Inside GEP’s Spend Category Outlook Report 2026: Pressure Points Shaping Direct Spend

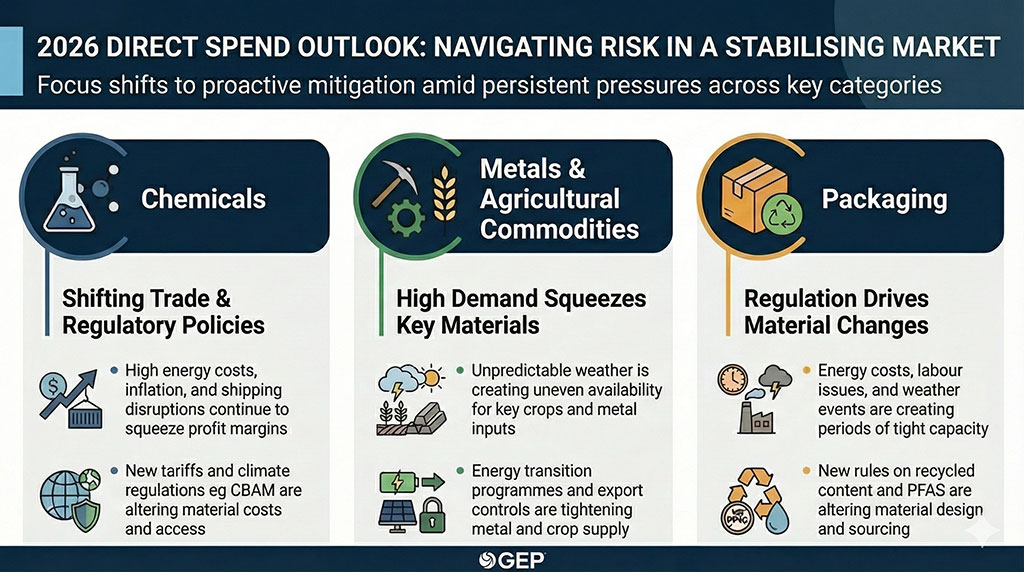

- Global conditions are steadier, but pressure on direct spend persists.

- Key materials in chemicals, metals, agriculture, and packaging move with shifting policy and supply signals.

- The report outlines category-specific pressures and strategic priorities for the year ahead.

February 03, 2026 | Spend Management 3 minutes read

There are moments in business when market conditions and new regulations knock on your door, and firms have to adapt immediately. Procurement leaders not only sense these shifts but find that their decisions carry more weight (and risks) than before. They feel a growing need for more control over how these forces play out, while external and internal forces continue to strain global supply chains.

The GEP Spend Category Outlook 2026 provides a detailed view of direct and indirect spend categories and shows how procurement strategies are likely to evolve over the coming year. The insights show how these categories affect supply confidence and influence the direction of growth planning for organizations preparing for another unpredictable cycle.

In this blog, we dive into the key insights across major direct spend categories and explore what's in store for global supply chain and procurement teams in 2026.

Need More Control Over Direct Spend?

Know how shifting policies and supply signals shape category plans

Talk to an Expert

What to expect in direct spend categories in 2026

In 2025, market conditions kept shifting, and procurement teams had to stay focused on keeping operations steady. They protected costs while navigating geopolitical strain and responding to climate and sustainability pressures. AI and analytics helped companies handle volatility more quickly, though most of the work still went into keeping category plans controlled and consistent.

As markets settle in 2026, the focus will be on making procurement more proactive and risk-averse rather than chasing rapid expansion. Let’s look at how key direct spend categories like chemicals, metals, agricultural commodities, and packaging remain exposed to category-specific risks amid stabilization.

Chemical Manufacturing

Demand is stabilizing after several years of weak consumption and price volatility, but profitability remains under strain. Energy costs and inflation continue to press margins, and disruptions across major shipping routes add more uncertainty to supply. Tariff shifts between the U.S., China, and the EU change long-used trade paths and tighten import access.

CBAM regulations and U.S. climate policies influence material costs and supplier positioning in global markets, adding new pressure to category planning. AI adoption expands across the chemical value chain and improves control over forecasting and supplier-related processes.

Metals and Agricultural Commodities

Climate volatility continues to unsettle availability across key crops and metal inputs. Unpredictable weather patterns tighten supply in some regions and force buyers to work with uneven output across others. Export restrictions on grains and specialty crops add more uncertainty and influence pricing across multiple markets.

Metal supply remains exposed to policy changes and a surge in global demand. Energy transition programs increase pressure on inputs such as copper, which are highly sensitive to market changes. Also, the growing demand for specialty materials like lithium, whose processing capacity is heavily concentrated in specific locations, keeps supply tight.

Trade rules and regional alliances also change how quickly material moves through the system and which routes remain reliable.

Packaging

Packaging enters 2026 with steady demand but uneven supply conditions. Production is affected by energy costs and labor pressure, and weather events disrupt output across paper-based and plastic-focused lines in different ways. These shifts influence availability and create periods of tight capacity across the materials companies rely on most.

Regulation shapes much of the movement in this category. New rules tied to recycled content and PFAS are driving changes in how suppliers design and manufacture materials, and they are altering which inputs can be used at scale.

Policy shifts across regions also affect how core inputs such as resins or pulp move through global markets, adding more variability to sourcing routes and delivery timelines.

Your Guide to Direct Spend in 2026

Gain insights on market signals affecting chemicals, metals, crops, and packaging this year

Download the Report

Direct Spend Outlook for 2026

The year ahead brings a steadier global environment, although the forces shaping direct spend continue to shift with policy movements, climate conditions, and material flows. These pressures set the tone for how organizations plan and how supply chains adjust through the cycle.

The GEP Spend Category Outlook 2026 examines these developments across direct and indirect spend and provides a view into the patterns shaping the year, supported by category-specific recommendations for deeper context.

Access the GEP Spend Category Outlook 2026 Report for a more detailed assessment of the year ahead.