EU ViDA: Transforming VAT Compliance in the Digital Age - All You Need to Know

- ViDA replaces periodic VAT returns with real-time digital reporting across the EU, starting July 2030.

- Digital platforms will be responsible for VAT collection in the gig economy under new deemed supplier rules.

- The expanded One-Stop Shop simplifies multi-country VAT compliance — saving businesses time and cost.

August 18, 2025 | Procurement Strategy 4 minutes read

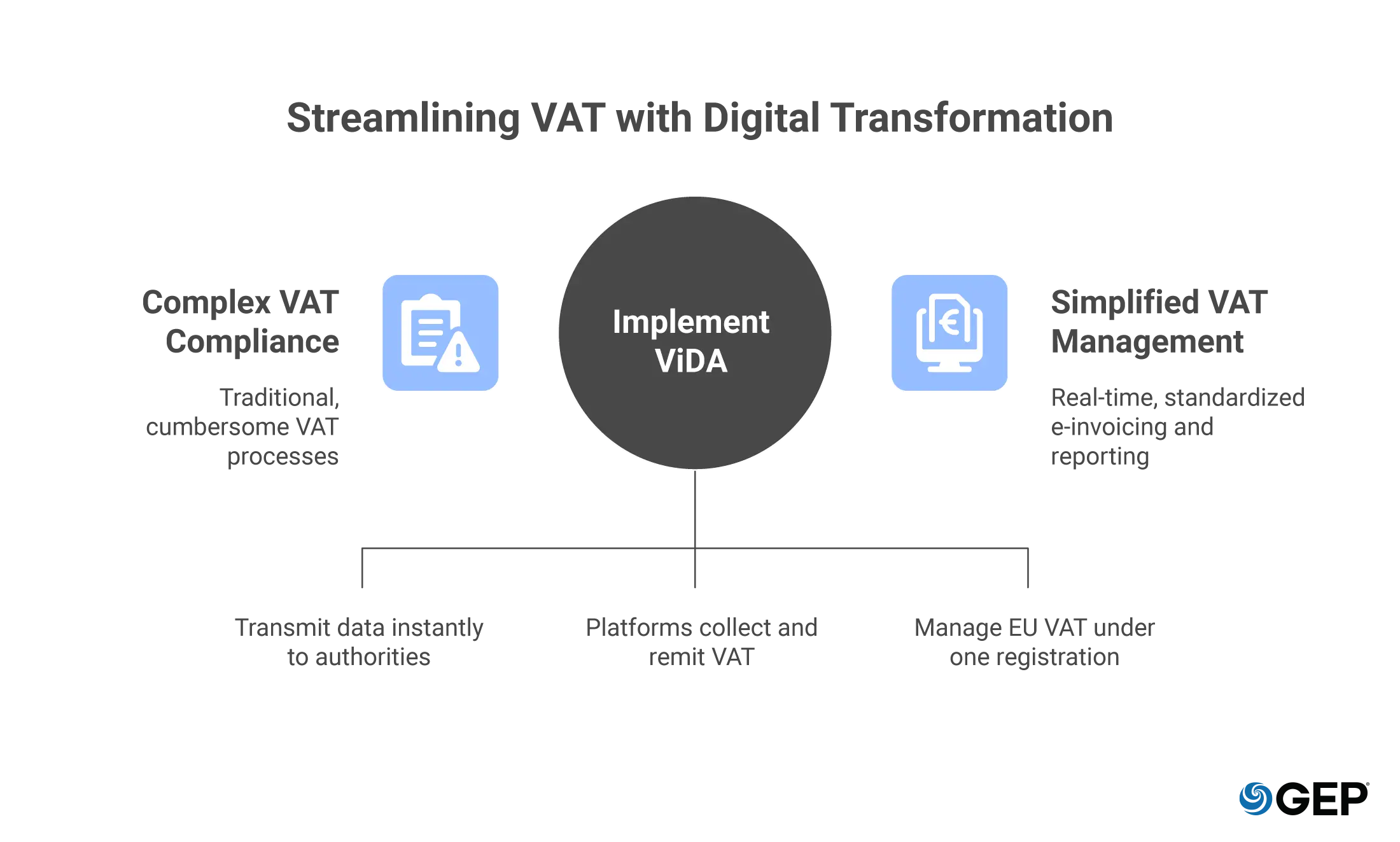

VAT compliance is about to get a major digital upgrade in the EU now.

Meet ViDA — VAT in the Digital Age — a bold initiative that will change how businesses are managing, reporting and remitting VAT across the European Union. This is not a minor policy tweak but a structural change designed to modernize and improve VAT into the 21st century. For procurement, finance, and compliance teams, it’s a shift you can’t afford to ignore.

This blog will break down what ViDA is, what it changes, why it matters, and — most importantly — how businesses like yourself can prepare.

What Is ViDA?

ViDA is the EU’s answer to outdated VAT systems in today's digital-first economy. This was officially adopted by the Council of the European Union in March of 2025, and was backed by both the European Parliament and ECOFIN ministers. It is now a binding regulation with long-term implications (European Commission).

The goals? Pretty ambitious but much needed:

- To curb VAT fraud

- To cut down the compliance burdens

- And finally, embrace digital tools to make VAT smarter, faster, and more transparent

Need Help Navigating ViDA and Preparing Your Systems for Compliance?

Our experts can guide you through the transition — from e-invoicing readiness to OSS integration.

What’s Changing? The Three Pillars of ViDA

ViDA introduces changes across three core areas — each with significant implications for how businesses operate across the EU.

1. Digital Reporting Requirements (DRR)

This is the heart of ViDA — replacing periodic VAT reporting with real-time data exchange. If you have up-to-date systems, you'll be able to reduce paperwork, get faster audits, and better compliance. The new requirements are as follows:

- Mandatory e-Invoicing kicks in by 1 July 2030 for all B2B transactions across the EU (Council of the EU).

- Businesses should report transactions in a standardized electronic format. This must be done using Peppol, which is the EU's chosen open network (PwC).

- This will enable real-time reporting to tax authorities — optimizing fraud detection faster.

2. Platform Economy Rules

If your business touches the gig economy, this matters — a lot.

- From July 2030, digital platforms like ride-hailing apps or short-term rentals will become ‘deemed suppliers’, responsible for collecting and remitting VAT on behalf of sellers who don’t do it themselves.

- Member states can start enforcing this as early as July 2028 (PwC).

- This levels the playing field between traditional and digital businesses — closing loopholes and reducing the risk of under-taxation.

For platforms, this means becoming tax intermediaries. For everyone else, it means fairer, more consistent rules across the board.

3. One-Stop Shop (OSS) Expansion

Remember the OSS? It’s about to get much more powerful.

- Starting 1 January 2027, businesses can manage VAT obligations for multiple EU countries through one registration (Deloitte).

- The OSS will now include more transaction types — from cross-border inventory transfers to utility services like gas and electricity (PwC).

- It’s a massive win for companies operating in more than one EU state — cutting red tape, reducing admin, and simplifying compliance.

Discover 101 Practical Ways AI is Transforming Procurement—Today, Not Tomorrow

Download GEP’s white paper to explore real-world use cases across sourcing, contracting, analytics, and more.

Key ViDA Milestones

Here’s a quick timeline of what’s coming — and when:

Date | What Happens |

|---|---|

| 14 Apr 2025 | Member states allowed to mandate e-invoicing domestically (European Commission) |

| 1 Jan 2027 | OSS expands to include cross-border B2B supplies and energy services (PwC) |

| 1 July 2028 | Optional VAT collection by digital platforms begins (PwC) |

| 1 July 2030 | Mandatory e-invoicing and platform VAT collection go live (Council of the EU) |

| 1 Jan 2035 | National systems must fully align with ViDA standards (European Commission) |

Why Should Businesses Care?

This isn’t just another EU directive with distant deadlines. ViDA brings real, measurable impact — both in risk and opportunity.

- The EU lost €61 billion in VAT revenue in 2021 — largely due to fraud and non-compliance (European Commission).

- ViDA aims to recover up to €11 billion within its first 10 years (PwC).

- Businesses could save €8.7 billion in administrative costs through OSS expansion and streamlined reporting (Deloitte).

The stakes are high. The sooner you're ready, the better you can reduce overhead, avoid penalties, and stay ahead of your competitors.

What Should You Do Now?

Preparation is everything. Here’s where to start:

• Audit your existing systems

Are your invoicing, ERP, and reporting platforms ready for real-time VAT exchange?

• Talk to your tech partners

Make sure your vendors are ViDA-ready — or will be by the time enforcement kicks in.

• Keep an eye on your local tax authority

Even though ViDA is EU-wide, how each country rolls it out may vary.

Final Thoughts

ViDA isn’t just about tax compliance — it’s about future-proofing your operations in a digital-first economy.

Yes, it requires new systems, new processes, and a mindset shift. But the payoff is worth it: faster reporting, fewer errors, reduced fraud, and lower costs. It’s a chance to bring procurement and finance teams closer to the front lines of digital transformation.

Start now, and by 2030, you’ll be ahead of the curve — not scrambling to catch up.

Resources

https://taxation-customs.ec.europa.eu/business/vat/vat-digital-age_en