The End of Cheap Scale: Why Resilience Is the New Efficiency in 2026

- The "bigger = cheaper" equation is broken: hidden costs like carbon taxes, geopolitical risks and ethical sourcing now often exceed the savings from rock-bottom prices.

- Investors now reward companies that build flexibility, adaptability and resilience into operations, not just those that maximize efficiency and utilization.

- Winning in 2026 requires C-suite alignment on metrics that explicitly price risk, moving beyond cost obsession to balance efficiency with resilience.

January 14, 2026 | Procurement Software 4 minutes read

The spreadsheet never lies. Or so we thought.

For decades, the math seemed irrefutable: double your volume, cut your unit cost by 20%. Build the biggest factory, negotiate the hardest, drive utilization to the limit. Finance loved it. Investors rewarded it. Procurement leaders built careers on it.

Then 2020 happened. Then 2022. Then 2024. Suddenly, the factories that looked brilliant at 95% capacity became single points of catastrophic failure. The suppliers offering rock-bottom prices turned out to be sitting in geopolitical crosshairs. Enterprises began to realize how fragile the "efficient" global network really was.

The era of cheap scale, where sheer volume automatically translated to competitive advantage, is over. Scale still matters in 2026, but the cheap part, the part where you could chase the absolute lowest cost while ignoring everything else, belongs to history.

When the Hidden Costs Became Visible

Here's what changed: the full cost of doing business finally showed up on the balance sheet.

Consider what a procurement decision looks like today versus 2015. A decade ago, Supplier A offered components at $2.50 per unit from a massive facility overseas. Supplier B quoted $2.75 from a regional plant. The choice was obvious: save a quarter per unit, multiply by millions of units, watch the savings roll in.

Now run that same scenario in 2026. Supplier A's facility is in a region facing new carbon border taxes that add $0.15 per unit. It's also in a trade corridor where tariff disputes erupt quarterly, so factor in a 3% disruption risk premium. Recent audits flagged labor practice concerns (i.e., add reputational risk to your ESG disclosures).

Suddenly, that "cheap" supplier is costing you $2.90 in true landed cost, plus the existential threat of a supply chain shutdown that could cost millions per day.

Sustainability is now a regulatory requirement with teeth. Geopolitical risk is a daily reality that can close borders overnight. Still think ethical sourcing is a nice-to-have? It's a brand-protection imperative in an age of instant social media scrutiny.

The companies still running 2015's playbook are learning this lesson the hard way. Their "efficient" networks are actually exposure maps, showing exactly where they're vulnerable when the next crisis hits.

The Friction Economy

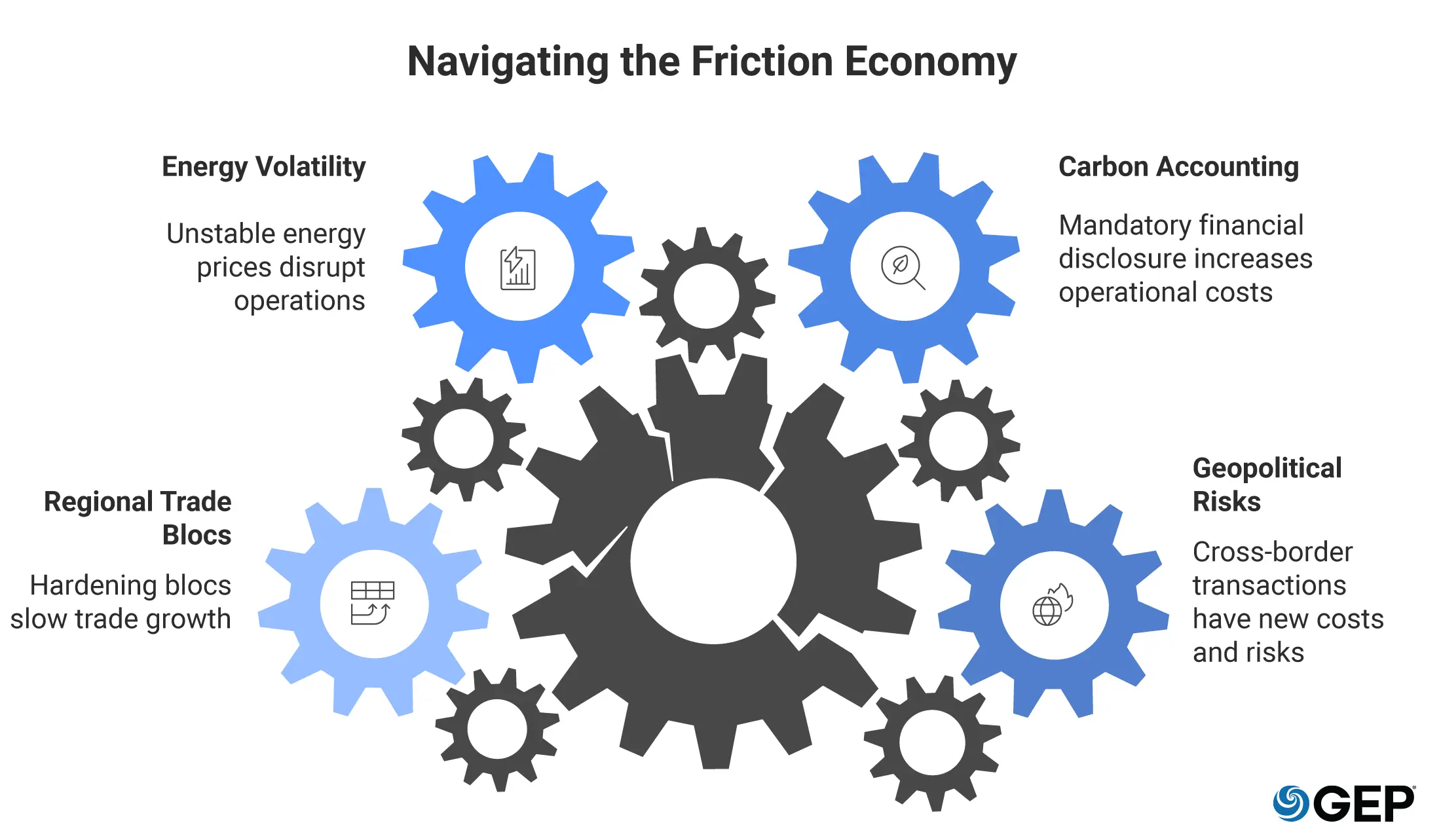

We've moved from a friction-free global economy to what might be called the "friction economy," where every cross-border transaction, every long-distance shipment, every centralized dependency comes with new costs and risks.

Trade still grows, but slower than GDP, a reversal of the trend that defined the early 2000s. Regional trade blocs are hardening, and energy volatility is the new normal. Meanwhile, carbon accounting has moved from voluntary reporting to mandatory financial disclosure.

The measure of efficiency has fundamentally shifted. It's no longer just "how much can you produce when everything goes right?" It's "how well can you maintain operations when things go wrong?"

What the Market Now Values

Boards and investors are starting to catch on. Investors in 2026 are paying premiums for companies that demonstrate genuine resilience, not just operational efficiency.

A telling example: two companies in the same sector, similar revenues, but Company A runs its factories at 95% utilization with paper-thin inventory buffers, while Company B operates at 80% with strategic slack built in. A decade ago, Company A would command a higher valuation for its superior efficiency metrics. Today? Company B trades at a premium because investors value its ability to absorb shocks without missing earnings guidance.

Resilience has moved from the "insurance" category to a core component of enterprise value. The companies delivering steady margins and credible guidance through volatility are rewarded. Those posting impressive efficiency metrics followed by surprise disruptions are punished.

Get the Strategic Clarity You Need to Navigate Volatility

Explore the Trends and Forces Shaping Global Supply Chains

Read Now

The Leadership Gap

Here's the uncomfortable truth: most organizations aren't structured to succeed in this new reality. The winners have fundamentally rethought how they measure value, how they model trade-offs, and how they align incentives across the C-suite.

They're building internal models that put explicit prices on risk. A high-disruption-probability supplier gets a surcharge in the cost model. A high-carbon supply route gets a carbon price layered in. These are practical tools that make trade-offs explicit and comparable.

More importantly, they're creating genuine C-suite alignment. When the CFO, COO and CSO evaluate options through the same lens, using metrics where the cost of risk is agreed upon by all parties, "balanced value" stops being a buzzword and becomes operational reality.

The Correction, Not the Crisis

The end of cheap scale isn't a problem to be solved. It's a market correction that's been overdue for years.

For too long, we externalized risk, ignored sustainability, and treated geopolitical stability as a given. We built supply chains optimized for a world that no longer exists. Now we're building for the world that does exist—one that's more complex, more regulated, more fragmented, and far less forgiving of brittle systems.

The companies that will dominate the rest of the decade aren't abandoning scale. They're redefining what successful scale looks like: large enough to capture efficiencies, but flexible enough to adapt; cost-conscious but not cost-obsessed; efficient but not fragile.

They understand that in 2026, competitive advantage doesn't come from having the cheapest supply chain. It comes from having the most balanced one—where efficiency, resilience, and responsibility work in concert rather than in conflict.

The spreadsheet still matters. But we've finally learned to fill in all the columns.

Want to explore how leading companies are navigating this transition? Download the full GEP Outlook 2026 report for detailed insights on the critical themes procurement and supply chain leaders need to be aware of in 2026.