NAFTA to USMCA: 3 Strategies for Automakers to Adapt to the New Rules

- North America’s automotive industry needs to shift gears in its sourcing strategy to comply with USMCA rules

- These strategies can range from roll up and tariff shift to finding an alternative staging regime

- Automotive OEMs can partner with a supply chain solutions provider to develop new suppliers

March 17, 2022 | Sourcing Strategy 5 minutes read

The United States-Mexico-Canada Agreement or USMCA has reset many trade and sourcing rules for automotive manufacturers who were tuned to the North American Free Trade Agreement (NAFTA) for nearly 25 years.

From 1994 to 2020 (when NAFTA was replaced with USMCA), most original equipment manufacturers (OEM) in the automotive sector knew the rules, the exceptions, and where and when to apply them.

The situation is different now.

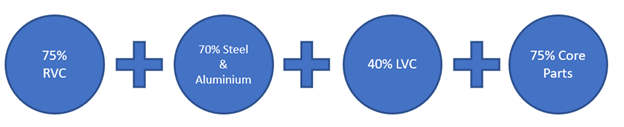

Automotive companies have been forced to shift gears in their sourcing strategy to comply with four mandatory rules. It is crucial for OEMs to comply with each regulation. Failure to fulfill even one rule will mean not complying with the entire USMCA and could result in significant fines and tariffs.

What are these new four rules and how have these impacted automakers?

Regional Value Content

OEMs must buy and/or produce at least 75% of the total value of a vehicle in the North American region. The parts are classified as “Core, Principal, Complementary, Rest/Others”. In NAFTA, the share of local parts was 62.5%.

Steel & Aluminum

70% of the materials must be bought in North America. This has forced many companies to change their raw material supply locations from other parts of the world (principally Asia) to North America. In NAFTA, this rule did not exist.

40% Labor Value Content

This means at least 40% of the total value of an automobile produced in North America must be bought and/or produced in high-salary plants in the region with a salary of at least $16 per hour. That rule creates a huge disadvantage for Mexico since companies there are not able to pay those salaries to any of their blue-collar workers. Canada has a few high-salary plants and the rest are in the U.S.

75% Core Parts

Special important components from a car are designed as Core Parts (engine, transmission, body and chassis, axle, suspension system, steering system, and advanced battery). Each one of these is made of enumerated components. The rule indicates that the weighted regional value content from these parts must be at least 75%.

3 steps for automakers to comply with the new rules

In this changed sourcing and manufacturing scenario, what strategies can OEMs deploy to fulfill these new requirements from USMCA without completely resetting their current processes? Here are three ways:

1. Roll up

Unless the specific origin rule for a part indicates otherwise, when it reaches the minimum required regional value content or RVC (broken down below), the part will “suffer” a roll up and will automatically be considered as 100% regional and comply with the USMCA.

Principal ≥ 70%

Complementary ≥ 65%

Others/Rest ≥ 60% (specific for each part but that is an average)

2. Tariff shift

Due to globalization, it is normal for OEMs to acquire raw materials from different parts of the world, especially when the prices are competitive. This is common in the automotive industry. Examples include the buying of natural rubber and aluminum.

A special section in the USMCA “allows” certain raw materials to continue to be brought from outside the North American region and still be considered as “regional” with the condition that the transformation thesematerialsl go through in North America is large enough.

For example, when an OEM brings a piece of wood from China to the U.S. and transforms this wood into a closet, it is nowhere neao what it was when it entered North America. So that makes it automatically regional. The same goes with tires. Natural rubber can still be brought from Asia and when an OEM applies a manufacturing process to it, the nature of the rubber changes to the point that it will be considered regional.

For some automotive parts like hoses, it is even easier. In many cases, the hoses can be brought in cable reels (outside North America) and when these are cut, crimped, or thermoformed, these become regional. This is because once that process is done, the parts can only be used for the automotive industry.

For each specific case, when a company is producing and or buying parts outside North America, it should conduct an analysis with the proper customs department to evaluate this option.

3. Alternative staging regime

The USMCA has a special period for OEMs to prepare themselves for transition to the new rules. This means that since 2020, the U.S. government requires companies to fulfill the agreement in a certain percentage, starting nearly to 65% for some categories until they reach 100% no later than January 1, 2025.

Why the automotive industry needs a supply chain strategy partner for USMCA?

Support for OEMs

OEMs that do not fulfill the requirements face heavy fines when they want to export cars to the U.S. (nearly 2.5% of total car value in taxes). OEMs can partner with a procurement and supply chain solutions provider to analyze which cases can fulfill the treaty with tariff shift or roll up (where necessary), or to assist in transformations such as opening plants/divisions where necessary in the NAR for them to fulfill the treaty.

For example, in accordance with the Office of the United States Trade Representative (USTR), German carmaker Volkswagen is working on developing and establishing a special battery plant in the U.S. which will give them a certain percentage from the required LVC. Many OEMs should take measures like these to fulfill the trade norms.

Support for suppliers

Since many suppliers have production outside North America, they are left out of sourcing or do not get nominations because they are currently “not fulfilling” USMCA requirements. The supply chain solutions provider can offer custom services and analyze for which specific cases they are able to fulfill the USTR requirements independently if they are in North America or elsewhere (with the support of tariff shift and roll up). In cases where they are not able to fulfill USMCA rules because of overseas production or raw material sourced from overseas, they will need analyses to bring their production or raw materials where convenient to North America. The strategy could include developing new raw material suppliers in the region or new plants for these manufacturing suppliers.

Learn more about how GEP can help automakers and their suppliers comply with USMCA rules.

Author: Giovanni Mures

Turn ideas into action. Talk to GEP.

GEP helps enterprise procurement and supply chain teams at hundreds of Fortune 500 and Global 2000 companies rapidly achieve more efficient, more effective operations, with greater reach, improved performance, and increased impact. To learn more about how we can help you, contact us today.

Krish Vengat N.

Vice President, Consulting

Krish is a seasoned procurement and supply chain management professional proficient at delivering sustainable cost savings and process improvements across industries. He has been a part of multiple procurement transformation initiatives and secured around a billion dollars of savings in direct- and indirect-related spend and supply chain operations. His clients at GEP include Fortune 500 companies, primarily in CPG, automotive, and industrial manufacturing.