Want Frictionless Finance? Start by Adopting Procure-to-Pay Automation

- Procure-to-Pay automation connects every step of the process into a single digital workflow.

- AI agents enhance this process by learning from past activity to spot patterns, predict delays, and prevent costly mistakes.

- P2P automation follows a unified, digital workflow that integrates directly with your ERP system.

February 02, 2026 | Procurement Software 4 minutes read

Every manual step in your purchasing process quietly taxes financial performance. Delayed approvals, missed invoices, and fragmented spend weaken cost control long before the impact appears in reports.

Procure-to-pay automation changes how purchasing decisions are made and enforced.

Modern procure-to-pay systems function as part of the core financial infrastructure. They manage approvals, apply policy as transactions are created, and expose spending patterns early enough to influence decisions.

The result goes beyond faster processing. You gain predictable execution and clearer financial oversight as transaction volumes grow. This blog explains what procure-to-pay automation really is, how AI and agentic workflows power it, and why it has become essential to sustain financial efficiency.

Do You Have the Controls to Manage Spend at Scale?

Learn how policy-led automation raises accuracy as volume grows

What Is Procure-to-Pay Automation, and How Does It Work?

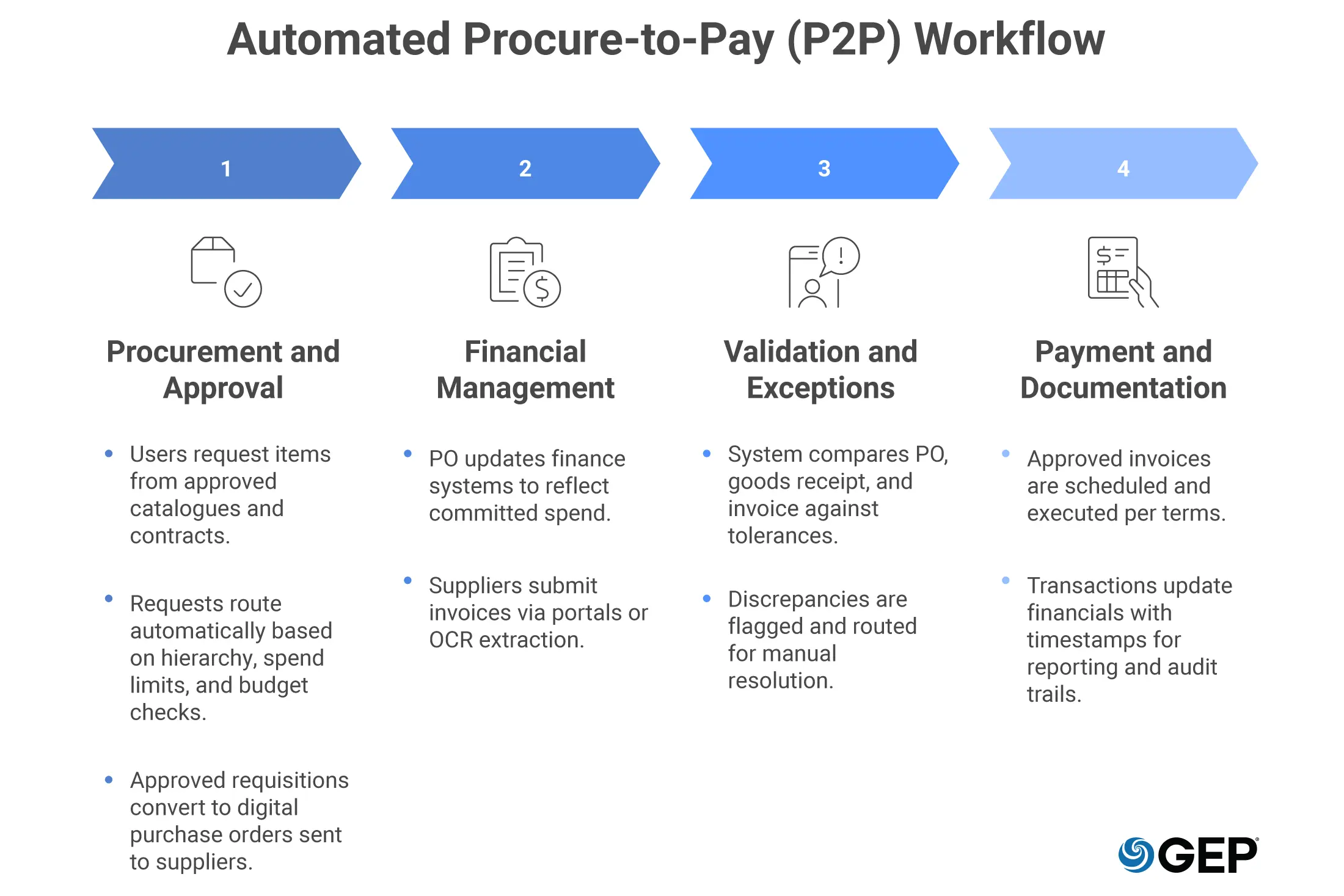

Procure-to-pay automation connects every step of the purchasing process, from demand to payment. Rather than relying on disconnected tools and manual handoffs, transactions move through a single workflow guided by predefined rules and data.

When a request is submitted, approval rules and budget limits are applied automatically. Approval triggers automated purchase order creation, receipt of goods or services is recorded directly in the system, and incoming invoices are captured automatically and matched against the purchase order and receipt.

Exceptions are identified early and routed to the appropriate owner, and standard transactions continue without delay. Every action is logged and documented for future reference.

AI agents add a learning layer to this process. Their role goes beyond executing predefined steps. They track transaction patterns, learn from prior outcomes, and adjust routing logic within defined boundaries. As usage increases, the system improves its ability to anticipate delays, surface unusual activity, and limit early spend leakage.

With agentic orchestration, every request is captured accurately, routed correctly, and flows seamlessly through the procurement cycle. Unlike standard automation that stops and waits for intervention when it reaches a roadblock, agentic AI investigates the problem, thinks for itself, finds an optimal solution, and executes independently.

Why Procure-to-Pay Automation Matters for Financial Efficiency

Manual paperwork slows business down. Automation speeds it up by replacing messy handoffs with clear digital steps.

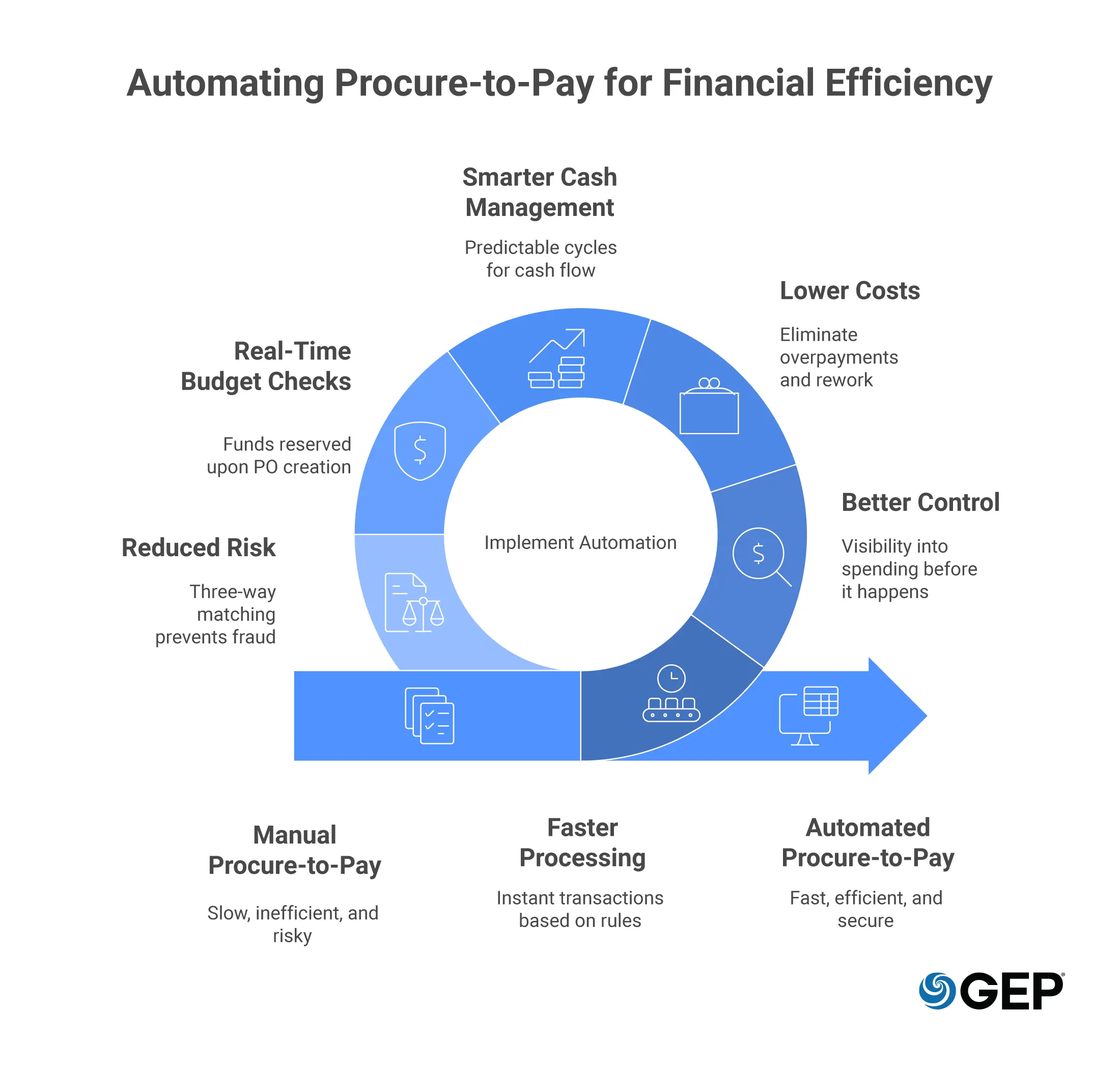

- Faster Processing and Shorter Cycles: Automation moves routine transactions through the system instantly based on set rules, so you don't have to chase signatures.

- Better Control and Visibility: Teams see exactly where money is going before it is spent. By forcing users to buy from approved catalogs, you stop unauthorized spending and ensure you always get the negotiated price.

- Lower Costs: Automation ensures you pay the right amount to the right vendor, eliminating costly overpayments and rework.

- Smarter Cash Management: Predictable cycles let you schedule payments to keep cash in the bank longer or pay early to capture discounts.

- Real-Time Budget Checks: The system reserves funds the moment a Purchase Order is created. This prevents the surprise of going over budget, as the system blocks the order before it happens.

- Reduced Risk and Fraud: Every step is tracked. The system uses "three-way matching" to automatically compare the order, the receipt, and the invoice. If they don't match, the payment stops. This ensures that you never pay for goods you didn't receive.

Without automation, teams depend on post-event controls. By the time issues surface, money is already committed or gone. That is why manual environments feel perpetually reactive. Finance spends time correcting outcomes rather than shaping them.

When Agentic AI Orchestrates Source-to-Pay

Learn how unified agents drive efficiency across complex workflows

P2P Automation Changes How Financial Decisions are Made

Procure-to-pay automation no longer focuses on margin efficiency. It is about control at the core. When purchasing decisions are governed by intelligent workflows and agentic oversight, financial performance becomes more stable, more predictable, and easier to manage.

The organizations that gain the most are not pursuing automation for speed alone. They are using it to reshape how financial decisions are made, enforced, and learned from over time. That shift is what turns procure-to-pay from a back-office process into a strategic financial system.

If you need financial efficiency at scale, you first need to identify the challenges unique to your business and then plan how to make procure-to-pay automation work for you. If you’re interested in seeing how GEP SMART’s procure-to-pay solutions can streamline your finance operations, you can reach out to us.

FAQs

Automation reduces the need for manual handling in routine work like data entry, invoice matching, and approval routing. As errors decline, rework drops, penalties become rare, and exception handling consumes far less time. Over time, those avoided costs turn into sustained reductions in operating expense.

Clear visibility into approvals and liabilities lets you decide when cash is committed and when it leaves the business. Faster approvals make it easier to capture early payment discounts and avoid late fees. It directly impacts the bottom line by reducing processing costs, capturing savings often lost in manual systems (such as early payment discounts), and tightening control over cash flow.

Every transaction feeds the system with data. AI agents learn from outcomes, refine controls, and improve forecasting accuracy over time. As errors decline and insight quality improves, financial efficiency strengthens as a natural outcome of daily operations.