Introduction

The paradigm is shifting — major global corporations are reorienting their capital investment focus toward emerging markets. To exploit the true value of these regions, companies are locating new manufacturing units there, and today almost 80 percent of new investments by global companies are being made in developing markets.

Procurement teams can fast-track capital projects, obtain greater savings and contribute toward successful outcomes — so it is critical for enterprises to understand the role of procurement teams in executing capital projects in these countries.

This white paper from GEP’s capital project experts provides insights into emerging markets and the geographical nuances that can help procurement teams collaborate effectively and efficiently with their local stakeholders.

Up until about 10 years ago, emerging markets and low-cost country sourcing were closely associated concepts. But now these markets, by themselves, have become attractive regions for business, with the capability to support a company’s growth strategy.

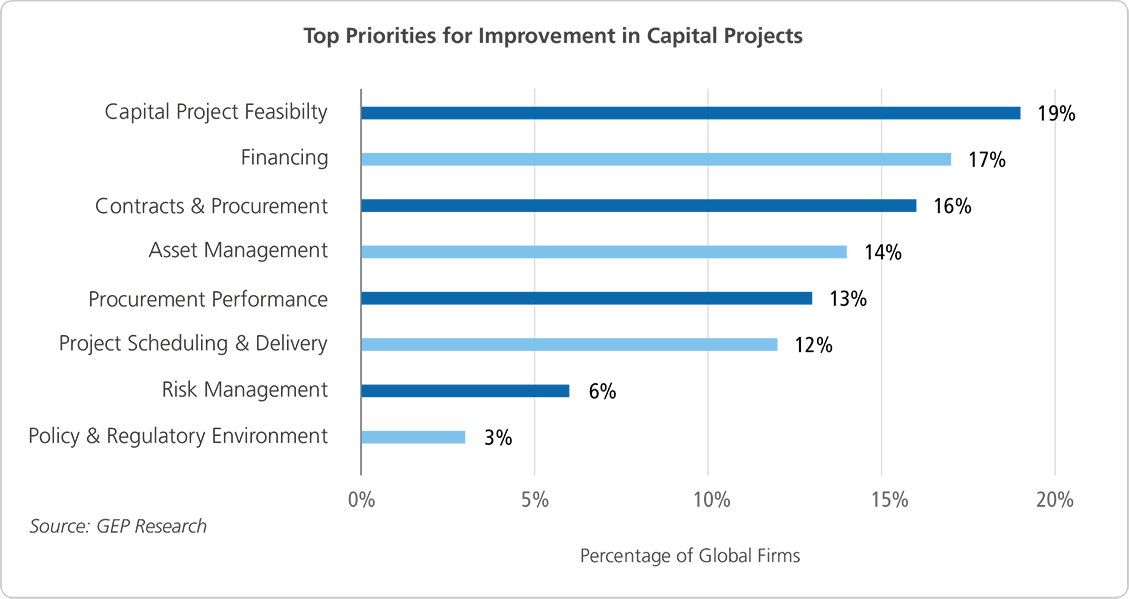

Global companies seeking growth in emerging markets will look at implementing successful capital projects in the region — which is easier said than done. These companies usually face a twin challenge — maintaining price competitiveness against local players and offering products that meet global quality standards. Our research indicates that contracts, procurement performance, project scheduling/delivery and risk management have been among the top priorities — after project feasibility and financing — for improving capital project implementation in emerging markets.

FACTORS TO CONSIDER WHILE IMPLEMENTING CAPITAL PROJECTS IN EMERGING MARKETS

Project Planning and Management

Capital projects in emerging markets are characterized by the use of many contractors and subcontractors with different capabilities. The complex resulting landscape calls for higher supervisory control right from the onset to align capabilities of different parties with the skills needed for the project, and to identify and plug skill gaps in the project organization. So leading companies entering emerging markets abandon the traditional EPC model that has previously proved successful in developed markets and instead manage engineering, procurement and construction contracts separately to ensure control and to preemptively identify risks. This is made possible by involving internal or external experts to chart and execute the overall strategy.

EPC Contractor Supply Market

Emerging markets often have monopolistic supplier pools with few viable contractors. Experienced contractors for special capital projects may not be available locally or may be in short supply, resulting in low negotiation power for global companies. This often leads to less favorable contractual terms with local contractors than what may be desirable in more competitive markets. Procurement teams in global companies need to be equipped with the right information on the local supply market if they are to secure favorable terms with local contractors.

Labor Supply Market

Emerging markets may have shortages of skilled labor for large capital projects. Generally, labor in emerging markets is skilled only for real estate projects and so may require significant training and educational programs before being sourced for more complex engineering projects. In addition, the shortage of experienced managers familiar with the quality and safety requirements of global business may compel companies to engage international contractors, which then increases project costs.

Raw Material Supply Market

Global firms can take advantage of lower commodity prices and the permitted use of lower-grade materials in emerging markets to reduce capex. For instance, using regular concrete structures instead of pre-engineered steel structures has helped global firms take advantage of metal prices. In addition to commodity prices, global firms should also account for availability of raw materials during project planning.

Equipment Supply Market

Procurement teams in global companies should compare the benefits of reusing project designs from developed-market projects with those of customizing the project design to suit local engineering capabilities. Reusing an existing project design may require buying major equipment and engineering services from international markets, while customizing designs may increase local sourcing and reduce capex. In addition, aftermarket and maintenance costs on equipment can be significantly lowered through local sourcing.

Examples of new capital projects being focused on emerging markets

- Jaguar Land Rover (JLR) announced plans to build its next factory in Slovakia by 2018. U.K.-based JLR has signed a letter of intent with the Government of the Slovak Republic to examine the feasibility of constructing a plant in the city of Nitra to manufacture up to 300,000 vehicles a year. The new factory will complement JLR’s existing facilities in the U.K., China, India and the one under construction in Brazil.

- Taiwanese manufacturing group Foxconn is planning an aggressive expansion in India, building up to 12 new factories and employing as many as 1 million workers by 2020.

- Toyota announced a major investment of $1.3 billion to build new car manufacturing plants in China and Mexico.

Project Fee Structure

Emerging-market capital projects are often characterized by flat-fee contracts with greater upfront project investment than their developed-market counterparts. This is due to the involvement of multiple parties (contractors and subcontractors), many of whom are generally cash-strapped and operate on an upfront funding model. Procurement teams should, however, take special care to align contractor incentives by putting a certain amount of their fees at risk. Incentive fees linked with project schedule and quality should be made contractual by using the right negotiation levers with contractors.

Quality

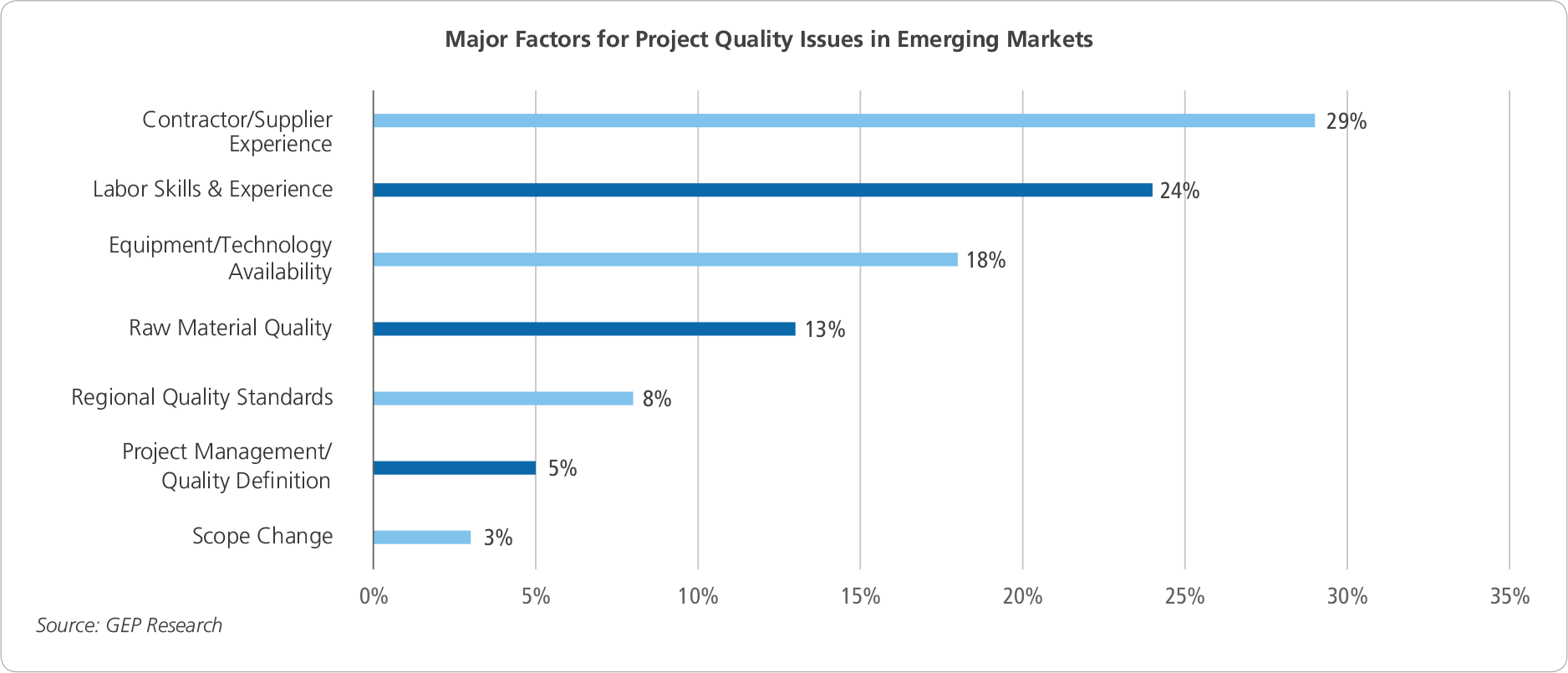

In emerging markets, capital projects often encounter quality problems due to inadequate skills and capacity, poor project management, and inferior quality of materials — all of which can lead to project delays and cost overruns. Global companies are sometimes tempted to transfer too much risk to contractors. Contracts that shift cost-related risks onto contractors run the risk of increasing the longand medium-term impact of getting inferior-quality materials or services as contractors look to cut costs by hiring less experienced labor or using cheaper material. So a governance model to monitor the shortterm versus long-term impact of decisions has to be established.

Regulatory & Political Risks

Emerging markets are frequently characterized by changing government and economic regulations and incentives aimed at increasing foreign capital for local industries. In addition, capital projects are often subjected to local environmental regulations. Global firms making direct investments in emerging markets through capital projects are generally advised to consult experts on local laws and regulations to optimally allocate capital and mitigate project risks. There have been more than a few instances of projects being stalled due to unforeseen political developments or involvement of activist groups that want to ensure that the benefits are passed on to the local industry and/or population and not just foreign investors. Engaging good public relations agencies at ground zero helps in navigating such issues smoothly.

Trade Restrictions & Tariff Risks

Global firms need to be cognizant of the number of trading blocks and associations that exist in emerging markets. Not all countries are part of trading conventions that ease import and export regulations and tariffs. Some countries and trade blocks may have complicated and unstable regimes that can significantly impact a project's feasibility.

Legal Risks

Legal frameworks are often not fully matured to bind contractual terms with local partners, thereby posing risks to foreign investors. In addition, disputes pertaining to land ownership may crop up during project implementation, which may lead to years of arbitration under the local legal framework.

PROCUREMENT COMMANDMENTS FOR SUCCESS IN EMERGING MARKETS

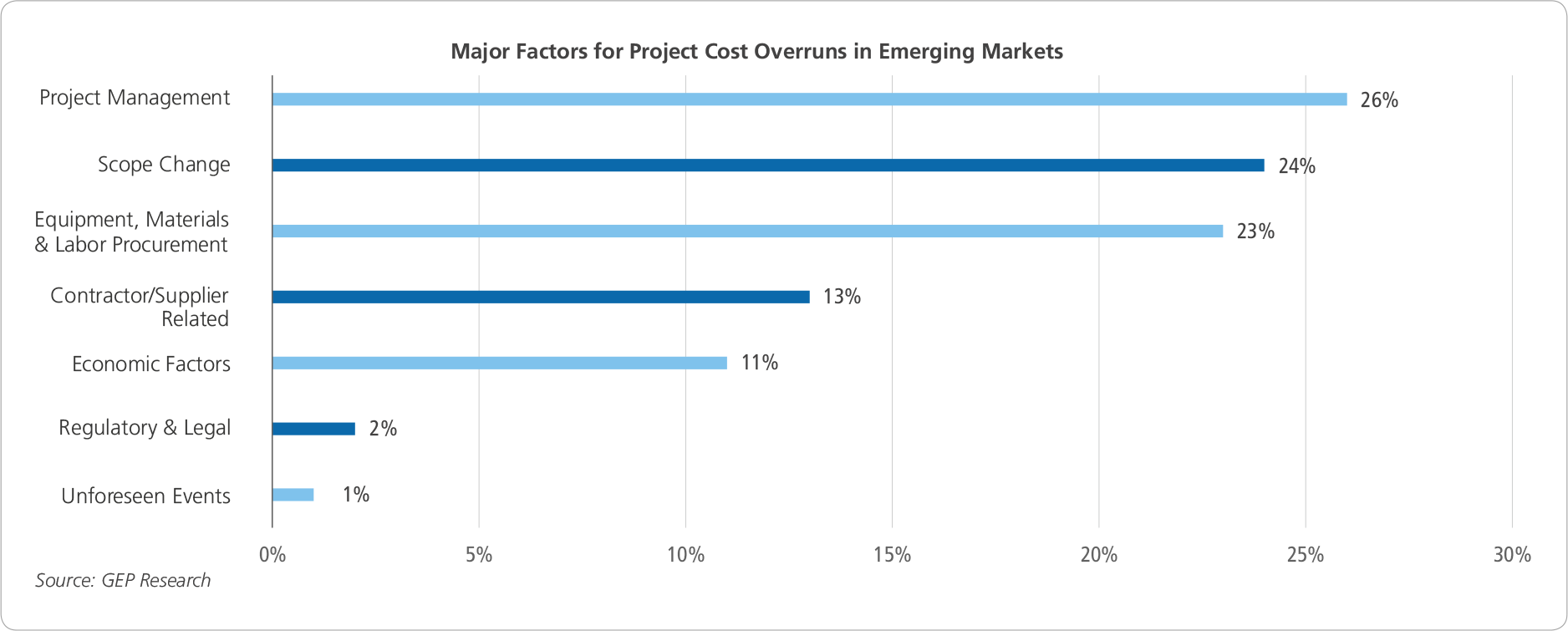

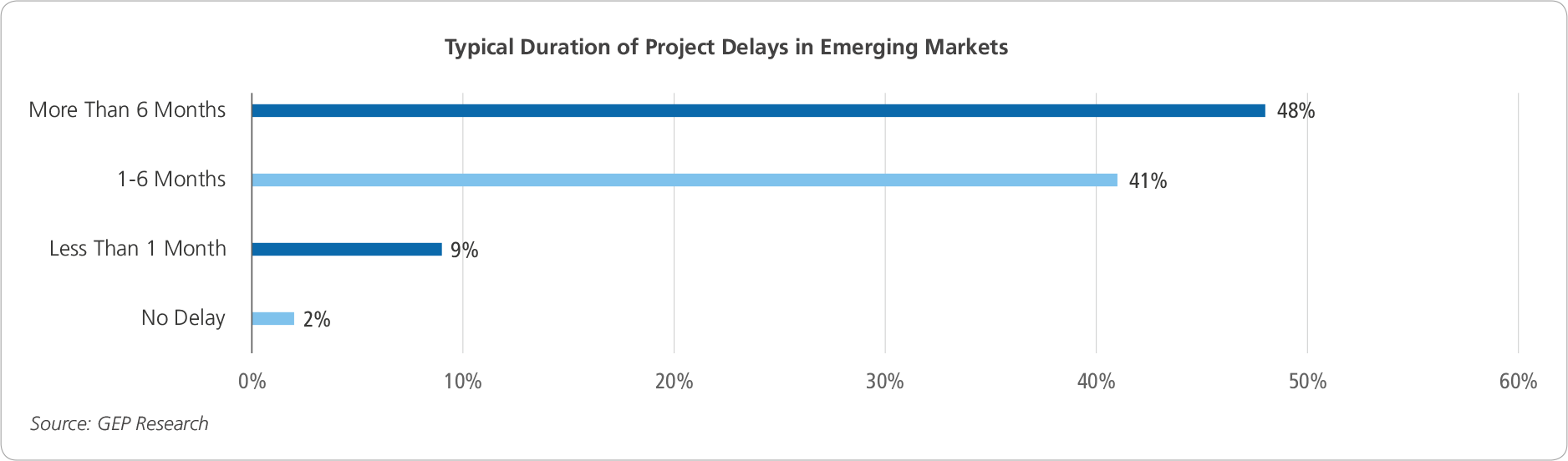

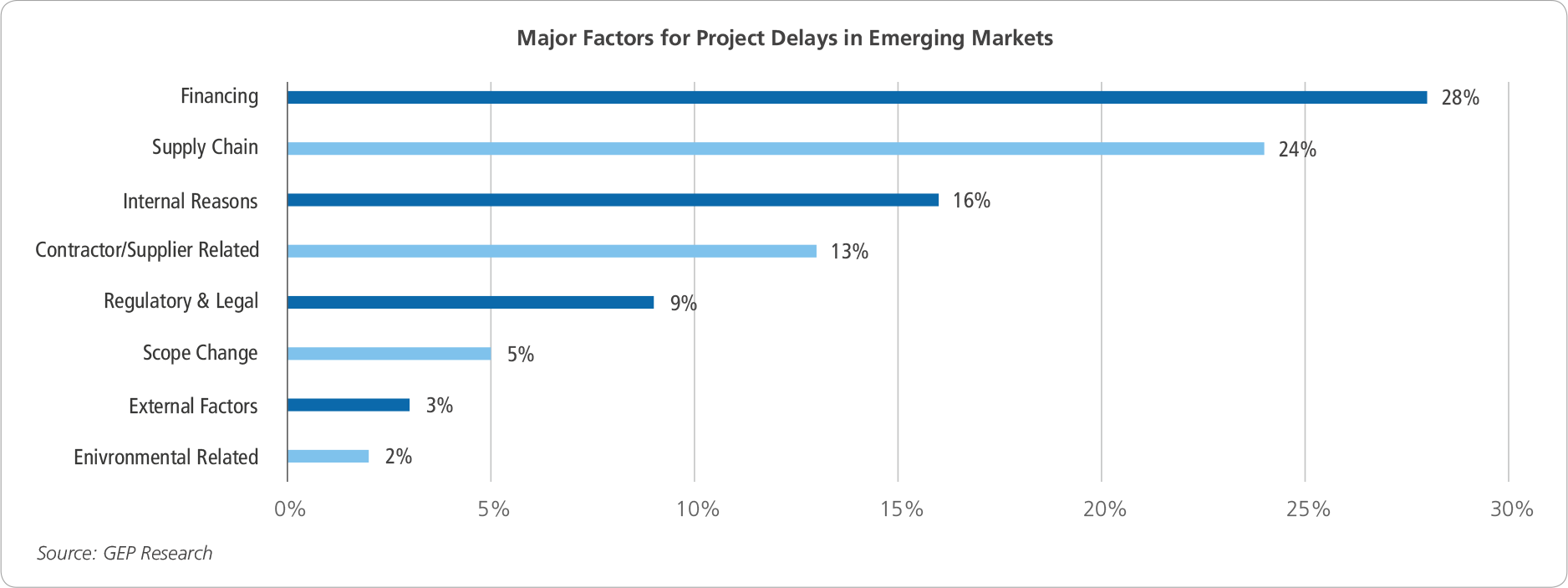

Even with awareness of the above-mentioned factors, projects frequently overshoot their budget, get delayed beyond the targeted timelines, or are plagued by quality issues. The reason? Capital projects involve many stakeholders, and the impact of the external environment on capital projects is significantly higher compared to other standard company projects.

Given the many factors that can influence execution, budget and delivery, project teams need to understand the key focus areas that make or break a project. The following eight “commandments” (or best practices) can boost success rates for organizations implementing capital projects:

Define Project Outcomes and Strategy

It is essential for capital project teams to have a localized capital procurement strategy and dedicated resources in a clearly defined organizational structure. In addition, prior to the start of the project, a set of defined processes and systems that reflects the local environment should be established, the budget should be agreed upon, and each stakeholder should be apprised of the “Return on Investment” and targeted timeline.

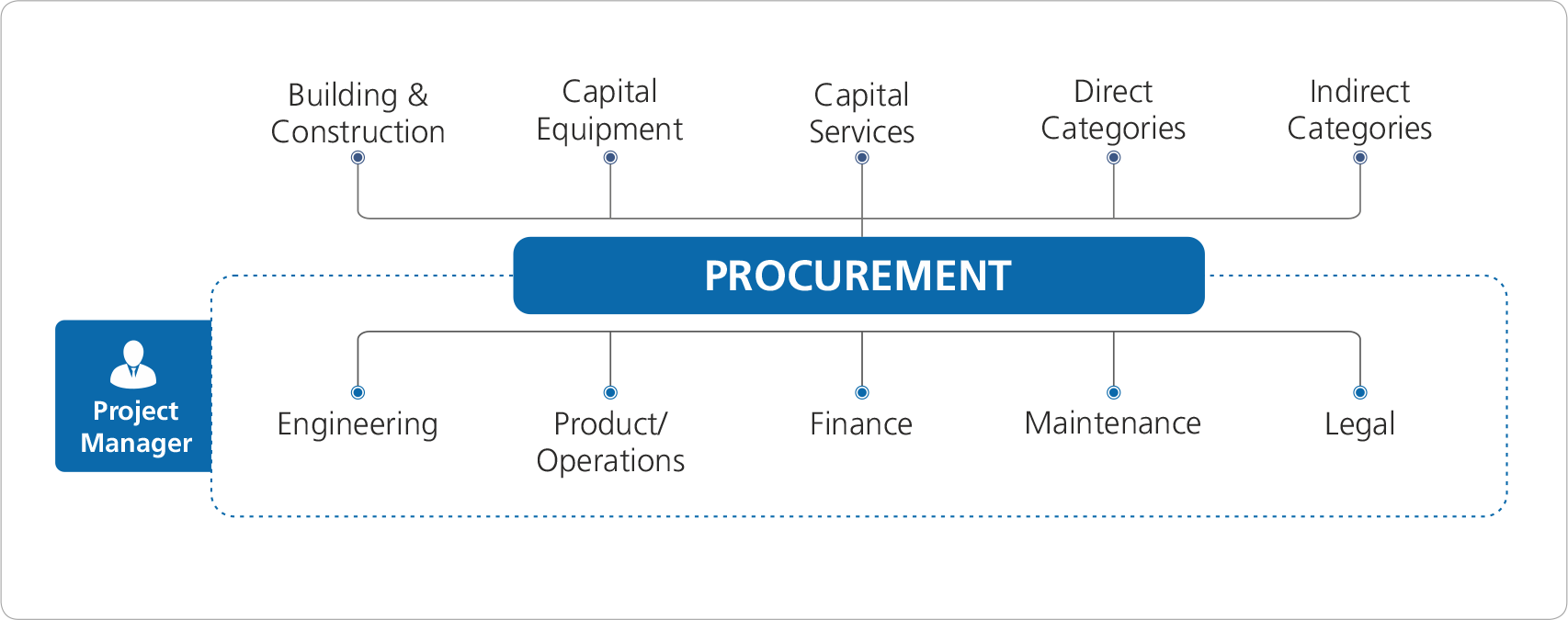

Establish a Core Cross-Functional Team with the Right Mix of Local and Global Stakeholders

You should have a cross-functional team that will be responsible for successful completion of the project and a smooth start for operations. This team will help fast-track day-to-day decisionmaking and provide an effective forum for cross-functional communication. Although many companies understand the importance of cross-functional teams, a highly integrated core team is rarely seen. A highly integrated cross-functional team is expected to increase the success ratio by more than 50 percent.

Procurement should collaborate with the engineering team throughout the project. Given that many companies would want to leverage their previous plant design and use local suppliers, the level of interaction goes up by a large factor. In some cases, when there is a monopoly in the supply market for a particular specification, procurement teams should seek the engineering team’s support to tweak machine requirements so that more suppliers can be invited to make the sourcing process competitive.

Establishing a good rapport with the engineering team early in the life cycle will provide a jump start to the overall project. In addition, involvement of quality and safety teams at every stage of supplier selection is critical, as it accelerates decision-making and the supplier onboarding process. It also serves as an effective lever for managing risks.

Establish a Robust Project Planning and Management System

Once a core cross-functional team is established, it is vital that detailed project planning is carried out for the plan, design, bid, build, commission, and operation phases of the project. As projects involve multiple contractors and stakeholders, deploy a project management system that provides high visibility on project activities and ensures smooth and timely execution. For instance, project teams should particularly factor in orders with long lead times and coordinate delivery scheduling with suppliers. A delay in placing an order or an uncoordinated delivery could result in derailment of the project in terms of timing and/or costs.

A procurement technology platform like GEP SMART should be adopted to manage project spend and to coordinate among different functions. It can be used to track project status and payment schedules, maintain real-time records of spend, coordinate approvals, and track orders.

Research the Market

Although participation of best-in-class suppliers right from the start is crucial to fast-track product and production trials, in emerging-market projects it’s more important to identify new local suppliers and ensure a competitive sourcing process. However, before partnering with any supplier, thorough due diligence should be conducted — procurement teams should organize plant visits to confirm production/technical capabilities and also hold detailed interviews with references provided by the suppliers.

In addition, a study should be conducted to understand the impact of the supplier's plant site on pricing, as many global suppliers have several sites capable of supplying the required material. Procurement teams should choose sites that have the lowest duties, taxes, and other assessments. Given the free trade agreements between many countries, it is important to understand their impact on sourcing capital equipment and direct materials. Furthermore, constraints arising particularly with respect to the Board of Investments (BOI) for tax incentives must be thoughtfully considered before selecting suppliers for the project. In some cases, BOI requires a minimum of 60 to 80 percent local sourcing to grant tax holidays and other benefits.

Prioritize Long-Term Benefits Over Cost

Many teams focus only on project timelines and budgets, eventually exceeding operating costs. Over the long term, this sets the project up for limited success, particularly in emerging markets. During capital purchases, long-term benefits and total cost of ownership (TCO) should be prioritized over the reduction of one-time buying cost. Many capital procurement teams also strongly acknowledge that lead times in many cases are more important than pricing.

Conduct Proof-of-Concept Implementations with Innovative Low-Cost Local Suppliers

Capital projects in emerging markets frequently present low-cost alternatives to conventional capital purchases. These low-cost local solutions, which are typically not viable options in developed markets, are often completely acceptable and find widespread adoption by emerging-market firms. Procurement teams can take advantage of these low-cost solutions by testing them in a proof-of-concept implementation before making an actual purchase.

Consider Triple Bottom Line to Be Sacrosanct

When defining outcomes, significant focus should be placed on sustainability (social and environmental aspects) besides the financial return on investment. Firms that include sustainability goals in their project outcomes tend to fare better in terms of project execution. When clearances or licenses are being sought, local government officials prefer companies that allay any sustainability concerns. More importantly, project teams should look at involving local communities by employing them in the project (in construction, operations, and other roles).

Align Partner Incentives and Mitigate Risks Through Contractual Terms Specific to Each Partner

Complete involvement of each and every partner is critical for capital projects in emerging markets. Introducing incentives and penalties in the contract for every contractor and supplier in a manner proportional to their impact on the project paves the way for success. In order to establish such a contract, a procurement team needs to clearly understand the criticality or contribution of a supplier toward the overall project. Furthermore, consulting experts knowledgeable about local best practices while creating contracts goes a long way in ensuring that contractual terms will be acknowledged by the partners.

Conclusion

The job description for a capital project manager often includes the ability to walk a tightrope in terms of budget and delivering innovative, low-cost solutions to achieve successful execution. This talented individual also needs to be something of a juggler, considering the many dynamic factors that need to be managed: cost, quality, lead time, safety, risk management, contract agreements, payment terms, delivery operations, and so forth. Failure to maintain any of these as expected in the project would result in disaster.

Many global firms manage their capital procurement projects in developing countries with support from consulting partners. It is essential to choose the right partner, as they typically complement and leverage capabilities of the in-house team to drive procurement activities and coordinate with the execution team.

The procurement partner provides guidance on sourcing strategies, manages sourcing activities, and evaluates procurement performance and related project risks on an ongoing basis. Specialized teams and local experts bring in great geographical knowledge and contribute toward speedy execution of projects. Getting clearances or licenses from local authorities, enabling customs clearance of imports, and coordinating with various government agencies can be effectively addressed by these experts.

In summary, the success of capital projects implementation in emerging markets depends on the following factors: preparedness of the team to think global and act local, the level of understanding of the local supply market, the degree of flexibility to engage with local suppliers innovatively (such as with incentive structures), and the ability to seamlessly engage external experts having local experience.

Case Study – Investing in Specialization

Case Study – Investing in Specialization

One of GEP’s clients, as part of a multi-year efficiency and cost reduction program that included trimming its workforce, consolidating plants and maximizing efficiency, decided to shut one of its plants in Australia and move it to Thailand. The decision to relocate was based on factors including cost (both direct and indirect), streamlined value chain, proximity to targeted markets, stability of currencies, an outmoded and undersized current facility, and tax concessions and free trade agreements with potential markets.

GEP helped the client in three main areas to ensure successful execution of the project:

- Procurement of capital goods needed for the new plant

- Handling of direct categories (ingredients and packaging)

- Handling of indirect categories including IT and professional services

GEP enabled the client to achieve more than 10 percent savings on the budgeted spend.