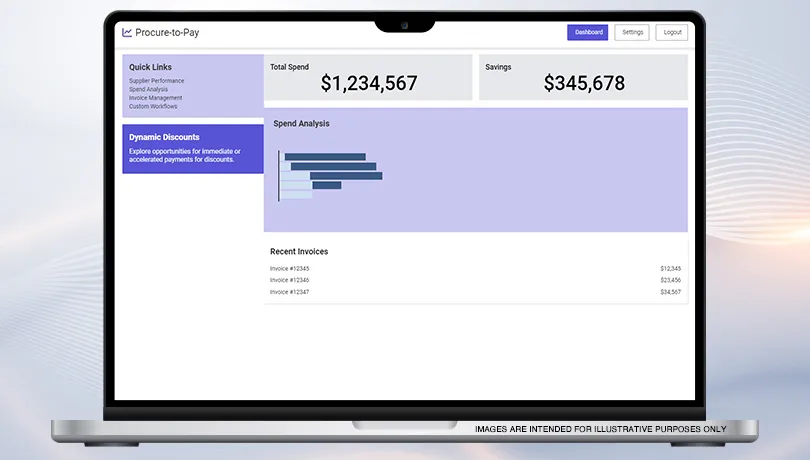

The finance and accounts payable teams are crucial to the source-to-pay process and can contribute significantly to strategic savings targets. GEP SMART™ AP automation software accelerates the opportunity-to-invoice process, making it easier to secure the right deals and purchase what’s needed within those agreements. With streamlined processes and comprehensive spend visibility, the finance team can better plan the cash flow and offer suppliers immediate or accelerated payments for spot discounts. GEP SMART’s dynamic discounting functionality empowers finance and AP teams to maximize savings.

THE GEP SMART ADVANTAGE

Punch-Out Catalogs

No more manual catalog maintenance. Find a consolidated list of items from all supplier websites, external procurement applications or hosted e-procurement systems in one place — GEP SMART.

Hosted Catalogs

Eliminate the need to integrate complex e-commerce systems or rely on third-party operators — GEP SMART’s hosted catalogs make it easy for suppliers to sell more and for enterprises to buy better.

Guided Buying

Purchase goods and services through optimal buy-pay channels and preferred suppliers. Customize the guided buying process to suit your preferences and boost compliance with GEP SMART.

Blanket Order

Effectively manage recurring, pre-specified purchases, drive higher buying compliance and achieve leaner operations with AI-powered GEP SMART.

Catalog Maintenance

Give your suppliers access to maintain, update and refresh their catalogs, customize pricing and inventory, and enjoy a consistent shopping experience.

Contract Utilization

Track your contract utilization and evaluate whether your hard-negotiated contracts are delivering optimal value and savings with GEP SMART.

Frequently Asked Questions

Dynamic discounting creates compelling value for both buyers and suppliers by transforming the traditional payment cycle into a strategic opportunity. For buying organizations, the model allows for the strategic deployment of excess cash to generate returns significantly exceeding current short-term investment options. When properly implemented, dynamic discounting typically delivers double digit annualized returns that substantially outperform alternative treasury investments.

From a supplier perspective, dynamic discounting provides critical access to working capital at rates often lower than traditional financing options, particularly for small- and mid-sized vendors with limited banking relationships. This accelerated cash flow strengthens suppliers' financial health, reducing the risk of operational disruptions or business failures that could have an impact on the broader supply chain.

The flexible nature of dynamic discounting represents a key advantage over traditional early payment discounts. Rather than fixed terms, dynamic models offer sliding-scale discounts based on payment timing, enabling suppliers to precisely control their working capital costs based on current needs.

Beyond the immediate financial benefits, dynamic discounting strengthens buyer-supplier relationships by demonstrating the buying organization's commitment to supplier financial health. This collaborative approach ensures normal timelines during supply shortages or capacity constraints.

For procurement leaders, dynamic discounting provides a powerful lever to deliver bottom-line impact beyond traditional cost savings, elevating procurement's strategic contribution to enterprise financial performance.

Dynamic discounting has gained significant traction across diverse industries, though adoption patterns vary based on specific financial positions and supply chain characteristics. Large corporations with strong cash positions — particularly in technology, pharmaceuticals, and consumer packaged goods — have emerged as early adopters, leveraging their balance sheet strength to generate attractive returns while supporting their supplier ecosystem.

Within these organizations, treasury and finance teams typically drive initial interest, recognizing dynamic discounting as an alternative investment vehicle that delivers superior returns compared to traditional short-term instruments. Procurement organizations play a crucial implementation role, identifying suitable spend categories and suppliers for program participation. Sophisticated procurement teams segment their supply base to target suppliers most likely to value accelerated payment — typically those with higher costs of capital or cash flow challenges.

Mid-market companies are increasingly employing dynamic discounting to strengthen strategic supplier relationships, particularly when they lack the leverage of larger organizations. For these companies, the relationship benefits often outweigh pure financial returns.

On the supplier side, participation tends to be highest among privately-held mid-size companies and smaller vendors with limited access to affordable financing. These suppliers value the flexible nature of dynamic discounting, which allows them to selectively accelerate receivables based on current working capital needs without long-term financing commitments.

Industry networks and platform providers have emerged as important facilitators, connecting buyers and suppliers through technology-enabled marketplaces that streamline program implementation and maximize participation rates.

Progressive organizations now integrate dynamic discounting into broader supply chain finance strategies, offering a continuum of financing options tailored to different supplier segments and market conditions.