Is That Supplier as Green as They Claim? Why You Must Rethink ESG Due Diligence in Procurement

- Most ESG due diligence processes fail to detect supplier risks beyond basic compliance and self-reporting.

- Procurement teams must balance cost and risk while shaping supplier behavior through smarter ESG criteria and collaboration.

- Effective ESG performance management in procurement requires continuous, data-driven assessments, not one-time audits.

October 27, 2025 | Procurement Strategy 5 minutes read

How costly can an ESG due diligence failure be? In August 2024, fast-fashion company Shein found child labor at two of its suppliers. Though they cut ties with both manufacturers, the news broke just as Shein was trying to go public in London, costing the company millions in lost value.

Most procurement teams have to check the ESG box — but do they know what they’re checking?

Environmental, Social and Governance (ESG) due diligence has become a standard step in onboarding and managing suppliers. Yet the standard approach—static questionnaires, outdated certifications and one-size-fits-all compliance templates—often masks risk more than it manages it.

In a world of rising regulation, activist shareholders and climate volatility, procurement professionals can no longer afford to mistake a paper trail for real performance.

ESG due diligence needs a complete overhaul. And procurement can lead the charge.

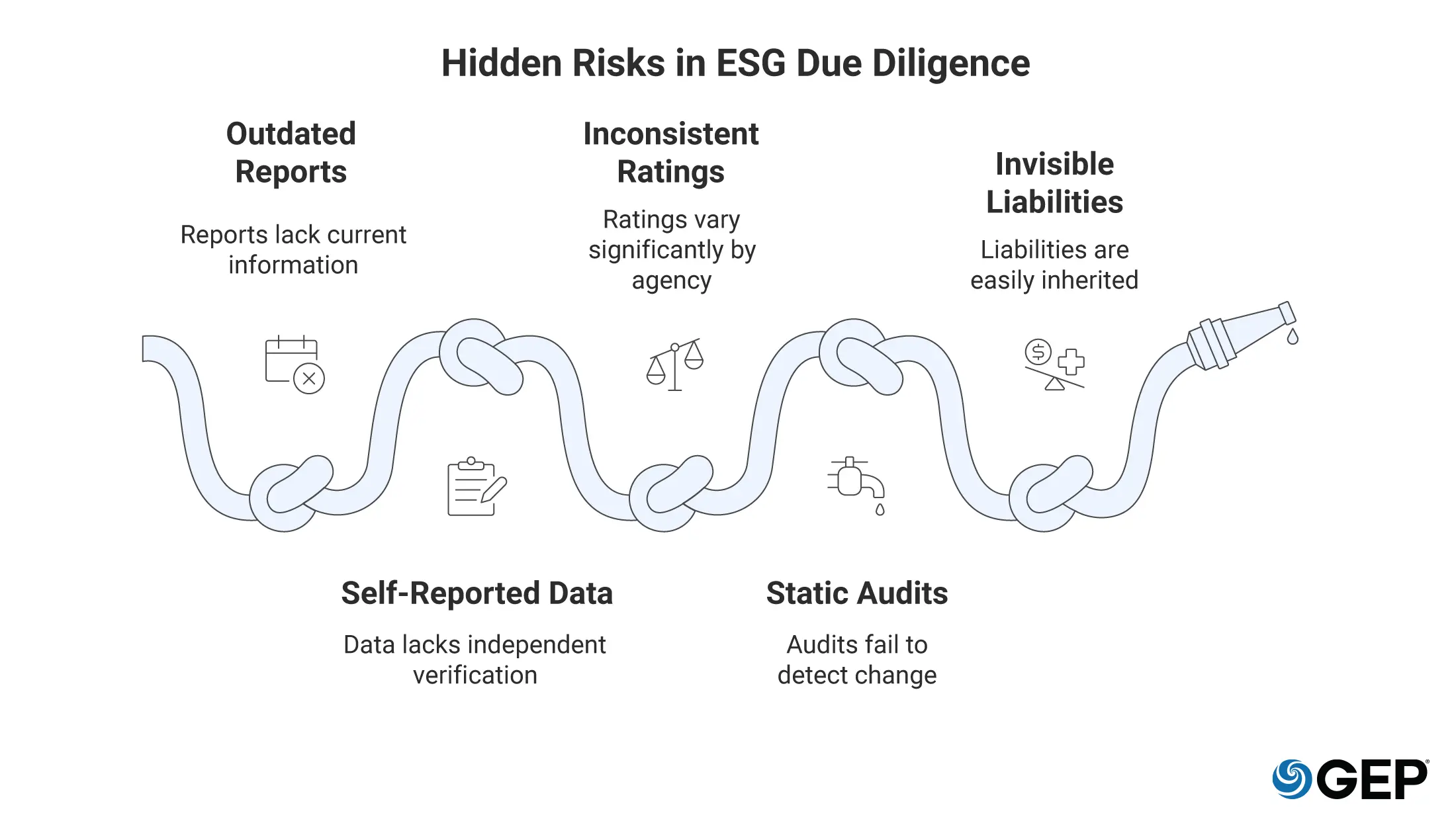

Why Traditional ESG Checks Fall Short

The assumption: if a supplier has a clean ESG report, they’re a low-risk partner.

The reality? Many of those reports are outdated, self-reported, or lack third-party validation.

A 2023 MIT Sloan study found that ESG ratings between agencies differ by as much as 60%, largely due to inconsistent data and opaque methodologies. And yet, procurement often relies on these ratings to vet critical suppliers.

What’s more troubling is the static nature of most due diligence processes. A one-time supplier audit or a checklist during onboarding may flag major red flags, but it can’t track changing behaviors, emerging controversies or shifts in regulatory exposure.

Procurement teams aiming to mitigate risk may instead be inheriting invisible liabilities.

The ESG Regulations That Matter for Your Supply Chain

Recent policy shifts have raised the stakes. The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) will roll out between 2027 and 2028. It requires companies to actively identify and prevent human rights and environmental harms across their value chains, not just in tier-1 suppliers. The Corporate Sustainability Reporting Directive (CSRD) further mandates ESG data collection and reporting, putting the spotlight squarely on procurement.

Germany’s Supply Chain Act and the upcoming EU Deforestation Regulation (EUDR) also tighten requirements around traceability, grievance mechanisms and risk management. Companies caught unprepared face steep fines and reputational damage.

And it’s not just Europe. India’s Business Responsibility and Sustainability Reporting (BRSR) framework, Japan’s ESG disclosure guidelines and Hong Kong’s new climate-transition expectations are expanding the regulatory web across Asia.

Procurement leaders must navigate this patchwork of ESG rules while ensuring supplier performance meets evolving standards. Success in this arena is about competitiveness as much as it is about compliance.

From Tasks and Workflows to Agentic Orchestration

Learn How GEP Qi Redefining Procurement

ESG Strategy

Smarter Supplier Segmentation

Think about ESG due diligence as a lens for supplier segmentation. Instead of treating ESG as pass/fail, companies can use it to prioritize engagement, performance monitoring and resource allocation. For instance:

A global consumer goods company sourcing from a wide range of suppliers across India.

Many of its tier-2 and tier-3 suppliers lack the infrastructure to meet the company’s full ESG reporting standards.

Instead of disqualifying them, the procurement team segments suppliers by ESG maturity. As these suppliers improve on ESG metrics, they unlock eligibility for longer-term contracts and preferred payment terms, creating an incentive-based path toward compliance.

Or imagine a large electronics manufacturer with operations across East Asia.

As part of a broader sustainability initiative, the company redesigns its procurement scorecard to reflect ESG performance. Suppliers who demonstrate active use of renewable energy, verified ethical labor practices and measurable waste-reduction programs receive higher ESG scores.

This shift enables the procurement team to direct more spend toward lower-risk, sustainability-focused partners, while using the scorecard data to identify high-risk suppliers who need remediation or closer monitoring.

These kinds of supplier segmentation strategies turn ESG from a blunt compliance tool into a precise instrument for driving value. By aligning resources with supplier risk, procurement can make ESG due diligence a catalyst for continuous improvement.

The Case for Real-Time ESG Intelligence

One of the biggest differentiators in ESG due diligence? Timeliness.

Emerging ESG tools now integrate real-time data from media sources, satellite imagery and even whistleblower reports. These tools can flag high-risk supplier behavior long before a scandal hits.

Consider the EU Deforestation Regulation. It will soon require companies to trace raw materials like soy, palm oil and timber to non-deforested land. Some firms are already leveraging satellite mapping to validate origin data. Others are partnering with sustainability consultants to monitor local land-use changes.

Even if your team lacks enterprise-scale tools, smaller-scale solutions like social impact trackers, environmental scoring plugins or regional ESG databases can provide a cost-effective path to visibility.

Counterarguments and the Case for Progress

"We don't have the budget for enhanced ESG monitoring."

Consider the math: Shein's child labor discovery cost millions during its IPO process. Even a modest investment in better ESG screening pales against these potential losses.

"Small suppliers can't handle complex ESG requirements."

The solution isn't lower standards. It's supplier development. Companies like Unilever create programs that provide training and technical assistance to help smaller partners meet ESG requirements over time. This builds loyalty while improving capabilities.

"ESG data is unreliable anyway."

The MIT Sloan study showing 60% variance in ESG ratings highlights real data quality issues. But sophisticated procurement teams use multiple sources to reduce this risk: satellite imagery, worker feedback platforms, regulatory databases and media monitoring. The goal is coordinated intel that reveals patterns.

"Enhanced due diligence slows procurement."

The speed advantage of minimal screening is often illusory. Companies that skip thorough ESG checks face supply chain disruptions and regulatory penalties that cause far more delays than upfront screening would have.

From Policing to Partnering

ESG due diligence enables companies to find and build relationships with the right suppliers. And procurement teams are uniquely positioned to elevate ESG from a set of checklists to a strategic lever for supplier value creation. With smarter segmentation, real-time data and a collaborative approach, ESG due diligence can become a catalyst for better supply chains.

The question isn’t just: Are your suppliers ESG-compliant?

It’s: Are they ESG-capable—and is your procurement process helping them get there?

Also Read: ESG CONSULTING SOLUTIONS & SERVICES