Latest Trends in Indirect Procurement Outsourcing Services: From Cost to Operational Control

- Indirect procurement outsourcing now centers on cycle-time reduction, compliance, and risk control rather than labor savings alone.

- Providers that combine automation with strong data governance deliver more consistent outcomes across services-heavy categories.

- ESG accountability and supplier risk management will define outsourcing success as much as negotiated savings.

January 29, 2026 | Procurement Strategy 4 minutes read

Indirect procurement rarely gets attention until it breaks. Marketing can’t onboard an agency. IT waits weeks for a license renewal. Facilities scramble when a contract lapses. These categories look small on paper, but together they touch every employee and every dollar that does not go into raw materials or production.

Over the last decade, many organizations outsourced indirect procurement to cut headcount and stabilize costs. That logic still holds, but the expectations have shifted. Leaders now want tighter control, faster cycle times, better supplier behavior, and cleaner data. Outsourcing providers face pressure to deliver all of that while navigating inflation, ESG scrutiny, and constant disruption.

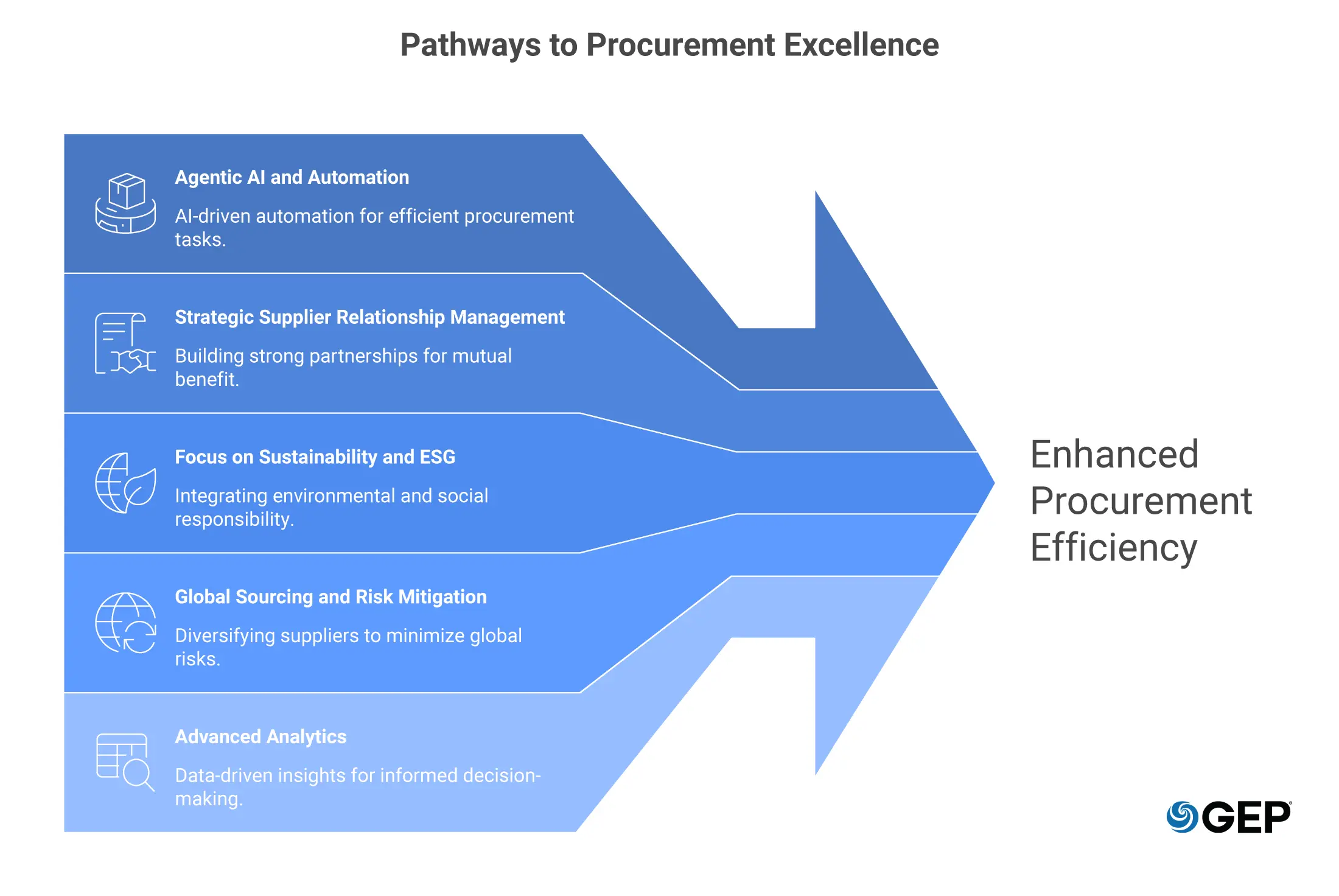

What follows are the key trends shaping indirect procurement outsourcing today, and why they matter.

Ready for Procurement Success?

Explore how autonomous AI agents can supercharge your procurement transformation

Agentic AI and Automation

Indirect procurement outsourcing now blends automation with agentic AI that can act, not just assist. Automation still handles intake, routing, catalog checks, and invoice matching at scale. Agentic AI goes further by validating demand, checking contract coverage, assessing supplier risk, and triggering sourcing actions within defined limits, without waiting for manual intervention.

Most outsourcing providers continue to rely on static, rules-based workflows. Those flows hold up in predictable categories such as office supplies or MRO. They fail in services, IT, and contingent labor, where specifications shift and risk surfaces mid-process. Agentic AI adjusts in real time by changing sourcing paths, escalating exceptions, or pausing awards when thresholds are breached. That adaptability depends on context, not preset scripts.

Data quality still sets the ceiling. Incomplete supplier records, weak taxonomies, and inconsistent intake inputs restrict how much autonomy agents can safely assume. GEP research shows organizations operating outsourced procurement on unified source-to-pay platforms achieve faster requisition-to-order cycles and higher contract compliance than those running fragmented systems. Agentic AI only scales when the data foundation stays clean and connected.

Strategic Supplier Relationship Management

Indirect procurement outsourcing used to focus on volume consolidation and rate cards. That approach misses the point for categories driven by performance rather than unit price. Agencies, consultants, software vendors, and facilities partners shape outcomes that finance alone cannot measure.

Leading outsourcing providers now embed supplier governance into their operating model. Quarterly business reviews, scorecards, as well as issue tracking sit alongside sourcing activity.

Some providers assign category leads who stay with key suppliers across regions, instead of rotating buyers through queues. This shift reflects a broader change in expectations. Procurement leaders want fewer suppliers, clearer accountability, and documented performance trends. Outsourcing partners that treat supplier management as administrative work struggle to keep pace. Those that act as stewards of the supplier base earn longer contracts.

Focus on Sustainability and ESG

Indirect categories carry real ESG exposure. Travel, marketing, logistics services, and IT hardware leave visible footprints. Regulators and investors now expect proof, not statements.

Outsourcing providers respond by embedding ESG checks into onboarding and sourcing. They track diversity certifications, emissions disclosures, labor practices, and regional compliance rules. The challenge lies in consistency. ESG data arrives in different formats and rarely updates on a predictable schedule.

Research shows that procurement service providers increasingly differentiate through ESG reporting depth rather than sourcing scale alone. Buyers ask for audit-ready documentation and category-level impact tracking. Providers that cannot supply verifiable data risk losing relevance as ESG reporting deadlines tighten.

Global Sourcing and Risk Mitigation

Indirect procurement once favored local suppliers and long-standing relationships. That model fractured under global shocks. Currency swings, regional shutdowns, sanctions, and tariffs exposed how fragile service supply chains can be.

Outsourcing providers now map supplier risk beyond tier one. They monitor geographic concentration, financial health, and regulatory exposure. Some build alternative supplier pools before disruption hits. Others integrate third-party risk feeds into sourcing workflows.

GEP data shows procurement leaders rank resilience and risk visibility above pure cost savings when evaluating technology and procurement services investments. Outsourcing partners that still sell labor arbitrage struggle against those offering structured risk controls and faster pivots.

Advanced Analytics

Analytics has moved from monthly spend reports to real-time monitoring. Procurement outsourcing services providers increasingly commit to outcome-based metrics such as cycle time reduction, compliance improvement, and supplier consolidation rates.

The hardest part remains normalization. Indirect spend data arrives messy, incomplete, and inconsistent across regions. Advanced analytics only work when providers invest upfront in taxonomy discipline and ongoing governance.

Gartner research consistently highlights data quality as the main constraint on procurement analytics maturity. Providers that treat analytics as an add-on dashboard rarely deliver sustained improvement. Those that bake analytics into daily workflows change behavior over time.

GEP Outlook Report 2026

Explore the dynamics shaping procurement & supply chain and know how to navigate them in 2026

Looking Forward

Indirect procurement outsourcing will increasingly look less like a back-office service and more like an operating partner. Buyers will expect providers to manage complexity, not just transactions. Agentic AI will assist, but humans will still arbitrate trade-offs in services-heavy categories. ESG reporting will become contractual, not optional. Risk monitoring will sit permanently in sourcing decisions rather than surface during crises.

The providers that succeed will keep their models grounded. Clean data. Clear governance. Defined accountability. Outsourcing will not disappear. It will simply grow up.

FAQs

Savings usually come from demand control, contract compliance, and supplier consolidation rather than price cuts alone. Organizations often see lower maverick spend and fewer rush purchases once intake and approval flows stabilize. Over time, reduced cycle times and fewer disputes also cut operating costs.

Cycle time from request to order remains a core metric, especially for employee-facing categories. Contract compliance, supplier performance scores, and issue resolution rates provide a clearer picture of control. Mature programs also track risk incidents and ESG coverage by spend category.