-

GEP Software

-

- Procurement Software

- Direct Procurement Software

- Indirect Procurement Software

- Unified Source-to-Pay

- Source-To-Contract Software

- Procure-to-Pay

- Midsize & High Growth Enterprises

- Key Capabilities

- Spend Analysis

- Sourcing

- Contract Lifecycle Management

- Supplier Lifecycle Management

- Third-Party Risk Management

- Purchasing

- Payments

- Data Analytics and Reporting

- Do more with GEP SMART

- Intake Management & Orchestration

- Intelligent Category Management

- Tail Spend Management

- Cost Data & Analytics (GEP COSTDRIVERS)

- AI-First Supply Chain Management

- Supply Chain Visibility and Execution

- Logistics Visibility

- Inventory and Warehouse Management

- GEP Multienterprise Collaboration Network

- Supply Chain Control Tower

- Field Services

- Supply Chain Collaboration & Planning

- Supply Chain Planning

- Purchase Order Collaboration

- Forecast Collaboration

- Capacity Collaboration

- Quality Management Software

- Should-Cost Modeling

- Direct Material Sourcing

-

-

GEP Strategy

-

GEP Strategy

Unrivaled supply chain and procurement expertise + the transformative power of AI

Supply Chain Consulting

- Environmental, Social and Governance

- Sustainability Consulting Services

- Socially Responsible Sourcing

- Scope 3

- Demand and Supply Chain Planning

- Collaborative Planning

- Source To Contract

- Procure To Pay

- Inventory Strategy & Management

- Operations & Manufacturing Excellence

- GEP Total Inventory Management Solution

- Network Strategy & Optimization

- Warehousing & Transportation Management

-

-

GEP Managed Services

-

GEP Managed Services

World-class skills, experience and know-how — amplified by the power of AI

-

- Europe exits two-year slump, led by German export rebound and domestic demand recovery

- U.S. manufacturers’ purchasing surges ahead of U.S. ‘tariff pause’ ending

- Asia supply chains pick up, though capacity remains underutilized in Southeast Asia

- No signs of cost inflation escalation yet despite the 10% universal tariff imposed by the U.S.

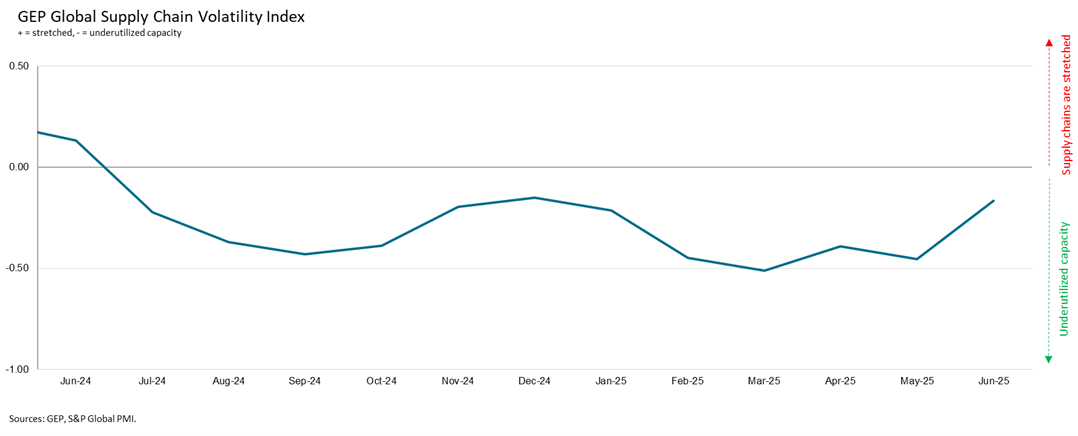

Clark, N.J., July 11, 2025 – The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories, and backlogs based on a monthly survey of 27,000 businesses — jumped to -0.17 in June, from -0.46 in May. The index hit a 2025 high as worldwide supply chain activity picked up despite the 10% tariffs imposed by the U.S. administration.

For the first time in more than two years, European manufacturers operated at full tilt, driven by front-loaded orders from U.S. customers and a rebound in both domestic and export demand, particularly across Germany.

In North America, demand for inputs surged as U.S. manufacturers moved quickly to secure inputs — commodities, parts, components and raw materials — ahead of a potential end to the current tariff pause.

Asia’s supply chains also showed signs of recovery, with stronger activity in India, Japan, and South Korea. However, spare capacity remains across Southeast Asia, where factory purchasing continues to lag, particularly in China.

Notably, there is no evidence in the data of cost inflation escalating dramatically, despite the tariffs.

“In June, Europe shook off its long slump and global supply chains ran at full capacity — despite the uncertainty and on-and-off again tariffs,” said John Piatek, VP, consulting, GEP. “But under the surface, companies are putting in place contingencies: stockpiling inputs, reshaping supplier networks, near-shoring operations, and securing supply chain financing.”

Interpreting the data:

- Index > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

- Index < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

Interpreting the data:

- Index > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

- Index < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

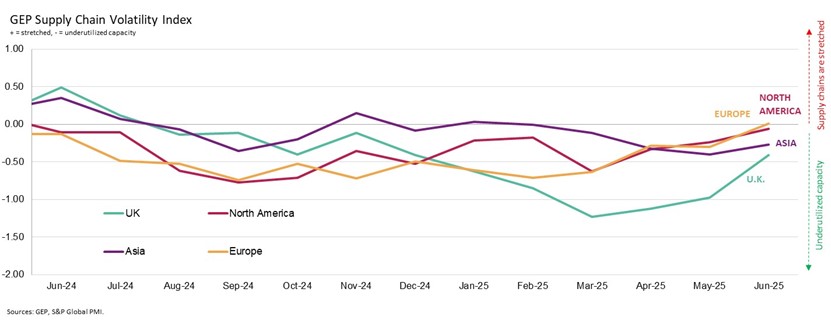

JUNE 2025 REGIONAL KEY FINDINGS

ASIA: Index rises to -0.27, from -0.40, indicating a pickup in Asian market activity, but the region’s supply chains remain underutilized overall. This mostly reflects subdued factory conditions in Southeast Asia.

NORTH AMERICA: Index rises to -0.06, from -0.24, as U.S. manufacturers ramp up purchasing sharply ahead of the tariff pause coming to an end. North American supply chains effectively ran at full capacity in June.

EUROPE: Index rises to 0.01, from -0.30, signaling full capacity utilization across Europe’s supply chains in June as the continent’s industrial sector emerges from its prolonged downturn.

U.K.: Index rises to -0.41, from -0.97, its highest for seven months, but still indicative of an elevated level of slack across the U.K.’s supply chains.

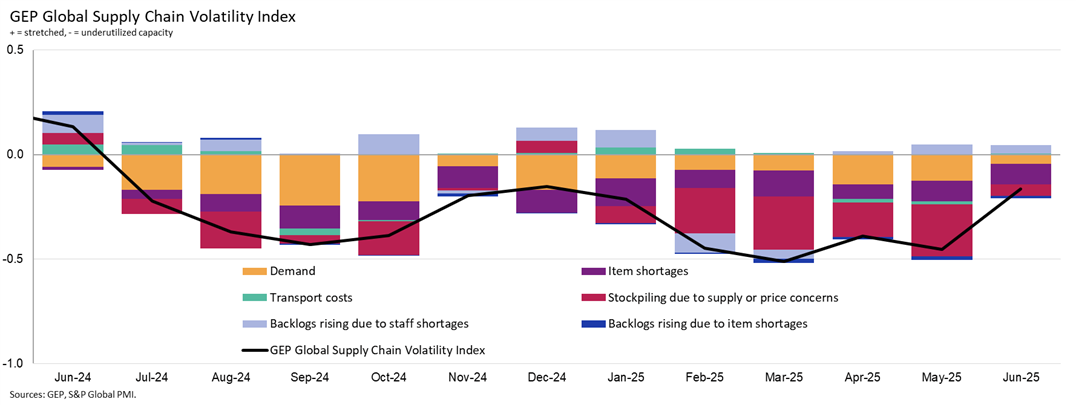

JUNE 2025 KEY FINDINGS

DEMAND: Global factory purchasing activity continued to trend upward in June, with demand at its most robust in just over a year. This was driven by a considerable rise in North America, driven by the U.S., as manufacturers ramped up buying ahead of the pause on U.S. tariffs coming to an end.

INVENTORIES: There were increased reports from businesses of a rise in stockpiling due to price or supply concerns during June. Mentions of safety buffers being built into warehouses were their highest so far in 2025 globally, with the prospect of higher tariffs driving procurement managers into precautionary action.

MATERIAL SHORTAGES: The global item shortages indicator, which measures the prevalence of supply problems, remains historically low, indicating robust availability.

LABOR SHORTAGES: Suppliers’ workforce capacity remains sufficient to process current order loads, according to our data. Reports of manufacturing backlogs rising due to staff shortages remain stable at historically typical levels.

TRANSPORTATION: Global transportation costs were once again in line with their long-term average in June. Reports from surveyed businesses of logistic cost pressures remain anchored.

For more information, visit www.gep.com/volatility

Note: Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Aug. 12, 2025.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global’s PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world’s best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP’s cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today.

Media Contacts

| Derek Creevey Director, Public Relations GEP Phone: +1 732-382-6565 Email: derek.creevey@gep.com | Joe Hayes Principal Economist S&P Global Market Intelligence Phone: +44-1344-328-099 Email: joe.hayes@spglobal.com | S&P Global Market Intelligence Email: Press.mi@spglobal.com |

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers’ Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media contact

Breadcrumb

- HOME

- NEWS AND UPDATES

- TARIFF PAUSE SPURS GLOBAL MANUFACTURING ACTIVITY IN JUNE, WITH SUPPLY CHAINS NOW OPERATING CLOSE TO FULL CAPACITY: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX