Overview

Global steel prices fell close to 30 percent over the past year. The slowdown of the Chinese economy had a direct impact on the global steel demand. With the slowdown, China’s steel demand peaked and inventories piled up. To offload the inventories, Chinese steel producers started an export overdrive. Cheaper Chinese exports flooded global steel markets and dragged down steels prices everywhere. Countries across the Americas, Europe and Asia-Pacific announced a slew of anti-dumping measures against Chinese steel imports. In light of these new dynamics, the key questions for global steel procurement and category sourcing managers are:

- When will prices bottom out?

- How much inventory to keep?

- Will there be expanded anti-dumping duties or even a ban on Chinese imports?

- Which location is the most competitive to procure steel?

- Is it time to renegotiate contracts?

In this white paper, GEP’s experts break down the factors controlling global steel prices and their impact for steel buyers. The paper also provides short- and long-term steel price forecasts, and outlines region-wise sourcing strategies based on the new market dynamics to help enterprise procurement teams optimize their steel spend.

China’s Miraculous Break-neck Growth is Over

Slower Growth is the New Normal

China’s gross domestic product (GDP) grew seven percent compared with the same period a year earlier in the three months through June 2015. The government’s GDP growth rate target for 2015 stands at seven percent. Compare this forecast with the 10.6 percent and 9.5 percent actual growth rates in 2010 and 2011, and it’s easy to assess the extent to which the economy is slowing.

Referring to the two decades of double digit growth rates, China’s official Xinhua news agency said last year in a commentary, “The country’s period of miraculous break-neck growth is over, but let’s get over it.” So, officially, slower growth is the new normal for China’s GDP. The Chinese government is rebalancing the economy away from a heavy dependence on investment and exports to a consumption-driven model and the impact is visible. The slower growth is expected to continue in 2016 too, with the IMF forecasting GDP expansion of 6.3 percent. The GDP is set to grow at a slower pace because of the reduced financial sector support and the stock market crash. China’s stock market saw the steepest losses in decades in mid-2015.

Construction Activity, Auto Sales Fall Off

Construction and housing, a key driver of Chinese steel demand, forms a large percentage of China’s GDP. Real estate investment grew at an average annual rate of more than 20 percent since the housing sector reforms in 1998. However, the construction sector slowed considerably during H1 2015. According to the National Bureau of Statistics, the growth of property investment in the first half of 2015 slowed 4.6 percent compared with the same period last year. In the same period, newly started developments by area plunged 15.8 percent. Construction activity is slowing because of the high domestic debt-to-GDP ratio and lower than expected returns from past infrastructure projects. The sector is expected to grow 4.7 percent during 2015 to 2019, a rate slower than the GDP growth rate.

In a double whammy for the Chinese steel sector, the automobile sector also slowed. Sales fell sharply in June 2015, growing 3.4 percent lower than the same period last year, according to data from the China Association of Automobile Manufacturers. With vehicle sales growing the slowest in the past six years in H1 2015, the 2015 full year sales growth rate forecast stands at a paltry three percent compared with 10 percent growth in 2014. With the stock market crash, auto industry executives and analysts are wondering if the world’s largest car market is entering a phase of stagnant or falling growth.

About 60 percent of the domestic steel demand is from housing and construction-related activity and close to eight percent is from the automobile sector. With the fall in demand, Chinese steel vendors, big and small, are burdened with rising inventory. Chinese steel vendors have no other go today, but to increase their steel exports.

China’s Domestic Steel Market

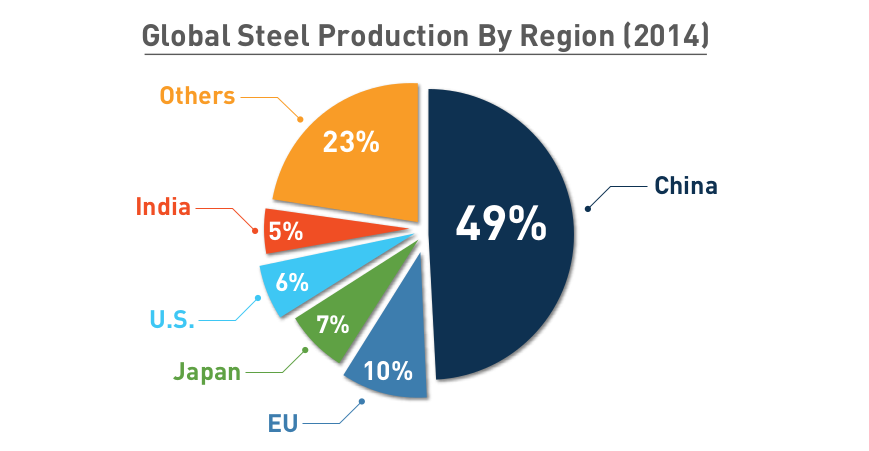

China’s Share of Global Steel Production

China produces close to 50 percent of the world’s hot-rolled coil (HRC) steel. According to China’s Ministry of Industry and Information Technology, China produced 820 million tons of crude steel in 2014. But, steel consumption fell by four percent to 740 million tons in 2014, which was the first such decline in more than two decades. In H1 2015, total steel production in China was around 410 million tons. For 2015, overall output is estimated to be 807 million tons, about two percent lower than last year. Chinese steel production peaked much sooner than expected, in 2014, contrary to what most analysts and commodity experts believed that it won’t peak until 2025.

With concerns about falling margins, China plans to reduce steel capacity by 80 million tons over three years. Chinese steel producers pay up to $26 per ton of steel as environmental penalty. The government is keen to consolidate smaller units with larger units or shut these units permanently. These measures are expected to take out some volume of the current capacity.

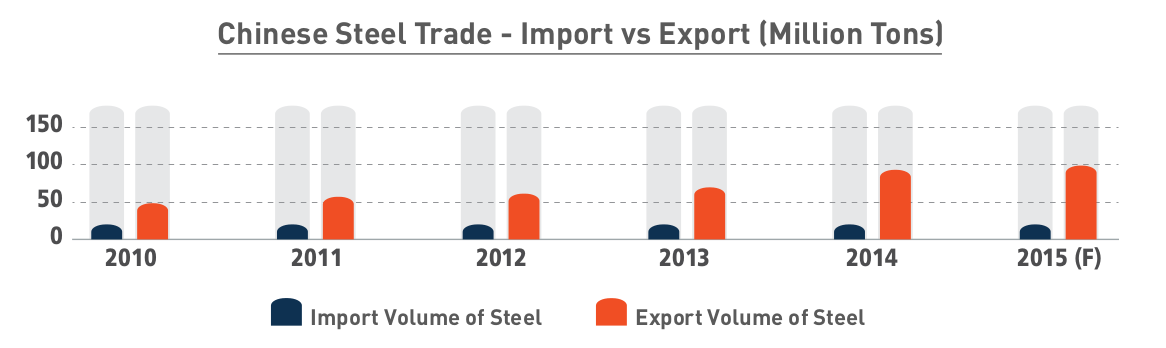

Chinese Steel Export Trend

Steel exports from China rose by 50.5 percent year-on-year to reach 93.78 million tons in 2014. From a net importer of steel in the 1990s, China transformed into the leading steel exporter in the mid-2000s. China’s steel imports have held steady at an average of a little above 10 million tons since 2010, while exports have climbed dramatically to reach 93.8 million tons in 2014. China exported 52.4 million tons of steel in H1 2015. In 2015, China is estimated to export a record volume of steel, with exports crossing 100 million tons by the end of the year. Chinese steel exports have increased more than 20 times over the past decade. With the drop in internal demand, capacity utilization at Chinese steel mills by H1 2015 stood at 72.3 percent, down 7.2 percent compared with last year. Still, Chinese steel exports are expected to outweigh imports by a factor of close to ten times.

For the volume of inventories that Chinese exporters hold, it’s more important to sell the steel at any margin and maintain cash flow. Adding to the overall impulse of the Chinese steel producers to expand exports, the Chinese government itself has a stiff target of exporting 10 percent of the total steel production.

Outlook for Chinese Market

Inventories and Feedstock

Steel supply in China exceeded demand by 80 million tons in 2014. Most Chinese steel mills hold surplus inventory, which they are willing to sell off even at a loss in the global market. The price of steel fell 28 percent in China in 2014 on a year-on-year basis. The price of key feedstock – iron ore – hit a six year low in July 2015 at $52/DMT. China’s total iron ore imports in the first six months of 2015 were 453 million tons, about a percent lower than the same period last year. China accounts for 70 percent of global seaborne iron ore. The factors that support continuing Chinese steel exports are not only low iron ore prices but also easy access to subsidized raw materials such as coking coal and natural gas.

Impact of Yuan Depreciation

The yuan has depreciated by more than 30 percent over the past year. With the depreciation of the yuan, Chinese steel producers can export steel at the same price with enhanced margins. Chinese steel export prices become more competitive with currency depreciation, providing exporters further incentive to maintain or enhance the momentum of exports.

Devaluation of Yuan

China devalued the yuan in August 2015. Although the Chinese government says the devaluation of the yuan is meant to bring the currency to the market level, market participants consider the devaluation a measure to boost exports. Considering the current global economic conditions, it’s reasonable to expect further devaluation of the yuan, and this in turn is likely to boost steel exports.

Overview of Global Steel Market

U.S. Steel Market

In May 2015, imports from China were 8.9 percent of all steel imports in the U.S., up from 8.4 percent in April. U.S. steel imports from China increased 68 percent in 2014. In fact, Chinese steel imports accounted for 28 percent of total demand in the U.S. The largest steel producer in the U.S., US steel, shut six plants in 2014 and has idled about one-third of capacity in 2015. Cheaper imports drove down realized prices for most U.S. steel producers.

Widening Arbitrage

- Chinese export price of HRC was about $100 per ton lower than similar US products in H1 2015

- CRC arbitrage is estimated to have increased from four percent in October 2014 to 16 percent in March 2015

- HRC arbitrage is estimated to be 22 percent in March 2015

European Steel Market

Chinese finished products imported into Europe during January to May 2015 rose 49 percent year-on-year. Total imports of steel products from China and Taiwan to the EU rose 70 percent from 2010 to 2013. European steel mills blame Chinese dumping for up to eight percent drop in capacity utilization. Leading European steel producer Arcelor Mittal cut capacity by five percent because of Chinese imports. Many European steel producers are operating at 50 percent of capacity, a level at which they struggle to maintain profitability. Arcelor Mittal and Tata Steel are expected to end production of flat hot-rolled coil and cold-rolled coil steel products. Tata Steel has also announced workforce reduction plans.

Undercutting EU Prices

- European prices were higher than Chinese export prices by an average of 20% (~$70) during H1 2015

- European products accuse Chinese exporters of selling products 35 percent below the Chinese production and transportation cost

Asian Steel Market

In the Asian steel markets, Chinese exports to India rose 133 percent to 1.7 million tons in April to October 2014 from 0.73 million tons in the same period of 2013, according to data from the Indian government. Of India’s finished steel imports of 2.5 million tons in April to June 2015, 0.7 million tons came from China. In H1 2015, India’s steel production fell to 50 percent of installed capacity. Vietnam was Asia’s biggest steel importer from China during January to April 2015 at 2.7 million tons — a 76 percent year-on-year increase compared with the same period last year. Philippines with 1.68 million tons and Indonesia with 1.6 million ton were the other major importers of Chinese steel.

Countries such as Vietnam are involved in the free trade of value-added steel by misusing free trade agreements (FTA). Vietnam imports steel from China, adds value to the extent of 10 to 15 percent, and claims FTA benefits, without actually maintaining the required level of 35 percent value addition. This free trade based on value added products is expected to be stopped in the near future, prompting higher Chinese exports.

Unfair Advantage

- Chinese HRC export prices were on an average $143 a ton cheaper than similar Indian steel in H1 2015

- Indian government can provide only up to two percent export subsidy, while Global Demand and Supply Trends the Chinese government provides up to 16 percent export subsidy

Global Demand and Supply Trends

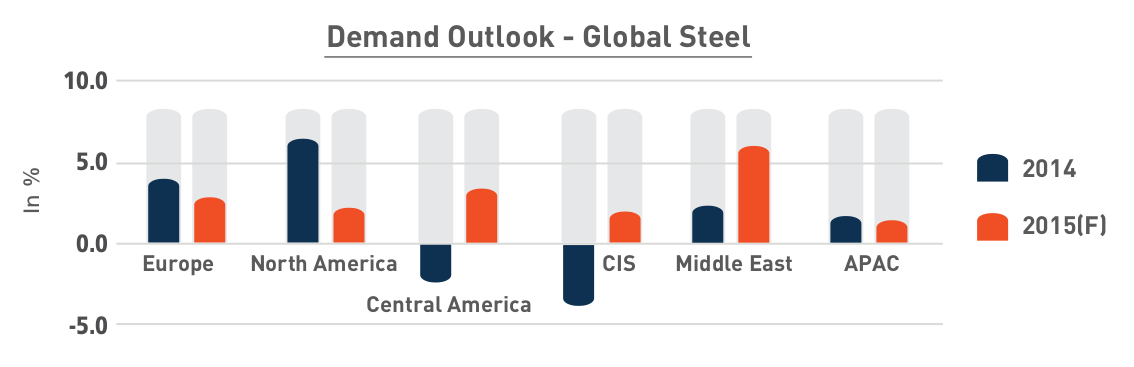

Across key global markets of the Americas, EU and Asia Pacific, demand was subdued in 2014 with a low year-on-year demand growth rate of three percent. For 2015, the demand growth rate projection across the globe is even low at less than two percent.

Impact of Anti-dumping Duties

Export Markets to Become Less Lucrative for Chinese Steel Makers

Export markets are poised to become less lucrative for Chinese steel producers with a slew of anti-dumping duties that have been imposed on Chinese steel in markets from India to the U.S. The U.S. has imposed duties ranging from 21 percent to 118 percent on products, such as steel nails and tubular products from China. The EU imposed 25.2 percent duty on cold rolled stainless steel and 28.70 percent duty on flat rolled electrical steels from China. India imposed anti-dumping duty of $309 per ton on Chinese HRC steel products, besides increasing its basic customs duty on steel.

Will There be a Ban on Chinese Imports?

Six major U.S. steel producers petitioned the International Trade Commission for imposing anti-dumping duties on Chinese steel imports, using a new trade bill that makes it easier to file trade cases against dumping. A ruling is expected on the case in early 2016. Following complaints from Eurofer, the European steel association, that dumping of flat cold-rolled steel products from China was causing “material injury” to the domestic steel industry, the European Commission launched an investigation against Chinese suppliers in May 2015. This investigation followed another investigation into Chinese steel rebar exports in April. Additional duties are expected against companies that did not cooperate with the investigation.

India has imposed anti-dumping duties on Chinese steel for five years. Tighter restrictions are expected on Chinese exports of TMT bars. With Chinese steel exports predicted to cross 100 million tons this year, the price levels can become unsustainable in most importing regions, prompting further anti-dumping duties. Further increases in anti-dumping duties will effectively lead to a ban on Chinese steel exports in many instances.

Steel Price Forecasts

Short Term

Chinese steel prices are forecast to decline 28 to 30 percent year-on-year in 2015 because of oversupply, weak demand, and low iron ore prices. The impact of production cutbacks in China is expected to support prices only from the beginning of 2016. This means global steel prices are expected to bottom out only in the first or second quarters of 2016. But, Chinese steel demand is expected to continue to record negative growth of about one percent in 2016 as well. Supply is expected to be steady in the short term because, to maintain cash flow, Chinese steel suppliers are willing to produce and sell steel with margins of five percent and, at times, even at negative margins.

Also, China’s metal market is likely to remain bearish in the short term and the dollar is expected to hold strong. So there is little upside price risk in the short term. With subdued demand from construction and automobile sectors keeping prices low, Chinese export steel prices are expected to be in the range of $330 to $350 per ton in H2 2015. A rebound is not expected in the short to medium term.

Long Term

Although China has planned production cuts of 80 million tons by 2017, these cuts are expected to only stabilize domestic demand. Chinese exports are expected to continue rising for the next few years. The fast-paced urbanization across the globe will support the steady rise in steel demand. But, whether China will continue to control the export market remains to be seen. During the next two to three years, prices are expected to increase in the range of $100-120 a ton and to rally up to $500 a ton.

Region-wise Sourcing Strategies

Europe

Demand in the European market is currently weak and production cost is high compared with other regions. Key steel suppliers can operate profitably only if volumes are high and most of them are operating at loss. You can expect quite a few steel suppliers to take capacity permanently out of the market.

Turkey, U.S., and China are the major sources of imports to Europe. Currently, smaller volume buyers with low lead time requirements source steel mainly from European suppliers. Lead time for imports from China to Europe is approximately seven weeks. For large volumes, with long-term demand requirement, you can consider sourcing steel from China.

U.S.

Adequate inventory is available in the U.S. market. But you can expect domestic demand to increase with improvement in the macroeconomic environment.

Because U.S. steel mills use the Electric Arc Furnace (EAF) process, you should keep a tab on the price movements of both steel scrap and iron ore to find a cheaper option, especially in the years to come.

With the new trade bill, Chinese companies exporting steel products to the U.S. are likely to face anti-dumping action. Current levels of imports from China may not increase significantly.

Domestic lead time for steel procurement is four to five weeks, while lead time for cheaper steel from China is seven weeks. So, procurement managers at larger companies, who require cheaper sources of steel based on planned volume requirements can consider sourcing from China.

Sourcing Strategy: Factors to Consider

Grade-based Rebates

The Chinese government is expected to provide rebates for specific grades of steel to counter anti-dumping duties. China is also likely to shift focus to high value products. Also, China might route low value products through Taiwan, where export tariffs are low.

Lesser volumes of boron-based alloy steel will be available in the market with the recent cutback in rebates by the Chinese government. Other alloy-based steel are costlier and are not suited for all applications, for example, wires.

Where to Buy: Domestic vs Import

Anti-dumping policies are set to make domestic products more competitively priced in the long term in the U.S. However, China will continue to be a cheaper source of steel for Europe and other high-cost locations. Globally, considerable price difference will remain for certain grades of Chinese steel that do not come under the ambit of duties. Turkey and Taiwan are increasing their share of global steel supplies and European steel procurement managers can consider these two countries as alternative sources for cheaper steel. Restrictions on semi-steel exports from China are yet to be come into force and China is likely to remain a preferred destination till controls are implemented.

Long-term Contracts & Hedging

Steel buyers can consider long-term contracts based on iron ore futures. Iron ore prices are expected to hover in the range of $40 to $50 per ton in 2015. Hedging of risk based on feedstock prices is expected to pick up in 2015. You can fix the preferred ratio based on the price movements. Large buyers can consider direct engagement or long-term contracts with steel mills.

Conclusion

Steel prices are expected to continue to fall up to $330 per ton until the first or second quarter of 2016. From then on, steel prices are expected to climb to $500 per ton in two to three years, with global urbanization propping up steel demand. For large volume requirements across the board, China will continue to be the default location for steel sourcing. But in the long term, domestic steel prices can become more competitive in the U.S. as trade measures come into force. Production costs continue to be on the higher side in Europe and local producers have cut capacities due to weak demand. So China will continue to be the cheaper source for steel procurement for European steel buyers. Taiwan and Turkey are the other cheaper sources for European steel procurement managers.

If you use the EAF process to produce steel, you must keep an eye on iron ore prices and the prices of steel scrap. Iron ore prices are expected to hit a bottom of $40 per ton in the short term. Essentially, Chinese production cuts are expected to only stabilize local demand. With Chinese steel vendors’ inventory levels and need for cash, Chinese exports will continue to dominate global steel markets.