Struggling with Duplicate Invoices? Here’s How AI Can Detect Them

- Duplicate invoices aren’t rare — they’re process gaps hiding in plain sight.

- Automation and AI can catch what manual reviews miss, before money walks out the door.

- Fixing duplicates isn’t just about saving cash — it’s about regaining control of your entire AP process.

August 20, 2025 | Procurement Software 5 minutes read

Duplicate invoices are silent saboteurs in accounts payable. They slip past unnoticed, cause double payments, trigger audit red flags, and quietly erode your team’s time and budget. And the real kicker? Most businesses don’t even spot the problem until the money is already out the door.

Sometimes it’s innocent. A vendor resends an invoice. Someone enters the same one twice with a tiny typo. Or a system glitch decides to process the same file again. However it happens, one thing is clear: duplicate billing is more common than it should be, and more expensive than you'd like.

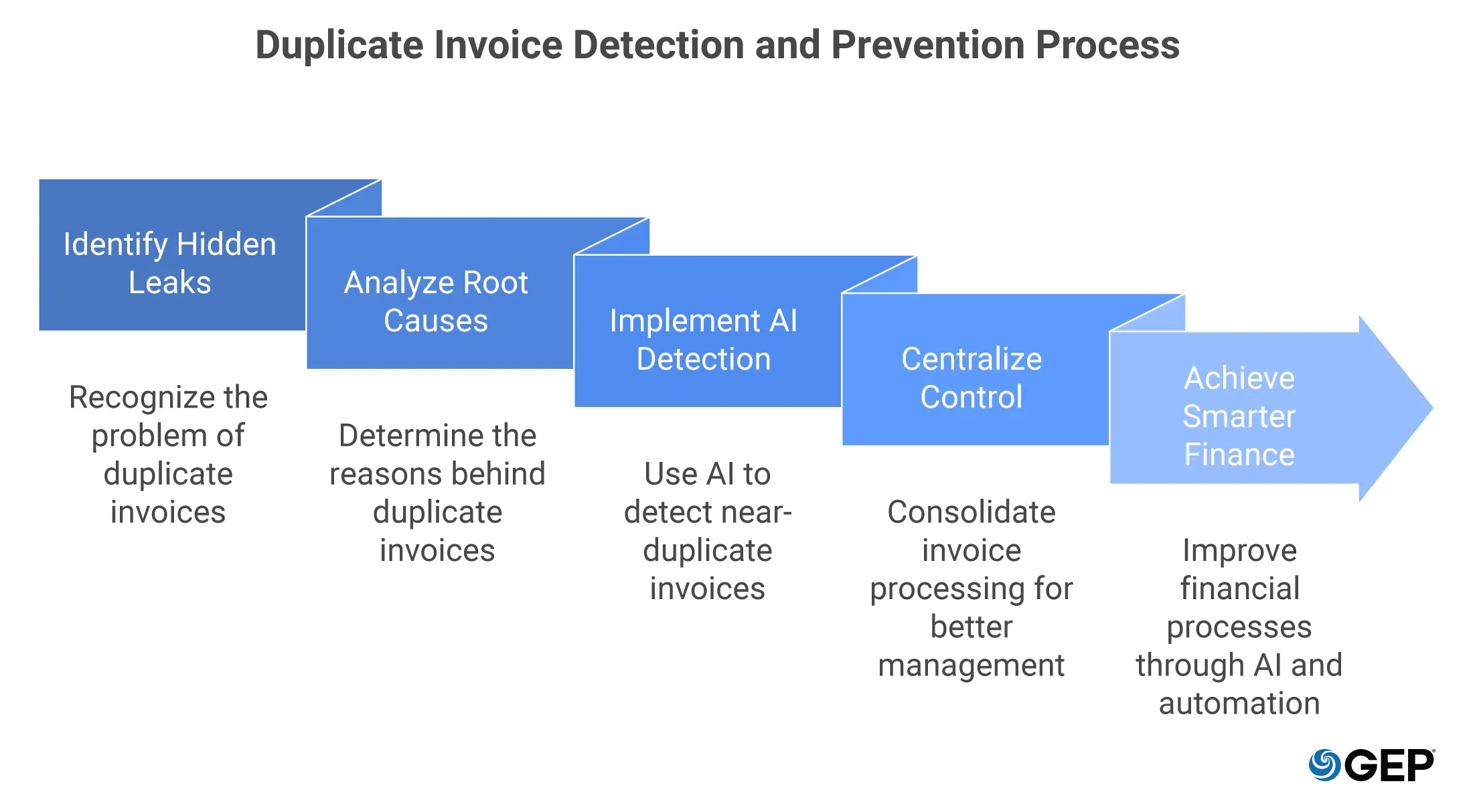

But buried in the problem is an opportunity. Every duplicate invoice reveals a weak point in the process. And every weak point is a chance to tighten controls, improve visibility, and stop money from leaking out.

In this blog, we’ll explore why duplicate invoices happen, how they keep slipping through, and what you can do to shut them down for good. If you’re tired of chasing costly errors after the fact, this is your playbook for getting ahead of the problem.

What Are Duplicate Invoices?

A duplicate invoice is a self-explanatory term; an invoice that’s been issued or recorded more than once for the same purchase. Sometimes it could be an exact copy, with the same invoice number, date, and amount. Other times, it’s a little trickier to catch, because there might be small differences in formatting or details, but it’s still tied to the same transaction.

Most times, it isn’t about fraud, but an error or a process gap. But it is still problematic – your business might end up paying twice for the same thing without realizing it until much later. And by then, it can be hard to fix.

How Do Duplicate Invoices Happen?

So, if this is such a known problem, why do companies still struggle with it? The short answer — because there are lots of ways it can happen, and most of them are easy to miss. Let’s go through the usual suspects.

• Human Error

This is probably the biggest one. When invoices are entered manually, it’s incredibly easy to type in the same invoice twice, make a typo that prevents proper matching, or miss small details. All it takes is one missed character or a wrong digit, and suddenly your system thinks it’s a new invoice.

• Vendor Resubmissions

Sometimes vendors don’t hear back in time and assume their invoice got lost. So, they send it again. If your system doesn’t have a way to recognize that it’s already received that invoice, it could be processed again without anyone noticing.

• System Limitations

Not every finance or ERP system is built with good duplicate detection tools. If your software doesn’t check for things like matching PO numbers, invoice amounts, or dates, then it’s not going to flag a second submission. And that’s how duplicates slip through.

• PO Corrections

Maybe a purchase order changes — say, the quantity or price is adjusted. The vendor sends a new invoice. But if the old one isn’t properly voided, both invoices could get submitted for payment. That kind of situation happens more often than you’d think.

• System Glitches or Tech Problems

This one’s frustrating. Sometimes integrations fail, syncs duplicate records, or imports get processed twice. These things don’t always throw up errors either. You may only notice something’s wrong when the payment goes out twice.

• Decentralized Invoice Processing

If different departments are allowed to process their own invoices and there’s no centralized system, it becomes hard to track what’s already been submitted. A single invoice might get sent in two times from different locations or teams — and no one realizes.

• Incorrectly Applied Credits or Adjustments

Sometimes a vendor sends a credit note, and someone in your team doesn’t apply it properly. Then someone else thinks the invoice is still due and enters it again. If there’s no reconciliation in place, that invoice could get paid a second time.

How AI Helps Spot Duplicate Invoices

Let’s talk about how AI actually fits into all this. This isn’t just hype — it’s genuinely making a difference. AP teams are now spotting duplicate invoices faster and with more accuracy, thanks to a few key AI capabilities.

AI Capability | How It Helps Detect Duplicates |

|---|---|

| Fuzzy Matching | Catches near-matches, like invoice numbers with small typos or formatting differences. |

| Pattern Recognition | Looks at things like vendor name, invoice amount, PO reference, and past payments to find overlaps. |

| Learning Over Time | Learns from your team's input. When you confirm or dismiss alerts, it gets better over time. |

| Real-Time Alerts | Flags suspicious invoices while they’re still in the system, helping you avoid duplicate payments. |

In short, AI acts like a second pair of eyes — one that doesn’t get tired, distracted, or miss the small stuff.

Do you know high-growth firms risk falling behind without AI in procurement?

Gain expert insights into closing the AI gap and driving smarter, faster procurement decisions.

Why Centralizing Invoice Processing Helps

Duplicate invoices aren’t just annoying. They tie up cash, delay operations, and can make audits a nightmare. But there’s a fix.

When you centralize your invoice processing, clean up your data, and use solid controls along with automation and AI, the risk of duplicates drops fast.

Still relying on spreadsheets, scattered emails, or manual checks? It might be time to modernize. A centralized, automated process not only cuts errors but also frees up your team to focus on what really matters.

Want to see how GEP SMART can help? Check out our invoice management solution — it’s built to help you spot, stop, and prevent duplicate invoices without slowing your team down.

FAQs

What is a repeating invoice?

Repeating invoices are scheduled to go out at regular intervals — like monthly billing for subscriptions or rent. They’re intentional, but they still need controls to make sure they don’t accidentally get paid twice.

How can I automate duplicate invoice detection?

Look for a platform that uses AI, supports 3-way matching, and offers centralized workflows. GEP SMART does all of this. It reviews invoice details in real time, flags anything suspicious, and helps you stay in control from the moment the invoice arrives.

How are duplicate invoices different from fraudulent ones?

Duplicate invoices are usually just mistakes — like data entry errors or vendor resubmissions. Fraudulent invoices, on the other hand, are sent on purpose to try and trick you into paying for something you never received. Both need to be caught early, but the intent behind them is different.