7 Common Procure-to-Pay Automation Implementation Challenges (And How to Fix Them)

- P2P automation is a critical lever for modernizing financial operations and strategic spend management.

- Most projects fail not because the software is bad, but because the foundation is weak.

- Implementation failures typically stem from three areas: adoption resistance, poor data management, and automating overly complex processes.

February 12, 2026 | Procurement Software 6 minutes read

You are under constant pressure to tighten financial controls without adding friction to the business. Yet even with increased investment in digital transformation, procure-to-pay automation remains one of the hardest initiatives to execute well at enterprise scale.

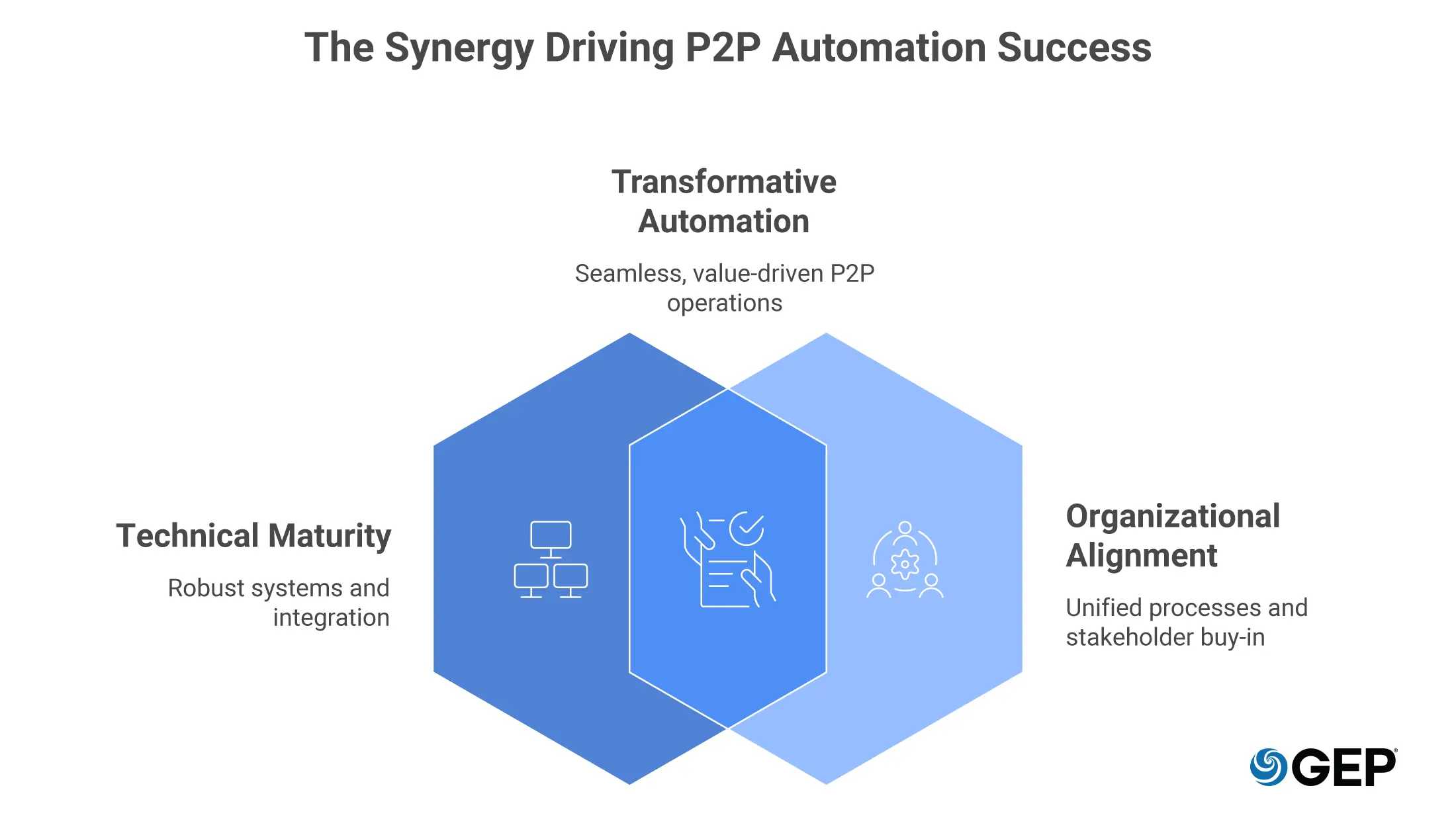

The challenges in implementing procure-to-pay automation rarely come from technology alone. They surface at the intersection of data, policy, suppliers, finance, and human behavior. When these elements fall out of alignment, automation increases complexity instead of removing it.

This guide breaks down the core challenges in P2P automation, explains why they persist even in mature organizations, and outlines how you can design automation that scales without sacrificing control.

What Procure-to-Pay Automation Actually Changes

Procure-to-pay automation is not a faster version of existing workflows. It restructures how demand, approvals, supplier engagement, invoicing, and payments move across the enterprise.

When automation is applied correctly, you move from fragmented execution to coordinated, rules-driven orchestration.

Traditional P2P struggles because it depends on manual handoffs, disconnected ERP modules, and informal communication. These conditions increase error rates, stretch cycle times, and weaken policy enforcement. Automation replaces those weak links with structured data flows, embedded controls, and real-time visibility.

At scale, the real shift is collaboration. Procurement, finance, and suppliers begin operating from shared data models instead of parallel systems. That shift is powerful, but it also exposes structural weaknesses that manual processes previously masked.

Key Challenges in Implementing P2P Automation

P2P automation is an operational transformation. You see how money moves, risks are managed, and decisions are made. The most common challenges show up in six areas.

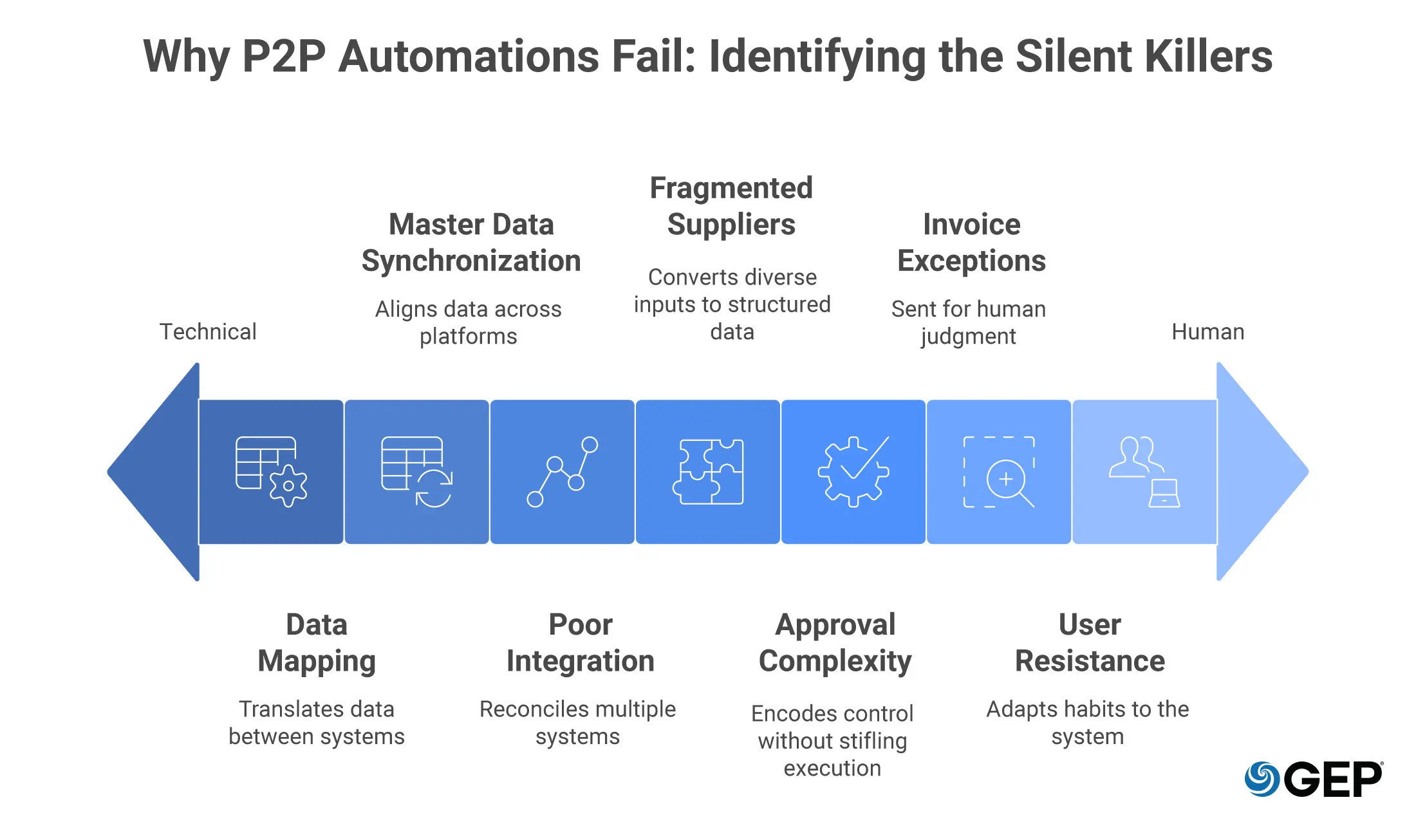

1. Fragmented Supplier Ecosystems

No supplier base is ever uniform. Some suppliers operate digitally, while others still rely on email, PDFs, or local invoicing practices. The P2P platform must function as a universal translator, converting everything into structured data. Automation depends on these structured inputs.

But the problem is that supplier maturity varies widely across regions and tiers. And configuring this "translation layer" to handle every variation without losing data is a major engineering hurdle.

For the system to work efficiently, vendors must submit invoices and updates through the new digital channels. Without a carefully planned onboarding strategy, supplier integration becomes the single largest threat to automation delivering true value.

2. Approval and Compliance Complexity

Enterprise approval structures reflect years of policy layering. Spend thresholds, category risk, regional regulations, and delegation rules intersect in ways rarely documented systematically. Translating these structures directly into rigid workflows results in automation that breaks. The challenge is having control without affecting execution.

3. Data Mapping and Transformation

Different systems organize data differently. The automation software must be taught how to translate information so it fits perfectly into the existing financial system. If the data fields do not align exactly then the transfer will fail, causing transaction errors that require technical debugging.

4. Master Data Misalignment

Automation forces your data to tell the truth. Vendor records, payment terms, tax attributes, and material definitions must align across procurement and finance. In many organizations, they do not.

The system must keep core databases identical across multiple platforms at the same time. Achieving real-time synchronization is technically difficult.

When a change occurs in one system but fails to trigger an update in the other, the systems drift apart, and transactions get blocked. What looks like a technology issue is usually accumulated data debt that automation surfaces immediately.

5. Poor Integration

Most enterprises operate across multiple ERPs, legal entities, and accounting structures. Automation must reconcile currencies, tax treatments, and financial hierarchies in real time.

Without a strong interoperability design, integrations become brittle. As more exceptions arise, processes slow down, and teams spend more time managing and double-examining AI outputs. This cancels the benefits of speed and efficiency, which is why automation was implemented in the first place.

6. User Adoption Resistance

Automation changes how people work. Requestors lose informal shortcuts, while approvers face structured decision points. Accounting teams shift from processing volume to resolving exceptions.

If incentives, training, and accountability are unclear, users adapt the system to their habits instead of adapting their habits to the system. That is how email invoices reappear, off-system buying grows, and automation quietly stalls.

7. Invoice and Payment Exceptions

Even mature environments face disputes, mismatches, and regulatory corrections. Automation does not eliminate exceptions. It concentrates them.

If exception handling is treated as an afterthought, operational load increases. If it is designed intentionally, automation becomes a filter that directs human effort where judgment actually matters.

How to Overcome Procure-to-Pay Automation Challenges

Automation does not fail because the system was configured incorrectly. It fails because the organization was not ready to operate differently.

Readiness Comes Before Configuration

Before workflows scale, people need to know who owns decisions, who owns data, and where judgment still applies. When those answers come later, automation adds drag instead of speed. You see it immediately in approvals that stall, exceptions that multiply, and teams that quietly step outside the system to get work done.

Supplier Connectivity Is the First Stress Test

If suppliers enter through a dozen different paths, automation spends its time reconciling variation instead of driving efficiency. Clear onboarding routes matter. So do consistent catalog formats and predictable invoicing rules. Once suppliers are grouped by business impact and transaction volume, effort stops being spread thin and starts producing results where it counts.

Data Discipline Determines Scale

Procurement and finance often believe they are aligned, until automation forces precision. Category structures, payment terms, and tax logic either match or they don’t. When they don’t, transactions move faster than errors can be corrected. Fixing data foundations early prevents automation from scaling problems that were previously contained by manual checks.

Workflow Design Is Where Theory Breaks

Static approval chains rarely survive real operating conditions. Spend varies. Risk shifts. Context matters. Workflows need to adjust without constant reconfiguration. This is where AI and agentic capabilities earn their place, by learning how decisions are actually made, routing work intelligently, and stepping in only when human judgment adds value.

Shared Ownership Keeps Automation Moving

Ownership cannot be ambiguous. When procurement and finance split responsibility, automation slows down. When they share it, problems surface earlier and decisions stick. Policies, integrations, and outcomes work better when accountability is explicit and jointly held.

Adoption Is the Only Metric That Matters

If people avoid the system, value never materializes. Expectations need to be clear. Training needs to reflect how work actually happens. Compliance needs to be enforced consistently. When the automated path is simpler than the workaround, behavior changes on its own.

Security and Risk Are Designed, Not Added Later

Automation pulls sensitive information into fewer places. Supplier banking details, commercial terms, and approval authority move through shared environments instead of scattered inboxes. Visibility improves, and so does exposure. The answer is not more after-the-fact review. It is control built directly into execution.

When access rules, audit trails, and risk checks operate in real time, problems surface while they are still small. Compliance stops being a clean-up exercise and starts functioning as part of day-to-day operations.

Effective P2P automation embeds access controls, audit trails, and compliance checks directly into execution. Organizations that invest in readiness, governance, and adoption unlock the full potential of P2P automation and position procurement as a strategic driver of enterprise performance.

Conclusion

The challenges in implementing procure-to-pay automation are structural. You are redesigning how the enterprise spends, manages, and collaborates across internal and external stakeholders.

Before deploying software, existing workflows must be mapped, simplified, and standardized. The goal is to automate a clean process, not a broken one.

Approaching automation as a platform rollout results in limited value. Treating it as an operational shift allows you to gain speed, accuracy, and control at scale.

Explore how next-generation systems improve compliance, accuracy, and financial control through advanced Procure-To-Pay Software Solutions.