The Gray Rhino Is Here: How Tariffs Are Forcing a Rethink in the CPG Industry

- Tariff shocks are altering CPG cost structures, forcing difficult pricing decisions.

- Consumers have responded with frugality, triggering brand-switching and demand compression.

- To survive, CPG companies must rethink supply chains, SKUs, and formulations.

April 29, 2025 | Risk Management 6 minutes read

By Gauranga De

The imposition of tariffs by the Trump administration and the ensuing flip-flops are no black swan. It is a gray rhino event — large, looming, and anticipated. While global supply chains have endured repeated disruptions, this moment marks a critical shift that will redefine industry norms.

It forces the consumer packaged goods (CPG) industry in the U.S. to navigate the crossroads between global geopolitics and everyday consumer demands. The tariffs will not only shape what CPG companies produce and how they price, but also how American households view value and spending.

The consumer is the ultimate barometer of economic policy. Every ripple in tariff policy washes up on the shores of household budgets. And today, we are seeing the early signs of those waves.

“Magic Price” Under Pressure

For essentials like milk, bread, cleaning products, and personal hygiene items, there is a “magic price” — a threshold — that signals value to consumers.

Breaching these price points risks altering purchasing decisions. Once the $1.99 loaf jumps to $2.49, the decision calculus changes. For many Americans living paycheck-to-paycheck, it's a reason to switch brands, or go without.

Shrinkflation and Sticker Shock

CPG brands are leaning into shrinkflation, that is, reducing product sizes while keeping price points static. But while this tactic offers short-term relief for margins it chips away at consumer trust. But Quick Service Restaurants (QSRs), which rely heavily on imported ingredients such as cheese and condiments, will likely have to introduce price hikes. A $5.99 combo meal, for example, may edge toward $6.49, subtly reshaping demand patterns.

Consumer Behavioral Shifts

The U.S. Consumer Price Index (CPI) is already on a volatile ride. Paul Ashworth, chief economist of Capital Economics, shares that inflation will soon rise to 4%.

Professor Sung Won Sohn, a renowned economist in North America, has projected that “in the best-case scenario, real GDP is expected to contract by 0.2% points, employment to shrink by 0.1% (that translates to 300,000 jobs!), and inflation to tick up by 0.2 percentage points.”

This is even before the entire tariff picture unfolds.

We’re entering a period of strategic frugality. Shoppers will prioritize essentials, defer discretionary purchases, and become more elastic in their preferences. Value will win over labels. In the long run, consumers are likely to reallocate spending, opting for lower-priced white-label or private brands over national ones, hurting the revenue of major players and eroding long-nurtured brand loyalty.

Loyalty will collapse first where product differentiation is low but brand premium remains high. In many ways, this could democratize buying patterns, shifting the market toward more value-driven decisions.

Challenges for CPG Companies

The view from the boardroom is complex. While the industry has navigated inflationary pressures before, the current tariff scenario and uncertainty compound challenges in new ways.

Cost Structure and the Price Umbrella

Tariffs raise input costs, directly and indirectly. Ingredients such as soybean oil, certain spices, packaging materials, and aluminum cans may come with a higher landing cost. This can create a “price umbrella” effect, where domestic suppliers see an opportunity to raise prices, on the back of international tariffs. The result: inflationary pressure across the board.

Supply Chain Imbalance and Demand Decay

As U.S. demand dries up due to new tariffs, there will be significant oversupply in countries that export to the U.S. This creates a unique distortion: supply gluts abroad, scarcity in America, and no easy solution. Frozen fries, a staple item that many U.S. fast food chains import from the Netherlands or Belgium, are now caught in this crossfire. For QSRs, this translates into real cost pressure, forcing them to either reinvent menus or absorb hits to margin.

Strategic Dilemma: Margin Compression or Pass-Through?

For CPG companies, the big question is: do we pass the cost on or sacrifice margins? For publicly traded firms with quarterly targets, there is limited wiggle room. Private brands, startups, and regional players can use this moment to undercut larger players, leveraging lower overheads and more agile supply chains.

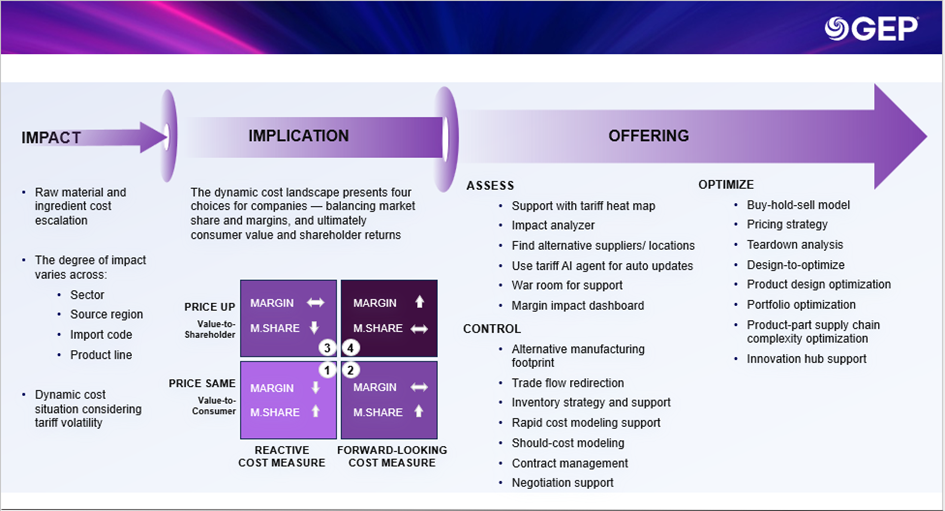

The answer lies in understanding consumer behavior, assessing real impact, and implementing controls to stabilize operations in the near term, and optimize in the longer term, balancing the needs of both consumers and shareholders (Figure 1).

Figure 1: Approach to Managing Cost Pressures

An Opportunity To Gain Ground

The picture is not all bleak though. There is an immense opportunity to turn these headwinds into tailwinds – a rare chance to realign market share.

Companies with a deep understanding of consumer behavior, especially elasticity and willingness to spend, can recalibrate their portfolios. Now is the time to assess product pricing architecture, optimize SKU strategy, and rethink packaging. Cost management must move from being a procurement responsibility to a board-level priority.

A sharp focus on direct material cost strategies — such as nearshoring suppliers, reformulating products, investing in vertical integration — could create lasting competitive advantage. The winners will be those who manage to deliver value without compromising margin.

Reevaluating product design — identifying tariff-impacted ingredients or raw materials and finding alternatives that maintain specifications and five-sense consumer acceptance (5SP technique) — can yield powerful results. This supply chain challenge can be addressed with design-specification-material (DSM) optimization.

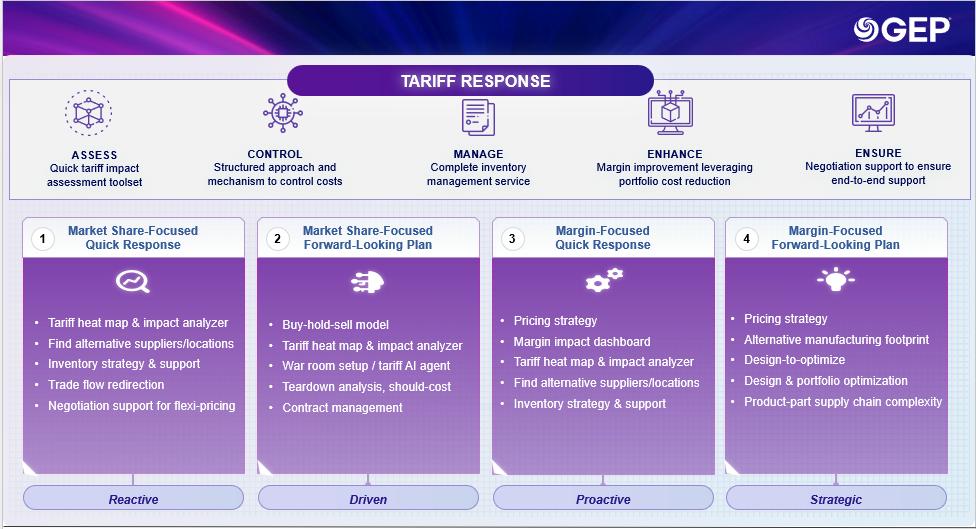

The tools and approaches for protecting consumer value and maximizing shareholder returns differ significantly. Depending upon their appetite, companies can consider one of these four approaches (Figure 2).

Figure 2: Four Approaches for CPG Firms

Approach 1: Reactive

Companies that want to protect or expand market share often prefer to keep prices steady. Many CPG and QSR firms rely on the magic price where even a slight change can disproportionately shift market dynamics.

In the near term, these companies may accept some margin erosion. For QSR products with minimal reliance on imported ingredients, the impact may be softer than anticipated.

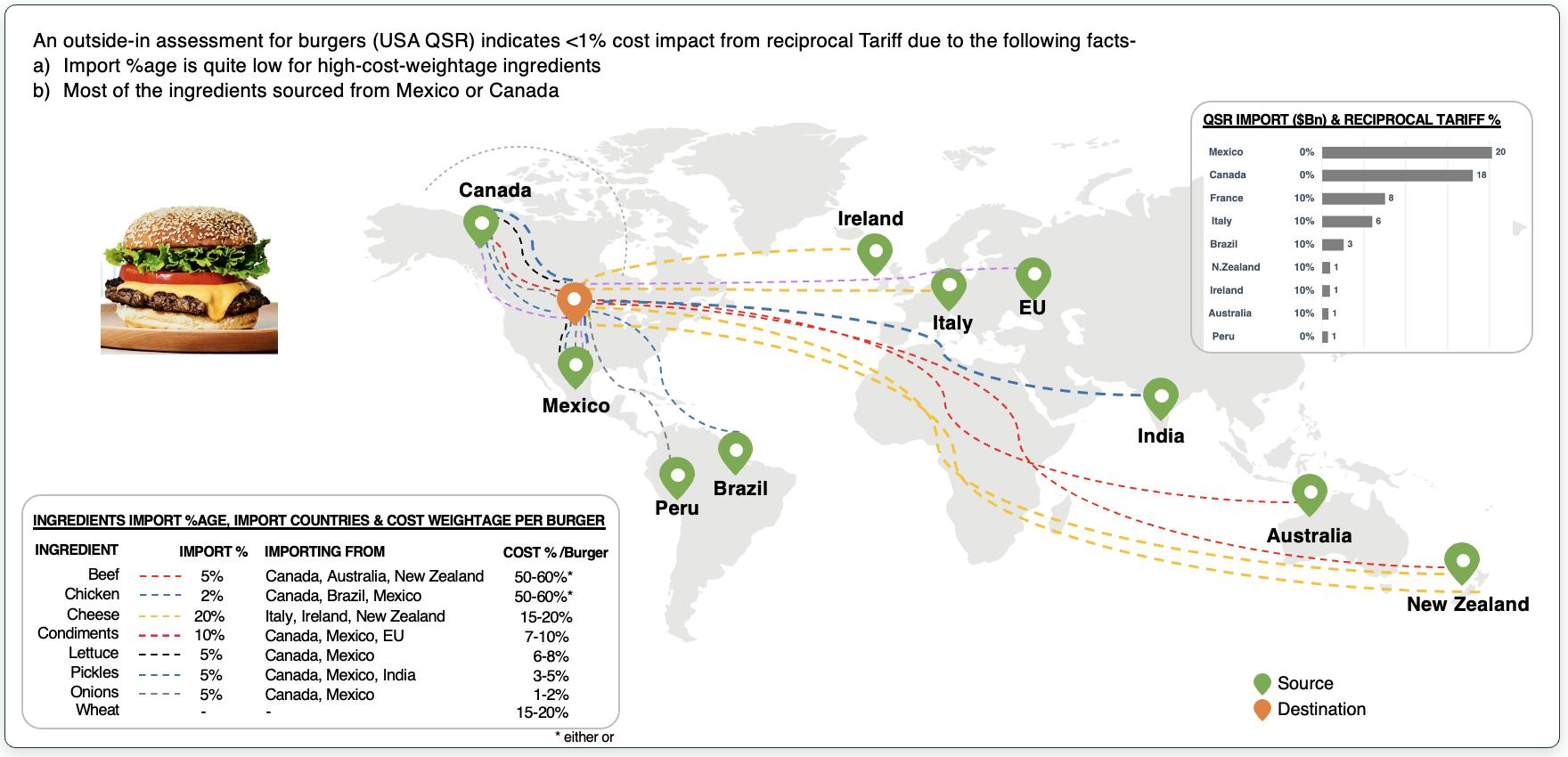

GEP’s analysis shows that for a typical burger, the cost increase may be only 1%–2% (Figure 3).

However, a key risk remains: If domestic suppliers raise prices to match imports (the price umbrella effect), costs could go up by as much as 10%. QSRs must conduct a detailed, product-by-product cost escalation assessment and develop targeted strategies to contain costs with minimal disruption.

Figure 3: Burger Prices May Hold Steady Despite Tariff Pressures

Approach 2: Driven

No company wants its margins to erode. There are innovative approaches to swiftly counteract margin pressures. In the case of volatile ingredients, deploying a third-party buy-hold-sell model can be particularly effective. Companies are also setting up dedicated war rooms for continuous impact assessment and using advanced AI models to minimize human oversight in a fast-evolving environment. To stay agile, firms are also conducting should-cost analysis to estimate costs and teardown studies to optimize recipes.

Approach 3: Proactive

Some companies may opt to shield margins and safeguard shareholder value, even if it means temporary loss of market share. This approach, common among B2B companies, can work in the B2C space when pricing becomes a key competitive tool.

Beverage companies, for example, often launch alternative SKUs with distinct differentiators to attract different consumer segments. A robust pricing strategy that accounts for price elasticity and shrinkflation is vital and should be evaluated against a tariff heat map. External expertise may be required to execute these strategies swiftly.

Approach 4: Strategic

The optimal strategy for companies hiking prices involves mitigating longer-term risks through a multifaceted approach that includes re-evaluating supply chain footprints (e.g., increasing domestic production), pursuing vertical integration, managing trade flows, and applying design-to-optimize principles. Additionally, a thorough product portfolio and supply chain-part mapping will enable more informed decisions that will help preserve margins and enable long-term growth.

Adapt and Survive

The gray rhino has finally arrived. For the CPG sector, now is the time to respond strategically, not just react. Companies must take a deeper look at costs from both sourcing and design perspectives, optimize product portfolios, introduce variants to ease pricing pressure, and find alternative ingredients. Consumers will adapt — they always do.

The real question is whether CPG companies and QSRs will adapt with them.

As tariff policies evolve, the only way forward is by staying vigilant, evaluating the entire supply chain, and drawing up alternative strategies.

Remember, in the CPG industry, it starts and ends with the consumer.

Gauranga De is vice president of consulting at GEP

Find more such insights on the GEP Tariff Management Resource Center

Talk to a GEP expert to protect your supply chain from tariff disruptions