Offshore Oil & Gas Vs. Offshore Wind Power Projects: The Intensifying Fight Over Resources

- Many oil and gas companies have difficulty sourcing marine vessels and skilled crew because of increasing demand from offshore wind energy projects.

- Technologies used in the offshore wind energy projects originated in the offshore oil and gas industry.

- Given the fight for resources with offshore wind projects, oil & gas companies need to finalize procurement decisions in advance to avoid shortages and uncompetitive contracts.

July 17, 2023 | Oil and Gas 3 minutes read

Investments in offshore oil & gas and offshore wind energy projects have soared since 2021, leading to increased competition between these industries for labor, marine vessels and other allied services needed for offshore installations.

As the world moves towards carbon neutrality, many countries are betting on offshore wind to meet their net zero goals. The U.K., for example, plans to source one-third of its energy from offshore wind farms.

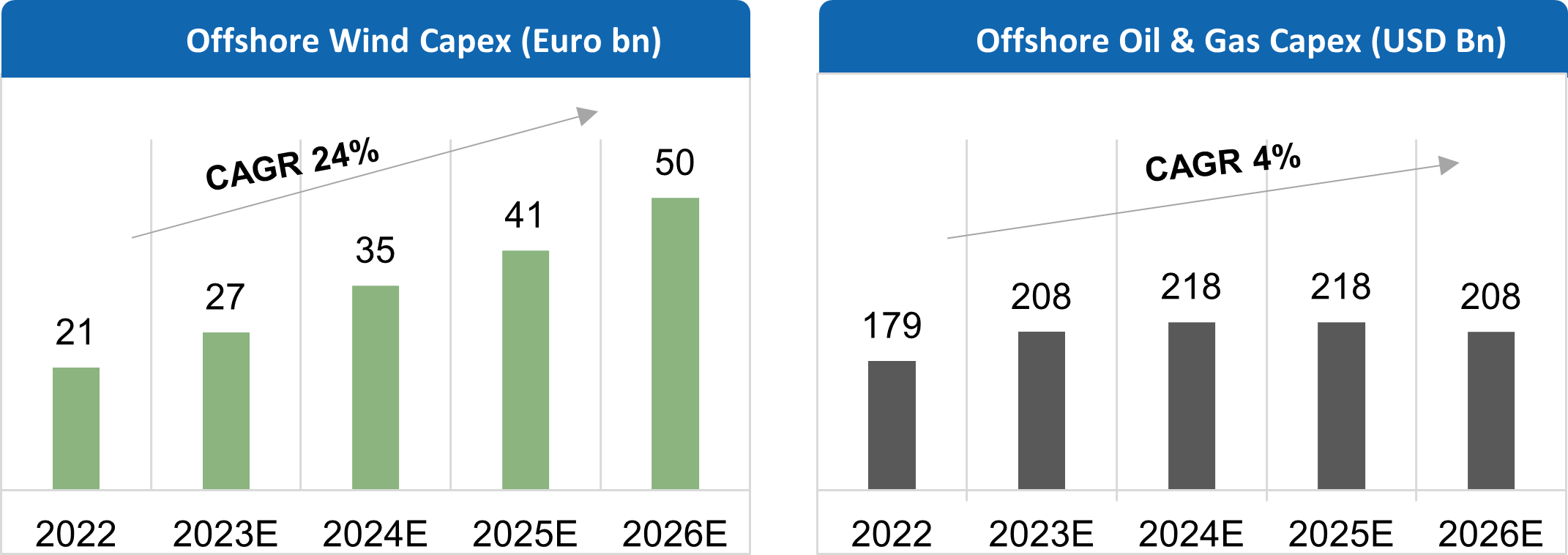

Source: Fugro - Analyst presentation; Q1 2023 trading update

Several European and Asian countries have also pledged to multiply offshore wind capacity by 2030. The total expected offshore wind capex is expected to grow from 21 billion euros to 50 billion euros by 2026 – a compound annual growth rate of 24%. In comparison, capex in offshore oil and gas projects is expected to grow by only 4% in the same period.

Also read: AI and Big Data Drive Oil and Gas Industry Recovery

Competition from Offshore Wind Farms

Many of the technologies used in the offshore wind industry are innovations that originated in the offshore oil and gas industry. Foundations are built in the same yards as oil rigs; jacket substructures used in offshore drilling rigs are used in offshore wind farms. Also, all the floating foundations proposed for offshore wind farms have their roots in deep-water drilling.

Similarities between offshore wind energy and offshore oil & gas don't end here.

The marine environment has its own set of challenges which are similar in both industries.

For example, construction in the open ocean necessitates a highly skilled crew. Deepwater wind farms had to complete the foundation and turbine installation operations for the Block Island Wind Farm in the U.S. using vessels from the Gulf of Mexico that had previously been used in the oil & gas industry.

Two segments greatly impacted by the increased demand for offshore wind energy are the marine vessels industry and the labor market. Many oil and gas companies are reported to have difficulty sourcing specific vessels such as geotechnical, offshore, and construction support vessels. Charter rates have also reportedly increased in the last few years.

A limited supply of certain vessels and shipbuilding activity is expected to intensify competition between traditional O&G firms and offshore wind.

Oil & gas professionals are vital talent resources in the renewable energy industry because of their many transferable skills.

Electricians, offshore construction engineers, information technology specialists, and environmental surveyors are increasingly migrating to offshore wind projects in search of better pay and opportunities.

This has the potential to exacerbate the already-existing labour shortage in the oil & gas industry.

The Global Energy Talent Index (GETI) report, based on a survey of 10,000 energy professionals from 161 countries, found that 55% of respondents open to switching sectors are interested in transitioning to renewable energy.

Also read: 4 Ways To Optimize Oil and Gas Operations

What's Next for Offshore Oil & Gas?

Certain oil and gas suppliers have already started to diversify their order books between renewable energy and oil & gas as part of their strategy to de-risk.

In the coming time, the demand from wind energy sector is expected to force suppliers to split into catering to either the oil & gas sector or the wind energy sector because of limited availability of resources such as marine vessels, labor and specialized equipment.

Therefore, it will be imperative for major oil & gas companies to plan certain activities and finalize procurement decisions well in advance to avoid any major business impact due to shortages, high charter rates and uncompetitive contracts with suppliers.

Author: Chetan Chaudhari

Know how GEP can help oil & gas companies optimize procurement and supply chain operations