Global Supply Chain Volatility Index

FEBRUARY 2026

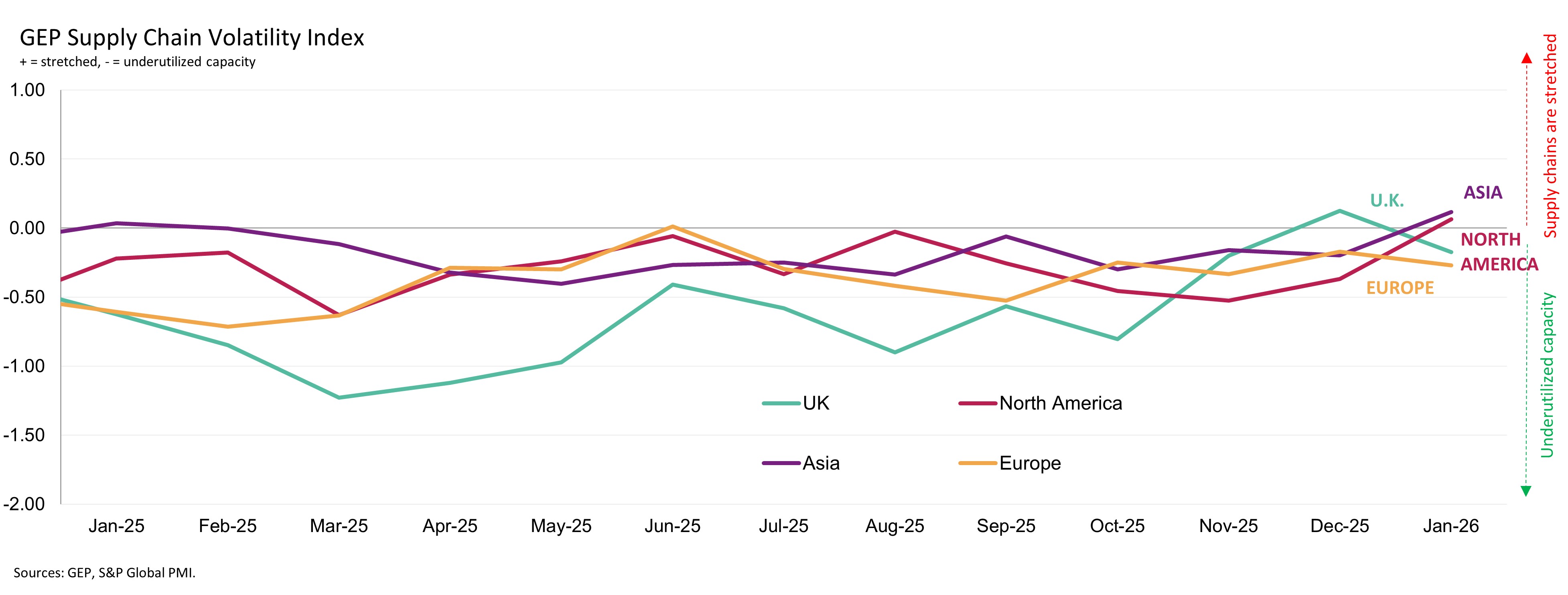

Global: -0.21

Asia: 0.12 +0.32

EU: -0.27 -0.10

NA: 0.06 +0.43

UK: -0.17 -0.29

Global Manufacturing Demand Rebounds in January to Its Strongest Since May 2022: GEP Global Supply Chain Volatility Index

- Manufacturers in Asia raise purchasing volumes in response to order book pickup — factories in China, Japan, Korea and India bought materials more aggressively in January

- North America’s supply chains at their busiest since May 2024, as U.S. industrial economy shows resilience

- Europe remains the laggard, with firms reluctant to restock, although there are tentative signs of recovering demand more...

GEP Global Supply Chain Volatility Index

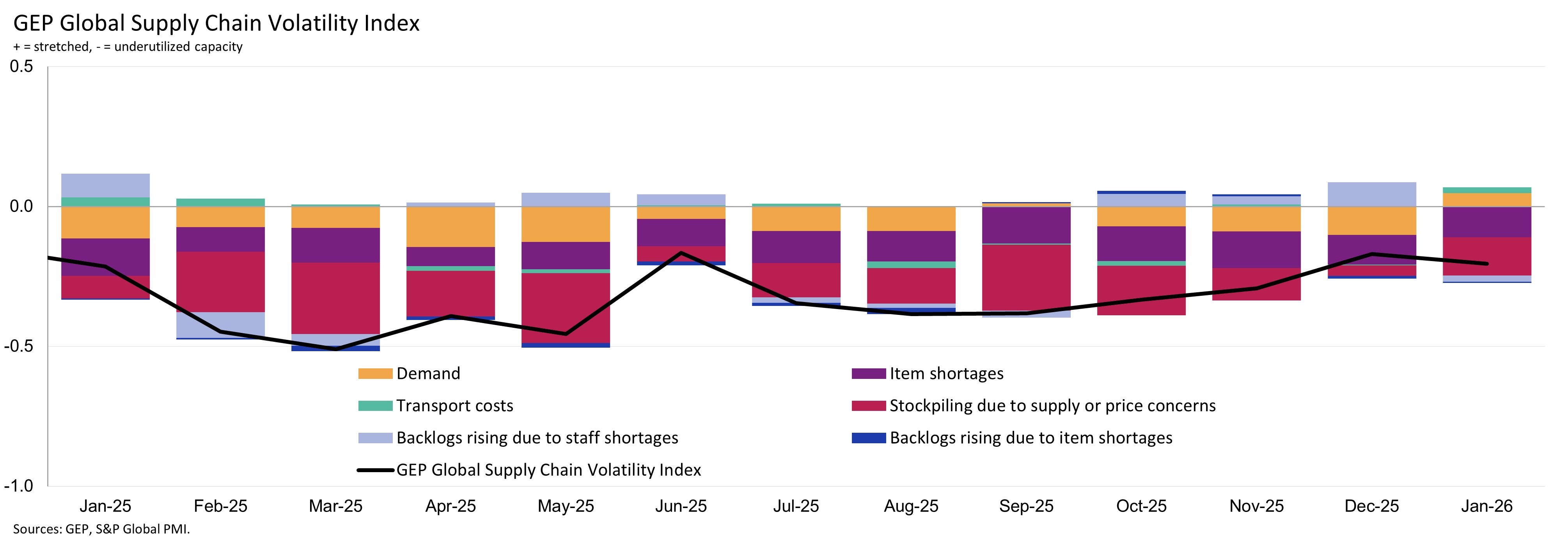

-0.04

FEBRUARY 2026

Asia: 0.12

EU: -0.27

NA: 0.06

UK: -0.17

Interpreting the data:

When the SCVI > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

When the SCVI < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

Asia: Demand surges as factories across the region step up purchasing

Europe: Factory purchasing remains subdued, though the pace of contraction eases

U.K.: Activity weakens as supply chains become underutilized

North America: Manufacturing rebounds as supply chains reach their busiest levels since mid-2024

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, March 11, 2026.

About the GEP Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. The GEP Global Supply Chain Volatility Index is derived from S&P Global’s PMI™ surveys, sent to companies in over 40 countries, totalling around 27,000 companies. These countries account for 89% of global gross domestic product (GDP) (source: World Bank World Development Indicators).

The headline figure is the GEP Global Supply Chain Volatility Index. This a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators complied by S&P Global.

The GEP Global Supply Chain Volatility Index is calculated using a weighted sum of the z-scores of the six indices. Weights are determined by analysing the impact each component has on suppliers’ delivery times through regression analysis.

The six variables used are 1) JP Morgan Global Quantity of Purchases Index, 2) All Items Supply Shortages Indicator, 3) Transport Price Pressure Indicator and Manufacturing PMI Comments Tracker data for 4) stockpiling due to supply or price concerns, and backlogs rising due to 5) staff shortages and 6) item shortages.

A value above 0 indicates that supply chain capacity is being stretched and supply-chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

A value below 0 indicates that supply chain capacity is being underutilized, reducing supply-chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the UK. The regional indices measure the performance of supply-chains connected to those parts of the world.

For more information on PMI surveys, PMI Comments Trackers and PMI Commodity Price & Supply Indicators, the GEP Supply Chain Volatility Index methodologies, please contact economics@ihsmarkit.com.