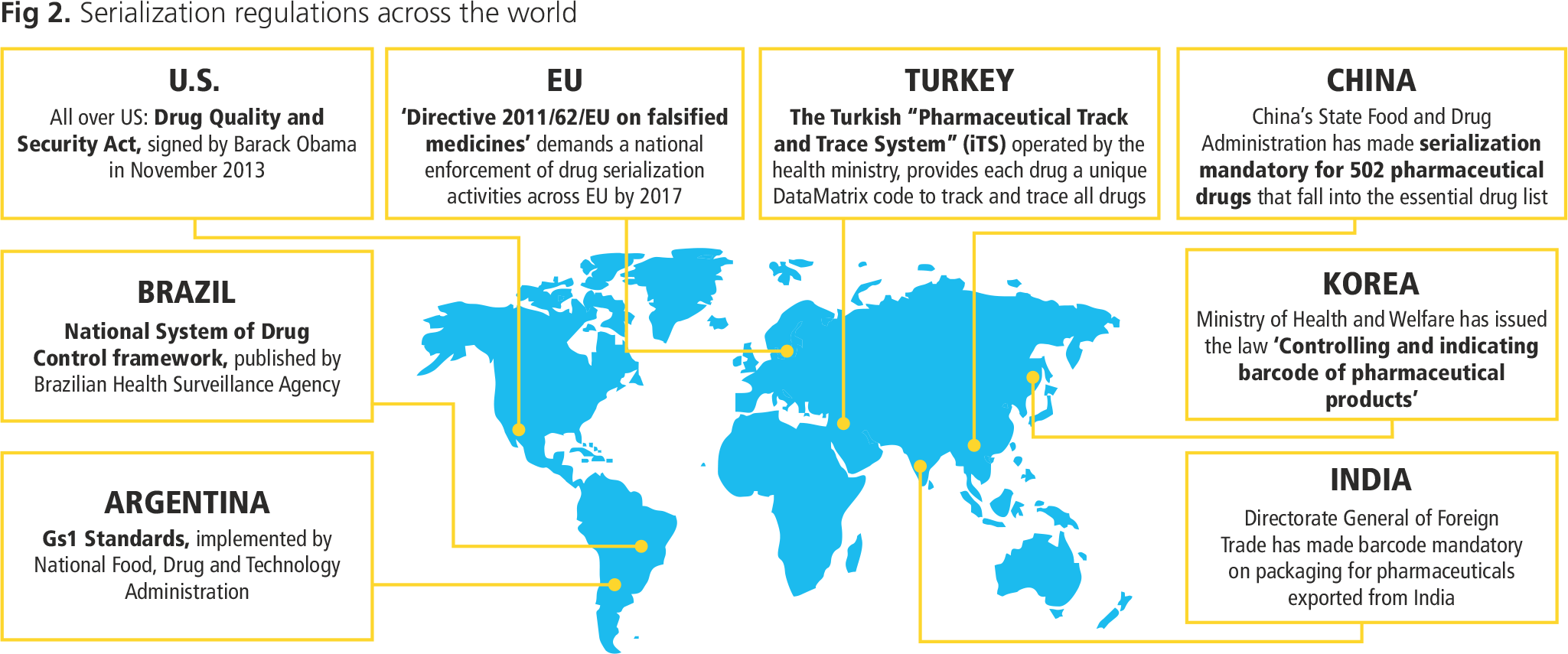

The current tracking process has several weaknesses and limitations, including manual inputs, no central database and no single entity responsible for tracking a particular product. This makes it extremely vulnerable to the entry of counterfeits. Regulators across the globe have created legislation to deal with this challenge, or are in the process of doing so.

While it may be challenging to eliminate all problems, robust T&T regulations will certainly help ensure that drugs can be tracked across the entire supply chain, and allow purchasers to recognise authentic products with clear traceability, and, conversely, detect illegitimate drugs and counterfeit products. T&T will reduce manufacturers' vulnerability to counterfeiting and diversion, and will thus improve profitability through efficient recall management, reverse logistics, chargeback resolution and proper planning. This can help pharmaceutical companies enhance their top and bottom lines.

While T&T is gaining popularity across the globe due to its benefits for the pharmaceutical industry as well as consumers, it presents several challenges.

- Cost management: The annual running cost of serialization can easily cross $180 million to 300 million for a major pharmaceutical company, with an additional burden of managing the inventory for the old packaging and non-serialized products. To this must be added the cost of hiring experts and consultants, and training in-house teams to ensure compliance and understanding of the various regulations.

- Unclear regulatory landscape: With active initiatives from the U.N. to track counterfeit drugs, many countries have planned a full-fledged electronic system implementation to track pharmaceutical products. Each of these countries has separate laws and different serialization standards. For example, the U.S. plans to include the SNI (Serial Numerical Identifier) of the alphanumeric “National Drug Code” (NDC) with product number and expiry date at all levels of packaging (primary, secondary, and tertiary) using a 2D data matrix and linear barcode. On the other hand, the European Union's plan includes the Manufacturing Product Code (MPC), along with pack number and expiry date, using technologies such as 2D, linear and even RFID, but only at a primary packaging level.

- Packaging changes: T&T will require RFID tags to be added or barcodes to be changed, thereby impacting the production process. Tag reading at distribution nodes will also affect the overall process in terms of time. For all of these serialization changes, it will be essential that packaging vendors understand the process and regulations.

- Impact on IT: Tools will need to be flexible to comply with national regulations and to integrate data with existing ERP systems as T&T will call for real-time tracking and reporting capabilities. Data management systems will be an additional requirement not only at the manufacturing site, but also with distributors and vendors.

- Impact on supply chain: A lack of standard regulations will restrict the adoption of tagging solutions and will affect cross-site coordination. Contract manufacturers and distributors will need to be familiar with the specific regulations, tools and IT requirements to enable coordination at every site and supply chain node.

- Lack of infrastructure: Infrastructure issues in distribution will reduce the efficiency of the T&T solution as synchronization will be lost, and this impact will be felt especially in developing countries, such as India, where infrastructure is of variable quality.

- Change management: Getting buy-in from all the stakeholders and team members will be crucial to ensure compliance and an effective rollout.

What Should Procurement Be Doing to Prepare for T&T?

With different deadlines in each country, the pharmaceutical industry is facing significant challenges to its inventory and procurement processes. All functions will be affected, creating particular challenges for those working with vendors and Contract Manufacturing Organisations (CMOs). On the whole, procurement needs to reconsider its supply base, with a special focus on IT systems, packaging and distribution.

While some in the industry have become early adopters and learnt valuable lessons, others have opted to “wait and see” to get complete clarity on regulations and timelines. While those who opt to wait and see may see a somewhat lower implementation cost, as everyone benefits from the lessons learnt by the early adopters, they may also pay a premium to get ready in time for looming deadlines. The U.S., for instance, has a 2015 deadline for serialization, where dispensers need to have established systems for verifying the products.

Piloting T&T with select packaging lines will not only enable enterprises to fully understand and gauge their resource requirements and help them to enhance the safety profile of marketed products and reduce counterfeit entry. It will also allow them to play a role in defining the standards and influencing the regulations which are eventually enforced.

GEP recommends the following six-step process for procurement organizations to capitalize on the T&T opportunity

- Set up a Dedicated T&T Team: It is important to create a dedicated team comprising all internal stakeholders (operations, marketing, IT, packaging, etc.) that will be responsible for analyzing and assessing the impact on each function. This team needs to be globally led but involve all key geographies and business units. The T&T team should look at best practices from the industry and assess their applicability for the enterprise. The benefits of setting up a dedicated T&T team include better planning, effective risk management, clear accountability and stakeholder inclusion.

- Create a T&T Playbook: Assess individual markets and geographies, and create a customized playbook to mitigate any penalties. Understanding country regulations and planning for them is even more important than finalizing a global strategy given the fragmented regulatory landscape.

- Assess Supply Chain Readiness: Conduct a detailed SWOT analysis of the supply chain to understand the intricacies, challenges and constraints. Also identify appropriate vendors based on their capabilities concerning regulations, technology adoption and resource skills, as well as their capacity to meet the coming demands.

- Build a Roadmap: Conduct a detailed gap analysis from the internal diagnostic exercise and supply base assessment, and create a roadmap with short- and medium-term goals, as well as steps for implementation.

- Run Pilots: Learn from real experience by running a pilot for one product in one packaging line. The pilot will also provide an opportunity to test different scenarios and vendor capabilities.

- Choose the Right Solution: A tool that is both flexible and scalable will allow enterprises to adjust their infrastructure rapidly and expand to other geographies. It is also crucial to implement a clear governance structure to steer the organization during a global rollout.

Conclusion

With increasing global concerns about drug diversions, thefts and counterfeit sales, governments and regulators across the world are pushing for new regulations and solutions to prevent these problems. Pharmaceutical companies should investigate the adoption of a T&T solution to mitigate supply chain risks, meet regulatory requirements and improve their bottom line.

The cumulative effect of changes to each component involved in serialization — which enables T&T — can have a substantial impact on the supply chain and internal as well as external resources. Procurement can play a strategic role in enabling this transition for pharmaceutical companies by optimizing T&T related spend on IT, packaging, and other vendors; ensuring regulatory compliance with all partners; and supporting change management at the enterprise level.