How Multi-Agent AI Makes Invoice Reconciliation a Scalable, Self-Running System

- Multi-agent AI splits tasks between AI agents that work in parallel.

- AI agents can fix common discrepancies on their own.

- When volumes spike, you can scale up by activating more agents.

December 18, 2025 6 minutes read

If you’ve spent time in accounts payable, you’ve likely noticed where the flow usually breaks. It often begins with invoices arriving in a mix of formats, each one structured a little differently.

Most automation tools only work right when an invoice looks exactly the way the system expects. When something acts outside the rulebook, the workflow force-stops and waits for your team to handle it. Across large volumes, these interruptions add up, and the whole system crumbles.

Multi-agent AI can handle a high volume of exceptions exceptionally well. Instead of relying on one automated routine to carry the whole load, a group of specialized agents share specific tasks and may also work in parallel.

AI agents coordinate like an experienced team would, passing tasks among themselves and involving someone only when a critical judgment call is needed.

Let’s dive deeper into multi-agent AI in invoice reconciliation.

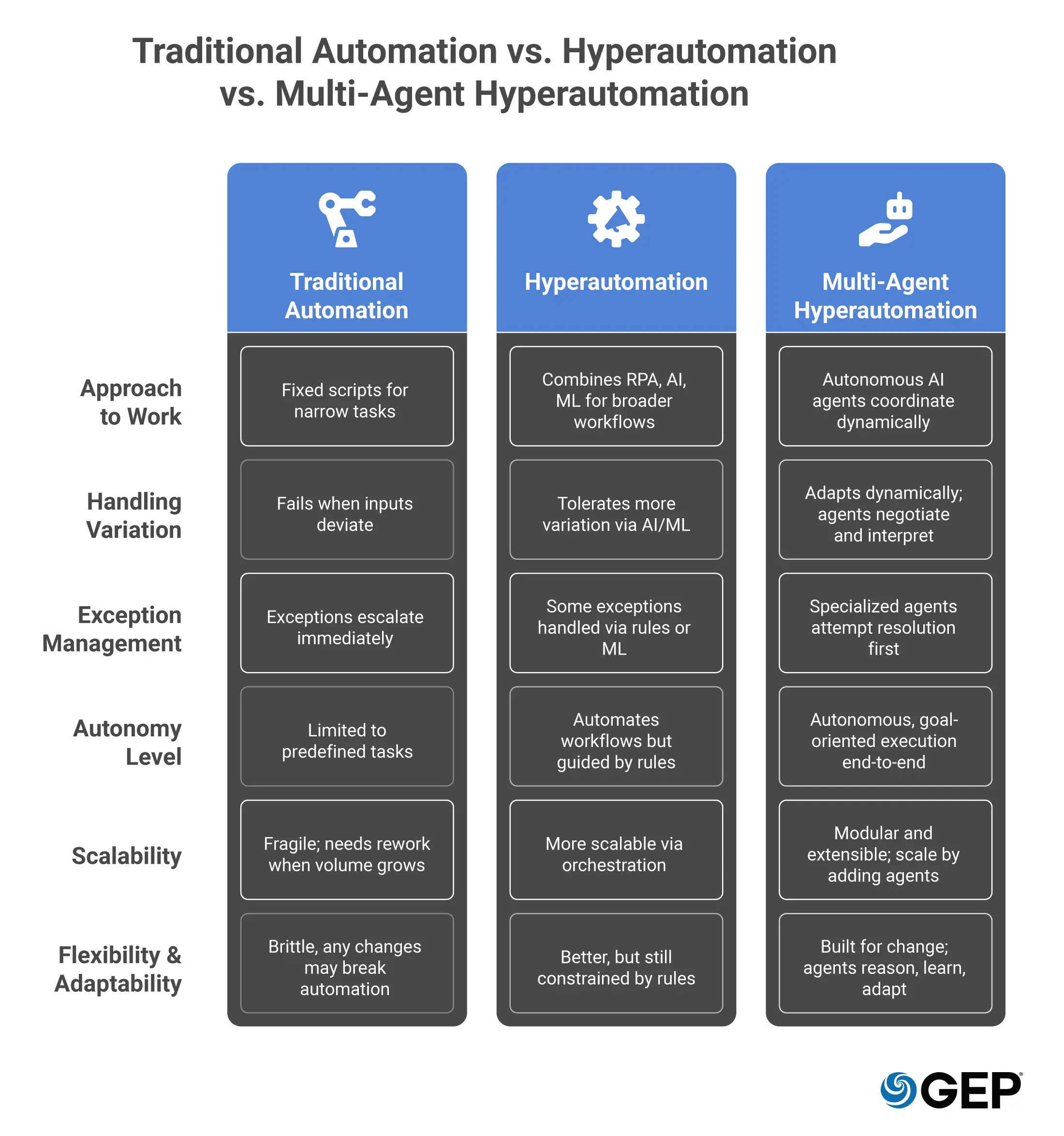

Traditional vs. Hyperautomation vs. Multi-Agent Hyperautomation

Traditional automation sticks to fixed rules and doesn’t adjust once those rules are set. It’s built around scripts, Robotic Process Automation (RPA), macros, and template-based Optical Character Recognition (OCR). These tools work fine as long as a document matches the format they were originally designed to handle.

They follow instructions well, but they don’t know how to handle anything outside those instructions. Move a field or change the layout, and the automation stops and hands the work back to the team.

Hyperautomation extends that setup with more capable tools. It brings together RPA, Artificial Intelligence (AI), Machine Learning (ML), Intelligent Document Processing (IDP), Natural Language Processing (NLP), workflow orchestration, and low-code platforms. This allows it to work with more document types and resolve some issues automatically.

Even with these tools, it still follows a planned sequence. If the system runs into something it doesn’t recognize, it stops and waits for someone to take a look.

Multi-agent hyperautomation approaches the work differently. It uses several agents, each responsible for a specific task — understanding the document, standardizing the data, matching details, checking compliance, or handling exceptions. Using Retrieval-Augmented Generation (RAG), they can pull the latest policies and contract terms as they work, which keeps their decisions consistent with your rules.

They share information through a multi-agent framework, adjust their work as data changes, and avoid the bottlenecks of a single fixed workflow.

Is Your Invoice Process Built to Scale?

Multi-agent AI keeps reconciliation steady as volumes rise

Here’s a detailed list of differences between the different automations:

Key Components of a Multi-Agent Invoice System

When you hear the term “multi-agent” for the first time, you’d probably think this sounds complicated. But it’s actually quite simple. Each agent has a job and works only on that job.

The system stays reliable because each piece is focused and predictable, and it's easy to backtrack moves when you need to.

Document Capture

This agent reads every incoming invoice and extracts invoice fields like dates, amounts, tax details, and line items based on the predefined template. When it’s unsure about a value, or finds missing information, it marks that for another agent to take over, instead of pushing incomplete or inaccurate data into the process.

Data Normalization

Once the details are captured, this agent cleans and standardizes the information. It aligns currencies, units of measure, tax structures, and naming conventions to provide the next agent with a consistent, reliable set of values.

Matching (Reconciliation)

The AI agent gathers everything: purchase orders, receipts, service entries, and contract terms related to the invoice. It then applies your matching rules, whether two-way, three-way, or four-way. Routine complexities like partial receipts or freight adjustments don’t interrupt the flow. If the numbers fall within your tolerances, the invoice continues without being held.

Exception Handling

When something doesn’t match, this agent steps in and breaks the issue down. It checks for rules and format, looks for context, checks how similar issues were resolved in the past, and fixes them. If more detail is needed, it uses generative AI to fill in missing information or alerts a human to review it as needed.

Payment Posting

Once the invoice gets approved, this AI agent registers it in the ERP and schedules the payment. Every action is timestamped with a complete audit trail for future reference.

Learning and Optimization

A feedback agent reviews the invoices that require human input. It studies what changed, how the issue was resolved, and whether the pattern shows up elsewhere. Over time, this reduces the number of invoices needing intervention and improves the accuracy and speed of the entire system.

You can also have a supervising agent or multiple levels of supervisors to ensure that nothing goes amiss.

With agentic AI, the supervisory layer becomes adaptive. Because it can learn and retain memory, it makes independent decisions when confidence is high and coordinates the work of other agents efficiently. But it still escalates anything high-risk or ambiguous to a human for final judgment.

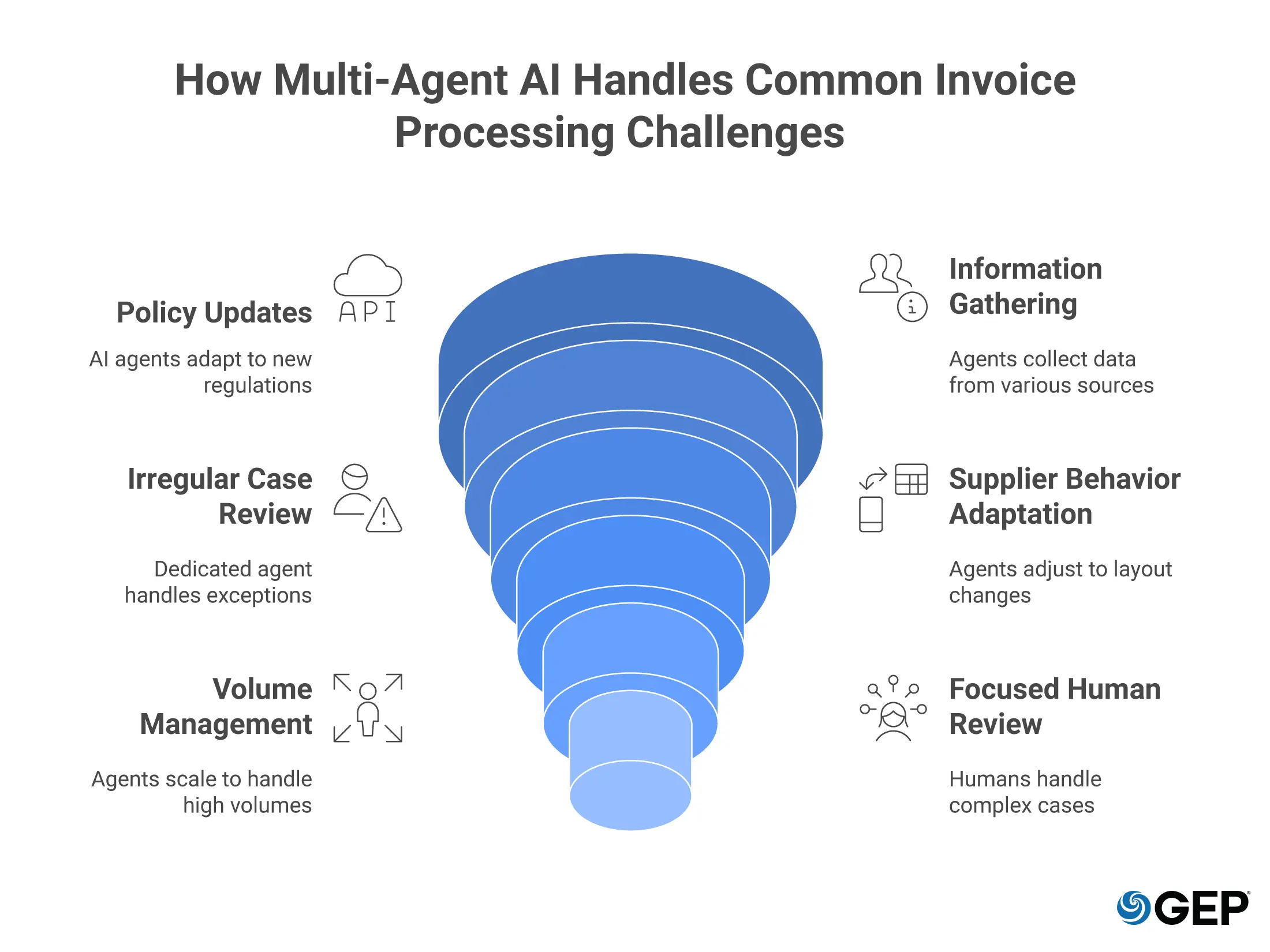

Common Invoice Reconciliation Challenges That Multi-Agent AI Handles

Policy and Compliance Changes

When policies or thresholds change, a human may update them once in the orchestration layer. AI agents then begin using the new logic on the next invoices that may need to follow those new regulations based on the location and policies they fall under.

Scattered Information

Agents gather what they need from your ERP, procurement tools, vendor sites, and other internal sources. With all the pieces in place, the validation step uses accurate and current information.

Irregular Cases

A dedicated agent reviews invoices that don’t need to follow standardized templates but may be marked as an exception. The AI agent figures out what caused the issue and suggests a practical fix. Many of these are settled before a person has to get involved.

Shifting Supplier Behavior

Agents recognize shifts in layouts. They pick up on these changes by looking at past behavior and adjust their extraction logic as needed.

High-Volume Periods

As volumes rise, more agents are activated to share the workload. Tasks run in parallel, so processing times stay predictable even during peak periods like quarter-end or seasonal spikes.

Focused Human Review

Agents handle routine mismatches, missing data, predictable and common low-impact issues on their own. Only the cases that truly need judgment reach a human. Everything else moves on its own.

Is Your Team Ready for Smarter Procurement Workflows?

These 101 real use cases show how AI supports faster checks and clearer decisions

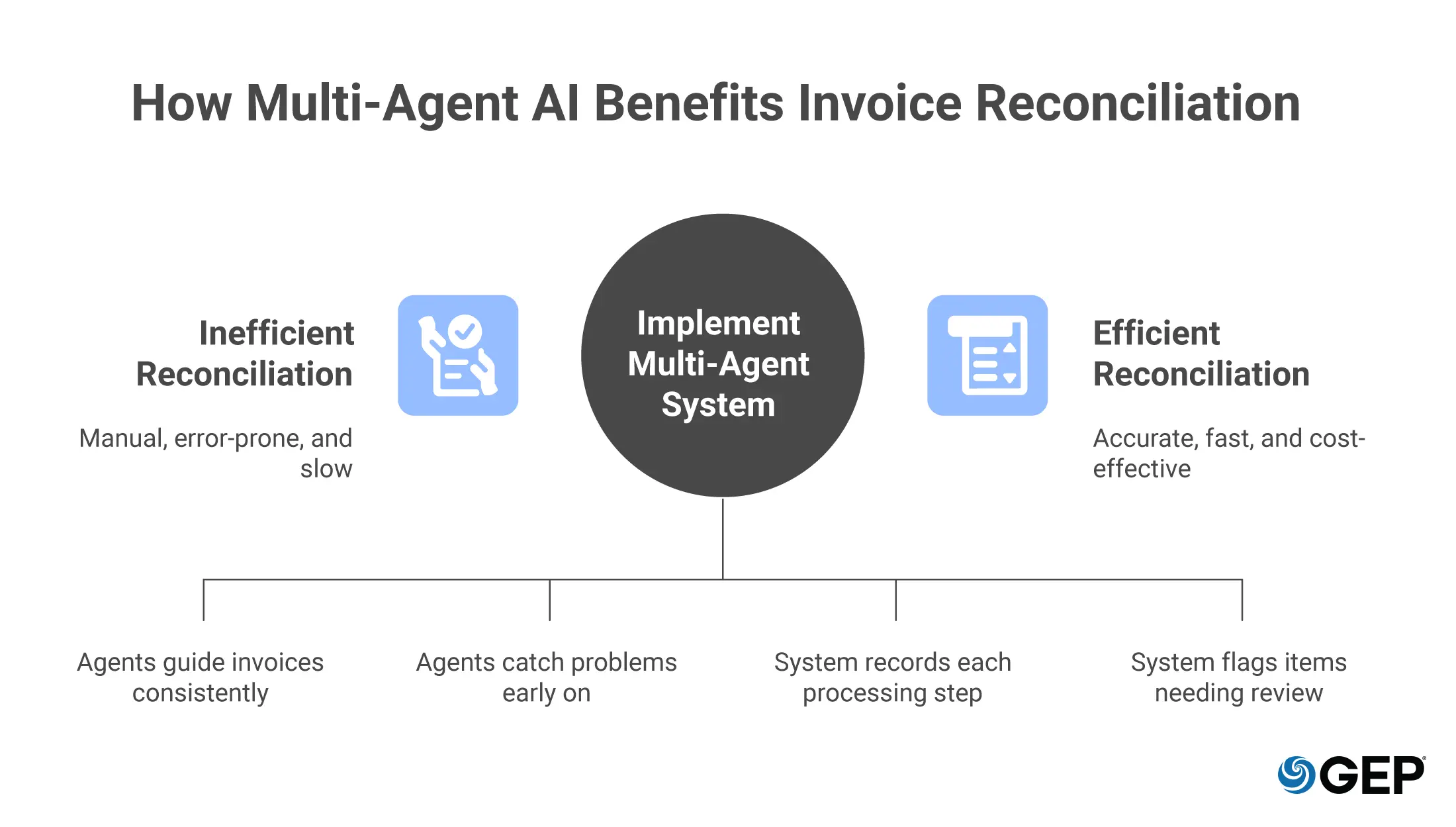

Benefits of Multi-Agent Systems in Invoice Reconciliation

Multi-agent systems help teams keep the reconciliation process steady, even as volumes grow. They do more of the work, so the team doesn’t feel the strain.

Greater Accuracy

Agents review the invoice against the related documents and catch problems early. This keeps issues from drifting into later steps, where they take longer to fix.

Faster Invoice Processing

After an invoice arrives, the agents guide it through the process without stopping for routine checks. Processing stays consistent, even when the workload spikes.

More Reliable Compliance

Each invoice goes through the same checks, and the system records the steps along the way. Audits become more straightforward, and outdated rules are less likely to appear in the process.

Better Visibility

The system shows the position of each invoice and flags items that may need a closer look. This helps leaders see how work is progressing and spot areas that need support.

Lower Operating Costs

Fewer exceptions mean fewer hours spent fixing minor issues. Teams can shift their attention to work that requires actual judgment instead of busywork.

Improved Experience for Everyone

Buyers see fewer unexpected stops in the process, and suppliers receive invoices they can work with right away. With less follow-up required, the workflow feels more manageable for everyone involved.

The Future of AI in Invoice Reconciliation

Procurement has always been fast, messy, and constantly changing. As your volumes grow

and as your suppliers evolve, AI agents keep the process stable, consistent, and compliant.

And this is only the start.

What’s coming next pushes the boundaries of AI even further. Agentic AI will spot and predict risks before they surface. It will also auto-adjust and adapt to new changes like new regulations, policies, workflows, and so on.

We’re heading toward a world where the entire procurement function becomes self-driven. If you want the fastest path to a touchless, audit-ready procurement workflow that scales with your business, explore GEP’s Invoice Reconciliation Software.