Rethinking Procurement: Should You Start With Intake or Just Procure?

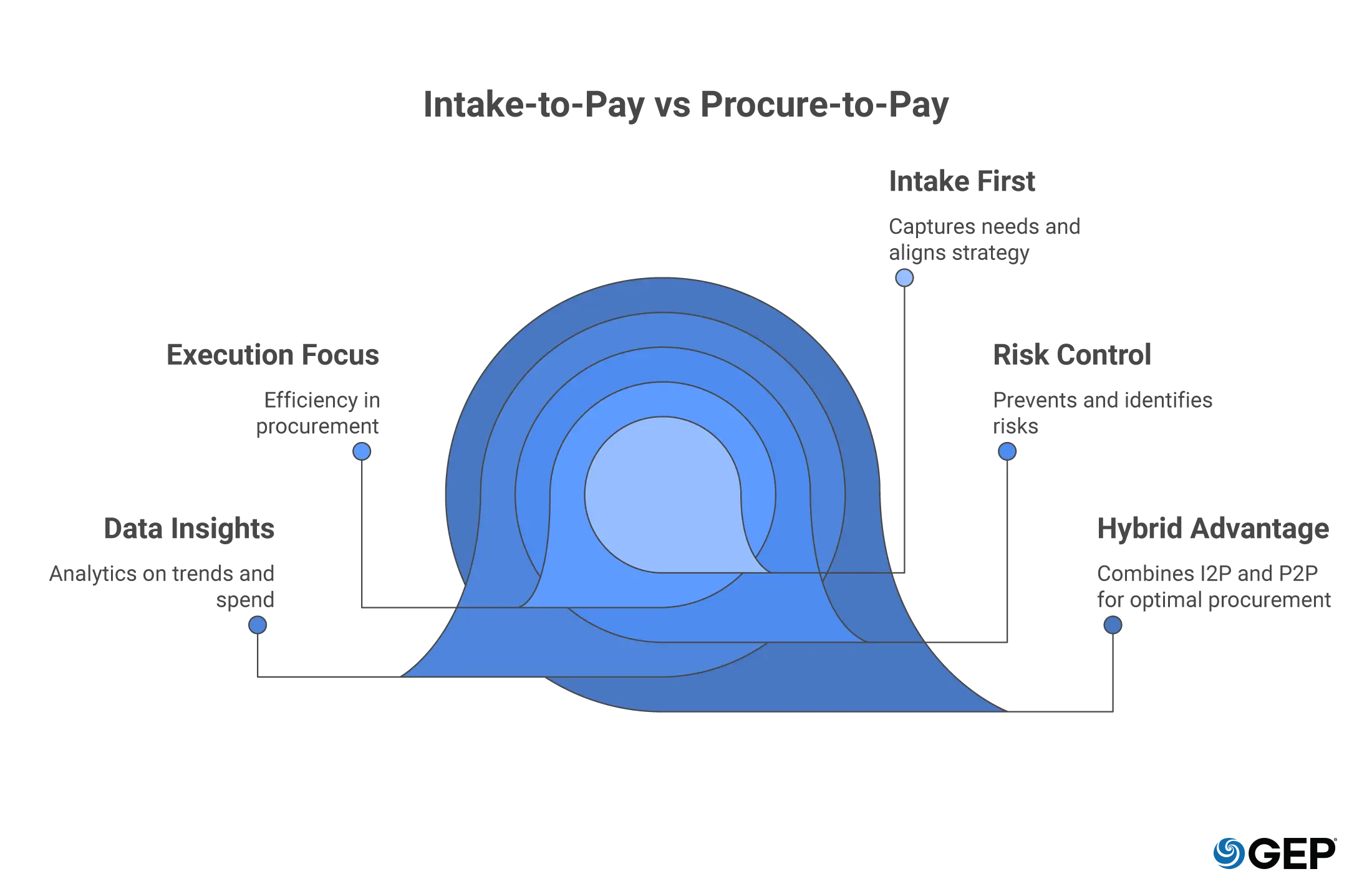

- Intake-to-pay puts strategy up front—capturing the “why” before the “what.”

- Procure-to-pay shines in execution—great for teams with mature procurement systems.

- The best approach might be a hybrid: use I2P for high-impact needs and P2P for everyday purchases.

October 01, 2025 | Cost Management 5 minutes read

In a world where every dollar counts and agility is key, the way businesses handle purchasing and payments is evolving—fast. That shift has brought new attention to procurement workflows, especially the traditional procure-to-pay (P2P) model and its more flexible, modern counterpart—intake-to-pay (I2P).

So, what’s the difference? And why does it matter now?

P2P has long been the default method for managing purchasing from requisition to payment. But I2P offers a fresh take—starting the process earlier by capturing stakeholder needs in a more strategic and structured way.

Both models lead to the same goal—paying the supplier—but how they get there, and the benefits they unlock, vary significantly.

In this article, we’ll walk through each model, highlight how they stack up, and explore which one might make the most sense for your organization’s needs today.

Ready to streamline intake and procurement into one seamless process?

Talk to our experts to see how GEP can help align intake, procurement, and payments with business goals.

What is Intake-to-Pay (I2P)?

Intake-to-pay (I2P) is a more modern, front-loaded approach that covers everything from the moment someone has a need, all the way to paying the supplier. What makes I2P different is that it puts a strong focus on the intake—making sure every request is well thought out, justified, and aligned with company goals before any procurement actions begin. The payoff? A smoother, more strategic, and more efficient process overall.

• Requisition and Initial Assessment

It all starts with someone submitting a request—usually through a user-friendly intake form. But instead of a basic form that just asks what they want to buy, the system asks for things like urgency, purpose, and business impact. This gives decision-makers more context to work with.

• Budget and Compliance

Next, the system checks whether the request fits within budget limits and follows internal rules or regulations. This built-in check helps stop unnecessary approvals and keeps spending in line from the start.

• Procurement Process

Only once everything checks out does the request move into the procurement stage. That’s where sourcing, supplier engagement, and contracting happen—but now, procurement is focused only on well-vetted, high-priority requests.

• Invoice Processing

Once the goods or services are delivered, the invoice gets matched automatically with the original request and purchase order. That cuts down on errors and delays.

• Making the Payment

Because everything is aligned upfront, the final payment step is smooth and quick. Vendors get paid on time, and finance teams aren’t chasing down missing information.

Introduction to Procure-to-Pay (P2P)

Procure-to-pay (P2P) is the traditional model. It handles the process from requisition to payment but usually skips the structured intake part that I2P focuses on. P2P is widely used and supported by many procurement platforms. It works best when your purchasing process is already streamlined.

• Requisition and Need Identification

In P2P, a stakeholder recognizes a need and submits a requisition. But this usually lacks the deeper business context that I2P intake forms provide.

• Requisition Approval

The requisition goes through approval workflows, which can be slow or inconsistent depending on how teams and systems are set up.

• Supplier Selection

After the requisition is approved, procurement steps in to source suppliers, negotiate terms, and issue purchase orders.

• Invoice Processing

Once a supplier delivers the product or service, they send an invoice. That invoice has to be matched with the PO and the goods receipt—often manually.

• Payment Authorization

After validation, the invoice is routed for payment approval. If there were issues in earlier stages, this can delay payment.

• Vendor Management

Vendors are typically managed after the fact, and the tools used may not be fully integrated with the rest of the P2P cycle.

Intake-to-Pay and Procure-to-Pay – Key Differences

Let’s dig into how these two models compare:

Aspect | Intake-to-Pay (I2P) | Procure-to-Pay (P2P) |

|---|---|---|

| Scope | Begins with request intake and covers the entire procurement lifecycle. | Starts after a need is identified and focuses on procurement execution. |

| Emphasis | Focuses on early alignment, governance, and validation. | Focuses on efficiency and transactional accuracy. |

| Request Management | Uses structured intake workflows to ensure context and business justification. | Often lacks formal intake, leading to inconsistent request quality. |

| Analytics | Provides insights into intake trends, bottlenecks, and stakeholder engagement. | Offers spend analytics and post-approval procurement insights. |

| Automation | Automates intake routing, policy checks, and early-stage triage. | Automates PO creation, three-way matching, and invoice processing. |

| Risk Management | Prevents compliance and budget risks before procurement starts. | Identifies and resolves risks later in the process. |

| Stakeholder Alignment | Fosters collaboration from the beginning between business units, finance, and procurement. | Stakeholders are often engaged in isolated steps, reducing visibility and ownership. |

Ready to Elevate Your Procurement Function?

Discover how leading organizations are building smarter, more resilient procurement teams—starting with the right pillars.

Intake-to-Pay or Procure-to-Pay — What is Better for the Business?

So which one should your business use? That depends on where your challenges lie.

- If you’re dealing with off-the-books spending, vague requests, or too many one-off purchases, intake-to-pay helps you take back control.

- If your procurement process is already humming along and you just want to improve speed and scalability, procure-to-pay might be all you need.

Bring I2P and P2P Together

Many companies are finding success with a hybrid approach—using I2P for strategic purchases and P2P for routine buying. It’s about choosing the right tool for the job. Procurement isn’t what it used to be—and neither are the tools we use to manage it. Intake-to-pay brings strategy, alignment, and foresight into the process. Procure-to-pay brings structure, speed, and efficiency.

At GEP, we help businesses bring both together—so procurement teams can move faster without losing control. Knowing how these models work gives you a better shot at building a process that actually works for your people.

FAQs

What is the main goal of the Intake to Pay process?

Intake-to-pay is designed to bring order and strategy to the very start of the procurement process. By validating requests early and checking for alignment with budget and policy, it helps organizations avoid errors and make better decisions from the get-go.

How can companies improve their procure-to-pay cycle?

Want to strengthen your P2P process? Try this:

- Standardize how requests and approvals work

- Connect procurement and finance systems

- Automate tasks like invoice matching

- Monitor vendor performance with solid KPIs

Consider using this procure-to-pay solution for better visibility, control, and scale

How can digital transformation impact the Procure to Pay process?

With digital tools in place, the procure-to-pay process becomes faster, more accurate, and easier to manage. Automation reduces manual work, integrations improve data flow, and analytics provide real-time visibility. It’s a big step up from spreadsheets and email chains.