How Autonomous Spend Analysis Changes Procurement Decision-Making

- Static spend reports explain the past but miss live risk and leakage.

- Automation classifies data, but autonomy changes decisions in motion.

- Continuous analysis turns spend signals into immediate procurement action.

January 28, 2026 | Spend Analysis 4 minutes read

Spend analysis has never lacked data. Enterprises sit on years of invoices, contracts, POs, and supplier records. The gap shows up later. Teams still rely on quarterly reports. Category managers still hunt through spreadsheets. Compliance gaps surface after audits, not before.

Traditional spend analysis describes what happened. It rarely changes what happens next. That lag now hurts. Supply risk shifts faster. Regulations tighten mid-cycle. CFOs want answers in weeks, not quarters.

Autonomous spend analysis aims to close that gap. It does not stop at classification or dashboards. It monitors spend continuously, explains changes as they occur, and triggers action inside procurement workflows. That shift matters because spend no longer behaves in neat annual patterns.

GEP research shows that most large enterprises still spend over half their effort cleansing and classifying data before analysis even begins. That work repeats every cycle. Autonomous systems remove that repetition and keep the data current instead of periodically refreshed.

Don’t Wait To Be Disrupted

Explore how autonomous AI agents are driving procurement transformation

ASK US NOW

How Autonomous Spend Analysis Works: The Technology Behind It

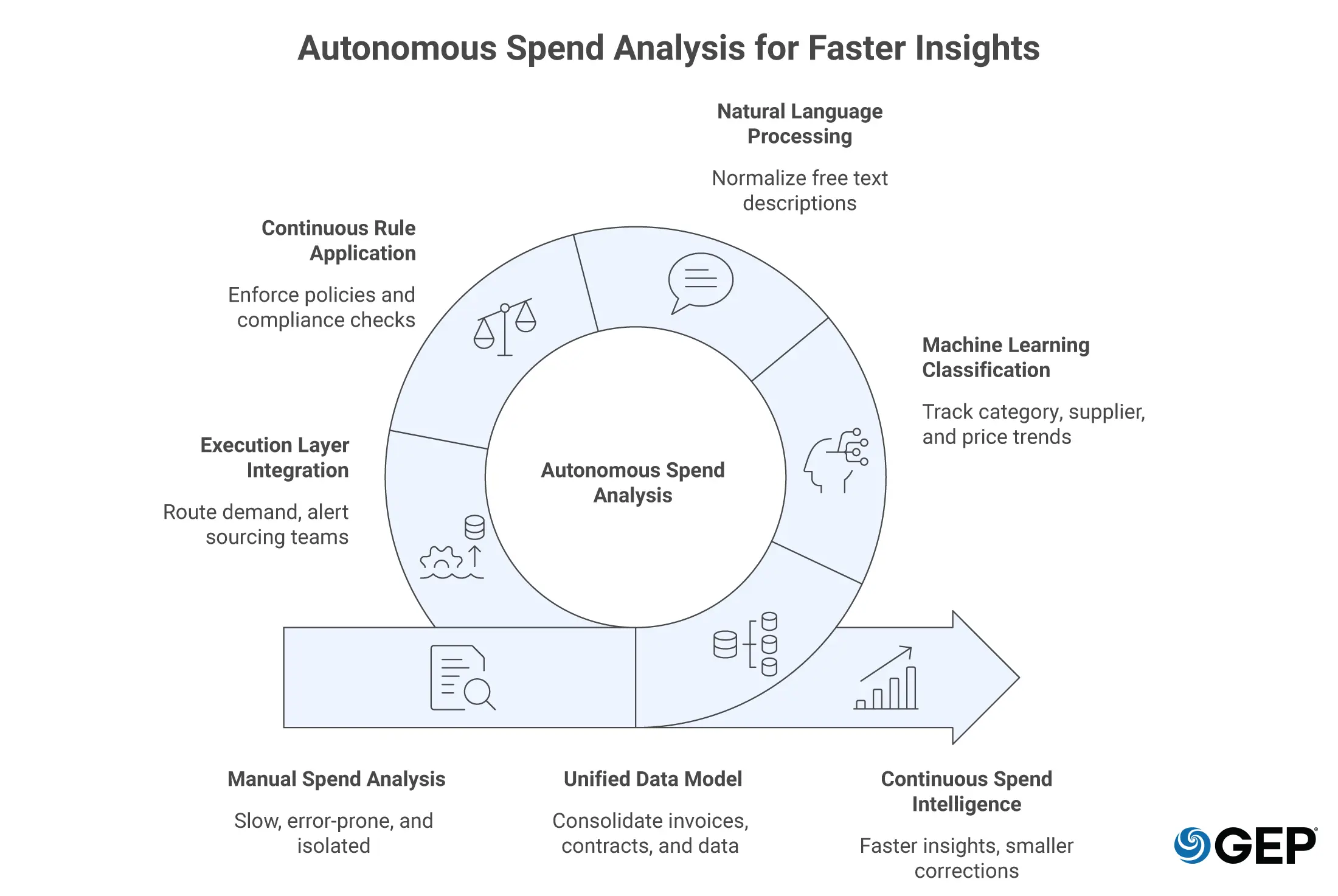

Autonomous spend analysis starts with unified data. Invoices, contracts, supplier master data, risk feeds, and market indices land in one model. The system does not wait for perfect data. It corrects, flags, and learns as it runs.

Machine learning handles classification, but that part alone is not new. The difference lies in behavior. The system tracks how categories, suppliers, and prices move over time. It remembers past corrections. It applies them again without prompting.

Natural language models read line-item descriptions, contracts, and notes. They normalize free text that once stalled automation. That matters in tail spend, where descriptions vary widely and manual effort used to outweigh savings.

Rules still play a role. Policies define thresholds, approval limits, and compliance checks. Autonomous systems apply those rules continuously. When spend drifts outside contract terms or approved suppliers, the system flags it immediately. It does not wait for a monthly review.

The system also connects to execution layers. When it detects maverick spend, it can route demand to catalogs or contracts. When prices rise beyond benchmarks, it can alert sourcing teams or trigger a review event. Analysis does not sit in isolation.

Gartner notes that organizations moving toward continuous spend intelligence reduce reporting latency by more than 50% compared to batch-based models. That speed changes how teams respond to issues. Faster insight leads to smaller corrections instead of large resets.

Click here to explore - Spend Analysis Software

How Autonomous Spend Analysis Optimizes Procurement Strategy

Strategy depends on reliable signals. Autonomous spend analysis improves those signals by keeping them current and contextual.

Category strategies sharpen because patterns stay visible. The system shows not just total spend but frequency, volatility, and supplier concentration. It highlights where demand fragments across suppliers and where consolidation makes sense. That insight updates automatically as behavior changes.

Risk management improves through linkage. Spend connects directly to supplier risk scores, sanctions lists, and performance data. When exposure grows with a high-risk supplier, the system surfaces it early. Teams can adjust sourcing before disruption hits.

Compliance moves from policing to prevention. Autonomous analysis checks spend against contract terms, diversity goals, and regulatory requirements in near real time. Exceptions surface while corrective action still costs little.

Forecasting also gains realism. Instead of relying on last year’s totals, teams see demand trends as they form. That helps finance and procurement align earlier on budgets and savings targets.

Everest Group research highlights that organizations using AI-driven spend intelligence expand managed spend coverage into tail categories without adding headcount. That expansion matters. Tail spend often hides price leakage and compliance risk that manual teams never reach.

Most importantly, autonomous spend analysis changes roles. Analysts spend less time preparing data. Category managers spend less time searching for issues. More time goes into decisions that require judgment, negotiation, and supplier engagement.

GEP Outlook Report 2026

Explore the dynamics shaping procurement & supply chain and know how to navigate them in 2026

EXPLORE THE REPORT

The Way Forward

Autonomous spend analysis marks a shift from hindsight to oversight. It replaces periodic review with continuous awareness. That shift fits a world where supply risk, pricing, and regulation change mid cycle.

The next phase will deepen autonomy. Systems will not only flag issues but recommend specific actions based on past outcomes. They will learn which interventions worked and which failed. Human teams will focus on setting guardrails and strategy.

Enterprises that invest early gain more than cleaner data. They gain a procurement function that reacts at the pace of the business. That advantage compounds as systems learn and coverage expands.

FAQs

Yes. Autonomous spend analysis links spend patterns directly to supplier risk signals such as financial stress, sanctions, and performance history. When exposure rises, the system flags it early. That allows sourcing teams to diversify or renegotiate before disruption occurs.

The system checks transactions continuously against policies, contracts, and regulations. Exceptions surface while spend is still in progress, not after audits. Reporting becomes simpler because evidence is already structured and traceable.

Data fragmentation remains the biggest hurdle. Change management also matters, since teams must trust automated insights. Clear governance and phased rollout help address both issues.