COVID-19 has thrown the global economy into flux. And with that, has triggered a rapid shift in enterprise goals and priorities.

Amid this volatility, how should procurement and supply chain teams organize for the rest of 2020 — and beyond? What should you be doing now to thrive in the new normal?

For starters, read the latest, post COVID-19 issue of the GEP Outlook 2020 Report.

In this timely report, GEP’s experts analyze global business and macroeconomic dynamics currently at play, and how they will shape procurement and supply chain agenda for the near future. The report also outlines specific priorities and focus areas to help you deliver on rapidly shifting enterprise expectations.

Why You Should Read This Report, Now:

- Understand current business dynamics and their impact on your goals and objectives

- Know the key functional areas that require an immediate shift in strategy

- Learn about new capabilities and technologies that you’d need to succeed now and tomorrow

Download and read your complimentary copy today.

INTRODUCTION

Only a few months into the new decade, the world looks very different, and the economic predictions that were confidently put forward at the start of this year have largely been upended. So we have undertaken to publish an updated edition of our eighth annual GEP Outlook Report, in which we present our revised analysis of the trends, priority topics and influencing factors that should capture the awareness of business leaders for the remainder of this year and beyond.

The challenges we all have unexpectedly encountered in the first and early second quarters of 2020 should drive home the message that stability should never be taken for granted, and that unplanned events can invalidate the expectations of even the most trusted authorities. But with 20 years of experience managing over $200 billion in spend for leading Fortune 500 and similar businesses, our firm and its team of respected consultants and technology advisors can offer guidance to help business leaders adapt and chart their course through the new environment in which we find ourselves.

Emerging from nowhere, the COVID-19 pandemic has redefined the concept of business resilience. Organizations across the world are focusing on employee health and safety, liquidity and cash flow, overcoming supply chain disruption, and managing risks to business continuity. The crisis has demonstrated the need to rethink long-established supply chain and forecasting strategies. And the pandemic isn’t all that has rattled the world in 2020. Trade wars, fires in Australia, locusts in East Africa, political turmoil, and other conflicts continue to dominate headlines. Business leaders have the unenviable task of navigating a global pandemic amid an economic downturn, a complex political landscape, consumer pressures to act on environmental concerns, and ever-evolving digital technology innovation and disruption.

Amid these challenges, supply chain and procurement will assume greater strategic importance than ever before. As objective business partners focused on both value and cost, they are strongly positioned to champion the recovery through the crisis and set the stage for winning the future. While most Fortune 500 companies have recognized the need for robust and effective supply chain and procurement functions during the past 20 years, leaders will use 2020 to strategically reposition the impact of these functions.

EXECUTIVE SUMMARY

The COVID-19 outbreak and the unpredictable first few months of the year put to rest any late-2019 predictions of what 2020 would look like. Global GDP is expected to shrink, tipping major economies into a recession, the severity of which will depend on the duration of economic restrictions and efficacy of fiscal measures.

Energy prices dropped significantly in early 2020, with substantial volatility attributed to a sharp decline in global demand and the OPEC+ price war through the first half of the year. Interest rates are being slashed across the globe as an emergency response to the health crisis. The liquidity and solvency problems that organizations face are producing unprecedented unemployment rates. The trade dispute between China and the United States remains a distraction for business leaders and is prompting many to slow down investment decisions. Similarly, the protracted separation of the United Kingdom from mainland Europe drags on, complicating the long-term business outlook.

New Technologies

Even in this time of uncertainty, the outlook for disruptive technology is crystal clear. With the COVID-19 pandemic resulting in shutdowns of offices, manufacturing plants, supply chains and more, companies will expedite their investment plans for digital capabilities such as automation. The supply chain of the future will be more digital and more automated; this crisis will convert many long-term skeptics. Through a combination of secure, cloud-based technology solutions and the introduction of artificial intelligence (AI), manual and timeconsuming activities will be streamlined and improved both within and outside supply chain and procurement.

Leaders who implement these new technologies will position their companies for growth, agility and increased resilience. Technology investments will also give new digital life to older ideas. Should-cost models, a longexisting concept in procurement, are now being integrated into technology systems. This new digital solution can unlock incremental end-to-end value and substantially upgrade conversations with suppliers and supply chain partners.

Supply Chain and Procurement: New Horizons

The presumptive recession will stifle growth for most industries and result in top-line decline for most organizations in 2020. Government stimulus packages will ease the pain a bit; however, as in 2008, the “bounce” will have to come from actions beyond quantitative easing. After years of focus on investment for growth, organizations urgently need to prioritize generating cash from their operations.

This shift in priority should result in a renewed recognition of procurement and supply chain from this crisis. Both functions will emerge as resilient value-drivers, not as points of failure. The lessons learned are expected to shape priorities for the long term.

Resilience and business continuity planning will be redefined across key business dimensions: cash management, supply continuity, talent management and agile business delivery models. In particular, supply chain will become a “day-to-day supply continuity steward” and will need to leverage personnel and technology to enhance visibility and mitigate risks. Looking outward, suppliers will be key partners in driving revenue growth and innovation as customer needs and preferences evolve post-COVID-19.

Supply chain leaders should look to invest in greater visibility of demand and its impacts on inventory and production capacity. Post-recovery, demand will be more volatile, requiring more rapid supply adjustments to manage costs. Investments should target deeper inventory visibility and distribution speed; the more agile the technology and the higher the visibility, the more effectively supply chain can control costs.

Analytics was the buzzword of the 2010s with many companies investing in data systems and resources, though not all have actually obtained actionable insights. Predictive analytics will build on the data aggregation abilities developed in the past decade, allowing leaders to uncover risk and value by deploying predictive and prescriptive algorithmic models. Forward-looking intelligence and benchmarking are producing fact-based insights about cost drivers and advancing supply chain and procurement to new levels of sophistication.

Procurement can play a key role in helping enterprises emerge in stronger financial positions as the pandemic subsides. Until now, a thorough focus on SG&A costs has been managed by leaders through the source-to-pay (S2P) process. Procurement is now evolving toward a new “budget-to-pay” model; instead of only tracking its cost reduction performance with finance, procurement will create a structure for total awareness and tracking of P&L impact. As budgets are created, procurement will connect directly into a company’s financial planning and analysis processes.

The long-term trend of outsourcing functional activities to low-cost country providers and third parties has created the need for more robust risk management programs. As operating environments for businesses change, new ecosystems will emerge with a strong focus on supply management to guard against future global business disruptors. Procurement is also moving past outdated modalities, such as targeting historical spend and past relationships, and is leading the introduction of technology, governance and supplier prioritization frameworks to fortify supply chains.

In an increasingly complex business environment, more will be asked from supply chain and procurement. Risk management and advanced analytics will emerge as vectors for driving change and protecting enterprises along with the long-standing focal areas of cost and efficiency. The coming years will likely be dynamic and surprising, led by a new generation of enterprise leaders creating highly strategic procurement and supply chain functions.

GLOBAL BUSINESS AND MACROECONOMIC TRENDS

Introduction

The global economy slowed somewhat in 2019 to 3% growth in GDP, down from 3.6% in 2018.1 This deceleration is the outcome of various factors, such as the prospect of a “no-deal” Brexit in the U.K., weak manufacturing output in Germany, impacts on tourism in Hong Kong from the long-running political turmoil, and political unrest in major economies. However, the world economy is projected to expand by 3.4% in 2020, driven by robust labor market and low inflation rates.1

The Macro Indicators

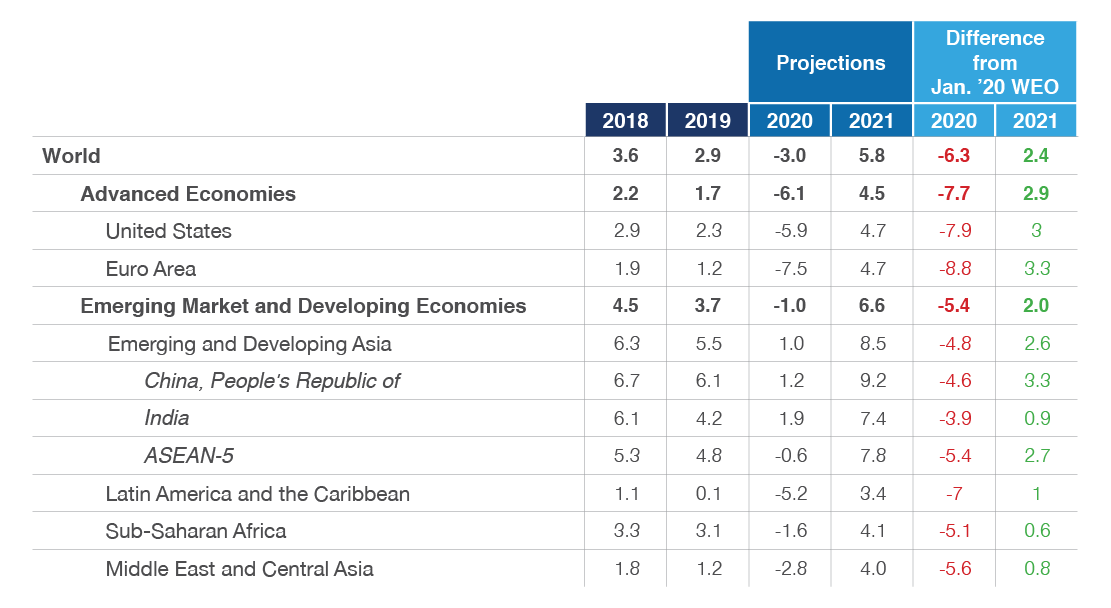

GDP Growth

With state-enforced lockdowns, widespread business closures, job losses, stretched health care systems and overall financial stress, the adverse impacts on global economic activity are unprecedented in recent times.

According to the IMF’s April 2020 World Economic Outlook, growth in the advanced economy group — where several economies experienced widespread outbreaks and containment measures — is projected to shrink by -6.1% in 2020.2 The GDP for the group of emerging market and developing economies is expected to shrink by -1% in 2020.3 This slowdown across all countries is attributed to severe external demand decline, dramatic tightening in global financial conditions, and a plunge in commodity prices adversely impacting exporters.

Real GDP Growth (Annual Percent Change — Historic and Forecast)

TABLE 1 | SOURCE: IMF WORLD ECONOMIC OUTLOOK, APRIL 2020

The eurozone is expected to be one of the hardest-hit regions. Germany in particular, with its large manufacturing sector being highly export-oriented, is facing a dual setback with both supply chain disruption and weak global demand. European economies that are heavily dependent on travel and tourism are expected to face a long-lasting shock as fears of fresh outbreaks will persist until a vaccine is developed.

China showed early signs of recovery as the 77-day lockdown in the epicenter of the pandemic was lifted in April 2020 and industrial enterprises resumed production. However, weaker global demand and risk of resurgence of the virus are likely to make the path to recovery slow.

Strong monetary and fiscal policy responses by national governments and channeling aid to countries with insufficient health care could set the stage for a potential 2021 rebound of the world economy.

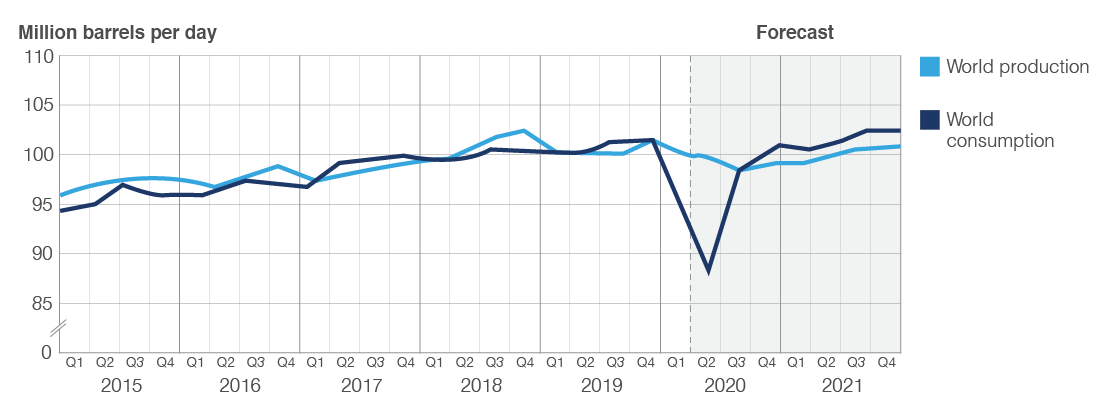

Energy Costs

Energy prices fell by more than 60% in Q1 2020 as measures to contain the pandemic curtailed travel and lowered global industrial activity.4 A price war within the OPEC+ coalition and a weak global oil demand added to the falling price trend.

The graph below from the U.S. Energy Information Administration (EIA) forecasts the world production and consumption in balance:

World Liquid Fuels Production and Consumption Balance

FIGURE 1 | SOURCE: EIA5

The joint discussion among the OPEC+ countries in early April 2020 resulted in planned production cuts by 9.7 million bpd for May and June, with gradual easing of cuts thereafter. According to Goldman Sachs, these would not be enough to offset the average 19 million bpd April-May demand loss due to the economic shutdown.6

With the outlook for global economic growth uncertain, demand and price volatility presents considerable challenges for businesses seeking to forecast oil prices and consumption requirements in the coming months.

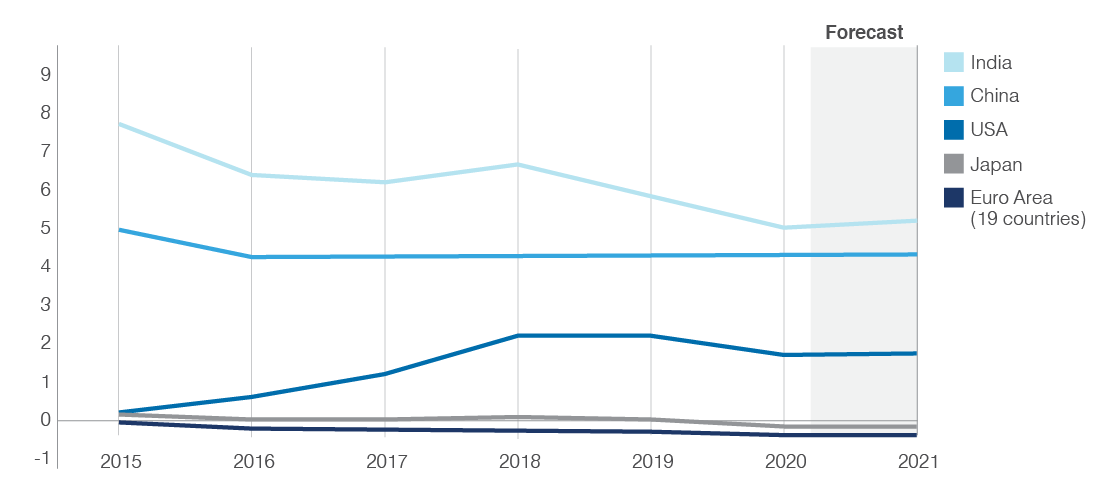

Interest Rates

Interest rates have been declining in the past decade among advanced economies, as trends in real interest rates across countries have converged. This decline is driven primarily by an increase in the premium that international investors are willing to pay to hold safe and liquid assets, as well as by lower economic growth around the world. To combat the economic impact of COVID-19, central banks and policymakers are taking emergency measures through fiscal stimulus and reducing interest rates further.

In the United States, the Federal Reserve had been holding interest rates steady in a target range of 1.5% to 1.75%.7 But as an emergency response to the COVID-19 pandemic, it cut the interest rates to the range of 0 to 0.25% in March 2020.8 The European Central Bank (ECB) has held interest rates at its historic low of -0.5% to cushion the economic fallout.9 China also reduced its short-term interest rates to 4.05%.10 With interest rates expected to be “low for long,” there is a significant risk that financial vulnerabilities will grow, making effective macroprudential regulation imperative.

Short-Term Interest Rates

FIGURE 2 | SOURCE: OECD11

Labor Rates

The slowdown of economic activity due to COVID-19 has created solvency and liquidity problems for organizations. This in turn has led to layoffs and unprecedented levels of unemployment. The year opened with global unemployment rate dropping to 5%.12 In the United States, that rate had dropped to 3.5%.13 The immediate effect of the crisis was preliminary U.S. unemployment and jobless claims reaching record levels in March. Economists at the Federal Reserve Bank of St. Louis predict that the unemployment rate in the United States could eventually reach 32%.14

The negative shock, however, does not uniformly affect all businesses. For example, many IT service professionals are expected to continue activities with minimal disruption, and cybersecurity specialists will be in high demand. Government stimulus actions, including extending unemployment benefits and subsidizing organizations for not cutting staff; fiscal measures such as payroll support for small businesses; and the potential for a shorter downturn will hopefully ease the unemployment rate in the coming months.

The current employment situation will push companies to implement efficient human resources processes for recruitment and retention. Companies are moving toward using AI to select résumés, conduct candidate screening, access a wider pool of talent, and automate repetitive yet essential processes. AI-based assisted hiring reduces costs and supports business growth by allowing hiring teams more time to focus on value-added work like retention activities.

Geopolitics

Two events that had arguably the strongest impact on the world economy in 2019 were the U.S.-China trade war and the persistent uncertainty of “Brexit.”

Despite improved relations between the U.S and China after signing phase one of the Economic and Trade Agreement, COVID-19 has become a new point of friction between the two nations and is likely to impact the second phase. The tariffs on imports of medical supplies and equipment have been a barrier for the U.S. in its fight against the pandemic. Even though the U.S. Trade Representative’s office temporarily lifted tariffs on some medical goods in March 2020, it is uncertain how much time it will take for both countries to return to diplomacy and cooperation.

The European Union (EU), European Atomic Energy Community (EAEC) and the United Kingdom signed a withdrawal agreement in January 2020, which provides for a transition period until December 31, 2020. A round of Brexit negotiations planned for March 2020 was cancelled. Both parties have until July 1 to agree on the extension of the deadline by one or two years. The UK’s decision on the extension of the deadline is complicated; a transition under current economic conditions might lead to disputes over adherence to new guidelines, whereas an extension could result in the UK having to provide additional funds to bail out the EU member states that are severely impacted by the pandemic.

Most Latin American countries have China, Europe and the United States as their leading trade partners. With all three severely impacted by COVID-19, reduction in demand is expected to result in a decline in exports from the Latin American countries, potentially to the magnitude of -10.7%.15 In this scenario, previously imposed unilateral sanctions and blockades by the U.S. on countries like Venezuela and Cuba might be lifted on humanitarian grounds to allow their economies to cope with the decline.

In April 2020, Japan announced that its stimulus package would include 220 billion yen ($2 billion) to help its manufacturers shift production back to Japan from China.16 Japan, for whom China is the biggest trading partner, saw imports slump by almost half in February 2020, resulting in Japanese manufacturers being unable to import necessary materials.17 To reduce dependency on China, the Japanese government is also encouraging companies to move production to other Southeast Asian countries, which will significantly change the geopolitical dynamics within the region.

To control the pandemic, trade and travel barriers have been put in place worldwide, which have constrained global supply chains from operating effectively. If these travel and trade restrictions persist for an extended period, companies will be forced to look internally to meet operational as well as supply chain needs. Like Japan, countries across the globe might encourage their companies to revisit supply chain strategies and focus on local suppliers.

THE 2020 LANDSCAPE REVISITED: SEVEN AREAS OF SIGNIFICANT CHANGE AND IMPACT

1. Business Resilience in the New Age

Business resilience planning will evolve as companies are forced to rethink traditional supply chain concepts and performance metrics. The focus will be on identifying areas where adverse impacts on businesses can be minimized in the post-COVID-19 era — such as these three:

• Shifting from bottom-line growth to cash optimization

Liquidity and cash management are becoming top priorities for firms as they look for opportunities within order-to-cash, procure-to-pay, and inventory management processes. Initiatives such as “payment terms rationalization,” which were considered “good to have” sourcing levers until early 2020, are now among the most strategic, receiving direct C-suite oversight.

• Bringing back the focus on supply continuity

Global supply chain risks are becoming apparent now with overreliance on low-cost country sourcing or single-source supply models — concepts associated with operational simplification and cost efficiencies. Most global organizations are conducting detailed supply risk modeling, risk prioritization, and recovery plan development to minimize future supply disruption risk.

In the immediate term, procurement will prioritize securing supply with appropriate safety stock adjustments as a buffer for supply chain disruptions. A fast-track, new supplier qualification process will be set up for alternative suppliers backing up those who are at-risk or operationally disrupted. In the medium to long term, technology initiatives could help drive improved visibility and control across the supply chain. Network redesign could further balance supply chain risks by bringing back some, or all, of the supply base to domestic sources.

• Talent management

Productivity has been significantly hit due to state-enforced social restrictions, employee stress triggered by job cuts and economic predictions, and inefficiencies arising from working outside traditional office environments. Transformational shifts are expected in workforce models, allowing organizations to be more agile and productive. Hybrid “human-robotic” workforce models will see greater adoption. Transactional processes driven by data and analytics will be more digital, reducing stress on human resources and bringing back a focus on driving value. Technology adoption could further drive productivity in the absence of on-site physical labor.

It will be critical to maintain a long-term view of business success factors to avoid cutting muscle rather than fat when fighting this crisis. When the economy recovers, organizations with resilient long-term plans and strong customer centricity are likely to emerge successfully. Deep cost cuts to support bottom-line profitability that leave little room for growth or investments will adversely affect an organization’s outlook once the crisis abates.

2. Cost Base Reset

Resetting the cost base for the post-COVID-19 world will be important as most major economies are expected to shrink and businesses struggle to maintain their top line.

As an immediate priority, firms will work toward improving working capital through measures such as extending payment terms and deferring or canceling all nonessential capital investments. Market movements will be leveraged to lock in price drops — for example, renegotiating commodity price contracts by tapping into a lower crude oil index with slim chances of recovery in H1 2020 given the simultaneous global demand drop.

Global contracts will be renegotiated, leveraging a stronger financial position — such as reopening contracts and negotiating cost reductions with suppliers located in highly devalued currency markets and benefiting from exchange rate variations. Demand, and thereby costs, could see significant cuts through policy updates to expenses such as travel, mobile devices, relocation, P-cards, and reimbursements.

The mid to long term will see the return of traditional, time-tested value engineering and product substitution levers that are known to deliver up to 30% in cost-base reductions.18 Restructuring fixed-price service contracts with “outcome-based” fees could further incentivize both parties to improve ROI. Strategic supplier collaboration programs will be nurtured as a source for disruptive ideas and mutually rewarding partnership opportunities.

Businesses could seek structural cost advantages by making changes at a more fundamental level. According to a recent Gartner survey, 74% of CFOs are considering extending remote work options, even after this crisis abates, for roles where this delivery model has proven as effective as the “on-site” model.19

A digital should-cost modeling solution could further enhance cost savings in the long run. It is enabled by AI analysis of data from multiple sources, providing deep insight into the origins of specific costs. With digitization, data availability and the computational power available today, a real-time evaluation could be performed across key categories, with automated updates on the input price data. This will also advance relationship maturity with suppliers by identifying improvement areas to jointly reduce waste through insights into cost drivers.

3. Third-Party Risk Management (TPRM)

Trends for 2020

The COVID-19 outbreak will continue to disrupt operations, affect supply chains and significantly lower production capacities of manufacturing units through the year. About 22 million businesses within China have been directly affected by COVID-19, impacting 56,000 businesses globally.20 Enterprises that have heavilyrelied on outsourcing, offshoring and lean manufacturing to reduce operating costs are now exposed to operational risks as never before. The near-term strategy to combat supply disruption during the crisis must include: identifying and establishing an alternative supply base; creating transparency in the network; limiting dependence on single-source suppliers; monitoring Tier 1 and Tier 2 supply chains; and buying insurance coverage for critical inputs.

Risk Assessment and Supply Chain Readiness Are Board-Level Issues

TPRM will have highest-level visibility in the board room and will be one of the top priorities for organizations through this year and beyond. Companies deploying risk-monitoring programs focusing on supply chain resilience will have a competitive advantage in the marketplace. The immediate, business-critical need for organizations is to perform a rapid risk assessment exercise to identify and mitigate risks arising from sole-sourced categories, lack of raw materials availability, supplier production shutdowns, travel and shipment restrictions, market closures, and unavailability of personnel.

Companies should ensure that their Tier 1 and Tier 2 vendors have robust risk management programs and business continuity plans in place to monitor risks in their supply chains. COVID-19 has spotlighted the need for proactive risk management programs further up the supply and value chains than traditionally implemented. Commercial policyholders should proactively review their insurance coverage provisions to guard against risk of COVID-19 and other infectious-disease-related losses.

Evolution of the Procurement Ecosystem to Manage Supply Risk

Over the past decade, the business environment that procurement supports has changed because of shorter product lifecycles, elevated customer expectations, and digital disruptors. Correspondingly, procurement organizations have changed the way they relate to their ecosystem of suppliers, partners, and affiliates. During an emergency like the COVID-19 crisis, procurement will shoulder greater responsibility for business recovery through supply risk management — whether by leveraging supplier-enabled innovations, reevaluating supplier relationships, or innovative supplier incentivization efforts.

• Alliance Management

Industries with long supply chains are dependent on supplier relationships now more than ever. Procurement leaders need to enhance collaboration with partners across the ecosystem not just to address current risks, but also to gain insights for future value chain risk assessments. The immediate priority for procurement will be to create transparency in the supply chain, understand Tier 2/Tier 3 supply limitations and identify alternative sources.

Supplier management should no longer be an exercise linked only to sourcing and contract timelines. With a new ecosystem of companies and new technologies to power interactions, procurement can continue to evolve its role and purpose from transactional to strategic. In industries such as oil and gas, procurement has built alliances with suppliers managing capital-intensive projects to mitigate the risks that occur between an investment and its return.21

• Supplier Prioritization

Supplier prioritization models need to be reconfigured to build resilience and mitigate systemic risks. Procurement departments traditionally segment suppliers by their current spend and importance to business continuity. This method, although reliable, deprioritizes suppliers that support strategic workstreams ranging from product development to branding, but do not fit well into traditional categories or metrics.22 The traditional pyramid segmentation must be reformed to capture the value suppliers can provide in value-added processes such as R&D and marketing. Traditional and small and medium-sized enterprise (SME) suppliers have been able to drive top-line growth when procurement has prioritized solution design in addition to standard metrics.23

Data Security Assessments in TPRM

As organizations continue to incorporate third parties into their ecosystems, the risk profile in data security expands. Data is more embedded in industries outside of the traditional technology space, and is more scrutinized through regulations such as GDPR. COVID-19 is accelerating the trend to work from home, which exponentially increases risks from unpatched devices and unsecured networks. The new dependence on online collaboration and conferencing tools, remote access and emergency relaxation of security controls for business continuity are intensifying security threats. In addition to established threats like phishing or spoofing, newtactics like deepfakes and AI-powered cyberattacks are emerging.

Data risk mitigation strategies of organizations today include mandating data security assessments of all third parties prior to onboarding; drafting comprehensive IT security policies; and investing in risk management platforms that offer continuous monitoring. The biggest gap is that evaluation methodologies have not been updated to consider the risks these platforms can capture.24 To offset data risks associated with COVID-19, organizations should make investments in automation, implement enhanced remote monitoring capabilities, and utilize specialized KPIs to identify immediate target areas of high risk.

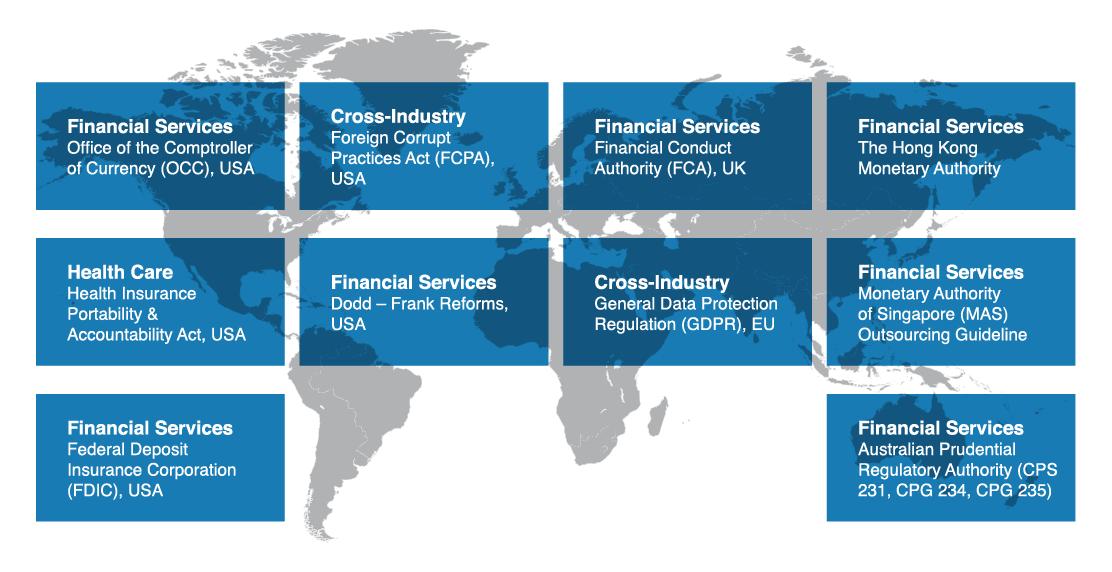

Global Regulation Impacts TPRM Across All Industries

Geographically, U.S. firms have the highest number of critical dependencies on third parties and correspondingly the most regulations enforcing scrutiny of third parties for risk exposure. In the past decade, risk regulations have become a global trend; additional mandates have come into law in EMEA and APAC as well. Increased global regulation necessitates comprehensive TPRM programs and has pushed firms around the world to introduce measures that evaluate the risk ratings of their third parties on a continuous basis.

Regulatory Bodies Responsible for Enforcing TPRM Across the Globe

FIGURE 3 | SOURCE: GEP

Due to its strict regulatory environment, the financial services industry has had the most intensive third-party management needs in the past decade. But TPRM is now becoming a concern across industries. While other industries are not required by law to have third-party management systems in place, most non-financial companies are bound by anti-bribery/anti-corruption (ABAC) and other regulations. In 2020, we will see the continued growth of TPRM functions in health care, pharmaceuticals and other industries.

Cases in Point

| Health Care:The U.S. health care sector has growing regulatory requirements that mandate third-party management. The Health Insurance Portability and Accountability Act (HIPAA) sets the standard for protecting private patient data, which is perceived to be even more valuable than credit card information.25 | Retail:A major American multinational had to pay $282 million for failing to maintain an adequate anticorruption compliance program. According to the Department of Justice and the SEC, the company’s subsidiaries in Brazil, China, India and Mexico had employed third-party intermediaries that made payments to foreign government officials to obtain or accelerate the issuance of building permits and other licenses.26 |

Leading Firms Are Relying on Technology to Drive Automation

Most of the third-party risk management processes established by firms today are largely manual and driven by primitive, cumbersome and unscalable tools such as spreadsheets and SharePoint folders. The lack of a single platform to aggregate all available information on suppliers limits the potential of TPRM assessments. Events like COVID-19 highlight the imperative for strong TPRM policies, processes, procedures and tools to be utilized proactively.

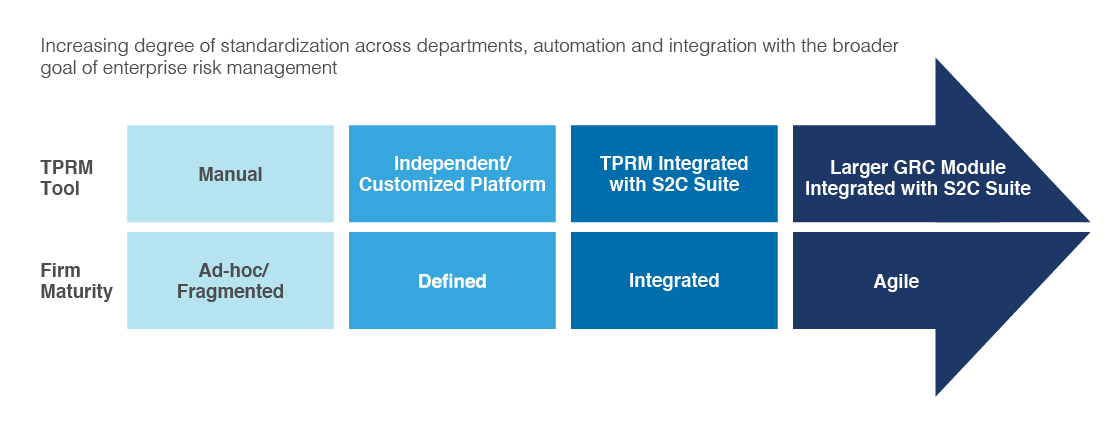

TPRM Technology Maturity Trend

FIGURE 4 | SOURCE: GEP

The independent/customized TPRM platforms available in the market support process workflow automation and enable collection and validation of assessment data with inputs from risk intelligence sources such as D&B, Dow Jones, and BitSight. These vendors, however, are not integrated with the source-to-contract (S2C) process. Due to the close connection between TPRM and sourcing, some firms have been quick to identify S2P platforms as the natural home for the TPRM tool. Responding to this trend, leading S2P providers are actively acquiring independent TPRM solutions and integrating them with their own platforms to provide advanced risk-monitoring capabilities.

Large companies are establishing a highly interconnected digital ecosystem that will connect the TPRM output to the governance and compliance functions and create visibility for senior leadership. Solutions available in this space include generic governance, risk management and compliance (GRC) software and specific risk management solutions integrated with the S2C suite. The vendor landscape is evolving constantly to capture the market for advanced solutions such as cloud-based technologies, robotic process automation (RPA) for routine tasks, AI for advanced reporting and interpretive tasks, and blockchain to validate third-party transactions.

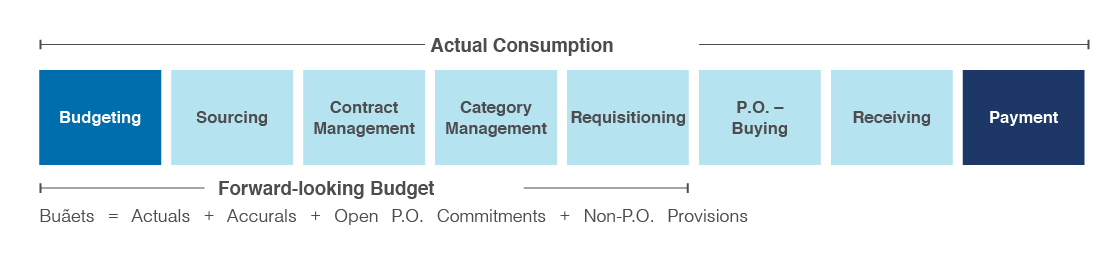

4. Source-to-Pay and Budget-to-Pay

The COVID-19 pandemic will prompt organizations to reevaluate their cost base, re-establish their budget baselines, and proactively identify areas for optimization. Many organizations are ready to extend the reach of the source-to-pay (S2P) process to budget-to-pay (B2P). B2P will help procurement and finance jointly develop cost-control measures instead of simply collaborating on P&L cost reduction impact.

Industries facing a demand crunch such as manufacturing, automotive, CPG, and retail had already set aggressive cost-reduction targets and will benefit significantly from B2P in the wake of the pandemic. By checking every requisition for budget availability prior to committing spend to external suppliers (imagine this for hundreds of thousands of requests), CFOs and CPOs can drive financial discipline and more aggressively and surgically separate good costs from bad costs.

How B2P and S2P Fit Together

Budget-to-Pay Process

FIGURE 5 | SOURCE: GEP

1. Initial streamlining of allocation and control of primary costs rests with Financial Planning and Analysis (FP&A) team

2. All decisions in the S2P value chain will be driven by budget availability. No budget, no pay

3. All requisitions in all buying channels will be checked for budgets prior to cost commitment to suppliers

4. Procurement savings will be tied directly to P&L, eliminating the need for monthly reconciliations with finance

5. Metadata required for budget tracking and reporting and automation of approval workflows across finance and procurement will be digitized on a single system of record (SOR) outside of standard ERP systems (which provide limited flexibility to adjust for nuances in control directives)

Disruptions in Source-to-Contract

While B2P will close the loop — with FP&A setting budgets as well as entering invoices — there are still disruptors in the traditional source-to-contract (S2C) space:

• New Technologies

As with the rest of the business world, digitization is dominating the S2C space. Digital trends and disruptive technologies — AI, machine learning (ML), RPA, blockchain, etc. — are beginning to have a significant impact on S2C. In conjunction with adopting these technologies, many enterprises are also reevaluating S2C and S2P processes and challenging the standard approaches that have been followed for decades.

• Measuring ROI

Enterprises continue to strive to build strategic partnerships to catalyze innovation and reap the benefits. One of the major trends in S2C is the shift from savings and value capture to measuring comprehensive ROI. An organization’s supply base is continually being reevaluated to identify the ROI of doing business with that set of vendors. This shift will prompt companies to re-examine their category strategies, such as launching competitive RFPs. The evaluation process will also adapt to ensure the right level of focus and credit are provided to innovative suppliers, so that analysis and supplier recommendations don’t get skewed.

• Category Workbench Tool

A significant change in S2C processes and technology is the category workbench tool. Empowering category managers with a tool that enables quick and holistic assessment helps them address immediate priorities while freeing time to focus on longer-term strategies. A category workbench reports which contracts are expiring within a specified period, which projects are active, which projects are underdelivering, the savings progress for the year, cost drivers and their impacts on the category, and much more.

Most enterprises have moved or are moving to S2P platforms and are pushing for automation and digitization across their supply chains. In 2020, significant strides will be made in automating and digitizing the S2C process. ML-powered tools can now, for instance, track and monitor the success of various negotiation strategies. Based on success rates, negotiation strategies likely to be most successful in a specific situation will be recommended.

ML can also significantly improve the contract management process. Based on historical contracts with suppliers and data on the goods and services being purchased, ML can recommend contract clauses that will expedite the contracting process and improve the strength of contracts.

In the current adverse environment, procurement should avoid panic-induced, indiscriminate cost-cutting measures. Instead, procurement should build the capability to accurately set, track and manage indirect budgets, leading to improved visibility and control. The traditional partnership between procurement and finance should evolve beyond siloed process optimization programs. Procurement can demonstrate value through deployment of a formal B2P process with proactive adoption of demand optimization and strengthening of procurement-finance partnerships.

5. Sustainability, Regulatory and Consumer Pressures

Over the past few years, sustainable supply chains have emerged as a mega trend that gives businesses a competitive advantage. After the immediate business needs arising from the COVID-19 crisis are addressed, sustainability will be a key consideration in long-term strategy development for organizations. The World Economic Forum’s 2019 list of top 10 risks to the global economy includes six pertaining to sustainability:

- Failure of climate-change mitigation and adaptation

- Extreme weather events

- Water crises

- Natural disasters

- Biodiversity loss and ecosystem collapse

- Manmade environmental disasters27

A growing number of prominent C-suite executives and thought leaders consider regulatory compliance and environmental impact a key — if not a central — element of their business strategy for performance improvement. For example, Unilever, which set up the Business & Sustainable Development Commission, concluded that the successful delivery of Sustainable Development Goals (SDGs) will create market opportunities of at least $12 trillion a year.28

With consumer pressures for greater sustainability expected to increase in the post-COVID-19 world, orienting businesses toward environmental responsibility will be key. While comprehensive risk assessments of supply chains are being conducted as a response to COVID-19, organizations should also be conducting environmental assessments at the same time.

Last year witnessed the introduction and tightening of regulatory environmental requirements across geographies, accompanied by improved compliance. For instance, China, the world’s biggest steel producer, ordered mills in key regions to meet ultra-low emission standards by 2020, affecting 60% of the steel capacity in the country.29 In the United States, dozens of environmental laws and guidelines were issued by the U.S. Environmental Protection Agency. Meanwhile, the International Maritime Organization’s low-sulfur fuel regulation for shipping (IMO 2020), which came into effect on January 1, 2020, has created a ripple effect in the global economy. The overall impact of IMO 2020 on consumers could be as much as $240 billion, as the added costs cascade down the supply chain, resulting in approximately $40 billion in increased transportation costs.30

Tighter government regulations and pressure from consumers for sustainable products means that enterprises must be more agile and proactive in their supply chain execution and risk planning. They need to manage environmental, regulatory and social expectations from multiple parties — including the company board, shareholders, government, auditors, activists, and the general public. Leaders will expect supply chain and procurement to focus on the following priorities to align with their company’s sustainability vision:

- Consider total cost over product life cycle, including but not limited to design, manufacturing, operations and maintenance, logistics, and product recycling and disposal

- Assess the risk of catastrophic events on the supply chain using weather patterns, heat maps and climate trend data to identify vulnerabilities and locate alternative supply and distribution pathways

- Formulate and communicate policies that help curb overall emissions and mitigate the risks and costs of weather-related disruptions

- Deploy tools and methods to help business functions better integrate sustainability costs and benefits into decision-making. For example, incorporate environmental cost considerations in supplier selection and contracts alongside the conventional criteria of price and quality

Factors related to sustainability will change the economic and environmental structures that business currently operate within. Top leaders across industries will look to integrate environmental and sustainability elements in their leadership initiatives, not only to reduce cost and business risks, but also to create unique value propositions, increase brand value and propel top-line growth.

6. Digital Technology and Transformation

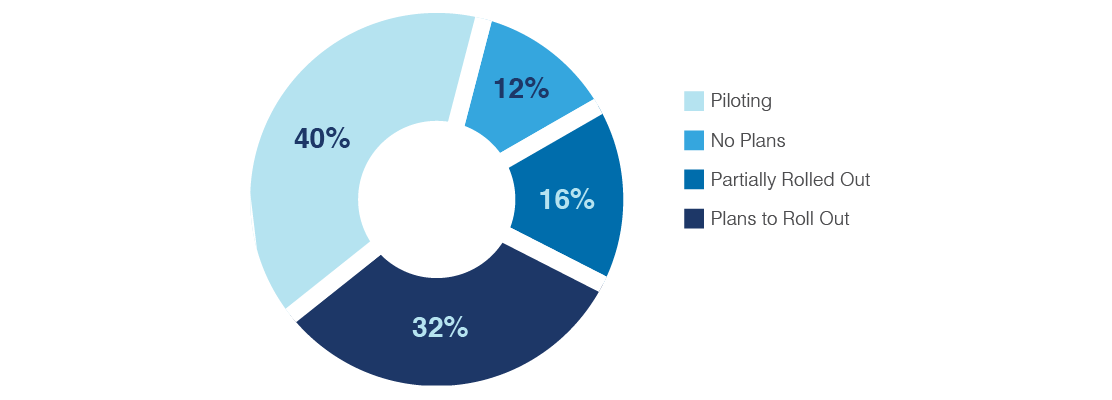

Supply chain and procurement leaders have been prompted to make investments in digital technologies, and like other business functions, embark on their own digital transformations. The growth and agility offered by digital technologies is enticing, and momentum is steadily growing. A recent survey of 25 large enterprises found that 88% had pilots or had plans to roll out digital technologies in the past year:

Digital Technology Rollout Progress

FIGURE 6 | SOURCE: GEP

The pandemic has further compelled organizations to turn to digital technologies as a response to the crisis. What was earlier considered an emerging requirement for organizational growth has now become an urgent priority for minimizing disruption. This will push the digital agenda more forcefully, which, in turn, will push supply chain and procurement teams to evolve from business enablers to business partners, collaborating with IT and the larger business on building digital strategies.

Five priority digital technologies loom large for businesses as we proceed onward in 2020:

1. Cloud

Despite an abundance of cloud solutions, many firms still don’t have a collaborative IT-supply chain strategy. Adopting a cloud solution that offers flexible capacity while keeping organizational data safe should be a first-line strategy. The flexibility public clouds offer to scale volumes and usage up and down enabled organizations with existing cloud strategies to meet urgent and immediate COVID-19 needs, such as quickly enabling remote work across employee groups.

2. Big Data Access and Availability

Organizations must approach data collection more strategically given the increased availability of data sources and data types. There is incredible potential to better understand the procurement and supply chain ecosystem and introduce new capabilities such as predictive modeling. Building a data lake infrastructure is a must, coupled with third-party specialist providers, external cloud server management or other methods of network optimization. This is especially necessary in a world relying on shorter lead times. Real-time visibility of demand and supply of PPE equipment has helped many organizations manage their requirements during the pandemic.

3. Automation

Tactical operations still typically consume the working capacity of procurement, supply chain and other professionals. Routine procedural work that is both mundane and vulnerable to human error is expected to undergo the fastest shift to automation. The internet of things (IoT) and the introduction of autonomous robots can help organizations alleviate dependency on people and their physical presence in offices, plants and warehouses in times of crisis. Gartner estimates that by 2023, over 30% of operational warehouse workers will be supplemented by collaborative robots.31

4. Data Security

Recent years have witnessed some of the biggest cybersecurity threats targeted at organizations, such as Shadow Brokers, WannaCry, and Petya. The explosion of IoT, data availability and cloud present some unique opportunities and challenges for businesses. To manage and utilize growing volumes of data from multiple sources, and to maintain enterprise security alongside increased remote working and virtual meetings, early adopters — even in high-compliance environments — will need to invest in AI-based data protection or blockchain technologies.

5. Intelligence and Reporting

Today’s reports are often static and manual. Future capabilities will use pattern recognition and modeling to develop stronger visual reporting and new dashboards to improve decision-making.

There are several key ways that enterprises are realizing the value of digital transformation today. Here are three notable examples.

Value Creation via Automation

Smart workflows have brought automation opportunities to upstream and downstream procurement processes.

In a recent report, Gartner presented the case of a large financial services institution that had restructured its contract repository, using RPA and optical character recognition (OCR) to digitize 8,000 contracts. Contract compliance continues to be a pain point for procurement teams and managing large numbers of contracts through automation represents real progress. Much of data entry can be managed with OCR, which enables auto-fill form capabilities. Configurable business rules and document routing can eliminate tasks that consume large amounts of working memory. By automating these tasks, procurement teams can dedicate a larger portion of time to strategic initiatives and urgent business needs.

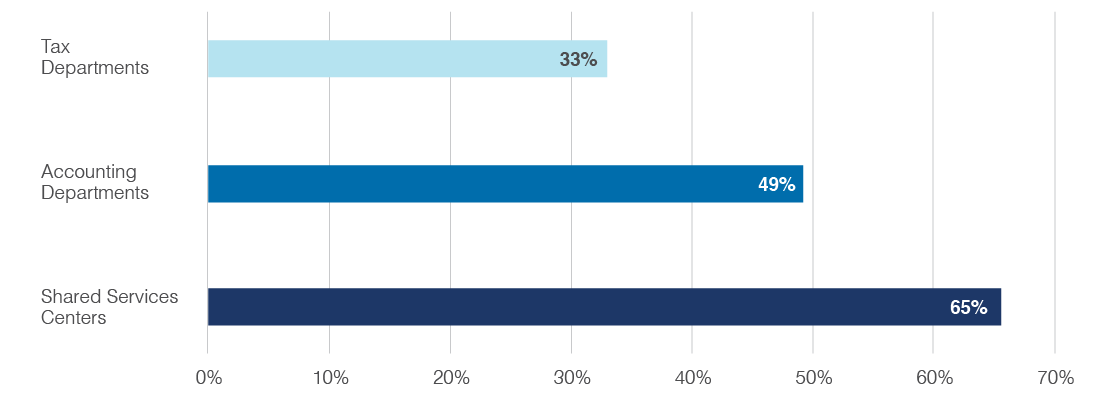

Departments with Highest Automation Investment

FIGURE 7 | SOURCE: GARTNER

Enterprises are at various stages of RPA implementation within each function. Procurement may be lagging behind other functions, such as shared services centers and accounting departments, as Gartner found.32 Only 8% of the procurement departments surveyed have begun RPA implementation.

In downstream procurement, up to 85% of use cases can be automated, as attested by academic research and expert opinion.33 An example of this is three-way invoice matching, where an invoice is approved only if its details match the associated purchase order and goods receipt.34 Tasks as simple as automating payment approval routes and sending automated emails for outstanding payments can meaningfully reduce bottlenecks and create efficiencies.

One of the leading automation platform companies has noted that during the COVID-19 pandemic, some customers started shipping directly from the manufacturing location of the supplier to their plant location. RPA robots processed all orders by entering them into SAP to get the order to the manufacturing center faster. Similarly, agents supported by automation started pulling customer data faster, ensuring a faster call triage process, faster routing to the appropriate agents, and shorter average call handling times. Global emergencies like COVID-19 will push organizations toward “hyperautomation” and expedite their automation journeys.

Value by Transforming Supply Chain and Procurement with Artificial Intelligence

AI is expected to significantly boost the strategic importance of the procurement function. The three main areas where AI can create value are spend classification, spend and contract analytics, and predictive modeling. While the first two will help identify savings, the third is a lever that will achieve the identified savings. The bottom-line benefits are estimated to be as high as 15-25% of addressable spend.35

Spend classification, powered by ML, can keep the spend database updated and reliable. Predictive modeling and digital should-cost analysis can help pull the right negotiation levers by identifying cost drivers across the value chain. ML algorithms can be used to detect anomalies in a data set — such as any unexpected changes in the price of a commodity — with a much tighter partnership between internal and external market data sources, including social media channels.

Future supply chain management software solutions, powered by cloud API (application programming interface) libraries and AI-enabled analysis engines, will be built on data lakes from transportation management systems (TMS), warehouse management systems (WMS) and e-procurement solutions. Their workflows will be defined by agility and by connectedness of teams from purchasing, logistics, inventory and warehouse management.

Value from a Collaborative Innovation Model

AI supports human inquiry and interaction through chatbots and cognitive assistants. Conversational reporting — used to analyze spend, project and sourcing data sets — is one of the better-known applications of natural language processing (NLP), a subset of AI.

Market leaders have started experimenting with multimedia catalog searches to guide users through corporate purchases. Allowing spoken inquiries or uploading of images to find the right products in a catalog of 10,000-plus items alleviates one of today’s chronic customer demands: “I want it, and I want it now!” At a time when the pandemic has forced organizations to function with reduced staffing levels, self-service portals like these will ease the burden on procurement teams to address standard customer queries. For mid-sized to large corporations, choosing partners with user-friendly, easily deployable and functional software is more important than ever.

7. Predictive Analytics

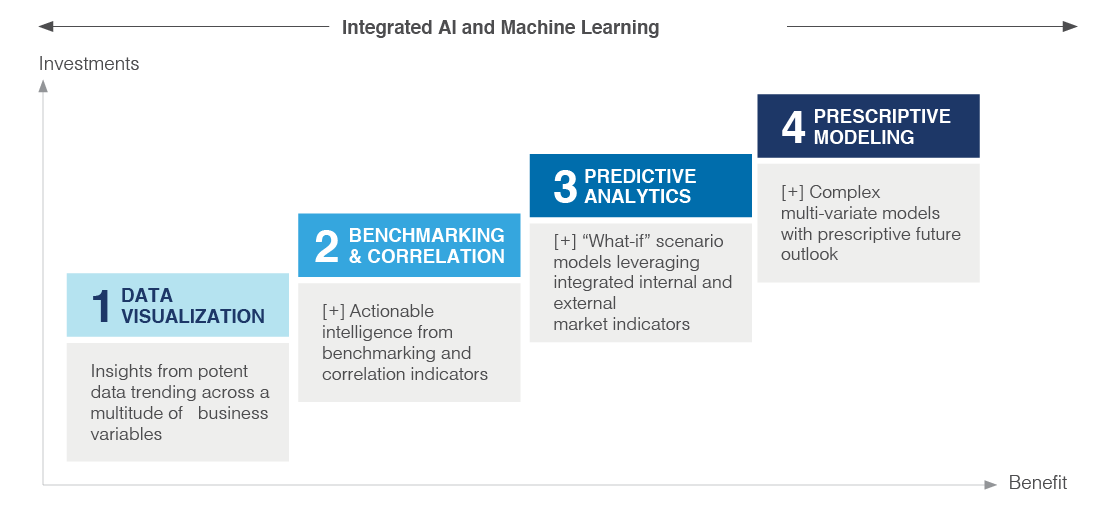

Procurement and supply chain organizations are in a unique position to exploit advanced analytics because they warehouse terabytes of data across spend, contracts, suppliers, operations, accounts payable/finance and market intelligence. Best-in-class companies are now focusing investments on extracting value from this data through predictive and prescriptive modeling. Predictive models funnel multivariate data streams into algorithms that can uncover exposure in the supply chain and gauge the potential impact of events, from low-risk to “black swan” anomalies like COVID-19.

The crisis illustrates the need to revisit existing forecasting models that rely on time-series techniques to make predictions using historical data. Prescriptive modeling uses the output from predictive models to generate options for rebalancing operations across production, distribution and inventory, and for mitigating identified exposure.

Making use of advanced analytics is one of the top priorities of CPOs over the next few years, according to a recent survey of CPOs by Ardent Partners. More than half — 53% — of the respondents believe that better data visibility and analytical capabilities will get their departments to the next level of performance.36

The Journey into Analytics

FIGURE 8 | SOURCE: GEP

Some of the emerging and most successful use cases for advanced analytics across direct and indirect spend categories include:

• Comprehensive View on Spend

Many procurement organizations continue to grapple with spend visibility, choosing to use existing taxonomies and transactional data. Deploying advanced and predictive analytics solutions makes it possible to benchmark internal data against external yardsticks from peer groups in real time to identify trends and actionable insights. This will be an invaluable tool for organizations to nimbly respond to the COVID-19 crisis with rapid changes in demand.

• Risk Management

Internal and external threats can put physical, financial and intellectual assets in jeopardy. Comprehensive data analytics capabilities can thwart fraud and enhance overall enterprise security. Predictive fraud analytics models that use statistical tools and relevant category knowledge can reveal fraud trends and drive proactive alerts to form a key component of risk management strategies.

• “Smart-Sensing” Value Finder

End-to-end value chain analysis yields value creation opportunities beyond sourcing and negotiations. External market drivers and internal supply data can be used to build a comprehensive, end-to-end predictive model that tracks changes in customer demand and adjusts supply accordingly to manage costs and drive efficiencies.

• Cognitive Sourcing

This is based on leveraging market intelligence and benchmarks to drive fact-based insights around major cost drivers, suppliers’ past performance data, current and future risks, etc. These applications enable sourcing teams to adopt a data- and insights-driven approach toward awarding contracts. Determining best fit and awarding contracts based on lowest prices or existing relationships, by contrast, are archaic methodologies.

As practitioners start to embrace advanced and predictive analytics for sourcing and business strategies, it’s important to focus on models that extract actionable, dynamic insights from internal and external variables and provide end-to-end supply chain visibility. COVID-19 highlights the need for real-time data streams and powerful analytics capabilities; companies without the ability to aggregate data from their various silos, parse the data, generate insights, and act rapidly will be exposed to greater risk. Advanced analytics provides a superior vantage point for decision-making, buttressing the effort to future-proof the enterprise and drive growth.

CONCLUSION

A combination of weakened financial markets, workforce disruption and restricted mobility is expected to make business stability a formidable challenge as global enterprises grapple with sluggish growth, diminished profitability and insufficient cash flow. The immediate focus for supply chain and procurement organizations, by necessity, is on addressing short-term challenges and accelerating businesses to a more normal status. In the longer term, executives should view the shock of this pandemic as another brutal example of the growing market volatility in which businesses operate. The operative word is resiliency, and supply management organizations must play an urgent and critical role in building resilient supply chains that are better suited for the volatility and risks of today’s operating environment.

Endnotes

- 1“World Economic Outlook, April 2020,” International Monetary Fund, 14 April 2020. Retrieved 17 April 2020 from https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

- 2Ibid.

- 3Ibid.

- 4“Oil Price Charts,” Oilprice.com. Retrieved 17 April 2020 from https://oilprice.com/oil-price-charts/

- 5“Short-Term Energy Outlook,” U.S. Energy Information Administration, 7 April 2020. Retrieved 17 April 2020 from https://www.eia.gov/outlooks/steo/report/global_oil.php

- 6“UPDATE 1-Goldman Sachs Still Sees Crude Prices Falling After OPEC+ Deal,” Reuters, 13 April 2020. Retrieved 17 April 2020 from https://www.reuters.com/article/global-oil-opec-goldman-idUSL2N2C102B

- 7Jeff Cox, “Interest Rates Left Unchanged, Indicates No Changes Through 2020,” CNBC, 11 December 2019. Retrieved 7 January 2020 from https://www.cnbc.com/2019/12/11/fed-decision-interest-rates.html

- 8 “Federal Reserve Issues FOMC Statement,” Federal Reserve System, 15 March 2020. Retrieved 2 April 2020 from https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315...

- 9Elliot Smith, “Euro Whipsaws as ECB Surprises by Holding Rates,” CNBC, 12 March 2020. Retrieved 2 April 2020 from