How Cash Auctions Enable Oil and Gas Producers to Support Suppliers and Extract Benefits

August 26, 2020 | Supplier Management Strategy 3 minutes read

The first instinct of any oil and gas producer is to guard cash reserves during a downturn. But the reality is, most producers are in far better cash positions than their major suppliers, who are struggling in this ongoing market slump.

This is because a steady, even if diminished, cash flow is guaranteed for oil and gas producers since they still sell the world’s most desired extracted commodity.

The cash flow of their critical suppliers, on the other hand, is drying up.

Consider the dire situation at major specialist providers. Their demand depends upon new drilling and production work, which when turned off can prove fatal to their already weak cash positions.

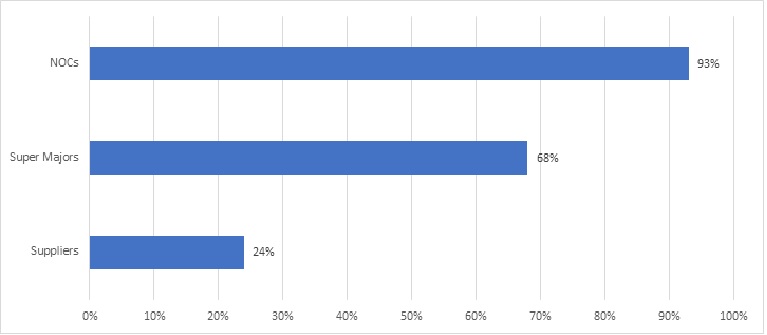

Even during relatively good times, an average major specialist provider can only cover about 25% of its current liabilities with operating cash flow. This is in stark contrast to the cash scenarios of oil and gas producers, who can cover more than 70% of their current liabilities out of the cash flows.

This is a good opportunity to provide a financial lifeline to suppliers and extract long-term benefits. The effective way to do this would be by auctioning cash.

Average Current Liability: Coverage Ratios of Producers and Suppliers

Source: GEP

What are Cash Auctions?

A cash auction is a competitive bidding among suppliers to secure cash injection from oil and gas producers in lieu of long-term benefits.

Producers can view this auction as a form of early payment discount or dynamic discounting, but on a much bigger scale.

The cash auction approach will better align with the needs of producers and their suppliers than traditional strategic sourcing activities. This is because cash auctions do not represent a zero-sum game of reducing list prices to win business.

Instead, both the parties benefit in the way that is most important to them right now. The producers bolster their short- to medium-term profit and loss, and suppliers receive a cash booster that can be the difference between solvency and bankruptcy.

This help producers reinforce their finances at a time when investor confidence — especially in those overexposed to shale — is at an all-time low. Through cash auctions, oil and gas producers are also able to keep valuable intellectual capital in play.

How to Do Cash Auctions?

While this solution is not for everyone, cash auctions have shown potential in other industries. These have provided the exact same benefits as dynamic discounting.

Instead of just leveraging a few days of cash arbitrage out of a pool of AP funds, procurement and supply chain management teams and treasury groups can make a larger cash pool available and auction it off.

The size of the cash on offer and the introduction of competitive bidding for cash, where the currency is cost reduction, can provide a novel lever to secure value in a supply base that is still recovering from the oil price shock of 2014-16.

As far as strategies go, cash auction by oil and gas producers is easily the most provocative one being proposed in the market today, especially in the light of the downturn. But this move can generate significant value for the producer as well as the supplier in current market conditions.

To know more such strategies, read GEP’s white paper – What’s Next for Oil & Gas? Recovery Scenarios and Navigation Strategies to Power Through the Crisis

Turn ideas into action. Talk to GEP.

GEP helps enterprise procurement and supply chain teams at hundreds of Fortune 500 and Global 2000 companies rapidly achieve more efficient, more effective operations, with greater reach, improved performance, and increased impact. To learn more about how we can help you, contact us today.

Patrick Heuer

Director, Oil and Gas

Patrick leads GEP's global upstream oil and gas business, providing practical, usable, and digital solutions for our clients’ most pressing operational supply chain problems.

At GEP, he applies the latest design and UX thinking to solve key operations problems for large oil and gas companies and leverage digital technologies to provide tangible P&L and balance sheet impacts.