Introduction

Nearly two years after a very small majority of the U.K. electorate voted to leave the European Union, much of the world remains on pins and needles, waiting to see how the future U.K.-EU relationship will be structured. The global business community is particularly riveted by ‘Brexit,’ as the U.K.’s departure from the EU is colloquially known. It’s a topic of great discussion and speculation, and rightly so, as Brexit will undoubtedly impact the fundamentals of the British and European economies in both the short and long term.

While the ultimate outcome of the ongoing political negotiations is not certain, one thing is clear: European supply chains will be impacted, and in a fundamental way in some sectors. It is expected that most organizations with U.K. operations will see their costs increase, for example, due to tariffs, capital costs for relocation of plants, or increasing labor costs. These rising costs in U.K. operations will negatively affect profit margins or result in price increases to customers for those companies that do not act to mitigate the risks of Brexit.

Regardless of the sector or the ultimate location of their corporate headquarters, the vast majority of multinationals with significant U.K. operations or sales will have to respond to Brexit. Even large businesses with no significant U.K. presence could witness impacts on their European supply chains due to changing economic dynamics. While politicians argue over the myriad versions of Brexit, there are plenty of examples of companies putting contingency plans into action.

Supply chains will be impacted either directly or indirectly through business changes driven by real or perceived Brexit risks, and we expect this impact to increase many times over as the withdrawal date of March 2019 comes closer and key terms become clearer. Supply chain impact will be one of the top Brexit risks to most businesses, and so procurement and supply chain functions need to play a key role in identifying and addressing Brexit risks.

Procurement leaders and functions must act now to prepare their businesses for the breadth and depth of change coming from Brexit. A lack of detail from the negotiations is not an excuse for being underprepared when the potential change is so significant. Procurement can provide a competitive advantage by being proactive in risk identification, mitigation and cost optimization; on the other hand, we expect underprepared organizations to suffer profitability consequences from the changes taking place.

Little Movement Beyond the Big Announcements

We are seeing blue-chip companies with major U.K. operations conducting precautionary activities, based on the fear of import tariffs and the loss of access to the single market (the real definition of which varies a lot across sectors). U.K. press coverage is rich with examples of companies moving production facilities or offices and staff to continental Europe. Some of the recent examples include Goldman Sachs upscaling in Frankfurt, drinks giant Diageo moving vodka production out of Scotland to Italy and the U.S., and airline easyJet setting up a new base in Vienna. They do so with a long-term strategic intent to either position their manufacturing assets in a secure supply chain environment where trade tariffs are known, or to locate headquarters within the regulatory environment which will maximize their access to key European markets (e.g. the banking & finance sector).

Besides the high-visibility announcements, our view is that few procurement and supply chain functions have a true holistic plan to address Brexit risks. Some companies are delaying investments as a standard method in times of uncertainty ― we see many companies cutting their Capex budgets ― but this is typically only a short-term solution. U.K. industries taking this approach may be on the path to missing future productivity gains while competitors in continental Europe continue to invest in their production tools and are boosted by higher growth.

The level of readiness of global or European organizations with significant sales in the U.K. but without much of an operational base is perhaps even lower ― but they also need to carefully consider what the impacts are for them, as they will still have significant supply chains and cost impacts in the U.K. involving tariffs, taxes, currency and interest rates, regulatory decisions and labor flows.

Supply Chains Under Threat From Four Key Risks

Corporations with heavy U.K. exposure are facing supply chain risks in four key areas: the ability to move goods and services across borders, changes to their cost base, changes to the regulatory environment and impacts on their workforce. Ultimately, these impacts are expected to increase costs and therefore either reduce margin or increase prices to customers; customers may also feel these impacts in increased lead times or more ’painful’ customer service due to complexities. Current research suggests that specific industries are at higher overall risk than others, with financial services leading the pack in risk terms.

Risk #1 – Difficulties in trading goods and services across borders

The outlook on the type of trade deals the U.K. might secure in the wake of Brexit is still very unclear. This could take many forms, ranging from full single-market access with continued tariff-free trade on goods and services to the more protectionist end of the spectrum, where tariffs are applied on all goods and services traded between the U.K. and EU, likely based on more costly WTO rules.

While the U.K government has been increasingly clear that the U.K. will leave the single market and EU Customs Union, their bespoke deal target means a lot of uncertainty as it is uncharted terriory. Non-tariff barriers such as new physical customs borders and labor rules will undoubtedly have a significant bearing on a company's ability to move goods across EU borders, and the costs to do so.

Risk #2 – Higher costs

Regardless of the type of deal that is secured, Brexit will invariably have an impact on the cost base of businesses with U.K. operations or sales. This could come in the form of new tariffs, which may well be passed directly onto customers, or other costly measures such as complying with EU Rules of Origin regulations in the event of a Customs Union exit. Brexit has already had a well-documented and significant impact on costs in the U.K. through exchange rate changes which themselves have resulted in higher import costs.

Risk #3 – Rapidly changing regulations

The regulatory environment for both U.K. and European companies has the potential to change significantly, with the likely result being that some degree of additional friction will arise between U.K. and EU trading partners, adding cost, time and risk to most cross-border supply chains. Whether the end result is a ’soft’ or ’hard’ Brexit will largely determine whether regulations underpinning each industry are set to remain closely aligned with the EU or whether they will shift away from the status quo, and current indications are that the likely outcome will be toward the ’hard’ end of the scale.

The most likely consequence is an increased regulatory burden for businesses due to the need to comply with multiple regulatory systems. U.K. companies that want to operate in Europe will be required to comply with the General Data Protection Regulation (GDPR) or any similar regulation in the future, and European companies with U.K. operations will have to comply with new U.K. regulations as legal frameworks diverge. We will also see obstacles in day-to-day business operations ― for example, an additional administrative burden of recruiting EU nationals in the U.K.

Risk #4 – Workforce availability

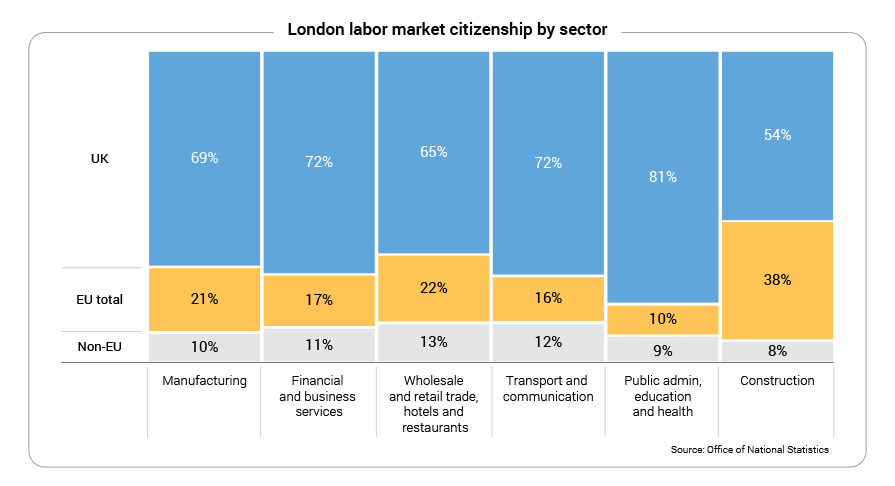

The British economy could face a labor supply shock due to Brexit if foreign workers stop coming to the U.K. In recent years, foreign and particularly EU workers have made up a substantial and growing proportion of the U.K. workforce, helping the economy and companies grow and fill key skill requirements. Some U.K. industries and regions are more heavily impacted by potential restrictions on immigration than others.

The construction, retail, and hospitality sectors will be worst hit if restrictive labor laws cut access to low-cost workers and speciality skills. For instance, in London, 38 percent of the construction workforce is of EU origin. The banking sector will be disproportionately hurt given its reliance on technical expertise that is in high demand. Other sectors sourcing highly skilled talent from across Europe will face increasing challenges, and staff with European language skills will become increasingly rare.

All Sectors Will Not Be Equally Impacted

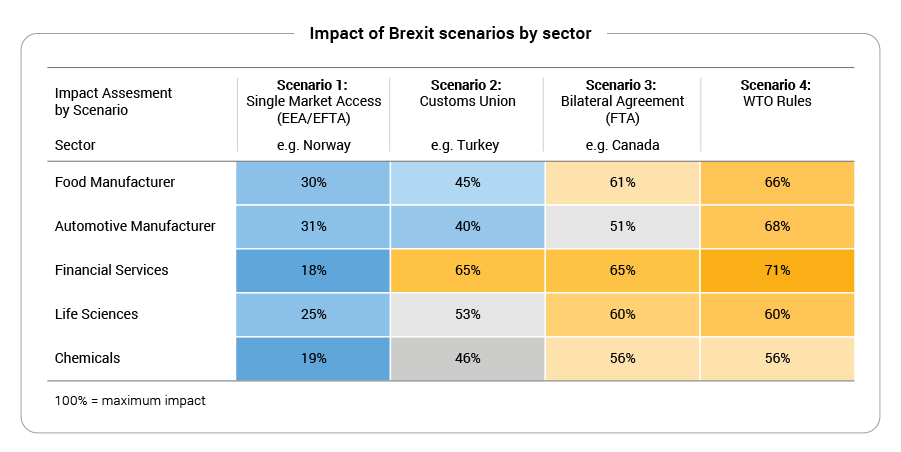

We have looked at how these four key supply chain risks would impact the U.K.’s top sectors under four different high-level Brexit scenarios. Undoubtedly, the end result will be different than any of these scenarios, but they can provide an indication of business challenges by sector.

Whereas, unsurprisingly, we found that an EEA-type deal with continued single-market access would be the least detrimental to all sectors, we also found that some sectors were more exposed than others in the alternative scenarios.

Financial Services is likely to be the most impacted in most scenarios as ’passporting rights‘ are critical to banks’ ability to operate across EU borders. The only scenario in which passporting rights would be guaranteed is under an EEA-type deal. Any other scenario would not automatically grant these rights to U.K. financial institutions post-Brexit. From a procurement perspective, this is already driving additional cost, for example, with office movement and securing of office space. This is likely to develop further and impact spending patterns with organizations having to maintain multiple locations with expenses across facilities, real estate and support services. We expect the Financial Services sector to spend significantly on professional services fees for lawyers, accountants and consultants to help it navigate the Brexit transition challenges.

Manufacturers need to be concerned about supply chain agility, total landed cost of goods, and access to both high- and low-skilled labor. Enhanced customs checks will prove detrimental to companies with products that have short expiry dates or lifespans. The food industry is also heavily reliant upon a highly European workforce with over 30 percent coming from the EU.

The U.K. Life Sciences sector is perhaps best positioned to mitigate the impact of Brexit as it faces zero tariffs for products such as drugs and medical devices, even in the event of ’complete divorce’ from the EU bloc. However, its ability to research and market new products may be affected by the loss of access to EU R&D funding and access to talent of EU origin. We are already seeing governmental organizations and funding moving out of the U.K., such as the European Medicines Agency moving to Amsterdam from London. Additionally, we could see regulatory divergence causing issues such as in product labeling.

What to Do Now

Procurement and supply chain leaders should act now and implement five simple steps:

#1 – Measure exposure to Brexit risks

Organizations can start by identifying business areas possibly affected by Brexit. Procurement and supply chain teams have the perfect opportunity to facilitate key parts of this cross-functional initiative, particularly if they have strong supplier relationship management (SRM) frameworks and tools in place. This will ensure a joined-up approach when developing and implementing contingency plans.

Following this, further focus can be put on supply chain and procurement areas to identify contracts, suppliers, pricing and impacts to business continuity in a new U.K./EU customs environment. Key information collected across direct and indirect categories should include ’spend not realized’ in GBP, suppliers/categories impacted directly and indirectly by exchange rates, and supply categories highly dependent on an EU workforce, as well as evaluations of incumbent suppliers’ readiness for Brexit in their own supply chains. Conduct an impact assessment on supply planning and distribution within the U.K. and EU. A starting point is to triage your supply base by evaluating two factors: criticality to your business and exposure to negative Brexit risks and costs.

#2 – Develop alternative supply strategies with trigger points

Identify what routes to market, network planning and delivery locations are needed. Establish target commodity groups by conducting a prioritization based on goods/services criticality, availability of supply and time required to qualify supply sources. These alternative sources should ideally be identified locally or in a tariff-free geography as the U.K. concludes trade deals with non-EU partners. Larger firms can leverage their relative strength to incentivize key suppliers to shift more of their operations to the U.K. Auto producers Nissan and Jaguar Land Rover are examples here: both firms recently invited a large group of international manufacturers to their U.K. base to help promote the idea of shifting their operations to the U.K.

Continental manufacturers currently sourcing from the U.K. should similarly identify alternative sources based in the EU and introduce higher levels of risk monitoring across their U.K. suppliers with similar trigger points. We expect that U.K. manufacturers could be heavily hit over the next 12 months as buyers in continental Europe reduce their volume commitments or contract to shorter time periods.

#3 – Reduce costs now

A weaker pound (since the Brexit vote) has already put pressure on the cost of goods imported for U.K. companies and created inflation throughout the economy, impacting growth. This deterioration could accelerate as we approach the effective Brexit date, depending on the agreement and details of political discussion on the transition. Organizations can identify what total cost of ownership models will be impacted and start ’Request for Information’ processes using ‘Should Cost’ modeling. Additionally, targeted cost reduction opportunity analysis and execution programs will provide competitive advantage as whole sectors are hit by Brexit. Other potential approaches include securing extensions to contracts in at-risk supply base areas to hedge against cost increases and risks now.

#4 – Be equipped for the heavy lifting

Preparing the procurement function for Brexit will require a significant investment from businesses to ensure sufficient capability across vendor negotiations, contracting and SRM. We anticipate sourcing exercises as well as contract amendments and notations to be required on a large scale for some organizations. Most organizations will be limited by capacity and capability, requiring external help. Often, contract amendments will require a level of flexibility from incumbent suppliers, who will be considering their own position and may or may not be open to these changes. Companies that maintain high levels of collaboration with their supply base will be well placed to run a smooth process, while others should focus now on conditioning critical suppliers in advance. Contractual language for any new agreement concluded from now until the Brexit date should be updated to include the right level of flexibility against the various Brexit scenarios.

Other practical steps for preparation include identifying firms who can help and budgeting for this accordingly. Organizations that aim to be one step ahead are already documenting the internal processes which are likely to be impacted and are building cross-functional teams that will be tasked with delivering execution activities due to Brexit.

#5 – Become an enabler for Brexit opportunities

As the U.K./EU trade negotiation outcomes become clearer and the U.K. concludes trade deals with non-EU countries, buyers will need to aim to offset cost increases, but may also gain access to sources of supply at lower cost and even benefit from more innovation from their vendors. Identifying these geographies and vendors upfront will provide proactive firms with an opportunity to create competitive advantage for their organizations. Embedding co-sourcing as part of an SRM program is an effective way to find the right solution to how to mitigate new costs together, for example. Similarly, procurement has an opportunity to support its organization’s growth in new markets. To do this, it needs to equip itself early with local market knowledge of the targeted geographies. A concrete and simple approach is to develop robust category strategies which include short- and long-term road maps covering the above.

Conclusion

Brexit is a great example of how region-specific events generate global repercussions impacting procurement and supply chain. It will have significant implications for any global or European company with major U.K. operations or sales, as well as U.K. businesses with significant operations or sales in the rest of the EU. Many factors will lead to increased supply chain costs, which will reduce margins or increase pricing to customers, making this a strategic board-level risk. Procurement and supply chain leaders and their functions need to be at the heart of business-wide Brexit planning and implementation, and they need to act now to seek competitive advantage and to avoid the increased costs and risks if this is left too late. With the first stage of political negotiations ending and certain aspects of the looming Brexit structure becoming clearer, the time to act has clearly arrived.