Introduction

The U.S. Federal government, with an annual spend of nearly $500 billion on products and services, is now facing the harsh reality of shrinking budgets and continuing resolutions.

The scene's not much different in other parts of the world. Faced with severe fiscal pressures, government acquisition organizations across the globe are looking for ways to cut down costs by reducing spend and lowering overhead, without affecting the quality of services.

The commercial sector has traditionally served as a benchmark for driving efficiencies in government organizations through best-in-class people, processes and technology.

Taking cues from some of the world's leading enterprises that spend billions of dollars in procurement, many federal government organizations have started focusing on acquisition process improvement and strategic sourcing. But these efforts are often piecemeal and aren't utilized to their full potential to get the savings to the bottom line.

This white paper lays out a structured methodology that federal acquisition organizations can follow for improving their acquisition process and leveraging strategic sourcing to drive maximum savings.

Transforming the Process

Process improvement is not a new buzzword in federal government organizations. In fact, it's been used for decades in various government reports and is an essential step on any major system implementation.

But therein lies the problem. Many federal acquisition organizations look at process improvement as a mere checkbox to move to the next milestone review or to meet oversight requirements, thereby failing to unlock potential savings and operational efficiencies.

Although there are many different acquisition process improvement techniques, all of them involve the following core steps:

Process Assessment is done to evaluate the current processes for efficiency and identify scope for improvement. Process Redesign involves designing the new processes, based on future plans and requirements of the organization. Implementation is pretty self-explanatory, however it is the area where most process improvement initiatives fail due to lack of buy-in from stakeholders. Finally, Ongoing Management is needed to ensure that the goals of the new process are achieved. All these steps are executed with the end goal of making the acquisition organization perform in a leaner, faster, cheaper, and better manner.

Ripe for Improvement

Process improvement in federal acquisition organizations can be extremely useful in reducing operational costs but can also lead to resource drain if not done right.

Federal acquisition organizations are often criticized for their lengthy acquisition processes. The long cycle times are primarily due to lack of budgets, absence of a proper acquisition strategy, self-imposed checks and balances, excessive paperwork, and lack of expertise, to name a few.

The fact is, many government acquisition processes are ripe for improvement and can generate substantial savings while dramatically improving their operational efficiency through well-executed acquisition transformation initiatives.

There are numerous bottlenecks in any federal acquisition process that slow down or even bring the process to a halt. These bottlenecks can be reduced or eliminated through process improvement to develop a more streamlined acquisition workflow.

The speed at which an acquisition organization can complete the acquisition cycle depends, to a great extent, on the way it is structured.

Currently, many federal acquisition organizations are structured based on the customer groups they serve, which is great for customer service, but not for cost savings.

In contrast, many commercial procurement/acquisition organizations have structured themselves around different categories of their acquisition or procurement spend. This allows them to best meet the needs of the organization they are buying for, as well as to better manage and control their spend.

Implementing Rather Than Creating Shelfware

No matter what type of process improvement an stakeholder level. No one is accountable to implement acquisition organization puts in place, issues occur the changes, so nothing is implemented. when it does not implement the process improvement correctly and creates “shelfware”.

It's a common occurrence in most process improvement projects: a team comes in and develops a detailed report with several recommendations for process improvement. This report is read but not implemented, and sits idle on the the decision-maker's shelf.

This occurs due to lack of accountability for proper implementation at either the leadership or process stakeholder level. No one is accountable to implement the changes, so nothing is implemented.

A good way to ensure both accountability and proper implementation is to incentivize process improvements through the yearly review process and link it to performance pay.

Ensuring that proper incentives are put in place for these stakeholders by the organization's leadership is essential to make sure that the time and resources associated with the effort are not wasted and buy-ins to any future process improvement initiatives are not diminished.

Realizing Real Savings

While the commercial sector focuses extensively on cost savings related to acquisition process improvement, the public sector is yet to fully grasp such opportunities.

Process improvement initiatives typically involve reducing cycle time and eliminating redundant processes, people or technology.

This is where the government sector needs a paradigm shift.

The commercial sector has embraced cost cutting and leverages every opportunity to optimize costs and get savings to the bottom line.

The public sector has been reluctant in eliminating process steps that are associated with technology or people, leading to cost and operational inefficiencies.

Faced with severe fiscal pressure, federal acquisition organizations must look at process improvement initiatives that focus on optimizing all available resources and minimizing cost to achieve their mission goals, without affecting service levels.

Even though there is a reluctance to make cuts in the public sector it is important to note that savings realized through process improvement in other value-added activities.

When implemented correctly with proper accountability at all levels, acquisition process improvement can bring about substantial improvements in service quality at lesser cost.

Strategic Sourcing

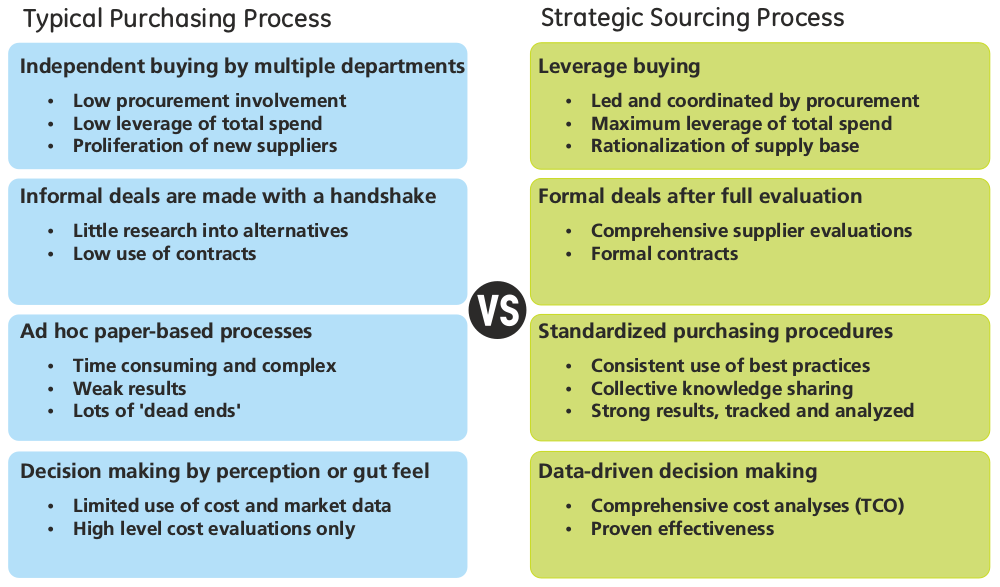

Many private enterprises turn to strategic sourcing to reduce the costs of buying goods and services while maintaining or improving service and quality. Large commercial organizations typically leverage the combined buying power of all business units to negotiate contracts with the lowest total cost of ownership (TCO) over the life of the contract.

Although fairly new, strategic sourcing is also finding place in federal acquisition parlance. Strategic sourcing has been utilized in the U.S. Federal Government Administration (GSA) has been running a large government-wide program called the Federal Strategic Sourcing Initiative (FSSI) since 2005. Currently, the U.S. Federal Government is procuring a number of categories through the FSSI, including parcel delivery services, office supplies, printing services, telecommunications, and wireless. While it's a good beginning, there are hundreds of categories that are not being procured through the FSSI.

The Office of Management and Budget (OMB) has issued guidance over the years to promote strategic sourcing throughout the federal government. In 2013, the OMB made it mandatory for all government agencies to appoint a Strategic Sourcing Accountable Official to continue to promote the use of strategic sourcing within the acquisition space. As promising as strategic sourcing may be in delivering cost savings, it has never been fully embraced by many federal acquisition organizations.

Executing Strategic Sourcing

Executing strategic sourcing is a fairly straightforward process. The main thing to keep in mind is that it is a data-driven process and the insights gained from data should lead you to the correct sourcing solution.

The process starts with spend analysis of the target categories for strategic sourcing. Once there is a good understanding of the current situation, the next step is to analyze what's happening within the marketplace.

A sourcing strategy is then developed, based on the business requirements.

RFPs are sent out to the industry. The vendor proposals received are evaluated on various predefined parameters. The best proposals are identified and respective suppliers are approached for negotiations on price as well as terms and conditions.

The proposal that provides the lowest total cost of ownership after negotiations is identified and the vendor offering the best deal is selected.

Using Data as a Tool

During the strategic sourcing process, data should be looked at as a tactical tool. Many organizations underestimate the power of their internal acquisition-related data. Understanding what is going on currently with a specific acquisition and how much money is actually spent seems like a very basic activity but it is something that is often overlooked. Federal acquisition organizations should think of the following questions while analyzing their data.

- What is the current spend?

- How much of this spend is currently under contract?

- Are we locked into these contracts or can we get out of them?

- How fragmented/concentrated is our spend?

- How many suppliers account for 80 percent of the spend?

- Is pricing consistent throughout the organization or does it vary with location?

- If there's a difference, is it justified?(transportation costs, higher quality, etc.)

- How is the item currently being purchased?

- At the local, regional, or national level? (centralized/decentralized)

Once you understand what is being spent currently, you can also assess the marketplace to see what is possible. By understanding what is going on currently inside the organization as well as in the marketplace, the acquisition organization would be able to develop the right acquisition strategy. It can't be stressed enough that it is extremely important to utilize acquisition data to develop acquisition strategies and, in turn, drive down acquisition spend throughout the life of the organization.

Embracing Total Cost of Ownership

Federal acquisition leaders need to truly understand the total cost of ownership over the life cycle of the product or service being acquired. TCO includes cost of acquisition, deployment, operation, support and retirement. Not understanding the TCO of what the government buys leads to excessive cost overruns. Having the ability to truly understand what it costs to own something throughout its useful life leads to sound acquisition decisions and substantial cost savings.

Taking Small Steps

In an ideal federal acquisition landscape, strategic sourcing should be done across the board for all services and products. Unfortunately, it seems to be a long shot, at least for now. So the best approach for federal acquisition organizations who want to leverage strategic sourcing is to take small steps towards it. They should begin with understanding the acquisition spend data and use insights from that data to analyze the current spend. This analysis should be used to identify target categories for strategic sourcing.

The right approach is to start with a few sourcing projects at a time to ensure success and then begin to roll them out throughout the organization. By using this approach, the organization can see the value of strategic sourcing through savings and garner more support throughout the organization for future initiatives.

Steps to Conduct a TCO Evaluation

- Before beginning any sourcing project, identify the key cost elements that comprise the total cost of operations for the product/service — beyond just price — through market research and analysis.

- Identify the cost drivers for the product/service — which of these can we control/influence?

- Once the cost elements and drivers have been identified, assess each of these components and assign an estimate percentage of total cost — if the assigned percentage is not significant (falls below five percent), eliminate it from your evaluation.

- With a revised, prioritized list of TCO components, assess the true cost of the product/service.

- Compare and save.

Conclusion

By utilizing and embracing process improvement and strategic sourcing techniques, federal acquisition organizations can effectively manage shrinking budgets and strict fiscal targets, while improving their service levels. Small investments and a conducive approach towards change can deliver significant savings and operational efficiencies, while relieving some, if not all, of the fiscal pressures faced by federal acquisition organizations on a daily basis.