What are Purchase Return Notes & How They Benefit Procurement?

- Returns aren’t the issue; poor return tracking is. A Purchase Return Note fixes that.

- It connects finance, inventory, and procurement to ensure that everyone works with the same data.

- Handled right, it doesn’t just record returns, it protects value and supplier trust.

September 08, 2025 | Procurement Strategy 5 minutes read

Returns aren’t the exception in procurement: they’re routine. Items show up damaged, out of spec, or are simply no longer needed. The real problem isn’t that returns happen. It’s what happens when they’re not tracked properly. That’s where friction starts: mismatched inventory counts, incorrect payables, and confused suppliers.

And here’s the thing: businesses that handle returns well don’t just avoid chaos. They actually recover more value. It helps optimize processes and reduce liabilities.

A Purchase Return Note is the operational link that makes that possible. It connects procurement, finance, and inventory by documenting exactly what’s going back, why, and how it affects your systems.

In this blog, we’ll look at what a purchase return note really does, how it fits into your workflows, and why teams that take it seriously are saving more money — and saving themselves a lot of rework.

Struggling to Track Returns Accurately?

Build a return process that’s fast, clean, and easy to manage.

Understanding Purchase Return Notes

At its core, a Purchase Return Note is a document your team issues when sending goods back to a supplier. It lays out what’s being returned, how much, and for what reason. This isn’t just paperwork; it’s a checkpoint that aligns your systems with reality.

The return note ensures your inventory doesn’t keep showing stock you’ve already shipped back. It also gives your finance team the documentation they need to adjust liabilities or costs. Whether you work in manufacturing, healthcare, retail, or services, this is the mechanism that formalises returns and keeps the numbers clean.

To simplify it:

A purchase return note is created when goods bought from a supplier are returned, whether due to quality issues, overstock, incorrect deliveries, or damage.

Key Details

A good return note is both specific and traceable. It typically includes:

- Supplier name and contact info

- Return note number and date of issue

- Reference to the original purchase invoice

- Details of the returned items (name, quantity, unit of measure)

- Clear reason for return

- Return location or warehouse ID

- Signatures or approvals from relevant stakeholders

Once created, the note is logged in your purchase return book, and used to update the return account, inventory account, and relevant financial records. In a connected system, this can all happen automatically — but the note still sits at the center as the source of truth.

The Role of Purchase Return Notes in Financial Statements

• Influence Accounts Payable

When you return goods to a supplier, you shouldn’t still be showing the full amount as payable. The purchase return note helps adjust that automatically. It reduces the liability in your system so you're not sitting on inflated numbers or paying for items you no longer have.

• Correct Income Statement

Returns aren’t just physical — they impact your reported spend. If you don’t record a return, your total purchase cost stays higher than it should be. That eats into gross profit and skews performance metrics. The return note acts like a correction slip for your income statement, helping you reflect actual procurement impact, not just what was ordered.

• Reflect Actual Spending in Balance Sheet

Think of the return note as the control lever for your inventory account. When it’s missing, your assets are overstated. That makes everything from valuation to working capital decisions less reliable. Recording the return keeps your balance sheet grounded in what’s actually on hand.

• Update Inventory Records

Your warehouse may have sent the goods back, but unless the system shows that too, planning takes a hit. A return note triggers the system update so everyone — from the planning team to the reorder engine — is working with real numbers.

• Maintain Supplier Communication

Suppliers don’t love surprises either. A return note is how you close the loop. It tells them what’s coming back, why, and how much — with no guesswork. It also makes credit notes, replacements, or reconciliations easier to process on their side.

• Uphold Return Policies

This is where policy meets practice. Return notes ensure you’re not just sending goods back randomly. They document that you followed agreed return windows, conditions, and procedures. That protects you, keeps suppliers accountable, and avoids friction that can damage long-term relationships.

Ready to put agentic AI to work in procurement?

Download The Agentic AI Playbook to see how leaders shift from automation to autonomy.

What are the Journal Entries for Purchase Returns?

Credit Purchase Return

If the goods were bought on credit and are being returned:

Debit: Accounts Payable (to decrease liability)

Credit: Purchase Returns (to reduce recorded expense)

This reverses the impact of the original invoice and shows that the buyer no longer owes payment for the returned items.

Cash Purchase Return

If the purchase was made in cash:

Debit: Receivable (reflecting refund or future adjustment)

Credit: Purchase Returns (reducing the expense)

Both types of returns are recorded in the return account and matched to the purchase invoice to maintain transparency and traceability.

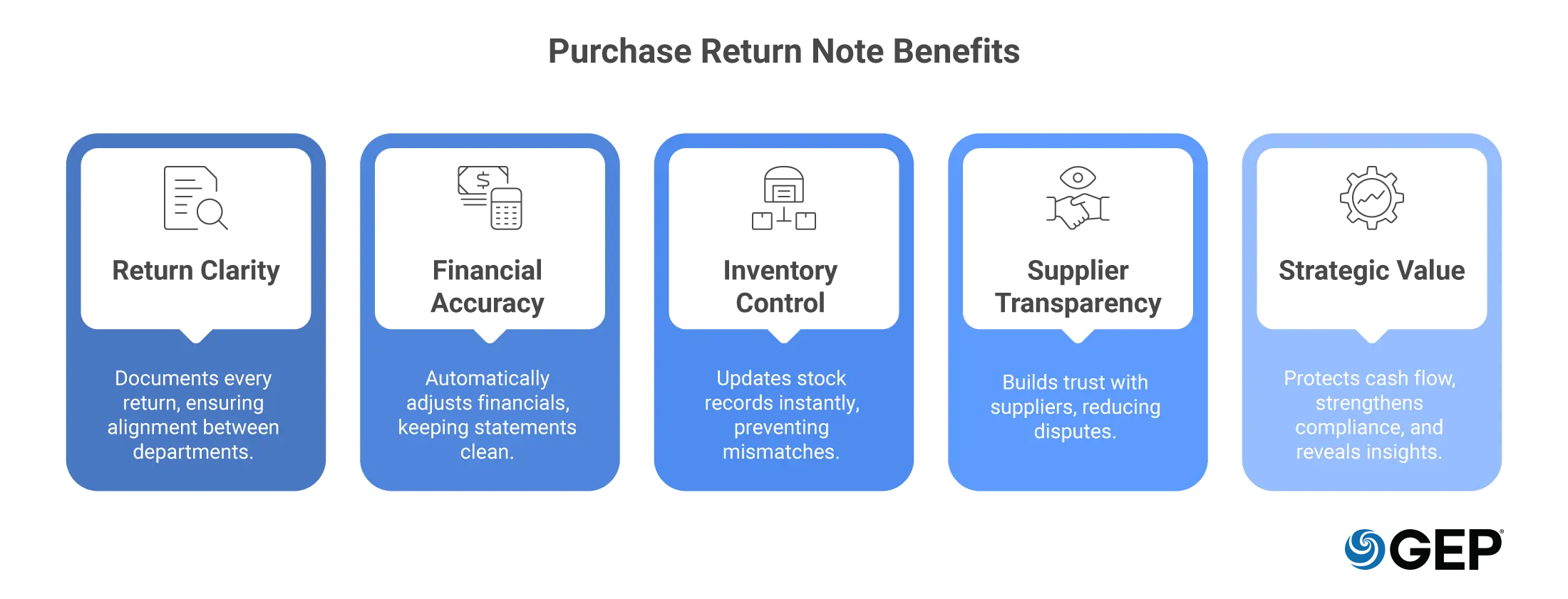

Benefits of Creating Purchase Return Notes

• Improved Inventory Management

When returns are properly logged, inventory stays accurate. This prevents overstocking, improves demand planning, and ensures space is allocated efficiently.

• Enhanced Decision-Making

Tracking returns helps procurement teams identify patterns. Frequent returns from a specific supplier might signal a quality issue. High return rates on certain SKUs may point to overordering or inaccurate demand forecasts.

• Accurate Financial Records

A return that isn’t documented creates mismatches in your books. A properly logged purchase return journal entry, linked to a return note, prevents errors during audits or month-end closing.

• Better Supplier Relationships

A return without documentation is a dispute waiting to happen. A return note removes confusion and supports smoother communication. Over time, it creates transparency that builds trust and accountability on both sides.

Why Purchase Return Notes Deserve a Strategic Role

Purchase return notes may seem like routine paperwork, but they hold strategic value. They reduce accounting risk, keep stock data clean, and help businesses stay aligned with supplier agreements.

Every returned item affects cash flow, operations, and reporting. A missing return note doesn’t just slow things down — it creates downstream issues in finance, procurement, and warehousing.

Leading procurement teams treat return notes as part of a broader procure-to-pay ecosystem. They ensure returns are logged with the same discipline as purchases and payments.

If your current return process is still manual, scattered, or disconnected from your systems, it may be time to streamline it. Using a purchase order tracking system can help you gain more control, clarity and automation to your returns.