Late Payments Hurting Vendor Ties? Eliminate Delays with Real-Time Invoice Matching

- Real-time invoice matching checks invoices instantly against purchase orders, preventing payment delays that can damage supplier relationships.

- Smart invoice matching systems catch errors right away. They cut manual work while keeping payments accurate and stopping fraud.

- Three-way and four-way matching provide complete checks, strengthening financial controls and improving cash flow for enterprises.

October 14, 2025 | Purchasing 5 minutes read

Do payment delays and invoice errors hurt your procurement operations and damage supplier relationships? Are you still relying on manual invoice matching and approval?

The old ways of processing invoices by hand can create a weeks-long bottleneck, as well as cash-flow problems for suppliers, and missed early payment discounts for buyers.

Real-time invoice matching fixes these problems. It automates the checking process and allows AP teams to validate and process invoices quickly. This helps streamline purchase-to-payment process and workflows.

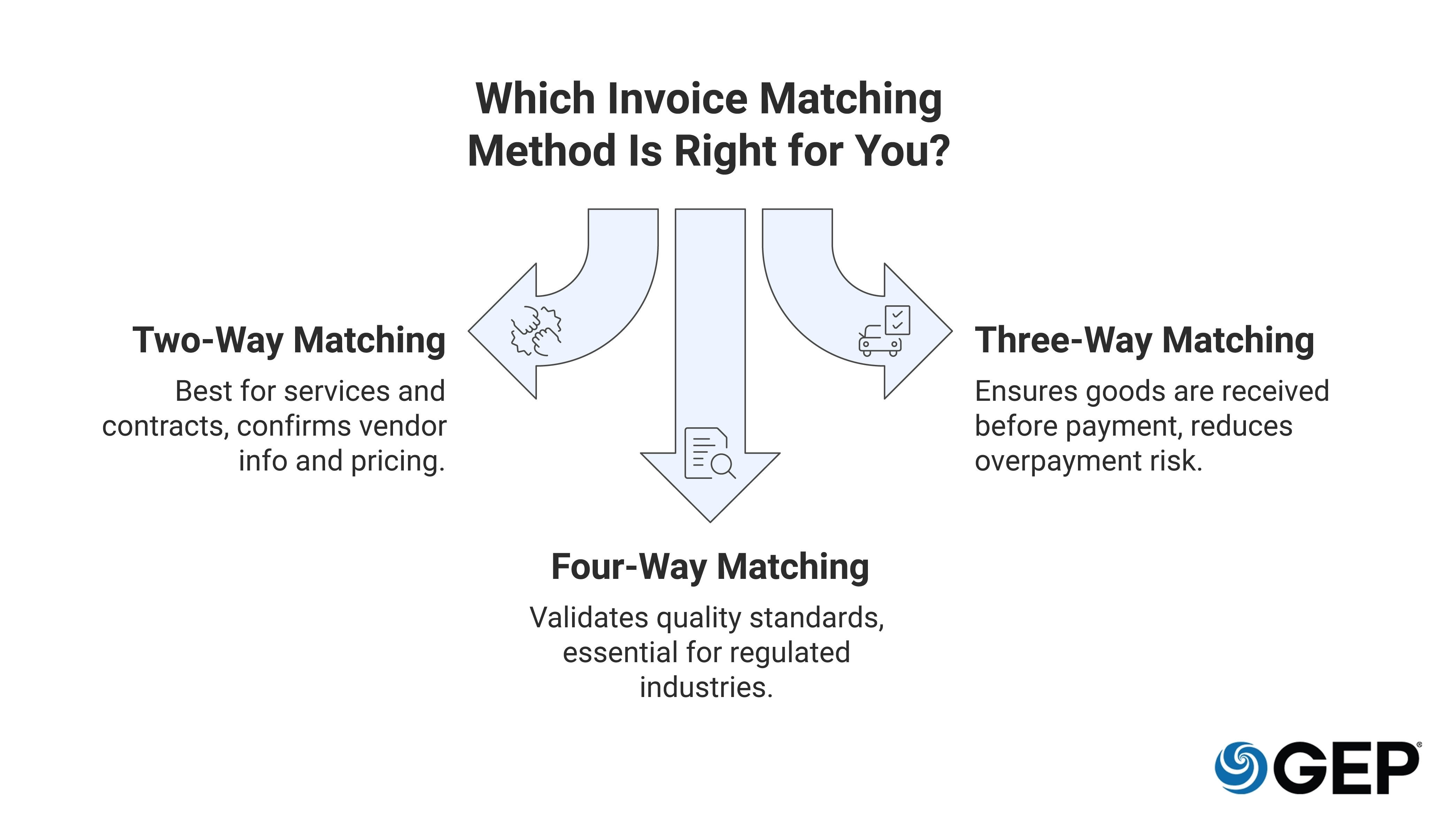

Understanding Invoice Matching and its Types

Invoice matching compares invoices to supporting documents before payment. This ensures companies only pay for goods and services they actually ordered and received. The supporting documents that the invoice is matched to will depend on what type of matching is being used.

Two-way Matching

Two-way matching compares invoices to purchase orders. It checks that invoice amounts match purchase order totals. It also checks vendor information is correct. Items must match what the company originally ordered.

This method works well for professional services or situations where you don't need to confirm receipt of goods. Examples include service contracts and software licenses.

Three-way Matching

Three-way matching adds delivery receipts to the checking process. It compares invoices against purchase orders and delivery receipts. This ensures payments only happen for items the company receives.

In three-way matching, delivered quantities must match the ordered and invoiced quantities. It thereby minimizes the risk of paying for items your organization never got.

Four-way Matching

Four-way matching provides the most complete check of invoices and includes quality inspection data along with purchase orders, invoices and delivery receipts.

This method is essential for industries with strict quality standards. Examples include pharma, aerospace and food manufacturing. It ensures received goods meet quality standards before payment.

Why Is Invoice Matching Crucial?

Without robust invoice matching processes, companies face greater risk exposure. Common risks include duplicate payments, fraudulent invoices and damaged supplier relationships.

Cost and Pricing Analysis

Automated invoice matching lets companies perform a thorough cost analysis. It compares invoice amounts to contract prices. The system finds pricing errors, unauthorized charges and cost-saving opportunities. It also helps procurement teams keep an eye on contract compliance.

Relationships With Suppliers

Invoice matching ensures timely and accurate payments, which can improve supplier relationships. Processing invoices quickly ensures that suppliers get paid on time, improving their cash flow and strengthening business partnerships.

Impact on Cash Flow

Having clear visibility into payment obligations through real-time invoice matching lets companies accurately forecast cash flow and optimize working capital to avoid unnecessary borrowing costs and overpayments.

Early Payment Incentives

When invoice matching happens in real time, finance teams can process payments within discount periods and take advantage of early payment discounts (typically 1-3% on invoice amounts).

Precision and Security

Automated invoice matching systems are more accurate than manual processes. They eliminate human errors in data entry and calculations, with strong security features to protect against unauthorized changes. Another huge plus: they keep complete audit trails for all

transactions.

Error Detection and Fraud Prevention

Real-time invoice matching systems can automatically find common errors like duplicate invoices, wrong quantities, pricing mistakes and vendor information problems, as well as fraud indicators. These features help enterprises mitigate financial losses and maintain strong internal controls.

Unlock Cash Flow in Real Time

See How AI-Powered Invoice Processing Frees Up Working Capital Fast

Manual Invoice Matching vs. Automated Invoice Processing

The performance gap between manual and automated invoice processing is enormous. Automating invoice processing is one of the biggest operational advances companies can make.

Workflow

Manual invoice matching involves numerous steps with employees handling physical paperwork through different approval stages. Modern automated workflows capture invoices digitally, pull out important data and move documents according to preset rules.

Processing Speed

Old-fashioned manual invoice matching often requires several days or even weeks for completion. During peak times, this approach creates serious slowdowns. Modern automated solutions can finish processing invoices in under an hour in many cases. Companies benefit by securing early payment savings and keeping suppliers satisfied with faster turnaround times.

Precision

Manual processing carries significant risks due to the possibility of human mistakes. Advanced automated solutions remove the need for manual typing while using smart algorithms to double-check information.

Scalability

Manual processes have limits to how many invoices they can handle. As volume increases, staffing also has to increase. With an automated system, teams can process thousands of invoices without additional staff, allowing them to scale easily to accommodate business growth.

Regulatory Compliance

Human oversight of invoice processes can cause compliance problems. Automated systems ensure compliance by enforcing business rules consistently and maintaining complete digital audit trails.

Cost Efficiency

Manual invoice processing requires significant resources including staff time, paper handling and administrative overhead. Automated systems dramatically reduce these processing costs while delivering better accuracy and faster turnaround times.

Start Matching Invoices in Real Time

Real-time invoice matching enables quick and accurate invoice processing. By eliminating traditional processing delays and manual bottlenecks, companies can strengthen supplier relationships through prompt payments and capture early payment discounts that improve their bottom line.

Going from manual to automated invoice matching improves cash-flow management, supplier relationships and operational efficiency. Companies that embrace real-time invoice matching gain competitive advantages from improved working capital optimization and stronger financial controls.

Discover More: Multi-Way Invoice Matching Software

Frequently Asked Questions

What is the biggest challenge in manual invoice matching?

The biggest challenge is the high error rate and time-consuming nature of manual processes. Manual matching often leads to data entry mistakes. Processing delays can take weeks to resolve; this creates payment delays and increases fraud risks.

How long does it take to implement an automated invoice matching system?

Implementation can vary widely depending on system complexity, but 6-16 weeks is typical. Cloud-based solutions can be deployed within 4-8 weeks, whereas on-premises systems may take 12-20 weeks, accounting for configuration, integration and training phases.

How does automation improve invoice matching accuracy?

Automation eliminates human error by using OCR technology to extract invoice data with 95%+ accuracy. AI algorithms compare information against purchase orders, and machine learning capabilities continuously improve accuracy by learning from processed invoices.

What is a Three-Way Match?

Before agreeing to pay an invoice from a supplier, the purchase order, goods receipt note, and invoice from the supplier are compared. This standard practice is known as a "three-way match."

A three-way match can assist in deciding whether only a portion of the invoice should be paid or the whole amount should be paid. The invoices must fall within the matching limits for the verification to succeed. If they do not, the invoice will be put on hold, and payments will not be made until the hold is lifted or the issue is resolved. A retained invoice is a fail-safe that prohibits payment of an order that has not been matched with a customer and is not confirmed.

When someone operates a company, the last thing they want to do is pay an invoice that is either false or erroneous. The use of three-way matching can assist in protecting the accounts payable from being exposed to fraudulent or incorrectly submitted invoices. A growing number of corporate leaders and departments responsible for the company's finances are turning to three-way match processing to reduce risk and rein in expenditure at their organizations. Integrating automatic three-way verification into the accounts payable procedure is an excellent protective method from overpaying for products and services or making a payment on a fake invoice.