Effective Category Management Strategy: A Practical Playbook for Category Managers in Procurement

- Turn isolated procurement activities into a disciplined operating model.

- Manage goods and services strategically by aligning cost, risk, suppliers, and business goals.

- Map sourcing strategies with the Kraljic Matrix to build an effective category management framework using AI.

October 01, 2025 | Procurement Strategy 11 minutes read

In the life of a category manager, change is constant, with most of it being absolute chaos.

Markets can shift overnight, suppliers push back, and costs shoot up. Yet budgets and timelines stay fixed while leadership demands answers you don’t yet have.

When time isn’t on your side, a reliable category management plan that executes flawlessly in virtually any situation can be your biggest win. Think back to every setback. What did you need in that moment?

Fewer surprises? Better supplier support? Real-time visibility? Strategic moves that keep supply, spending, and compliance in check?

That’s the promise of a strong category management strategy: it takes the chaos and turns it into decisions you can stand behind. It shows what to buy, where, at what price, what risks to expect, and how to do it right. And with the correct digital platform in place, this process plays out in real time.

This blog covers everything from understanding why category management matters to building a framework you can actually rely on, regardless of how unpredictable things get.

What is category management?

Category management treats a set of related goods or services as a portfolio. This portfolio has well-defined objectives, a market view, supplier records, and sets the rules that make buying repeatable and measurable.

Instead of handling every contract or supplier separately, procurement teams define categories and build strategies for each. It enforces a category management plan for each portfolio and tracks demand shaping, sourcing practices, contracting, supplier performance, and risk reduction.

Talk to our Expert

What does a category management plan include?

A strong category management plan defines the scope, targets, priorities, risks, market analysis, supplier management approach, chosen strategy and roadmap, KPIs, governance, and corresponding schedules.

A successful category plan becomes the playbook for how sourcing events are run, how suppliers are reviewed, and how savings and performance are sustained over time.

Done well, it aligns procurement decisions with broader business goals, not just short-term savings.

What does a category manager do?

The role of a category manager is to maintain supplier relationships, negotiate contracts, and ensure that they get the best value for purchases.

Category managers are often the primary point of contact for suppliers, managing relationships, performance, and negotiations. They analyze market shifts, map opportunities and risks, and develop and execute a category strategy. They work in collaboration with key business units to align the category strategy with company objectives.

Types of categories in procurement

In procurement, categories can be broadly classified into direct and indirect categories. Each category requires a different approach.

• Direct categories

These are critical materials and components that would end up in the final product or packaging: electronics, textiles, automotive parts, and plastics. These direct categories require close technical collaboration with operations and quality departments.

• Indirect categories

These are non-critical items that support the business but are not part of the final product: office supplies, software licenses, safety gear, utilities, and maintenance equipment. These favor standardization, catalog control, and channel rules.

• Services

These are external services that companies need. Companies prioritize deliverables, rates, and compliance over per-unit price for logistics, recruitment, auditing, IT support, training, and creative services.

Each category requires a unique strategy to manage effectively.

Why category management matters (concrete outcomes)

Good category work delivers measurable results beyond a single negotiated contract. Expect:

- Lower total cost of ownership through consolidation, spec simplification, and smarter replenishment.

- Fewer off-contract buys and shorter purchase order cycle times when catalogs and approvals mirror the plan in procurement systems

- Better supplier performance because contracts include KPIs, quarterly reviews, and remediation paths.

- Reduced continuity risk via multi-sourcing, safety stocks, or regionalization where logistics or trade rules demand it.

- More actionable analytics when GL mapping and clean master data make spend visible.

These gains are repeatable and measurable.

The Agentic AI Playbook for Procurement Pros

Your roadmap to moving from pilots to production, with AI that adapts, learns, and delivers.

Strategic Sourcing vs Category Management

Strategic sourcing is the process of identifying and selecting suppliers that can provide the best value for a specific category. It is a critical component of category management.

Category management takes a broader view by not only focusing on sourcing but also on managing the performance and value of the entire category over time.

Strategic sourcing is an event-driven process: running RFIs, RFPs, or auctions to secure supplier terms. Category management decides when to run those events, which levers to use, how to segment suppliers, and how outcomes translate into contracts, catalogs, and workflows.

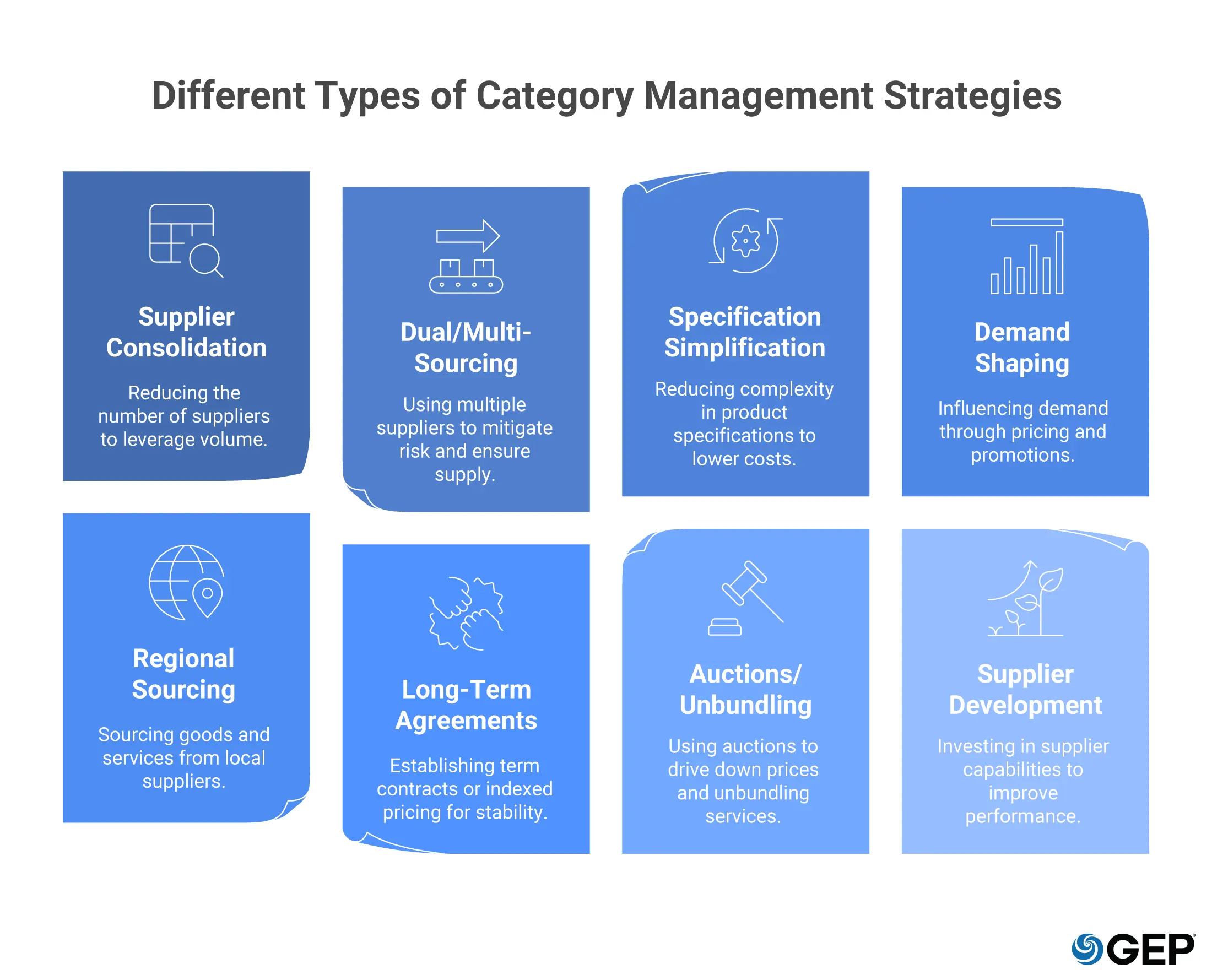

Types of category management strategies: When to choose them, and why

There is no universal solution. The right strategy depends on two questions you need to answer upfront: How important is the item, and how risky is the supply?

Those answers shape the game. Below are some of the most useful category management strategies for you to choose from:

• Supplier consolidation

Strategy: Buy more from fewer suppliers when items are standard and lots of suppliers exist in the market. That simplifies contracts and often improves price.

Risk: If one supplier fails, you’re exposed.

Keep a contingency plan ready in volatile markets so you don’t sacrifice continuity for a small unit cost saving.

• Dual or multi-sourcing

Strategy: Critical items shouldn’t sit with one supplier when the item is critical. Splitting volumes between two or more vendors reduces single-point failure risk.

Risk: Slightly higher average cost because you lose scaling benefits. Use competition between suppliers to keep pricing sharp and align contracts with clear performance benchmarks.

• Specification simplification

Strategy: Reduce the number of product variants when the organization is buying too many similar parts or materials. Cut down on similar parts and shift to standard Stock Keeping Units (SKUs) to make purchasing, inventory, and quality management cleaner.

Risk: Pushback from stakeholders who want specific features or legacy variants. You can show should-cost analysis and quality performance comparisons to justify changes.

• Demand shaping

Strategy: Change how the business consumes the category when usage behavior is driving costs and not supplier pricing.

Risk: Resistance from users who feel they’re losing flexibility or control. Build service-level agreements with clear availability targets.

• Regional sourcing

Strategy: Regionalize the supply chain to source materials to where consumers are when imports result in long lead times, increased inventory, and customs risks, or when customized products are needed.

Local sourcing lowers shipping and logistics expenses, avoiding import duties, tariffs, and taxes. It can also lead to shorter supply chains and more sustainable sourcing.

Risk: Higher landed cost compared to global low-cost suppliers. Critical resources might not be available locally. Run a total cost of ownership (TCO) model and opt for hybrid sourcing for items that are better off being sourced globally.

• Long-term agreements

Strategy: Use multi-year contracts when suppliers need assurance before scaling for your demand. In volatile markets and when supplier costs spike, tie raw material prices to a published index (e.g., steel, oil, chemicals) to keep costs fair.

Long-term agreements work when you want stability over multiple years, where you commit to volume and the supplier invests in capacity. Indexed pricing ensures continuity without burning through your budget as prices adjust monthly or quarterly with the index.

Risk: If market prices fall, you may be locked into above-market rates, or index swings may create budget volatility. Build flexibility with price adjustment clauses, volume bands, review checkpoints, and guardrails like floors and ceilings.

• Auctions and unbundling

Strategy: Break down packages and run reverse auctions online when specifications are clear and the market is competitive.

Breaking packages apart helps, too. Splitting labor from spare parts in a maintenance contract and auctioning each part increases contestability and opens up more supplier options.

Risk: Overemphasis on price can hurt quality or service. Prequalify suppliers thoroughly before the auction and apply weighted scoring for non-price factors.

• Supplier development and Innovation

Strategy: Help suppliers improve when a supplier is weak but critical. Build supplier capability in quality and uptime. Address quality issues with audits, corrective actions, and kaizen workshops.

Pilot new materials or services with startups, but clear legal and security gates first so pilots scale quickly when successful.

Risk: Requires an investment of time and money without a guaranteed payoff. Define clear improvement targets upfront, use phased milestones, and exit if progress stalls.

Each category needs its own plan that prepares for different market scenarios.

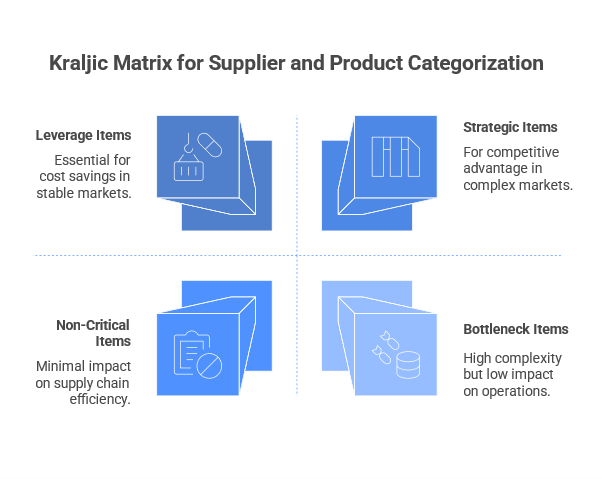

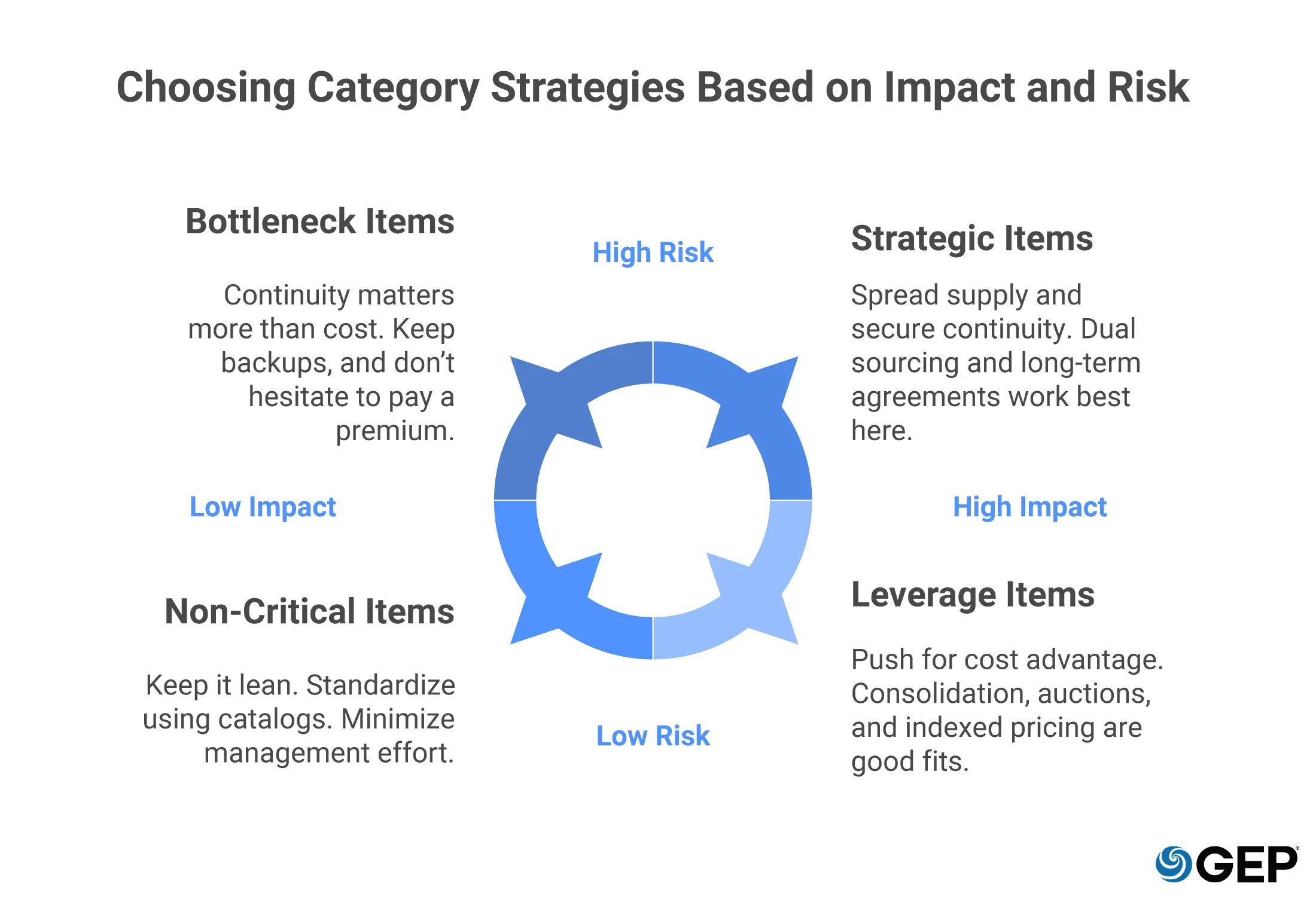

The Kraljic Matrix sets the direction by showing how each category should be managed based on business impact and supply risk.

It answers key questions like which suppliers have the most volume, where the quality or continuity risks are, what can be optimized, and how purchases will be kept on-contract.

That insight feeds directly into your category management plan.

How to Build a Category Management Strategy using Advanced AI Capabilities?

An intelligent category management plan works as a structured roadmap. It brings together spend data, purchase volumes, market trends, and supplier profiles, while also setting out the ideal sourcing approach and RFx methods for each category.

A good category plan answers three questions: what to buy, who to buy from, and how to respond if conditions shift.

1. Scope and Objectives

What it delivers

A signed one-page scope with KPIs and targets for cost, continuity, quality, sustainability, and compliance.

Natural language pulls key points from meeting notes and briefs. Intent classification ranks competing requests and highlights trade-offs. Upload minutes, and you get a draft scope with three to five targets ready for sign-off. That single step cuts weeks of back-and-forth.

2. Analyze Current Spends and Demand

What it delivers

A clean spend baseline and a reliable view of demand.

Monitor category spend and identify trends by commodity, business unit, region, and supplier. Clean 12–24 months of data. Leverage intelligent spend views: global supplier regional spend, actual vs. budget, contracted vs. non-contracted spend by category, and more. Normalize units and flag one-offs and recurring demand patterns.

AI classifies spend into the right taxonomies, like the United Nations Standard Products and Services Code (UNSPSC), standardizes units, and links fragmented data back to their parent groups. It also flags outliers, separates recurring demand from one-offs, and generates demand forecasts with more accuracy than manual trending. The result is a consolidated ledger, monthly forecasts, and a flagged list of unusual transactions.

3. Segmentation and Market Scan

What it delivers

Prioritized categories and supplier segments with market signals built in.

Map items on a Kraljic matrix. Review supplier capacity, cost drivers, and regulatory or geopolitical risks.

AI clustering tools can place items and suppliers into a Kraljic matrix, while natural language processing scans filings, press reports, and regulatory updates to enrich supplier profiles.

Forecasting models project commodity or freight indices up to two years ahead. With those signals in hand, you can see which categories need extra attention and which are stable enough to leave as they are.

4. Evaluate Cost and Risk

What it delivers

Cost benchmarks you can test against and supplier risk scores you can trust.

Predictive models flag delays or quality risks before they become visible in delivery reports. Build should-cost models for high-value items and test vendor quotes against the model.

Should-cost models break an item into inputs such as material, labor, freight, and tariffs, showing what a fair price range should look like. Scenario engines then stress-test the numbers — for instance, what happens if energy costs double or if wage rates rise sharply.

Risk scoring combines financial health indicators with compliance findings like Service Organization Control 2 (SOC 2) audit exceptions. With this, you can compare quotes against the benchmark, score potential failure modes by likelihood and impact, and record escalation points with clear ownership.

5. Stress-Test and Choose a Strategy That Fits

What it delivers

Compare scenarios, select strategies, and document what the plan will and will not do.

Total Cost of Ownership (TCO) models test different scenarios. It could be single supplier versus split awards, fixed-price contracts versus spot buying, or make versus buy, depending on what matters most for that category. Optimization engines test mixes under constraints like supplier capacity or diversity requirements.

The output is an automated scoring that shows the cost impact, risk exposure, and operational complexity of each option. You review three to five scenarios, select the best path, and carry those assumptions into the plan for governance.

6. Develop an Executable Plan and Operationalize

What it delivers

An executable plan with a sourcing calendar, key performance indicators, and preloaded contract obligations.

Jot it all down: scope, targets, sourcing calendar, KPIs, and governance. Then load contracts, publish catalogs, and align approvals. AI tools can pull threads together quickly. Generative models write the plan narrative and calendar in a consistent format.

Contract analytics lift renewal dates and obligations straight out of documents using OCR and natural language processing. The result is a plan that’s published with key dates already locked in, plus a sourcing calendar that operations can act on immediately instead of waiting around.

7. Plan Supplier Selection and Onboarding

What it delivers

Find the right RFx types (RFIs/RFPs) that apply, followed by structured AI evaluation for supplier onboarding.

RFx assistants suggest event types and scoring weights. Response summarization condenses supplier bids. Automated verification and scoring models speed up prequalification and onboarding, flagging outliers. The supplier onboarding process includes automated document capture and data enrichment.

Negotiation recommendation engines can suggest price targets and realistic negotiation pointers based on current market shifts. Catalog engines convert sourcing outcomes into entries and approval flows.

8. Measure and Adapt

What it delivers

A category plan that keeps a record of every decision and is updated in real time.

Track KPIs monthly, refresh market intelligence, and update the plan after major shifts.

Dashboards show how things are running in real time: scored shortlists, award recommendations, KPI tracking, and early alerts when metrics start slipping. That gives managers the chance to step in early and prevent expensive misses.

Whether monitoring supplier metrics and spend patterns or using anomaly detection for automated change logs explaining why decisions were made, AI keeps you in the loop at all times. It also learns from outcomes to improve forecasts and future award recommendations.

Conclusion

An effective category management plan provides category managers a buffer when markets fluctuate, suppliers change courses, and costs climb. It prepares you for the worst and sets expectations right from the start. Everyone can get on the same page, as stakeholders know the scope, strategy, and deliverables early on.

And yes, expect friction. But that’s part of the process. If you track every change made and what led to it, it will help you optimize for when you hit similar hurdles in the future.

With GEP’s Intelligent Category Management software, the only AI-driven, end-to-end solution, category managers gain real-time visibility and control across every category activity.

Frequently Asked Questions

Procurement categories are groups of related commodities or services that share demand and supply factors and suppliers. The categories differ depending on the size and kind of organization and the supply market.

Broadly speaking, a category is a group of related goods or services based on broadly similar characteristics, such as packaging category and energy category.

Why do Procurement Categories Exist?

Procurement categories have the potential to enhance procurement procedures and boost business efficiency. Procurement categories can help achieve the following:

- Create a focused procurement strategy for related goods/services

- Improve your understanding of your organization's procurement spending

- Produce substantial savings

- Make arrangements for aggregated supplies to cover a category of several transactions

- Instead of pursuing numerous vendors for different things, figure out how much your company spends on all stationery items and the type of items

An enterprise can reach an arrangement with one or a small number of vendors to fulfill its needs. This strategy can result in considerable savings and increased procurement efficiency.

Categories and Subcategories of Procurement

The procurement categories need to be broad enough to allow for competition in the market. Around ten broad categories should be enough to cover a large portion of your organization's spending. Where there is a requirement for additional differentiation, a variety of products or services may include subcategories, as follows:

Category

A set of commodities or services that share demand and supply factors and sources

Subcategory

A reasonable subgrouping of market/services/goods features within a category

Procurement categories with similar descriptions can further be divided into sub-categories based on unique characteristics of the materials.