Is Your Accounts Payable Still Manual? Here’s Why You Should Switch to AP Automation

- Many businesses are leveraging technology to expedite manual, paper-based and human-intensive tasks in accounts payable.

- AP automation can help teams do more with less, freeing up staff to work on more strategic and value-adding tasks.

- It can also be an ideal way to kickstart a larger enterprise-wide digital transformation.

November 16, 2024 | Accounts Payable 3 minutes read

Not many people in the office talk about accounts payable. Everybody knows it’s basically routine back-end operations involving the processing and payment of supplier invoices.

But this function comes into the picture almost immediately when a supplier complains about their payment getting delayed. In such a situation, procurement and accounts payable teams often blame each other.

Irrespective of who is to blame for the payment delay, the relationship with the supplier is likely to deteriorate. This can hurt the business in the long term.

What is the takeaway from this situation?

Routine as its work may seem, the accounts payable team plays a key role in building strong relationships with suppliers and third parties.

After all, suppliers want to get paid on time without having to remind or chase procurement and finance repeatedly.

So, what’s needed for timely invoice processing, approval and payment?

The one-word answer is automation.

Eliminate paperwork and automate all manual, paper-based accounts payable (AP) tasks with the help of technology.

How AP Automation Helps

If your AP function still relies on manual work and human resources, you are missing out on several ways to work efficiently.

Technology can help AP teams work faster and more efficiently while maintaining the level of diligence required. It can automate all invoice handling tasks including validation, matching and reconciliation. All this while integrating with existing ERP systems.

It’s hardly surprising that AP automation is today a key priority for businesses looking for ways to do more with less resources.

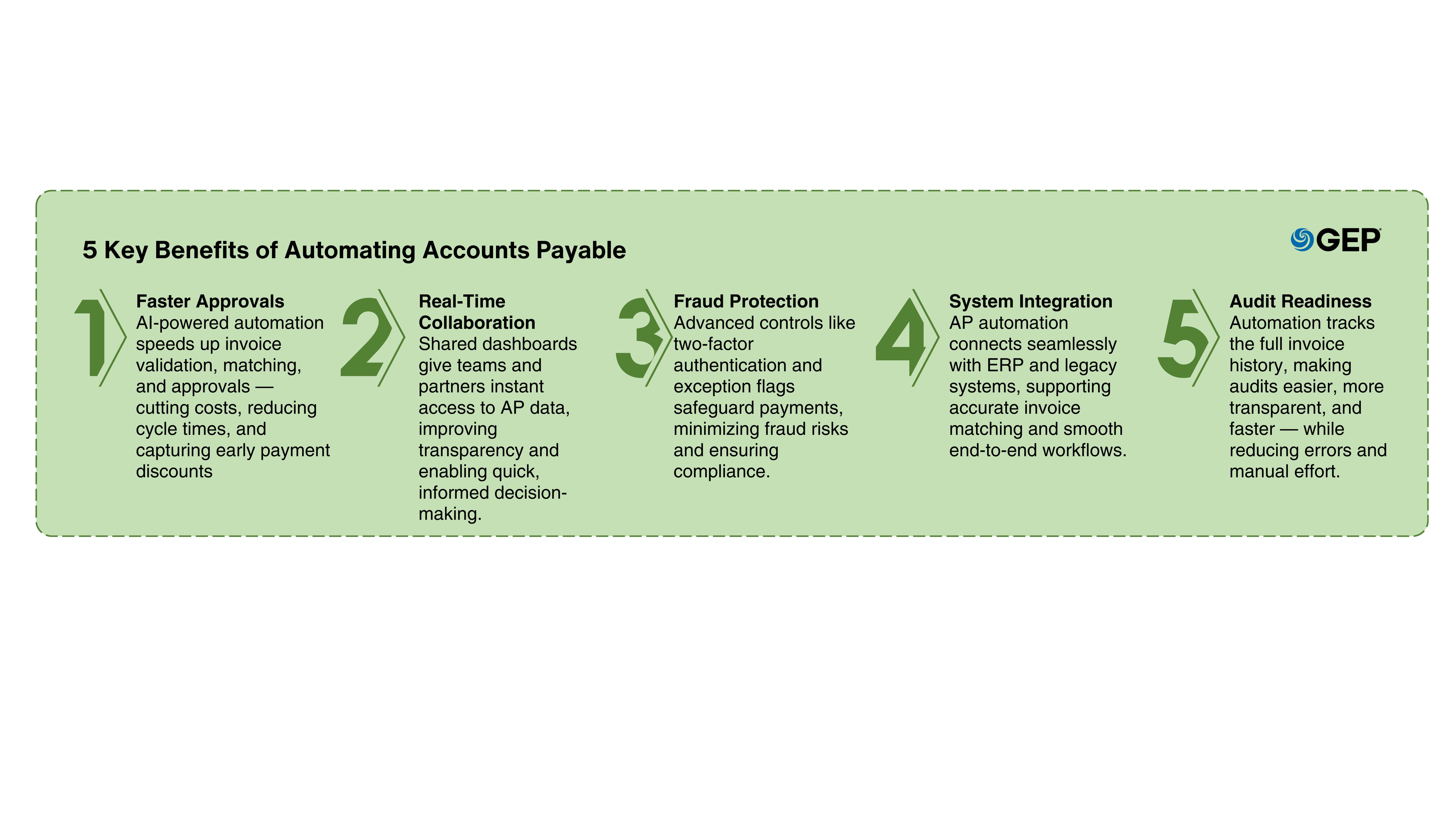

Here are the key benefits of using AP automation software:

• Faster invoice processing and approvals:

Powered by AI, machine learning and optical character recognition (OCR), AP automation software can extract the most pertinent information from digital invoices and match them with purchase orders. In case there is a mismatch, it can follow the established processes for approving the payment. Faster approval reduces invoice processing costs and cycle times. It also allows procurement to cash in on early payment discounts.

• Real-time collaboration:

With AP automation, different stakeholders can access relevant data and information at the same time. Cross-functional visibility enhances transparency and allows internal teams and external partners to work in close collaboration. Real-time dashboard reporting allows business leaders to retrieve critical information quickly.

• Fraud prevention:

AP automation enables advanced payment controls with two-factor authentication and duty separation. It can also flag exceptions for review by authorized persons. Different people authorize invoices and payments, reducing the likelihood of fraud.

• Seamless integration:

AP automation software seamlessly integrates with ERP and legacy systems and performs multi-way invoice matching based on configurable rules and preset tolerances. It feeds the matches and exceptions into an optimized workflow that allows the buyer to review and accept the invoice, make changes or reach out to suppliers for clarification.

• Simplified audit:

AP automation helps determine the authenticity of all purchases. It tracks the entire history of how and when an invoice is processed. This allows auditors to access real-time information and cross-check the purchasing information.

In addition to the above benefits, AP automation can slash invoice processing costs by up to 76%, suggests a survey by Ardent Partners. When translated to hundreds of invoices processed by the function over a year, this can increase potential savings.

Additionally, businesses using AP automation are likely to encounter fewer exceptions than their non-automated peers. This allows the procurement teams to devote more time to value-adding tasks.

Perfect Way to Kickstart Digital Transformation

AP automation opens the door for a larger enterprise-wide digital transformation program. To meet the growing demand, many companies now offer standalone AP automation solutions that can work well with other modules in the customer’s ecosystem.

By automating accounts payable, businesses can streamline the latter stages of procurement operations.Over a period, they can expand this program and add other modules from the same vendor without having to invest in a big installation or deployment project. In this way, they can extend their digital transformation program across different functions.

If you are planning to do more with less by automating accounts payable, check out GEP SMART. Learn how GEP SMART’s AP automation software can digitally transform accounts payable and enable a touchless environment for invoicing and payments.