The C-suite is getting crowded.

At the top levels of an organization, the chief procurement officer (CPO) is competing with other energetic and determined executives for influence and funding within an enterprise. Establishing procurement as a key strategic force is essential to ensuring that its value is recognized internally.

No doubt, procurement will continue to be held accountable for cost savings targets and category management responsibilities. But its portfolio is increasingly extending into support for product development, product management and manufacturing activities.

Indeed, procurement is particularly well positioned to both identify and oversee key “make versus buy” opportunities. Not only do these projects align to the core cost savings mission of most procurement departments, they also provide procurement teams the opportunity to fully leverage insights into external supply market conditions and internal manufacturing processes, capacity and strategy.

Success here requires a structured approach. Accordingly, this paper will outline a process that procurement can follow to facilitate these opportunities, taking into account key strategic, operational and financial considerations.

As part of this whitepaper, we will also examine emerging market trends and provide examples that demonstrate how procurement can increase its strategic value by leveraging pre-existing relationships and knowledge capital.

Identifying Opportunities

I) Internal Analysis

The criteria that qualify a product for insourcing or outsourcing can vary by industry and geography. Despite these variances, a conceptual framework that defines a product's strategic importance and the internal competencies required for production, is a good starting point.

The question “where can we produce this SKU at a lower cost?” is best addressed in light of a clear understanding of corporate strategy, market conditions, and consumer demand. Indeed, clear alignment with consumer demand and corporate vision is a hallmark sign of a mature procurement operation. Procurement organizations that lack this understanding should first focus on attaining alignment before moving on to more progressive functions such as “make versus buy” enablement.

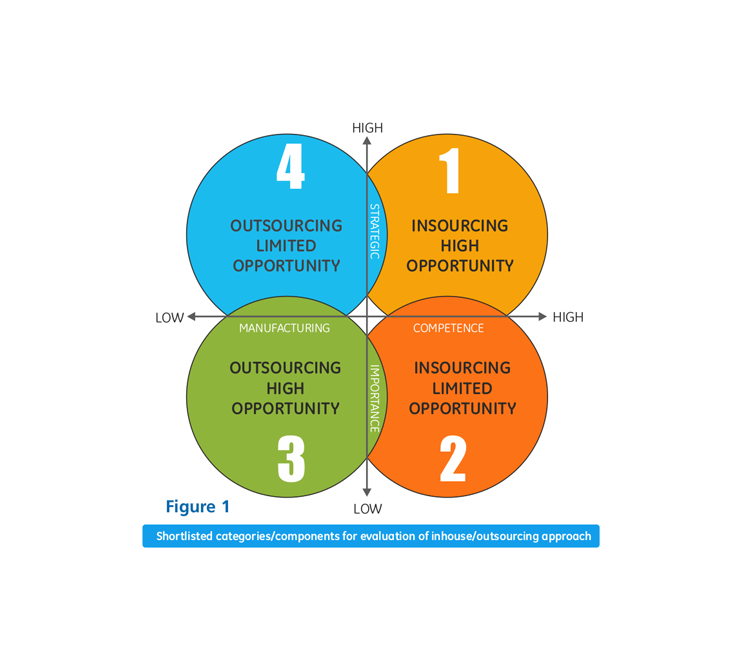

In general, products that are of high strategic importance and generally align with internal manufacturing competencies are best suited for insourcing evaluation, while those of little strategic importance — do not fit within current competencies — are prime outsourcing candidates. The following framework outlines three key factors, from both a strategy and competency standpoint, to evaluate products or product categories and identify potential opportunities.

Strategic Importance (SI)

In order to quantify strategic importance, procurement should seek to weight the evaluation factors outlined below in accordance with industry and geographical nuances, augmenting the evaluation factors as necessary.

- Market Leadership

- High SI – the retention of in-house design and engineering capabilities is essential to ongoing product development and improvement.

- Low SI – there is little ongoing product innovation and development internally.

- Business Criticality

- High SI – any failure from a quality or timing perspective would have a significant negative impact on the firm's revenue, profit, or image.

- Low SI – the product is ancillary and production would not be majorly disrupted by minor quality issues or supply chain delays.

- Intellectual Property Control

- High SI – there is a high risk associated with the leakage of technology, manufacturing processes or inputs/ingredients.

- Low SI – there is little to no IP associated with this product or its production.

Internal Competencies (IC)

The internal competencies outlined below should also be given appropriate weightage by procurement. Additional factors may be necessary depending on the industry type and manufacturing environment.

- Technical Expertise

- High IC – the firm has established specialized knowledge not readily available in the competitive marketplace.

- Low IC – there is little to no specialized knowledge required for production.

- Installed Capacity

- High IC – the firm has made, or is planning to make investments in manufacturing equipment and/or technology, that would remain idle if not utilized to manufacture a particular product.

- Low IC – flexibility of installed capacity to handle other SKUs.

- Regulatory Compliance

- High (IC) – the firm has a clear understanding of regulatory requirements and has developed an internal structure designed to closely adhere to these requirements.

- Low (IC) – the firm struggles to adhere to regulatory requirements and relies on external support to do so.

It's important to establish a clear timeframe for the product segmentation derived from this exercise. A product that is defined as strategic today may no longer be strategic in the future or vice versa. For the timeframe established, procurement should now have a clear sense of potential insourcing and outsourcing opportunities as depicted in Figure1. The analysis of these categories, thus far, has been primarily inward-facing and now needs to be augmented by procurement's detailed understanding of supply markets on a category basis.

II) External Analysis

After the internal analysis is complete, procurement should take the products or product categories shortlisted for assessment and evaluate them within the context of external supply markets. If external manufacturing capabilities exist, the level of supplier competition, availability of economies of scale, and supplier capacity are three primary factors to consider in the opportunity identification process, as they highlight categories with the potential to drive cost savings. These preliminary cost savings opportunities will later be validated by a detailed financial analysis process as part of business case development.

Economies of Scale: Procurement should utilize its understanding of supply markets to compare economies of scale offered by external suppliers for a particular product with those available from internal production. Organizations should leverage internal economies of scale through insourcing activities, while evaluating outsourcing potential for those categories where significant economies of scale are available in the external supply market.

For example, a corporation that has a 70 percent market share in the production of bronze plaques would hardly benefit from outsourcing production when it has the most dominant position from a supplier leverage and manufacturing scale perspective.

- Level of Competition: A high level of competition among suppliers indicates savings potential through outsourcing; a low level of competition could be a potential catalyst for insourcing. The level of competition within a supply market depends on where a product sits on its lifecycle curve. It often takes time for suppliers to adopt an emerging technology that requires complex manufacturing processes. As a product reaches the later stages of its growth phase and enters into maturity, the supply markets usually evolve to support the manufacturing process in a competitive fashion.

- Capacity: For items with high variability of demand, excess supplier capacity makes a strong case for outsourcing. The reduction of fixed overheads for idle time and machinery can be transitioned to a supplier who is most likely pooling the demand of multiple customers. Disruptive innovation through new and emerging technologies also has the potential to impact capacity. For example, internal capacity could increase through the acquisition of a 3D printer. Plastic components that were once being purchased from external entities could now be insourced, given the flexible capacity of a 3D printer.

Breakout Example

The ongoing trend among large corporations to outsource promotional printing is a case example that highlights all the three aforementioned factors. Third-party print suppliers have been able to establish substantial economies of scale through the production of large-scale printing presses with higher yields and lower operating costs. This is also a very mature industry where competition is high and the end product verges on a commodity. Finally, an organization's print demand can vary significantly based on product selling cycles. The fixed costs associated with the retention of employees and print equipment are hard to justify when most major print houses have available capacity that can ebb and flow with business cycles.

At this point in the evaluation process, procurement should be equipped with a refined group of products and/or product categories that are clear candidates for insourcing or outsourcing initiatives. The candidates identified for further evaluation do not need to be entirely finished products, but could also be “intermediates”. A further layer of evaluation should be conducted on the level of spend and contribution to profit that these products represent. Depending on the risk appetite of the firm, priority can be given to high spend, and thus high savings opportunities.

Alternatively, procurement can focus on smaller spend areas to progressively build credibility in a lower risk environment. Regardless of the approach, these categories must be carefully scrutinized with cross-functional support in order to prioritize and quantify the opportunity that each of them represents.

Outsourcing for a North American Manufacturing Co.

Applying the opportunity identification methodology, the procurement department of a manufacturing company, with revenue of $1 billion, identified metal forming production as a potential outsourcing candidate. The company had two production facilities, one in the US and the other in Mexico. From a strategic standpoint, there was recognition that most of its products had similar initial forming operations and the area where it differentiated itself from the competition was the final assembly and finishing process.

Thanks to the auto production boom, Nuevo Leon in Mexico had established itself as a base for automotive metal forming process. Procurement conducted a supply market evaluation and identified excess manufacturing capacity for this type of production. As such, the initial forming operations were outsourced to suppliers in Mexico, following which, the client completed the final forming and assembly operations in its Mexico plant.

Unused capacity in the US plant could now be used to satisfy the ever increasing demand for contract manufacturing, as higher labor costs could be passed on to contract customers. This resulted in a considerable savings for the company, while maintaining its core competency.

Insourcing for a Global Biotechnology Company

The procurement team of a $3.8 billion biotechnology company established a pipeline of SKUs for insourcing candidacy based on direct spend data for three years. The team eliminated SKUs based on annual spend cut-offs. The pipeline was further reduced by selecting only those SKUs that aligned with core manufacturing capabilities. This exercise left 15 percent of the initial SKUs remaining. Procurement then worked collaboratively with R&D, manufacturing sciences and manufacturing to create a prioritized pipeline based on ROI, contractual agreements, capacity, and supply chain risks. Ultimately, the team was left with a list of SKUs representing 5 percent of annual direct spend with projected savings of 50 percent.

Procurement then played the role of project management for a client team consisting of manufacturing, manufacturing sciences, procurement, R&D, and quality. The team started its due diligence with inputs from R&D, legal and manufacturing. A detailed project plan was created with identification of milestones and owners for each activity. Key risks were identified along with mitigation plans for each scenario. Weekly meetings were held to track progress of the project plan. Brainstorming sessions were also conducted to find opportunities to increase savings. The project took six months and was implemented with successful completion of three pilot-scale and three full-scale batches with 70 percent savings.

Prioritizing Opportunities and Developing a Business Case

Once a series of products or SKUs have been identified, procurement must engage functional groups from across the organization to determine the true viability of an insourcing or outsourcing project. Procurement should work to leverage pre-existing relationships within different functional groups to serve as a facilitator for the overall “make versus buy” business case development.

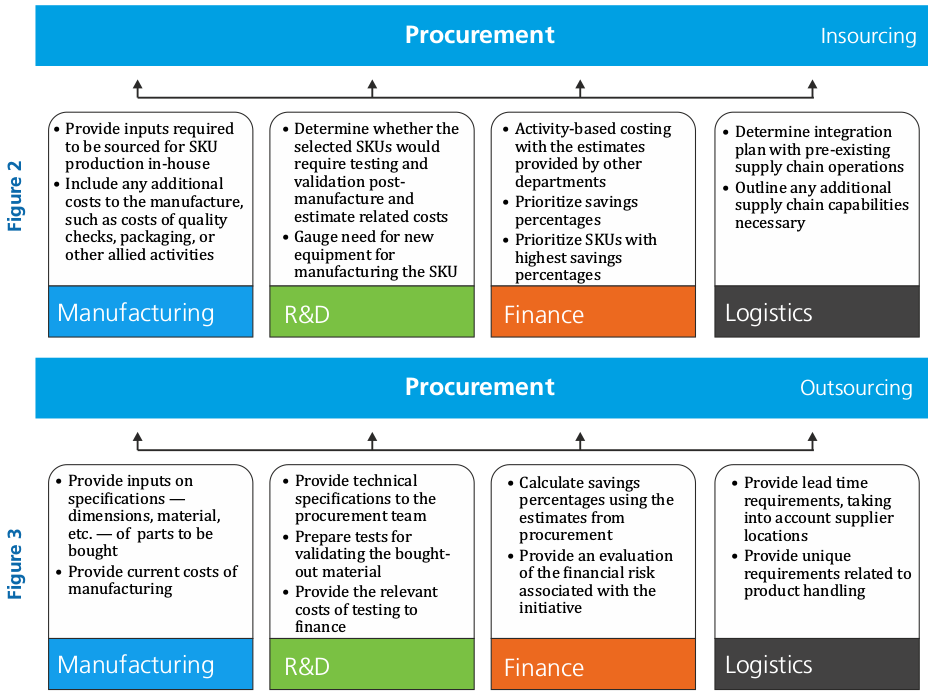

The four main stakeholder groups in any insourcing or outsourcing evaluation process will most likely be manufacturing, R&D, finance and logistics. Depending on the product category, additional stakeholder groups, such as information technology and marketing, will play an integral role in the business case development process. Several key inputs from these primary divisions have been outlined in Figures 2 and 3. This list is not exhaustive and does not dive into the detailed financial analysis process.

As the inputs flow in from the various functional groups, opportunities will then need to be prioritized based on savings potential and operational viability. All evaluations must be conducted within a TCO framework, taking into account initial procurement and manufacturing costs, and ongoing costs associated with contributors — right from quality control to waste disposal. In addition to acting as a facilitator, procurement will be also be responsible for providing key inputs, which include:

Outsourcing

- Supplier identification and assessment

- Supplier price quote evaluation

- Product outsourcing TCO assessment

Insourcing

- Procurement scope expansion evaluation

- Raw material supplier identification and assessment

- Projected raw material expenditure evaluation

When developing a business case, a risk mitigation plan should also be created. Risk should have been significantly minimized during product identification and prioritization, but there is an inherent degree of risk associated with any insourcing or outsourcing transition that must be carefully managed. Challenges such as technology and systems-related issues can be pre-empted through early engagement with appropriate internal stakeholder teams as well as sufficient knowledge sharing and collaboration among internal resources and any new supplier partners. The ultimate objective is to ensure that no disruption to the consumer experience occurs during the transition.

Planning the Implementation

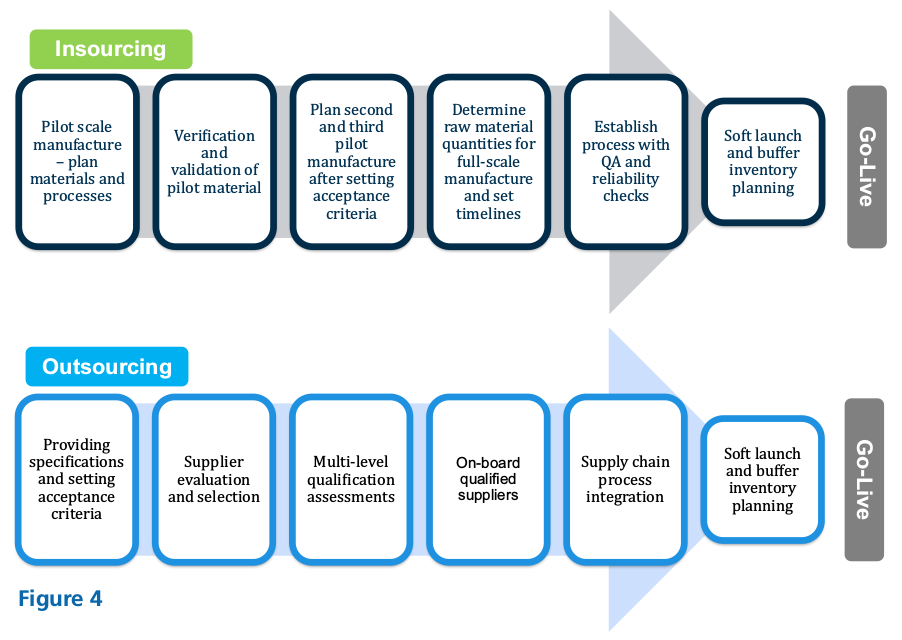

The role of procurement does not end with opportunity identification and business case development. Procurement is well versed in activities such as implementation roadmap development and contracting enablement and, thus, is well positioned to take a leadership role in implementation. While it is important that procurement acts as an ongoing facilitator, the engagement of other business units such as manufacturing becomes increasingly important in this stage of the process. Some of the key implementation-related activities for both insourcing and outsourcing initiatives have been outlined in Figure 4.

A clear implementation plan should be augmented by an understanding of critical success factors. These factors can vary depending on the circumstance, but should always include the following:

- Involvement of all Relevant Functions: The role of a facilitator can go a long way in enhancing the perceived strategic value of procurement. However, orchestrating the appropriate engagement of all functional groups is a challenging process that must be carefully managed.

- Change Management: While the objective of the insourcing or outsourcing activity is to leave the customer experience unchanged, there are many behind-the-scenes changes to processes and responsibility allocation that such initiatives entail. A clear change management plan and proper communication can help prevent any barriers to change.

- Rigorous Financial and Strategic Analysis: Given the risk that such projects entail, each insourcing or outsourcing decision must be supported by extensive analysis that has been reviewed and verified by key internal stakeholders.

Conclusion

Recognition of procurement's potential as a key strategic partner to the larger organization is gaining momentum in board rooms across the globe. Today, procurement's role has evolved beyond saving costs and managing categories to leading key strategic decisions such as “make versus buy”.

The successful execution of “make versus buy” projects not only drives quantifiable cost savings, but also helps organizations confront major strategic and operational issues.

Procurement, with its deep understanding of the external supply market and internal competencies, is best suited to support the top management in every step of a “make versus buy” project – right from identifying opportunities to implementing them successfully.

By doing so, procurement can redefine its role and enhance its strategic value within an organization.