Executive Summary

With enterprises continuously looking for favorable sourcing opportunities, procurement's focus has shifted towards high-growth emerging markets such as BRIC (Brazil, Russia, India and China) and MIST (Mexico, Indonesia, South Korea and Turkey).

Establishing a procurement strategy for emerging markets involves a broad set of related inputs that include: evaluating attractiveness of emerging markets over time, current opportunities to capture value, and assessing challenges and risks.

Companies planning to source from emerging markets must understand the market diversity, be more flexible to changes in market dynamics, and leverage every change to realize maximum savings. Companies that try to lock in a low price for the long term, potentially lose out on rapidly changing market dynamics. By adopting a “category management” based approach, developing a nimble organization structure and incorporating flexibility into contracts to react swiftly to any upcoming changes, procurement can ensure success in emerging markets.

Categorizing Emerging Markets

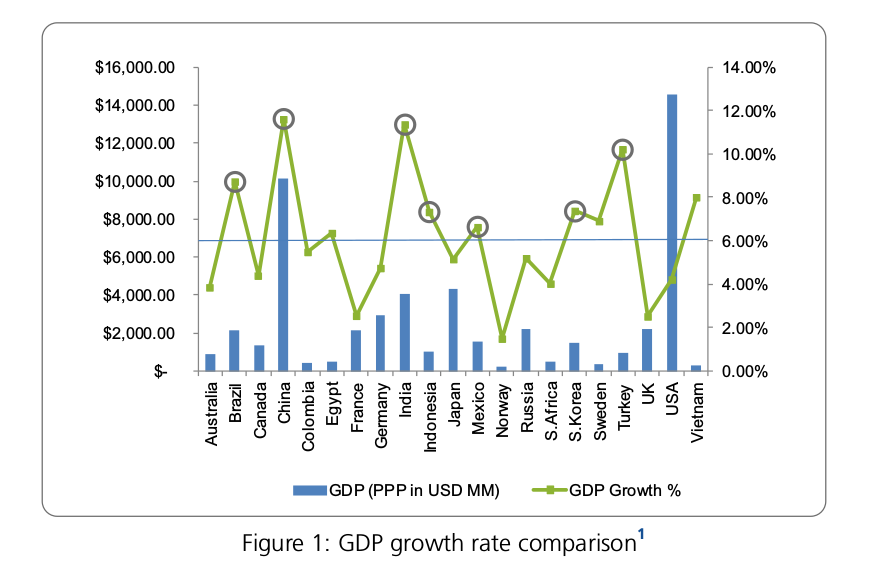

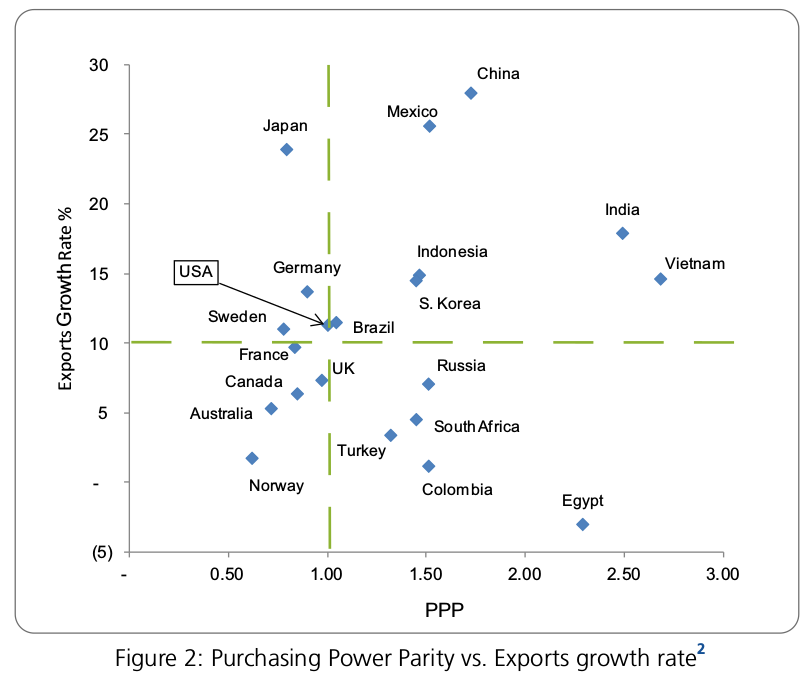

Emerging markets are often categorized by macroeconomic indicators, such as Real GDP Growth Rate, Purchasing Power Parity, Export Growth Rate, etc.

Some of the more creative classifications — such as BRIC (Brazil Russia India China), MIST (Mexico Indonesia South-Korea Turkey), CIVETS (Colombia Indonesia Vietnam Egypt Turkey South Africa) – came into being to help the financial institutions sell investment products based on those economies. However, apart from being fancy monikers, some of these classifications indeed make perfect sense when considered from procurement's perspective of low-cost country sourcing. For example, one of the bases for classification of BRIC quartet is the fact that Brazil and Russia are forecasted to be the leading raw materials suppliers to the world, whereas, India and China are forecasted to be the leading goods and services suppliers to the world.

However, it is important to consider more than just the fancy acronyms when evaluating countries as low cost sources of materials, goods or services. The following macroeconomic indicators help separate leaders from followers:

- GDP Real Growth Rate

- Exports Growth Rate

- Purchasing Power Parity

It is essential to consider all the aforementioned metrics together to identify a strong emerging market for sourcing materials, goods and services.

Real GDP Growth Rate indicates the vibrancy of the economy – the economic activity, productivity growth and suppliers' growth within the concerned economy.

Purchasing Power Parity (PPP) and Export Growth Rate (%) indicate the overall competitiveness of the supplier markets within these countries. Taking into account the three macroeconomic indicators mentioned earlier, we see that along with the BRIC nations, Mexico, Indonesia and South Korea are also considered favorably by the world markets for sourcing goods and services.

Developing a Procurement Strategy

The outlook for emerging markets shows that many companies expect increases in sourcing from BRIC countries, although, growth rate of sourcing from China seems to be slowing. Sourcing from India had seen an increase in the recent past. Currently, though, response to sourcing from India is mixed sourcing cost can be lower due to sharp depreciation of the currency but the government policies have not been exactly conducive. For example, the country is importing iron ore despite having large iron ore reserves, which is making the domestic steel industry susceptible to the volatility in global commodity prices.

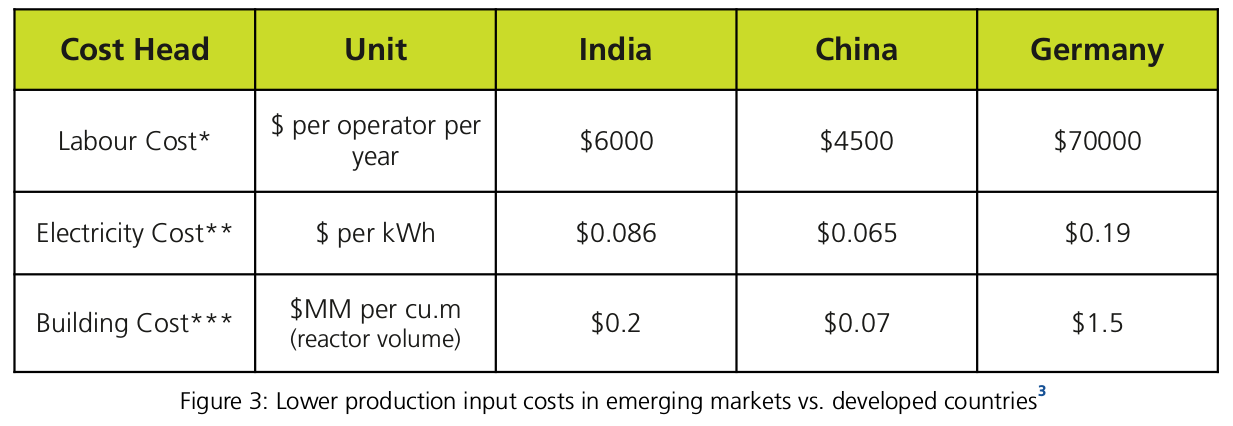

In general, though, sourcing from emerging markets can offer significant benefits, with companies leveraging lower costs of production to achieve savings upwards of 20 percent in many cases.

Establishing relationships with suppliers in the form of sourcing engagements can also allow establishing foothold or initial entry in developing markets. Companies can also leverage low-cost labor in emerging markets to more effectively tackle demand fluctuations.

In spite of the relative attractiveness of emerging markets for sourcing goods from a cost standpoint, companies need to consider the increased risk profile of these countries. For example, change in government policies and/or tax structure can adversely impact cost of goods. Similarly, sourcing strategies will need to account for greater political and economical instability, less developed infrastructure, and poor intellectual property laws and enforcement. Additional complications can arise from increased cost to logistics – longer lead times, resulting in higher inventory carrying costs – and aligning internal stakeholders to seeing value in LCC sourcing.

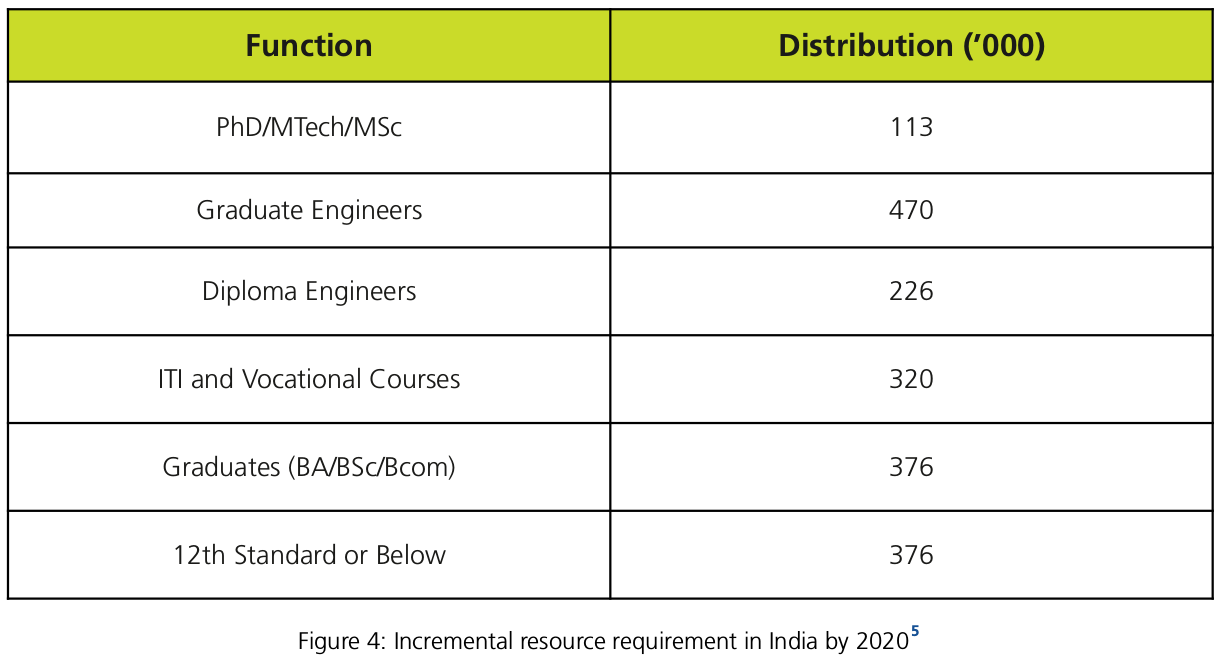

For example, infrastructure is a key issue in sourcing from India. Inefficient supply chain costs the country's economy an estimated $45 billion 4 per year. Transportation bottlenecks create inefficient lead times and can delay deliveries to customers. In some parts of the country, energy supply can be a concern as well. Availability of skilled workforce is also an issue in India, both from the point of number of skilled workforce required in the future as well as the skill level of today's workforce.

In China, on the other hand, while the infrastructure is good, compliance with the law — including child labor, environmental and intellectual property laws – is a challenge.

The resource situation is comparatively better in the MIST countries.

In addition to the considerations above, companies sourcing from emerging markets need to realize that they will require greater flexibility and time to capture benefits. Generating the starting list of suppliers in emerging markets can be an arduous task because that list needs to be really big to compensate for information asymmetry and identify brokers disguised as suppliers. This, for example, can be the case for China. Once the initial list is available, suitable amount of buffer needs to be built in to complete the sourcing exercise because suppliers will have little respect for deadlines.

To mitigate these challenges, companies sourcing from emerging markets are focusing on:

- Establishing procurement strategies to ensure supply continuity

- Designing category management contingency plans

- Aligning supply surety with overall business risk tolerance goals

Being Flexible to Market Diversity

In the developed world, markets are mature and procurement policy focuses on finding the best price-quality combination in the market. Savings are derived from use of the firm's available negotiating leverage, which incentivizes long-term lock-ins with strategic suppliers. This can become counter productive when sourcing from emerging markets, because, while it maximizes savings from negotiation, it shuts the door on another avenue – savings from flexibility.

Emerging markets are very dynamic. For example, legal frameworks and policy changes are more drastic and unpredictable; micro as well as macro growth rates are dynamic. Technology changes are more frequent and rapid, as these economies look to compress the developed world's advances into a much shorter time-frame. Contract compliance is lower due to lack of maturity of legal frameworks, changes in monetary and fiscal policies, and inflation, which lead to frequent contract amendments. Firms that are flexible enough to take advantage of every change stand to realize significant savings. Flexibility can result in as much or even more savings than pure negotiating leverage.

Diversity across emerging markets can be primarily attributed to the differences in market growth drivers and constraints. Rising domestic demand in emerging markets can, for example, be an impediment if you are sourcing the same products or finished goods overseas. Differences in the level of innovation – another growth driver – will drive the cost and quality of production across countries. On the other hand, factors that constrain growth – cost of certain raw materials / chemicals – can be steeply affected by the country's dependence on global commodity prices. For example, due to India's dependence on oil, increases in oil prices push up the country’s energy costs, eventually increasing the cost of production. Additionally, in China, Indonesia and India, only companies in the organized sectors have global manufacturing standards that augur well for exports. On the other hand, in South Korea and Russia, manufacturing standards are more consistent across industries and companies.

In summary, differences in market growth drivers and constraints arise from changing market dynamics, variance in input prices, and the level of sustainability and innovation. These can be different both within and across markets. For example, they could vary across industries within a particular country, as well as across countries, in the emerging market, for the same industry.

Adapting Your Procurement Strategy

With currency, market dynamics and legal frameworks changing so often, it is important to identify two or more emerging market sources for each commodity. From month to month, one source could become more competitive against the other, and the benefit should be leveraged. Also, any significant economic events can affect currency conversion rates, inflation rates and stability in emerging markets. Monitoring these can help a company react early to any impending changes. In a nutshell, to adapt procurement strategies to the changing nature of emerging markets, the following will be critical:

- Aligning sourcing strategy with long-term market potential: Sourcing strategy should be in line with company's future marketing, expansion and product development goals, as well as changing market scenarios.

- Formulating sourcing strategies by product / service categories: Sourcing strategies tailored by supplier segments can help utilize supplier competencies better, creating competition and maximizing savings.

- Leveraging country-specific unique competitive advantages: An entry without comprehensive risk mitigation measures may pose significant operational disruptions, offsetting any cost benefits. Flexibility and agility of supply chain is critical in mitigating supply risks.

- Working with suppliers to manage costs effectively: Buyers with sound cost mitigation strategies should work with preferred suppliers and help manage input costs.

- Partnering with global firms investing in sustainability and innovation: Strategic partnerships with few suppliers investing in newer and sustainable technologies will deliver bigger, long-term benefits, even if they are more costly upfront.

- Developing firsthand knowledge of supplier markets: Committing time and resources to overcome the information asymmetry within the supplier markets and/or availing the services of reliable third-party service providers (e.g. supplier databases)

For companies wanting to establish or expand footprint in the emerging market, localizing sourcing wherever it is appropriate or feasible would be critical to keep costs low. For example, in case of making capital investments, it would be prudent to source equipment manufacturing / assembly and engineering maintenance services locally. Equally important would be to develop local standards for raw materials, equipment, packaging, facilities, and environment health and safety, to draw parity with the cost of production of local companies.

Category Management Based Approach

Although procurement's level of influence is increasing in emerging markets, challenges still persist. Recent surveys show that procurement's full involvement in all spend areas is likely to increase the most in emerging markets. Also, the level of influence is highly correlated to hard benefits, which means that it is maximum for categories with large savings potential.

Procurement strategy must have a more category management based approach towards emerging markets. To derive maximum benefit, the category must be actively monitored to get a head start on any upcoming changes. Having local domain expertise is critical in achieving this. Additionally, the contracts and organization structure should have the flexibility to react quickly to any upcoming changes. Such changes can help maximize savings or — in some cases — minimize cost inflation, based on market changes.

References:

- GEP analysis; 2010 country GDP and growth numbers from Indexmundi.com

- GEP analysis; 2010 country PPP and export percentages from Indexmundi.com

- US Bureau of Labor Statistics, ** – Energy information agency; Contract pharma

- Procurement leaders

- IMaCs Analysis