Procurement outsourcing impacts procurement spend as well as the operational costs that are addressed by other forms of business process outsourcing, so the rewards can potentially be much richer.

The Everest Group estimates that a procurement outsourcing engagement spanning the entire source-to-pay process can address a cost base that could represent 5 to 15 percent of an organization’s overall revenues. (Most other BPO segments typically impact less than 1 percent of overall revenues.)

As a result, the potential bottom-line impact that procurement outsourcing can create is higher. Everest Group’s benchmarking of procurement outsourcing contracts reveals that, on average, organizations that outsourced procurement realized 5 to 10 percent savings on their outsourced procurement spend.

With so much at stake, what’s the best way to move forward? GEP and the Everest Group have compiled a list of best practices to help you take full advantage of procurement outsourcing:

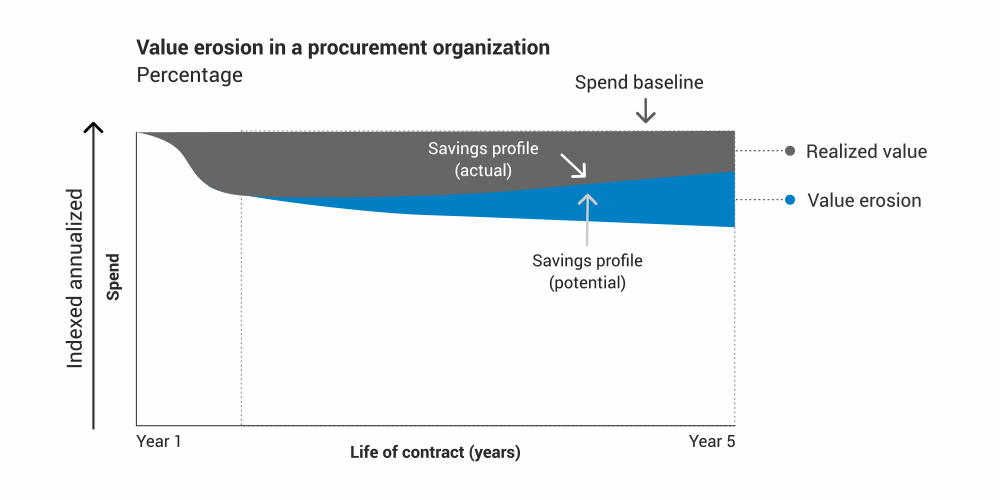

Procurement outsourcing contracts have typically been focused on a few activities within procure-to-pay (P2P) operations or within sourcing and category management. Fewer procurement outsourcing contracts take an end-to-end, source-to-pay (S2P) approach. P2P-focused contracts deliver operational efficiency, while source-to-contract (S2C)-focused contracts can deliver unit-price reduction. However, the lack of integration between upstream and downstream processes often results in significant savings leakage. For example, non-compliance in the P2P process erodes the value generated in the S2C process.

To ensure targeted savings are fully realized, there must be a tight linkage between sourcing and finance teams to ensure that contracted savings get driven to the bottom line by adjusting budgets. Without this close partnership, sourcing savings are not fully realized, as budget holders most often spend these savings and consume their full budgets, rather than selectively reinvesting them where they can have the greatest impact on shareholder returns.

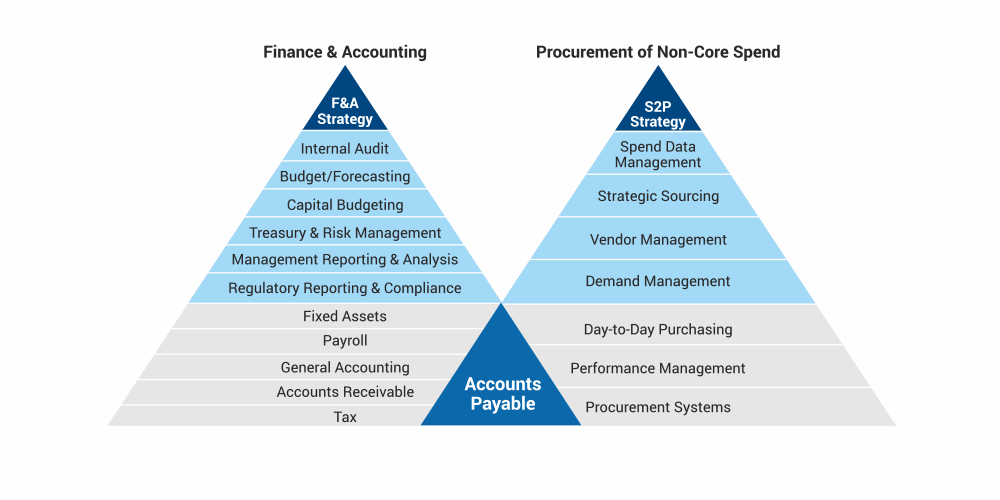

Additionally, FAO and PO have a clear overlap around the accounts payable (AP) function. PO is heavily dependent on efficiency and compliance in the AP process to derive savings.

Significant value created in a PO engagement can be eroded by maverick spend, duplicate payments, and poor working capital management. It's critical to have finance involved in the PO initiative right from the beginning, along with sourcing and procurement, to ensure smooth transitions across the two functions.

CFO-level involvement can often help accelerate and increase savings, particularly within areas of the business where procurement has not traditionally been heavily involved, such as marketing and legal functions. CFOs can be particularly influential here in brokering these partnerships and ensuring that the domain expertise of the service provider is fully leveraged so that all high-spend areas are well managed and supported by procurement. Lastly, additional benefits to finance from active involvement with procurement include improved information and data, as finance is dependent on inputs from procurement. More streamlined and integrated processes and data can help reduce the processing time and effort of the finance function, which in turn can lead to savings from AP headcount reduction.

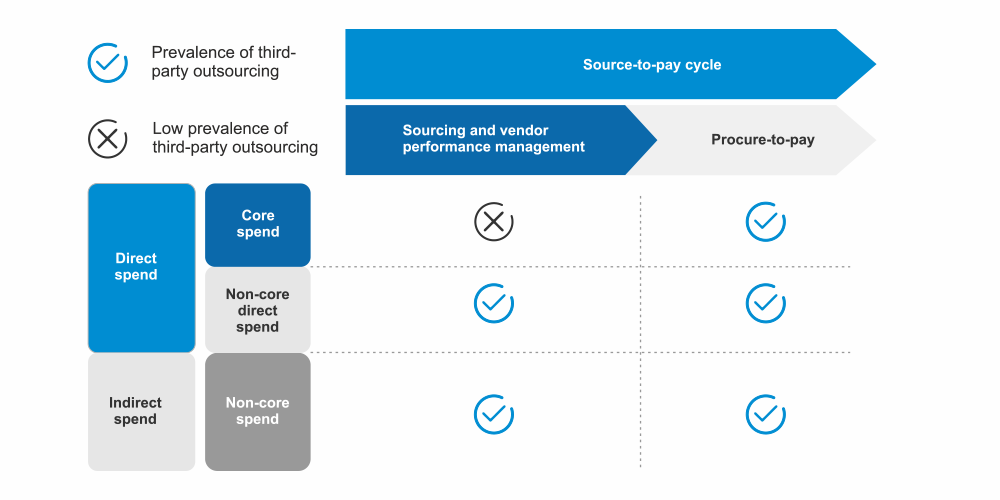

There are multiple nomenclatures to classify procurement spend. The most common has been the differentiation of direct versus indirect spend, with the premise that PO typically applies to indirect spend, while direct spend is strategic and needs to be managed internally. However, with maturity of the PO market, and the need to drive bottom-line impact in a tough economic scenario, PO is encroaching on traditional direct spend areas through P2P outsourcing, tail-spend management and specific categories such as packaging, bundled services, and MRO. Also, while the classification of direct versus indirect spend makes sense in a manufacturing, it has less relevance to service-oriented sectors such as telecom, hospitality, and financial services.

In the current state, where service-oriented sectors are also leading adopters of procurement outsourcing, it makes more sense to classify spend as core versus non-core, rather than direct versus indirect. All spend that can be outsourced, including all indirect categories and non-core direct categories, such as MRO, can be classified as non-core spend.

As discussed earlier, the procurement outsourcing value proposition is fairly complex, and hence buyers need to take a phased approach to manage risk. However, it is equally important to have a long-term vision and not focus on short-term benefits that can erode with time or lead to severely limited options in the future, when the client has a clear need to expand the procurement outsourcing scope. It’s fine to start the engagement with just parts of the P2P or S2P function or with certain categories to build trust and create a comfortable working relationship between the buyer and service provider. However, the buyers need to have a long-term vision of how to develop a scalable model for the entire S2P cycle covering all non-core categories. Buyers need to have a strategic vision with regard to centralization, adoption of sourcing models, technology and process transformation, and organizational changes to create an integrated and streamlined S2P cycle.

Unit price reduction drives the largest quantum of value in a procurement outsourcing engagement, followed by spend compliance and operational efficiency. Unit price reduction, which includes savings derived from the S2P process through competitive bidding, global sourcing, contract negotiation, supplier consolidation, demand management and SKU rationalization, accounts for 40 to 60 percent of savings in PO. However, an aspect that most buyers fail to grasp is the importance of spend compliance. Compliance drives another 30 to 50 percent of realized savings. A strong governance structure, with equal participation from the buyer and service provider, needs to be put in place to promote compliance and prevent savings leakage through maverick spending, budgetary and demand issues, and vendor non-compliance. Operational efficiency savings are driven by more standardized and rationalized processes, accounting for reduced time and effort, leading to savings through headcount rationalization and labor arbitrage, and operational benefits like reduced duplicate payments, Early Payment Discount (EPD) capture, and working capital improvements.

To learn more about procurement outsourcing from GEP, contact us today.