There’s constant pressure on procurement leaders to reduce costs. But after addressing the low-hanging fruit, where do you go from there?

Because of its perceived complexity, MRO spend tends to be overlooked as a source of cost reduction. But when you apply the right strategies, it’s possible to achieve significant savings.

A new white paper from GEP — Unlocking Cost-Reduction Opportunities in MRO: How to Tame Seemingly Unaddressable Spend — details exactly how procurement leaders can impact their bottom line by taking a closer look at how they manage MRO.

What’s Inside:

- The challenges of MRO sourcing — and what to do about them

- Specific strategies to unlock greater savings in your MRO sourcing

- Change management and post-sourcing best practices

This is a must-read for procurement leaders looking for new ways to minimize costs and keep their enterprises on the most competitive footing.

Maintenance, Repair and Operations (MRO) is a vast category. Perceived high complexity can cause a lack of focused effort on cost optimization for even the most mature organizations. Many companies tend to overlook up to one-third of their MRO spending, lacking resources or comprehensive strategies. In reality, this spend may have significant cost improvement opportunities if treated in the right manner. Procurement leaders, equipped with the right strategies, could save up to 25% on life cycle costs that include acquisition, installation, operations and maintenance costs.

MRO management can prove to be a nightmare for many organizations given the inherent complexity of MRO:

- Large number of SKUs (running into tens of thousands in many cases)

- Large number of suppliers in the mix (again hundreds of suppliers)

- High volume of low-dollar items

- Lack of visibility into spend/data/specifications at an organizational level

- High degree of user preference in supplier selection

- Significant capital blocked in inventory

MRO spend typically constitutes 3% to 5% of an enterprise’s total indirect spend. Sophisticated MRO procurement management can have a significant impact on the bottom line. Good MRO management practices also help prevent any stockout situations that could cause a loss of millions of dollars due to production downtime.

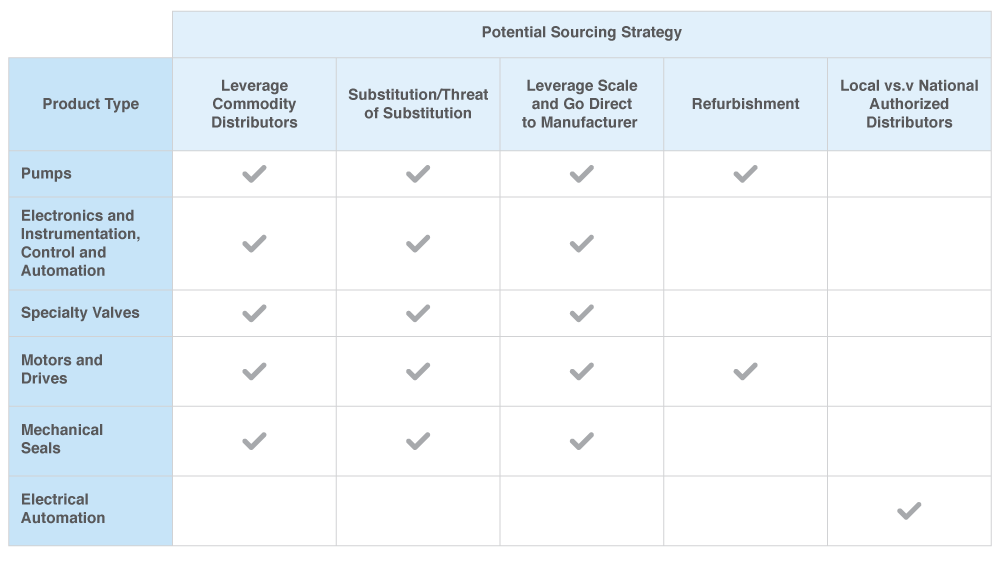

Success requires multiple strategies, as not all aspects of MRO are the same. A comprehensive approach is nuanced enough to reflect the realities of different types of MRO and effective enough to return optimal value from all portions of MRO spend.

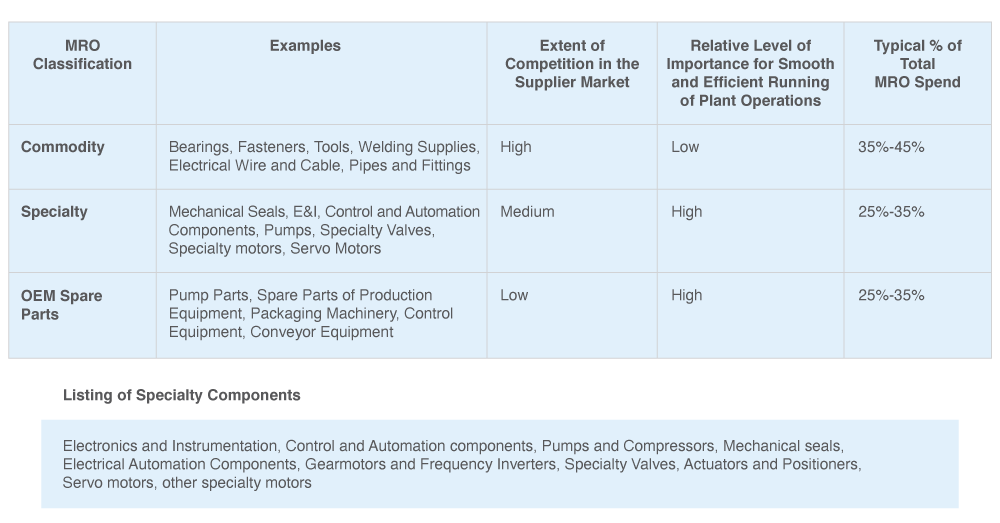

An effective and recommended MRO classification strategy would be to group MRO into the following three segments, with unique challenges and opportunities for each.

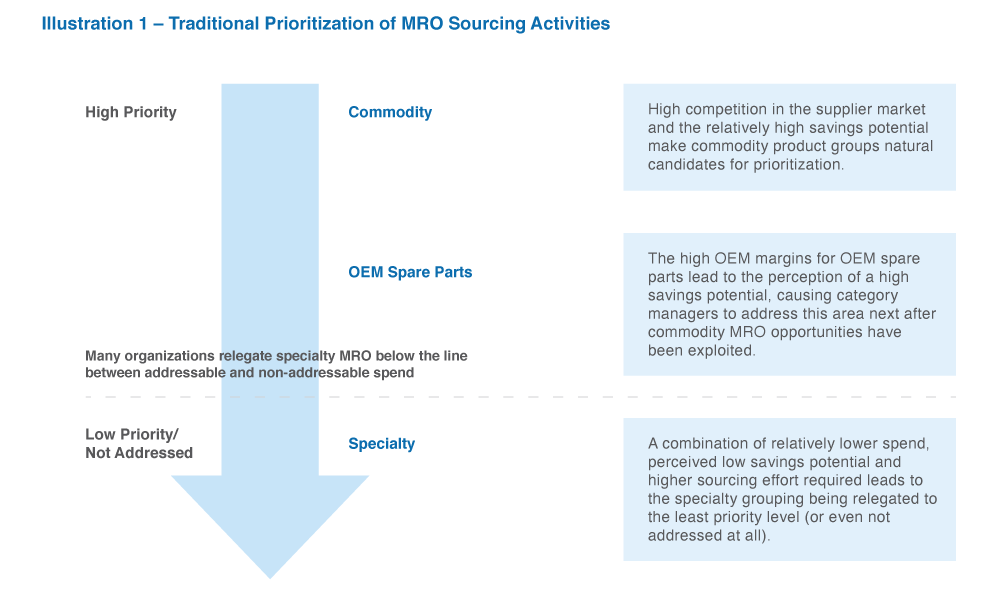

Many organizations traditionally view MRO through the lens of a more simplistic OEM vs. non-OEM distribution, with most of the non-OEM focus being on commodity material, overlooking specialty MRO. Specialty MRO requires strategic focus, just like commodity MRO does, for the following reasons:

- Significant spending on specialty MRO parts

- Achieving supply assurance is more challenging for specialty spare parts compared to commodity, given the high supply market complexity for specialty parts

Even for enterprises that do focus on specialty MRO, both sourcing teams and end users can sometimes de-prioritize cost-optimization efforts for these when compared to commodity MRO items, given the relatively lower return on effort and higher sourcing complexity for these.

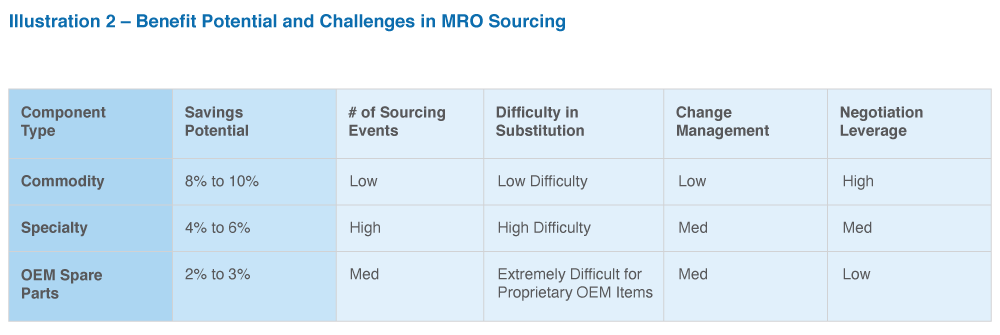

Best-in-class organizations invest sufficient effort in the sourcing of these parts, as there is potential to achieve an average 4% to 6% annual savings on this portion of the spend if the right sourcing strategies are used.

CHALLENGES IN SPECIALTY MRO SOURCING

1. High number of sourcing events required

Specialty product manufacturers and distributors are typically niche entities and cover a limited scope of products. These products can also be purchased from larger, broader-based commodity distributors, but such distributors typically do not cover more than 15% to 25% of a specialty MRO portfolio. Therefore, supplier consolidation opportunities are limited, and addressing the full suite of specialty MRO would require a larger number of individual sourcing events relative to commodity MRO.

2. Difficulty in finding alternative products and solutions

Specialty components are characterized by more advanced engineering, higher precision and a higher degree of customization. Therefore, it is challenging to find alternative products (brands) that would have the same specifications, performance and reliability

3. Change management challenges

Also, substantial effort is required to drive acceptance of feasible substitutes with business stakeholders and end users, again due to the complex nature of technical specifications, high confidence in the performance of products already in use and concerns about the viability of substitutes.

4. Lower negotiation leverage with suppliers

Bargaining power with suppliers is restricted because of a limited number of supplier options. Also, incumbent suppliers are well aware of the switching challenges and high end-user preferences for their current product base. Procurement leaders need to use creative negotiation strategies to move the needle with the suppliers in this environment.

5. Complexity in selecting the right supplier engagement model

For most specialty products, an enterprise can, depending on its geographic footprint, product purchasing mix and past sourcing due diligence, among other factors, work with any of the following three supplier engagement models:

- Direct with manufacturers

- With niche distributors that cover a limited selection of product types and have authorized distributor relationships with certain manufacturers

- With large-scale pan-regional/global distributors that typically stock a large portion of all commodity MRO and also an assortment of specialty MRO through their manufacturer relationships

Zeroing in on the optimal model requires considerable due diligence and homework.

SOURCING APPROACHES FOR SPECIALTY MRO SOURCING

1. Leverage commodity distributors

A great first step is testing key commodity distributors — typically pan-national/pan-regional/global, and serving as one-stop shops for a substantial amount of commodity components — for their coverage and pricing of specialty MRO product types. Commodity distributors can typically supply 15% to 25% percent of the specialty MRO requirement, including offering equivalent substitutes. They are motivated to offer aggressive pricing on specialty components to create differentiation with others who are directly competing with them on the large bucket of commodity MRO. Along with obtaining attractive commercials, this strategy helps minimize the number of sourcing events and the overall effort. More elaborate actions can be then taken for the remaining 75% to 85% of the product portfolio.

This strategy is applicable for many types of motors and drives, mechanical seals, electronics and instrumentation and certain types of pumps and specialty valves.

2. Leverage scale and work directly with manufacturers

Large global enterprises may have substantial spending with a given manufacturer across regions and sites. They may be buying one or more brands of the same manufacturer across locations, with the manufacturer having no visibility into this large volume of current (and future) global spending. Teams should explore the manufacturer’s interest in and ability to offer direct pricing. For various logistics and business reasons, a direct manufacturer relationship may not work out in all cases. However, this approach is worth exploring given the potential benefits. Manufacturers may be interested in exploring direct relationships if there is a critical mass of spending, typically $4 million or more per year.

This approach has been used, for example, for all of pumps, specialty valves, electronics and instrumentation, motors and drives, and mechanical seals.

3. Substitution/threat of substitution

While substitution is not the most straightforward approach and comes with a variety of challenges, it is by far the most effective sourcing strategy for specialty MRO components, both in terms of changing to lower-priced identical/equivalent substitutes, and in terms of extracting benefits from incumbents by inducing credible competition. It is important to remember that substitution is difficult but possible and is an effective tool for exploring cost reduction opportunities.

- Reverse engineered and 3D-printed, identical components: For certain major pump and specialty valve brands, there are feasible options available in the market where these components are being reverse engineered and manufactured by (a) their major competitors, (b) other lesser-known manufacturers in the same region or regions, and (c) other manufacturers in lower-cost regions. Such components are exact matches to the original components in terms of technical specifications.

- Equivalent substitutes: Going to market to explore alternative products from distributors or manufacturers is an effective strategy. While substitution may come with the requirement to make simultaneous engineering changes to the machinery configuration, the commercial benefits may overcompensate for these system adjustments. More often than not, the credible threat of substitution itself helps move the needle with the incumbent supplier base sufficiently. Some insights on substitution considerations for a few example product types are included below:

- Pumps – Alternative pump brands that carry pumps with similar characteristics and output as those being replaced can be used. It may require some degree of engineering changes in the ambient pipeline system to accommodate pumps from a different brand.

- Specialty valves – Substitution of one brand for another is a little easier than in the case of pumps.

- Mechanical seals – Standard seals are easy to substitute. Advanced mechanical seals involve a degree of customization; other manufacturers can produce seals with the same customized configuration if sufficient lead time is given.

- For some types of products, replacement with higher-performance (not equivalent but higher-performance) substitutes can lead to a significant reduction in operational costs (life cycle costs). Motors are a good example, as 70% to 90% of the life cycle cost of a motor is driven by energy consumption. Replacing standard motors with premium efficiency motors can help achieve up to 20% life cycle cost reduction.

4. Refurbishment (or rebuilding/remanufacturing)

Use of refurbished components/parts is an increasing trend, and one that has significant commercial benefits. Especially for certain specific varieties of pumps and specialty valves, best-in-class enterprises gravitate toward use of refurbished components wherein worn out (used) pumps/valves are taken out of operation (at an appropriate stage of their useful life where these are still “refurbishment worthy” and not simply scrap value) and sent to remanufacturers to rebuild them. Remanufactured components offer 30% to 60% savings compared to identical new components while offering the same performance, reliability and life span.

5. Electrical automation components

In some locations, there may be the option to buy from more than one authorized distributor of the same manufacturer. This typically involves a smaller local distributor and a larger distributor with a more extensive geographic footprint. Competitive pressures within this supplier pool may help obtain the desired commercial improvements.

CHANGE MANAGEMENT AND POST-SOURCING IMPLEMENTATION

Optimal ongoing MRO management and supplier implementation is as important as high-quality MRO sourcing. This becomes even more critical when switching suppliers. Below are some best practices to help ensure that potential benefits coming out of sourcing activities are operationalized all the way to their full accrual.

For implementing substitute products, a number of business stakeholders need to be consulted regarding the technical and commercial feasibility of those substitutes. On the technical side, reference checks with industry peers and others who may have been previously using the same target substitutes, and also detailed performance charts, Mean Time Between Failure information, etc., developed by the component manufacturer, would help in gaining confidence. Negotiating the right warranty terms and strong installation support and other technical support services go a long way as well. On the commercial side, business stakeholders typically own budgets, and it is important for procurement to articulate a clear business case (considering TCO) that helps the business to see the benefits in terms of meeting their budget targets.

Furthermore, to keep risks at a minimum, it may help to first implement a small pilot and test a substitute product or product mix for a limited application. Wholesale changes can be made after reviewing actual performance in the target environment. It is also important to be patient and keep in mind that accruable benefits from such changes are realized over a relatively longer period (one to three years) and are not overnight quick wins. However, these long-term benefits are promising enough for the enterprise to engage in a systematic effort to pursue these strategies.

SUMMARY

Segregating any complex mix of MRO requirements into well-defined product groupings primarily based on supplier market characteristics is a great first step. This approach helps address all aspects of MRO requirements. For specialty MRO components, creative strategies can induce competition and increase buying power. These strategies, while providing business benefits, come with implementation challenges. However, these hurdles would be fairly straightforward to navigate with guidance from experienced experts and industry best practices.

AUTHORS

Abhinav Gupta

Senior Director, Consulting

Abhinav has led numerous large-scale procurement transformation engagements for Fortune 500 and Global 2000 corporations across industries and geographies, closely working with and assisting C-level executives in achieving their desired financial, operational, and organizational results. Abhinav is an SME on MRO procurement. Apart from this, his other areas of expertise include procurement transformation, organizational design, opportunity assessment, operating model re-design, process excellence, supply chain optimization. He has 17 years of experience overall, with 11 years in consulting, and the remainder in a variety of industry and technology roles.

Manish Pardasani

Director, Consulting

Manish has more than 13 years of experience in procurement. He has delivered and led a variety of procurement consulting engagements spanning strategic sourcing, category management, zero-based budgeting (ZBB), transition to procurement managed services, etc. He is a subject matter expert in the MRO category and co-leads the MRO thought leadership group at GEP. Over the years, Manish has delivered substantial MRO savings for clients across industries and regions. Apart from MRO, Manish also has significant experience with sourcing of equipment, general and professional services, direct materials and packaging.

Theme: Procurement