The CPG industry has enjoyed strong growth for the past few decades. But now it seems to be losing steam to fast-changing consumer preferences and shifting channel landscape. And if the mass exodus of CEOs at CPG firms is any indication, things are indeed getting difficult.

What can CPG companies do to renew growth and boost profitability? And how can procurement help?

In a new paper, Procurement in the CPG Industry: Key Challenges and Value Opportunities, GEP’s experts share three high-impact strategies for CPG companies to respond to changing market dynamics and stay competitive. The report also shares specific action points for procurement teams to underpin the enterprise’s growth agenda.

A must-read for procurement professionals in CPG and retail companies looking to create competitive advantage and sustainable value for the business.

Introduction

The consumer packaged goods (CPG) industry is facing unprecedented, fundamental change. An entirely new generation of consumers with highly specific product preferences, a paradigm shift in the retail landscape and continued pressure from private-label products are pushing CPG companies out of their comfort zone.

Over the last few years, CPG companies have focused on improving declining operating margins by cutting costs. However, many companies have struggled to replicate this kind of success on an ongoing basis. Interesting to note: Over the past 18-24 months, there has been a mass CEO exodus from large CPG manufacturing/retail companies.

Key Challenges for the CPG Industry

Increasing consumer preference for natural and organic products

The shift in consumer demographics (especially with the emergence of millennials) is leading to more consumers shopping in the perimeter of the grocery stores rather than the inner aisles.

Evolution of the retail landscape

The retail landscape is fast evolving. On one hand, e-commerce giants like Amazon are redefining the retail space (with its acquisition of Whole Foods). On the other, major retailers (such as Walmart) and discount stores (such as Aldi) are rivaling e-commerce competition and potentially creating price competition among retailers.

Private-label brands moving up the value chain

Private-label manufacturers historically catered to the cost-conscious consumer and that still continues to be the trend with consumer-care products. However, there is an evolving trend toward “premium” private-label offerings in packaged food products that tout natural/organic credentials. Sprouts Farmers Market, Whole Foods Market, Trader Joe’s and Kroger are significant players offering “premium” private-label offerings.

Industry Growth Opportunities

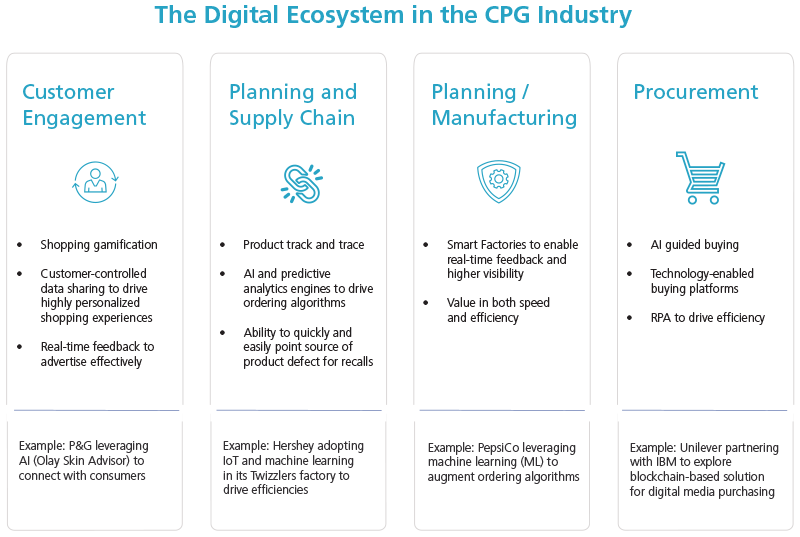

1. Digital Transformation

Digital transformation not only enables operational efficiencies but can act as a driver for growth — with an entire digital “ecosystem” of various tools and technologies such as blockchain, artificial intelligence (AI) and predictive analytics. There are multiple examples of major CPG companies catching up with these trends:

The Procurement Connection: Procurement leadership is well-positioned to drive scalable convergence across the digitization spectrum:

- Positioning procurement as change leaders. Bringing emerging technologies to the enterprise and collaborating cross-functionally to embrace turnkey digital transformation initiatives

- Facilitating acquisition and implementation of emerging technologies, working closely with IT stakeholders

- Continuing to generate value, driving bottom-line savings and funding requisite investments

2. Product and Packaging Innovation

Smaller CPG companies have created a lot of excitement with natural, organic and healthier product offerings. Naked Organics and Noosa Yoghurt are prime examples.

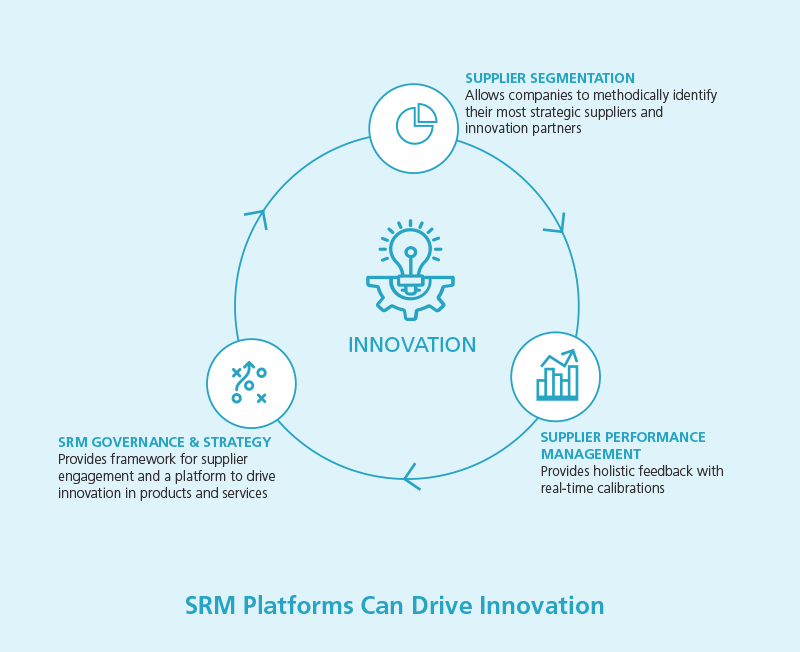

The Procurement Connection: The dynamics of the CPG industry provide an ideal opportunity for procurement executives to evolve mission-critical priorities related to product innovations:

- Vertically integrate with suppliers to have better visibility of product ingredients and help reduce time-to-market for new products

- Facilitate “dynamic formulations” of products to drive agility and costs

- Deep supplier relationship management (SRM) programs to drive innovation in products and packaging designs

3. Growth Through M&A

Large CPG players are anticipated to capitalize on trendy smaller players and diversify their current portfolios through M&A. Examples include Post Holdings’ purchase of Weetabix and Bob Evans Farms, Nestlé’s acquisition of Sweet Earth and Mars acquiring a minority stake in KIND.

The Procurement Connection: Procurement executives can provide holistic value to the enterprise in support of M&A:

- Engineer post-merger integration (PMI) efforts through policy, process and technology integration

- Transform the value creation model through scaling cross-enterprise merger synergies related to third-party spending

Conclusion

The procurement function is uniquely positioned to support transformative changes in CPG companies owing to extensive interaction with third-party suppliers who often serve as harbingers of change and innovation. In addition, procurement collaborates cross-functionally within the organization (with marketing, IT, supply chain, manufacturing, etc.) and is therefore well-positioned to cascade and champion transformation initiatives. Overall, given the seismic shifts in the CPG industry, procurement should embrace its role as a key transformation enabler and take full advantage of this valuable opportunity to help enterprises remake themselves for the new generation of consumers.