Late Payments Are Costing Companies Millions: How AP Aging Reports Can Save Your Bottom Line

- Poor accounts payable visibility and timing is a key cause of companies losing out on early payment discounts.

- AP aging reports serve as the financial radar system that prevents cash flow crises while strengthening critical supplier relationships.

- Modern procurement teams use automated aging analysis to transform reactive payment processing into strategic vendor management.

October 07, 2025 | Accounts Payable 5 minutes read

Picture this scenario: A CFO at a mid-sized manufacturing company sits down for her quarterly vendor review, only to discover her company is sitting on $2.3 million in outstanding payables, with over $400,000 past due by more than 60 days.

Worse yet, they've missed early payment discounts worth $46,000 in just three months. The culprit? A manual accounts payable process that leaves critical payment data scattered across spreadsheets and email threads.

This happens everywhere. Companies without proper AP aging visibility struggle constantly. They miss payment discounts. They strain supplier relationships. They can’t predict cash flow. The solution is a tool that many finance teams ignore: the accounts payable aging report.

Understanding AP Aging Reports

An accounts payable aging report is a financial dashboard for vendor obligations. Basic AP reports just list what you owe. Aging reports do more. They organize data by time periods. As a result, you get a clear view of payment urgency and cash needs.

Think of it as organizing supplier payments into buckets. Current amounts go in one bucket (not due yet). Past due amounts go into other buckets: 1-30 days, 31-60 days, 61-90 days, and over 90 days. Each bucket tells a different story about your company's payment performance and financial health.

The report typically displays vendor names in rows. Aging periods appear in columns. For each supplier, you see exactly how much falls into each time category, plus a total owed. A detailed version would include individual invoice numbers, due dates and payment terms. Summary versions show only vendor totals.

Here’s an example: Your aging report shows Supplier A has $50,000 current, $15,000 in the 1-30 day range and $5,000 over 90 days past due. This pattern suggests there’s a dispute or process breakdown that needs attention. The good news is that most obligations to this supplier are current.

Why Procurement Teams Need AP Aging Intelligence

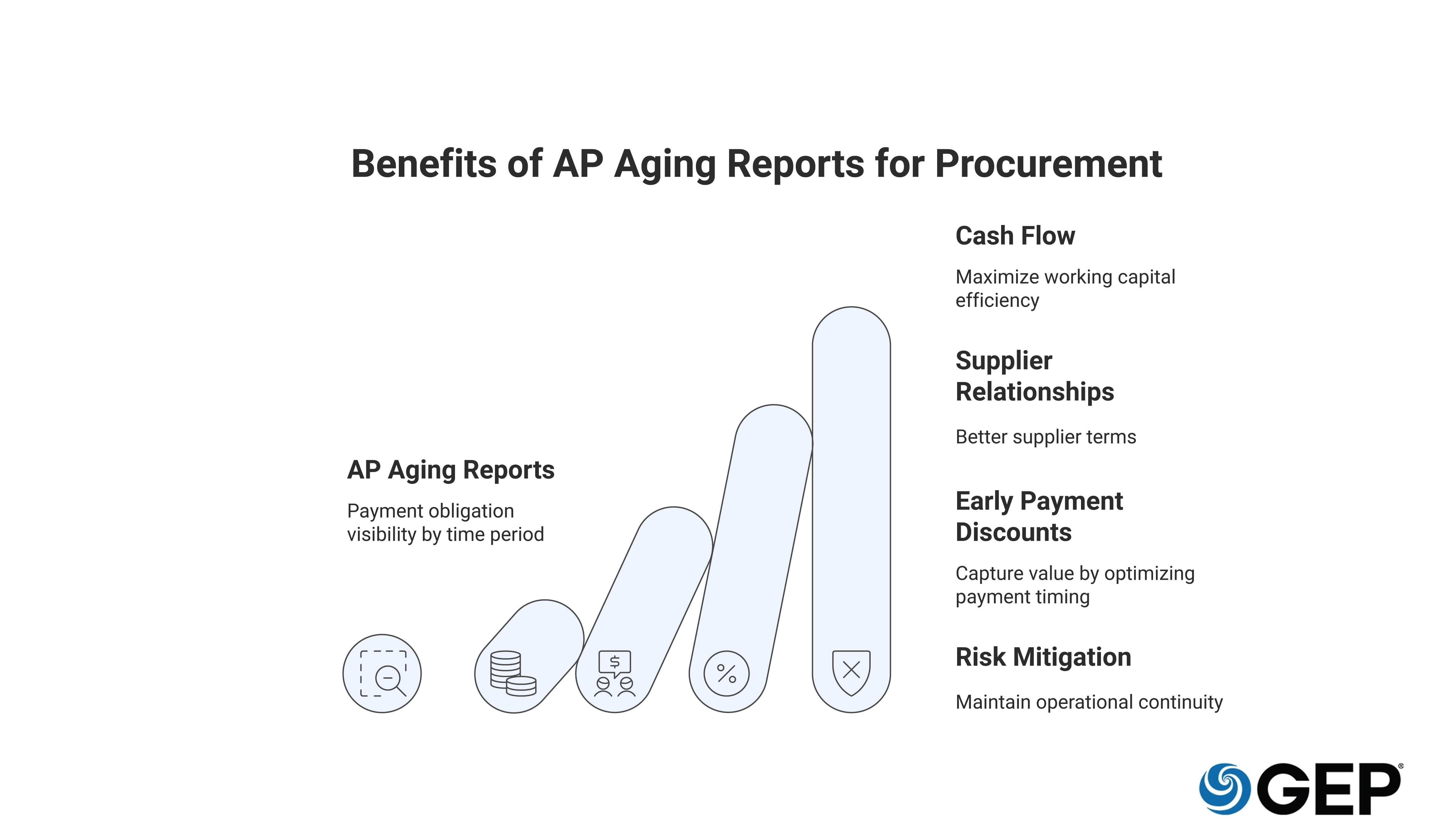

Traditionally, accounts payable is a back-office function. Process invoices. Cut checks. Simple. Smart procurement teams know better. They use AP aging reports to drive four strategic outcomes:

1. Cash flow optimization is first. Understanding when payments are due lets procurement teams schedule them to maximize working capital efficiency.

2. Supplier relationship management becomes more effective when payment patterns are visible. Suppliers notice customers who consistently pay on time. Payment reliability often translates into better terms, priority treatment during supply shortages and stronger collaboration on cost-reduction initiatives.

3. Early payment discounts require precise timing that only aging reports can provide. These discounts, typically ranging from 1-3% of invoice values, add up fast.

4. Risk mitigation for critical suppliers is possible when you have a clear view of payment obligations. Aging reports help you identify and prioritize payments to strategic suppliers and maintain operational continuity.

Reading Your AP Aging Report Like a Pro

Good aging report analysis follows a simple pattern. Start with the big picture, then drill down into the details. This approach reveals both opportunities and risks in your payment portfolio.

Begin With the Totals Column

To understand your overall payment obligation, look at the totals column. It should align with your accounts payable balance in the general ledger. Big differences mean data problems that need fixing now.

Look at the Aging Distribution

Healthy payment profiles show 70-80% of balances in the current column. Amounts should get smaller in each past-due category. If more than 20% of your total payables are past due, you need better payment processes or cash-flow management.

Identify Outliers and Patterns

Scan for larger amounts in older categories. Also look for suppliers with amounts spread across multiple time periods. These patterns often indicate disputes, approval bottlenecks or data entry errors.

Watch for Negative Balances

Negative balances usually mean overpayments or incorrectly applied credit memos. These situations may qualify for vendor refunds or credits against future purchases.

Track Key Performance Indicators

Days Payable Outstanding (DPO) measures the average time between invoice receipt and payment. Most companies target DPO ranges of 30-45 days for optimal supplier relationships while maintaining cash-flow benefits.

Also Read: How AP can Optimize Cash Flow

How to Prepare an AP Aging Report?

Here’s a straightforward five-step process for creating an AP aging report that transforms scattered payment data into actionable financial intelligence.

1. Collect Invoices

Gather all unpaid vendor invoices from your AP system, email records and departmental files. Include invoices awaiting approval, disputed bills and recurring payments like utilities or subscriptions to ensure complete visibility.

2. Categorize Payables

Group invoices by vendor type, department or expense category. Common groupings include office supplies, professional services, utilities and inventory purchases. This organization helps identify spending patterns and problem areas.

3. Create Aging Buckets

Sort payables into time-based categories: current (not due), 1-30 days past due, 31-60 days, 61-90 days and over 90 days past due. Calculate aging by comparing invoice due dates to your report date.

4. Summarize Total Amount Due

Calculate totals for each aging bucket and create vendor-level subtotals. Healthy businesses typically show 70-80% of payables in the current category, with smaller amounts in past-due buckets.

5. Review for Accuracy

Cross-check report totals against your general ledger accounts payable balance. Verify aging calculations, look for duplicates and confirm that payments and credits are properly recorded.

AP Aging Best Practices

Good AP aging management requires regular processes that connect to procurement and finance operations. How often you review aging reports, and what format you use, impacts how useful they are.

Schedule Weekly Aging Reviews

Schedule reviews during peak invoice periods (usually mid-month and month-end.) Include both AP staff and procurement team members to ensure payment decisions align with supplier relationship strategies.

Set Limits

that trigger automatic alerts or escalation procedures. Many companies require executive approval for payments over 60 days past due. This gives senior management visibility into potential supplier problems.

Integrate Aging Data

Procurement systems provide buyers with payment performance context during supplier negotiations. Suppliers often offer better terms to customers with excellent payment track records.

Automate Routine Processes

Modern accounting and ERP systems can create aging reports on demand, send automatic reminders for approaching due dates and flag early payment discount opportunities.

Create Stakeholder Dashboards

Dashboards should show aging information in the right format for different audiences. Executive summaries might focus on high-level trends and total cash requirements. Operational reports provide detailed invoice-level information for processing teams.

Automate Your AP Process With AI

Discover the AI Use Cases Transforming Procurement Workflows

Transform Reactive Payments Into Strategic Advantage

Mastering AP aging analysis can improve supplier satisfaction, working capital efficiency and procurement cost reduction.

When procurement teams understand what they owe, when payments are due and how their payment patterns affect supplier relationships, they gain negotiating power and operational flexibility.

Artificial intelligence is enhancing AP aging capabilities. Predictive analytics can forecast payment requirements, automatically identify optimal payment timing for discount capture and flag potential supplier relationship risks before they become critical issues.

For procurement professionals serious about driving bottom-line results, mastering AP aging report analysis represents low-hanging fruit with significant impact.

Start by requesting your current aging report. Analyze the patterns and identify the opportunities. Then build the processes that transform accounts payable from a cost center into a strategic value driver for your procurement organization.