Global Supply Chain Volatility Index

June 2025

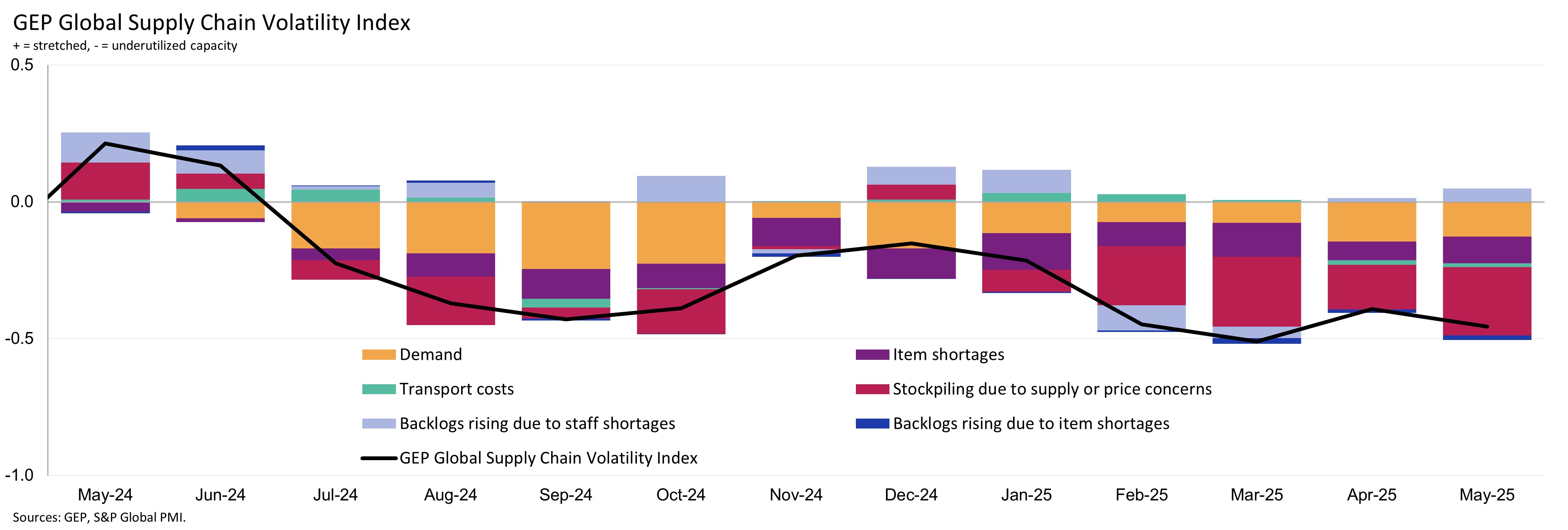

Global: -0.46

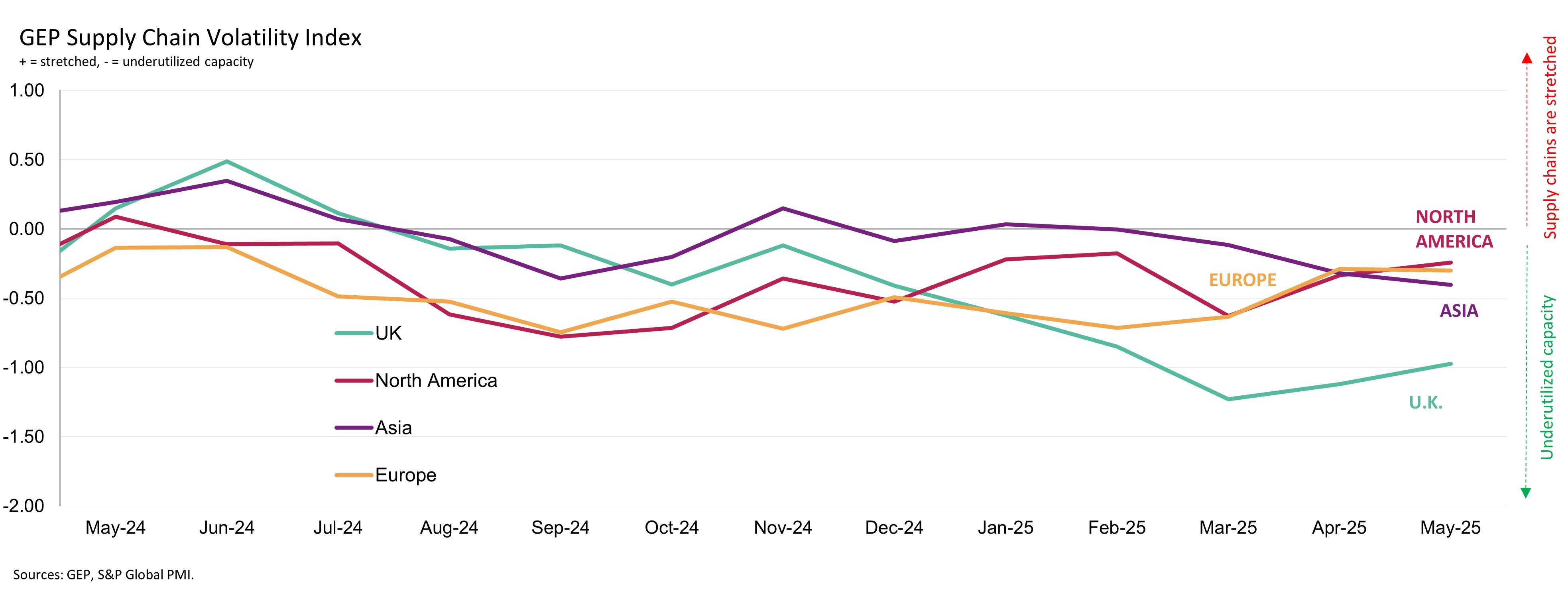

Asia: -0.40 -0.08

EU: -0.30 -0.01

NA: -0.24 +0.09

UK: -0.97 +0.15

Asian Manufacturing Activity Falls to 17-Month Low as Tariffs Hit China-Based Suppliers: GEP Global Supply Chain Volatility Index

- U.S. manufacturers front-load inventories in anticipation of further tariffs

- North American factories remain underutilized, with persistent weakness in Mexico and Canada

- Europe inches toward industrial recovery, while U.K. downturn deepens . more..

GEP Global Supply Chain Volatility Index

-0.46

June 2025

Asia: -0.40

EU: -0.30

NA: -0.24

UK: -0.97

Interpreting the data:

When the SCVI > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

When the SCVI < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

ASIA: Asian Manufacturing Hits 17-Month Low as Tariffs Take Hold

EUROPE: Europe’s Industrial Recovery Inches Forward, Boosted by German Stimulus

U.K.: U.K. Manufacturing Slump Worsens

NORTH AMERICA: U.S. Manufacturers Stockpile Ahead of Expected Tariffs

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, July 10, 2025.

About the GEP Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. The GEP Global Supply Chain Volatility Index is derived from S&P Global’s PMI™ surveys, sent to companies in over 40 countries, totalling around 27,000 companies. These countries account for 89% of global gross domestic product (GDP) (source: World Bank World Development Indicators).

The headline figure is the GEP Global Supply Chain Volatility Index. This a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators complied by S&P Global.

The GEP Global Supply Chain Volatility Index is calculated using a weighted sum of the z-scores of the six indices. Weights are determined by analysing the impact each component has on suppliers’ delivery times through regression analysis.

The six variables used are 1) JP Morgan Global Quantity of Purchases Index, 2) All Items Supply Shortages Indicator, 3) Transport Price Pressure Indicator and Manufacturing PMI Comments Tracker data for 4) stockpiling due to supply or price concerns, and backlogs rising due to 5) staff shortages and 6) item shortages.

A value above 0 indicates that supply chain capacity is being stretched and supply-chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

A value below 0 indicates that supply chain capacity is being underutilized, reducing supply-chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the UK. The regional indices measure the performance of supply-chains connected to those parts of the world.

For more information on PMI surveys, PMI Comments Trackers and PMI Commodity Price & Supply Indicators, the GEP Supply Chain Volatility Index methodologies, please contact economics@ihsmarkit.com.